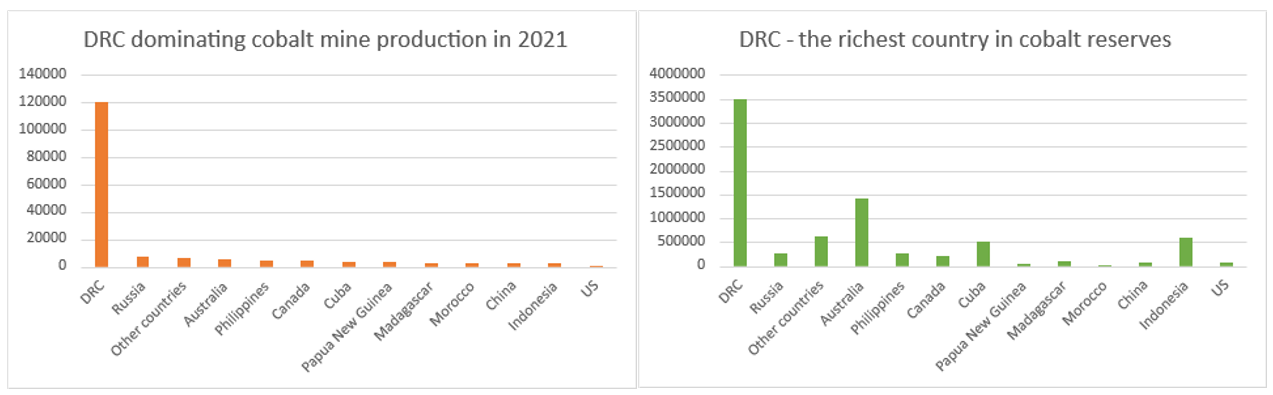

Transport electrification is at the forefront of the international climate transition agenda. Because of this, global demand for cobalt is projected to grow fourfold by 2030,i which raises the question, are mineral supply chains robust enough to fuel a sustainable EV revolution? While demand surges, supply is limited to only a few countries. The Democratic Republic of Congo (DRC) is the leading source of mined cobalt, supplying more than 70% of global cobalt mine production in 2021.ii Meanwhile, over half of the cobalt processing and refining capacity is situated in China, which produces three-quarters of all lithium-ion batteries.iii EV battery manufacturers face a significant sustainability challenge: how can they secure the cobalt supply they need while mitigating the ESG risks associated with mining and processing it?

1. Estimated cobalt mine production in metric tonnes, 2020 | 2. Estimated cobalt reserves in metric tonnes, 2020 |

The Environmental Footprint of Cobalt Mining and Processing

Mineral waste from mines can pollute rivers and other freshwater sources in their vicinity and have a direct health impact on people and animals, as well as crops. Further down the value chain, the processing of cobalt generates tailings, which, if not treated and stored properly, can have adverse impacts on the environment. While cobalt reserves are concentrated in a few countries, the processing is geographically concentrated in China.

Artisanal Mining and the Human Cost

It is estimated that around 15-30% of the DRC’s cobalt supply is extracted from artisanal and small-scale mines rather than large-scale industrial operations,iv making it a source of livelihood for a significant share of the population. The scaling up of cobalt mining in response to increased demand from the EV battery sector will most certainly lead to growth in artisanal mining. This development exacerbates the social and environmental risks typically associated with these activities.

- Artisanal miners (also known as creuseurs) use rudimentary hand tools and are exposed to frequent, and often fatal cave-ins of galleries and tunnels. Sometimes creuseurs illegally infiltrate industrial concessions to dig their own pits. In 2019, 43 miners died in a collapse of a cobalt mine owned by Glencore in the Kolwezi area of the DRC.v

- Prolonged exposure to fine dust, particulates and toxic pollutants, combined with a lack of proper protective equipment, can cause serious chronic diseases.

- Artisanal miners operate informally; hence, the enforcement of labour rights is often lacking. In 2014, UNICEF estimated that around 40,000 children worked in cobalt mines in the DRC. While reports of child labour have declined due to initiatives taken over the past few years, it remains a systemic issue in the region and a significant concern associated with cobalt mining.

How do EV Battery Producers Handle Cobalt Supply Chain Challenges?

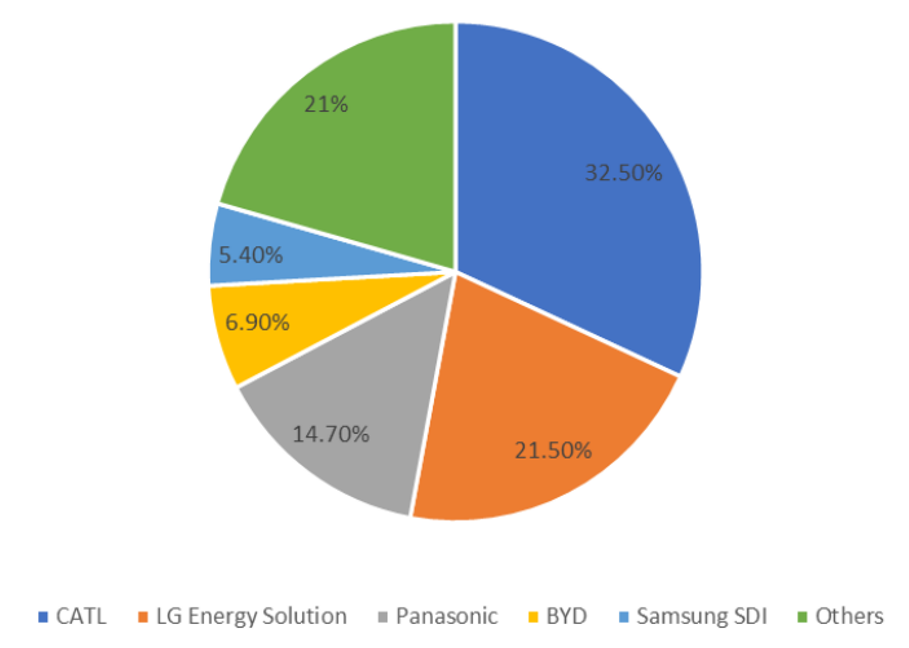

According to data from SNE Research,vi an EV and energy market research firm, the top five sellers of EV lithium-ion batteries in the first quarter of 2021 were Contemporary Amperex Technology Co. Ltd (CATL, from China), LG Energy Solution (at the time part of LG Chem, Ltd, from South Korea), Panasonic Corp. (Japan), BYD Co. Ltd (China) and Samsung SDI Co. Ltd (South Korea).

Market share of leading EV battery manufacturers

Source: SNE Research

While this sector is concentrated mainly in three East Asian countries, we also note that most of the significant active players in the market are part of larger diversified businesses. CATL’s principal business activity is the manufacture and sale of EV batteries; however, Panasonic is a conglomerate active in multiple sectors, BYD is primarily a carmaker, and Samsung SDI’s business is divided between battery technology and electronic components. LG Energy Solution is a pure-play battery manufacturer, but it was only listed as a separate company in 2022. The most recent data available is from FY2021 when the company was part of LG Chem, a diversified chemicals business.

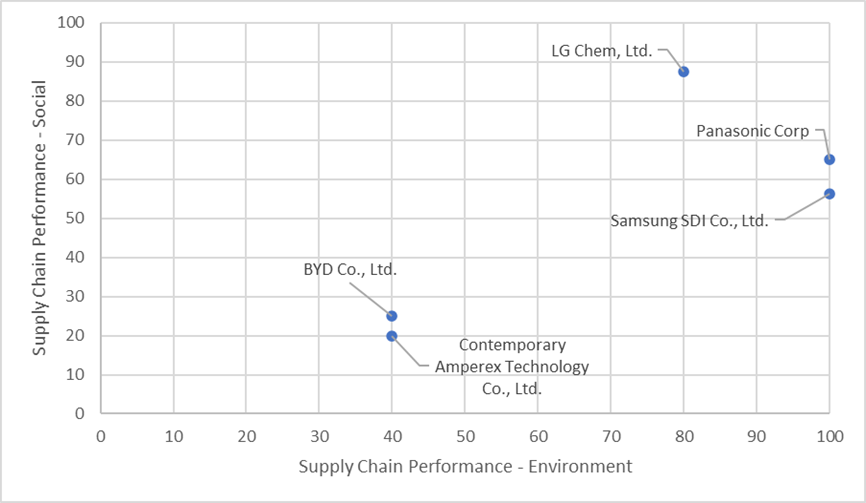

Although the companies are not all purely EV battery makers, we believe that Sustainalytics ESG management indicator scores can be considered representative of EV battery operations because our methodology explicitly considers the scope of an ESG programme when assessing its quality. By averaging relevant Sustainalytics research scores, we have developed metrics to assess the supply chain management capabilities of the EV battery market leaders along two axes, environment and social.

Supply Chain ESG Performance Among Selected EV Battery Manufacturers

Source: Sustainalytics, data extracted on 16 February 2022

Efforts to manage the supply challenges posed by reliance on cobalt range from developing cobalt-free batteries, such as lithium-iron-phosphate or LFP (Panasonic, Samsung SDI), to acquiring stakes in a cobalt mine (CATL)vii or setting up joint ventures that help secure a stable supply of raw material (LG Chem). Moreover, Panasonic conducts specific supply chain surveys regarding the responsible procurement of cobaltviii and runs risk assessments based on received responses. Samsung SDI also carries out surveys among suppliers of cobalt and other minerals. Since 2019, it has been participating in the Cobalt for Development project,ix which aims to improve living and working conditions in mines in the DRC and their adjacent communities.

The war in Ukraine has shown that supplies of essential commodities, such as food and fuel, can be disrupted by geopolitical tensions and conflicts, leading to higher price levels and volatility. Similar concerns exist regarding the supply of raw materials used in EV lithium-ion batteries, such as cobalt, where China is a dominant player. As our analysis shows, significant ESG risks can lie not only within the operations of the producers themselves but also upstream in the value chain. We believe that ESG factors are valuable in assessing investments in companies involved in the EV battery sector due to their potential to uncover such risks and lead to a more efficient and sustainable allocation of capital.

To learn more about how investors can engage on this topic with companies operating in the cleantech industry, contact Sustainalytics’ Thematic Engagement services.

Sources:

[i] World Economic Forum, “Making Mining Safe and Fair: Artisanal cobalt extraction in the Democratic Republic of the Congo”, 2020, p.3

[ii] U.S. Geological Survey, “Mineral Commodity Summary 2022 – Cobalt”, USGS Online Publications Directory, available at: Mineral Commodity Summaries 2022 - Cobalt (usgs.gov), accessed 3 May, 2022

[iii] IEA, “Global EV Outlook 2022. Securing supplies for an electric future”, June 2022, p.6

[iv] World Economic Forum, “Making Mining Safe and Fair: Artisanal cobalt extraction in the Democratic Republic of the Congo”, 2020, p.3

[v] Reuters, (27.06.2019),” Accident at Glencore mine kills at least 41 in Congo”, (accessed 3.05.2022) at: https://www.reuters.com/article/us-congo-mining-glencore-idUSKCN1TS2CE

[vi] SNE Research (01.06.2021), accessed 16 May 2022, at: http://www.sneresearch.com/_new/html/sub/sub2/sub2_01_view.php?id=95916&s_keyword=&f_date=&t_date=&pg=3&cate_id=&type=press

[vii] Mining Technology (12.04.2021), “CATL to acquire stake in DRC’s Kisanfu copper-cobalt mine in $137m deal”, (accessed 16.05.2022) https://www.mining-technology.com/news/catl-acquire-stake-drcs-kisanfu-copper-cobalt-mine-137m-deal/

[viii] Panasonic Corp, “Responsible Supply Chain”, (accessed 25 March 2022), at: https://holdings.panasonic/global/corporate/sustainability/pdf/sdb2021e-supply_chain.pdf

[ix] Samsung SDI Co., Ltd., Sustainability Report 2020, (accessed 25 March 2022) at: https://www.samsungsdi.com/upload/download/sustainable-management/2020_Samsung_SDI_Sustainability_Report_English.pdf