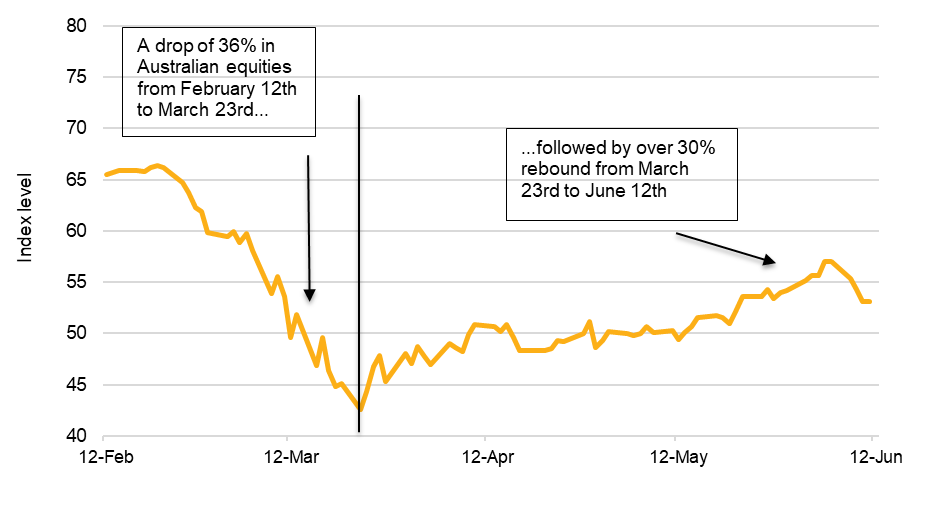

“We are living in extraordinary times” seems to be these days’ mantra. It certainly reflects well the dynamics of global share markets, including Australia’s, as shown in the chart below.

Source: Sustainalytics, Morningstar Direct[i]

There has been much discourse around the impetus that ESG investing is likely to experience in the COVID-19 recovery. The relative outperformance of ESG funds in the sell-out is one key reason underpinning this expectation. More broadly though, the pandemic has highlighted the importance of balancing economic growth with environmental and social outcomes.

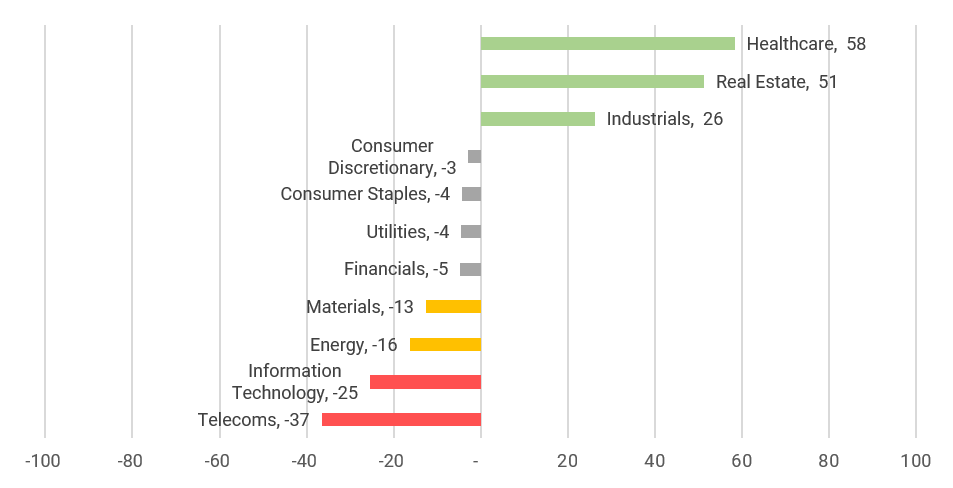

In this article, we leverage the findings of our recently published Portfolio Research paper “ESG in the COVID-19 recovery”. We unpack the results of our unique ESG at a reasonable price (ESGarp) model, which combines ESG risk score and P/E ratios, to scan the Australian equity market and search for opportunities for investors to get the biggest ‘ESG bang for their buck.’ ESGarp scores range from a maximum high of 100 to a minimum low of -100. The higher the number, the strongest the prospects for adding attractive ESG stocks that also trade at lower relative valuations.

ESG at a reasonable price (ESGarp) scores for Australian sectors

Source: Sustainalytics, Morningstar Direct[ii]

Three sectors on top: Healthcare, Real Estate, and Industrials

Australian Healthcare has the highest ESGarp score (58) among peer sectors globally, meaning it is a good place to shop stocks with strong ESG scores and attractive valuations. Although a small market, the average spreads of ESG Risk Rating score and P/E ratio were both favourable and sizeable compared to world averages. The average 20% share price decline[iii] was far more profound than the average global drop of 6% in the global Healthcare sector. Part of the difference can be explained by a lower weight of Pharmaceuticals in the ASX 200 compared to other markets, as Pharma stocks generally held their value better.

Traditionally, healthcare is a sector where Australia has a competitive edge, having produced recognized global leaders such as Cochlear and CSL. Both these companies face considerably lower ESG risk compared to sector peers and have delivered excellent returns on invested capital over the past ten years. A return on equity above 40% consistently, year over year, is quite rare and usually a signal of pricing power and strong competitive advantage. Quality does come at a higher price, however.

The share prices of companies like Ramsay Health Care and Ansell collapsed, although they have partly rebounded in the latest trading sessions. The case of Ansell is particularly puzzling: a manufacturer of protective wear, the company lost almost half of its value in the sell-off, until the market figured out that it was a possible COVID-19 catalyst stock. In hindsight, both Ramsay and Ansell would have been great value additions to portfolios, as they both have good ESG scores and relatively cheap valuations. Some investors might have missed the boat on them, although they are still looking relatively inexpensive. Healius is another stock with a relatively good ESG score and trading below fair value estimates.

Real Estate is another sector coming out at the top of our ESGarp model (51). With a whopping 45% decline[iv] at the bottom, Australian Real Estate showed some of the better ESG scores and P/E ratio spreads of any market. In most markets, it is difficult to get both aspects at a sizeable discount. Thus, ASX-listed real estate firms offer a compelling proposition. France is the only other market which is closely comparable.

As we noted in our report, “Navigating ESG Issues in Australia: Identifying Risks, Seizing Opportunities,” real estate is a comparatively low-risk sector and can be a source of competitive advantage for investors in Australian stocks. The strong ESG performance is mainly a result of management and strategy: Australian real estate firms tend to have superior business ethics policies, more effective customer management programs, more significant investments in green buildings, as well as limited involvement in incidents. Uninterrupted economic and population growth down under over the past 30 years, strong building activity in the country, and indeed some of the highest rent and property prices in the world, contributed to high valuations in the sector. However, falling house prices, rising unemployment, and general economic slowdown are all contributing to the depressed valuations and creating challenging conditions for the coming months, particularly for income-seeking investors in REITs.

The S&P/ASX 200 Real Estate index has sharply rebounded from the bottom but is still 25% below the February 2020 peak. This may provide investors with a compelling case to bet on the recovery of real asset prices with strong ESG credentials. We are however cautious that this space may well be a value trap. Some Australian real estate companies are overvalued and some undervalued, making it a tricky sector to navigate.

Finally, Industrials is a sector that was hit harder than others on a global scale, with the halt of most non-essential manufacturing and transport. Australian industrial companies show up relatively well in our model, with the third best ESGarp score behind France and Germany (26, 39 and 3 respectively). ESG Risk Rating scores are favourable, with only a slight premium on P/E ratios. This is a sector to buy lower ESG risk companies at reasonable valuations.

Two sectors trailing: IT and Telecoms

Conversely, ASX-listed Telecoms and Information Technology show some of the worst results in our ESGarp model, at -37 and -25 respectively. Australian Telecom has the most reduced prospects to find good ESG companies at a lower relative valuation compared to the global peer sector, while IT is the second worst behind the Chinese equivalent. This is primarily the result of some Australian technology stocks trading at high P/E multiples relative to global peers, without the favourable ESG scores, thus underperforming in our model. This may be in part due to the characteristics of some companies, which are smaller in size than some global peers and thus provide fewer insights into their sustainability management while trading at higher valuations because of their growth stage. Telstra is a possible exception: with good past metrics on return on equity that have recently suffered, resulting in the stock trading near its all-time low share price, it looks like a contrarian play with a good ESG rating.

These findings may prompt some investors to examine whether their valuations about future growth and earnings are adequately pricing in potentially subtle but material ESG risks. Closer engagement with investee companies on issues such as corporate governance practices, data privacy policies, cybersecurity measures, and service quality may provide additional insights and nuances.

Neutral sectors

Many sectors in the Australian equity market show neutral prospects for good ESG companies at a lower relative valuation, in the aggregate and compared to global peers. For brevity, we only provide a quick snapshot of the underlying analysis.

- Consumer Discretionary (ESGarp of -3): average ESG risk scores and P/E ratios, close to the global numbers. The sector was notably impacted as it is concentrated in two of the most negatively impacted subindustries, Casinos, and Travel, Lodging and Amusement, which particularly in Australia are reliant on tourism, especially from China.

- Consumer Staples (-4) companies in Australia have average ESG Risk Rating scores and P/E ratios, with similar overall characteristics and patters to the rest of the world. Most companies faired well and retained value.

- Financials (-5): experienced similar share price declines to the world average, but higher P/E ratios. Canada, a similar market in many dynamics, is more desirable for both ESG risk scores and P/E ratios. Australian banks have overall strong balance sheets which they have deployed to assist customers, thus using the COVID-19 crisis as their redemption moment from past scandals. Numbers look much better for some asset managers.

- Energy (-16) and Utilities (-4) show a small advantage compared to the rest of the world. While Australia is well known for its coal industry, most players are either part of bigger diversified miners, small caps outside the ASX200, or private entities. Energy companies in our coverage are more focused on liquefied natural gas, compared to European, US and Canadian oil majors. Crude price slumped due to precipitating demand and lack of storage capacity which clogged the market, whereas gas prices faired better. Therefore, Australian energy firms managed to contain losses, and they are relatively less exposed to stranded assets and better positioned for transition in the medium term.

- Materials (-13) appear slightly worse off in ESG Risk Rating spreads and P/E ratios. Many Australian miners are smaller than global peers (with the obvious and notable exceptions of mining giants BHP and Rio Tinto). Smaller firms often have fewer formal ESG practices in place than their large-cap peers, and have less dedicated resources for sustainability reporting, resulting in worse ESG scores. Iron ore price remained relatively strong throughout the crisis, benefiting BHP, Rio Tinto and Fortescue. Curiously, however, Australian gold miners did not see the same run up as Canadian gold companies, and this lack of price appreciation brings to question if a disconnect has occurred.

The current dynamics in the stock markets create significant opportunities for investors to buy companies that are trading at attractive valuations and that carry good ESG credentials. Our ESGarp model offers an innovative way for investors to assess where they can get the biggest ‘ESG bang for their buck’. We hope that the analysis and case studies presented in this article can assist investors as they make these determinations about the Australian equity market.

Sources:

[i] As of June 12th, 2020. Taken from the State Street ETF STW, which tracks the S&P/ASX 200 index.

[ii] Change in P/E ratios calculated from February 12th (the peak of the global equity market prior to the COVID-19 pandemic) to April 24th. ESG scores as of March 27th. Companies with extreme P/E values (P/E ratios <1 and >100) were removed.

[iii] https://www.marketindex.com.au/asx/xhj

[iv] https://www.marketindex.com.au/asx/xre