In the ever-evolving landscape of mandatory corporate sustainability reporting, the implementation of the EU’s Corporate Sustainability Reporting Directive (CSRD) appears to be a watershed moment with implications for companies both in Europe and beyond. The CSRD is set to take effect on January 1, 2024, and will impact approximately 50,000 companies within the EU, representing 75% of EU companies' total revenues, along with an estimated 10,000 or more companies worldwide. This article focuses on the role of the CSRD within the global reporting standards ecosystem. It offers insights into companies' compliance readiness and discusses potential benefits for investors.

Understanding the Corporate Sustainability Reporting Directive

Adopted by the European Commission in November 2022, the CSRD1 replaces the preceding Non-Financial Reporting Directive (NFRD), which required over 11,000 large EU companies to disclose environmental, social, and governance (ESG) information.

The CSRD significantly broadens the scope of companies subject to mandatory sustainability reporting and has three main objectives:

Expand and standardize the existing rules on non-financial reporting and increase the comparability of data.

Introduce a mandatory audit and assurance requirement to ensure the reliability of data and mitigate risks of greenwashing and/or double accounting.

Require information to be reported in XHTML format and digitally tagged to feed into the European single access point.

Estimates indicate that it will impact approximately 50,000 companies in the EU, equivalent to 75% of EU companies’ total revenues. Specifically, the regulation applies to three different categories of businesses:2

- EU companies that exceed at least two of the following thresholds: a) more than 250 employees, b) total revenues of more than EUR 40 million (US$42 million), or c) total assets of EUR 20 million (US$21 million).

- Businesses listed in an EU-regulated market, irrespective of whether the issuer is established in the EU or a non-EU country. This includes listed small and medium-size enterprises (SMEs).

- Non-EU entities with annual EU-generated revenues above EUR 150 million (US$160 million) and which also have either a large or a listed EU subsidiary or a significant EU branch generating EUR 40 million (US$42 million) in revenues.

As the CSRD incorporates a value chain perspective, its effects are likely to extend to suppliers not directly covered by the directive. Such companies, while not in the immediate scope of the regulation, will still be required to provide CSRD-aligned information to EU business partners.

Understanding the European Sustainability Reporting Standards

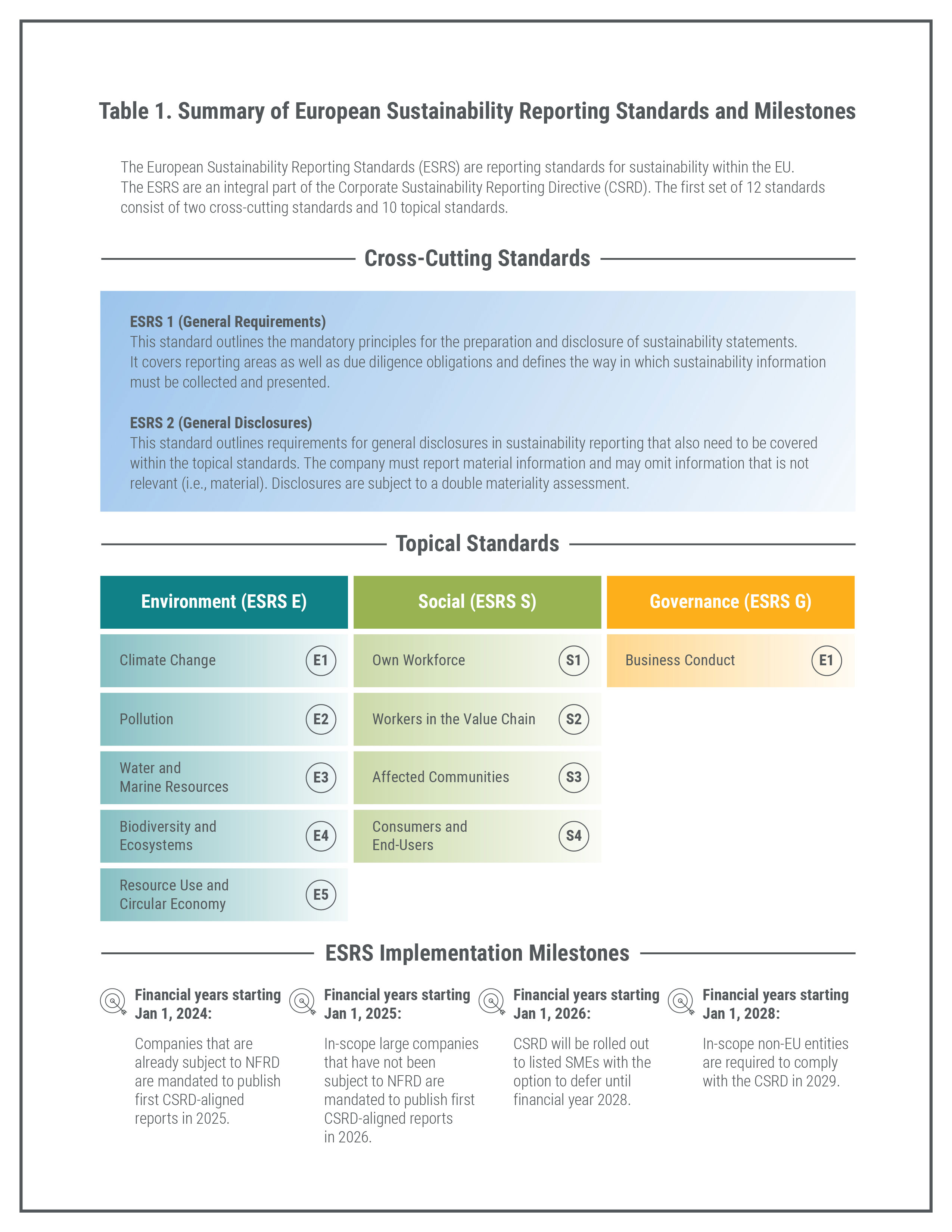

In July 2023, the commission adopted the first set of European Sustainability Reporting Standards (ESRS).3 The CSRD and ESRS are closely interlinked, but they serve different purposes. The CSRD sets the legal framework of the reporting directive. The ESRS, on the other hand, establishes common guidelines for the disclosure of ESG information and serves as the foundation for auditors to provide credible assurance.

The standards are designed to offer clarity and assist businesses in effectively communicating and managing their sustainability performance. The ultimate goal is to improve access to sustainable finance (e.g. sustainability-linked loans, sustainable bonds, etc.). Additionally, the common standards aim to reduce reporting costs in the medium to long term and alleviate the reporting burden on companies. See Table 1 below for a summary of the ESRS.

Source: EFRAG. For informational purposes only.

How the CSRD Integrates With the EU Regulatory Landscape

Sustainable finance stands as the cornerstone of the commission’s strategy for achieving the European Green Deal and fulfilling the EU's commitments to climate and sustainability. The Sustainable Finance Action Plan (EU Action Plan) represents a major policy objective that promotes and facilitates sustainable investment flows across the EU.

Two pillars of the EU Action Plan4 are:

- The EU Taxonomy classification system, which identifies economic activities that contribute to the EU's climate and environmental objectives, and

- Disclosure rules for investors (Sustainable Finance Disclosure Regulation or SFDR) and companies (CSRD).

One of the objectives of the CSRD is to provide standardized, reliable, comparable, and granular data to various capital market participants, enabling them to fulfill their own reporting obligations under SFDR. Under the EU Taxonomy Regulation, NFRD in-scope entities were required to report on their taxonomy alignment,5 and with the CSRD‘s expanded scope, more businesses will be seeking taxonomy alignment in the future.

Another regulation closely linked to CSRD and aligned with the EU Green Deal is the Corporate Sustainability Due Diligence Directive (CSDDD).6 The CSDDD mandates that large companies:

- Conduct due diligence to identify and address adverse human rights and environmental impacts within their value chains and

- Present climate plans aligned with the Paris Agreement.

The CSRD will complement the forthcoming CSDDD by addressing the public disclosure aspect of due diligence obligations for companies subject to both regulations.

CSRD Interoperability With Global Reporting Standards

The commission has successfully aligned the ESRS with global standard-setting bodies such as the Global Reporting Initiative (GRI) and the International Sustainability Standards Board (ISSB).7 The GRI serves as a significant reference point, and many of the ESRS reporting requirements draw inspiration from the GRI Standards. In September 2023, the European Financial Reporting Advisory Group (EFRAG) and GRI issued a joint statement confirming the high level of interoperability achieved between the ESRS and the GRI Standards, assuring that existing GRI reporters will be well prepared to comply with the ESRS.8

The ESRS and the first two ISSB standards, released in June 2023, were developed in parallel. Despite ISSB's focus on financial materiality, companies obligated to report under ESRS for climate change will largely provide the same information as those using the ISSB standard for climate-related disclosures. Additionally, the widely acknowledged standard for climate change-related disclosures developed by the Task Force on Climate-Related Financial Disclosures (TCFD) is fully integrated in ESRS.

Company Readiness for the CSRD

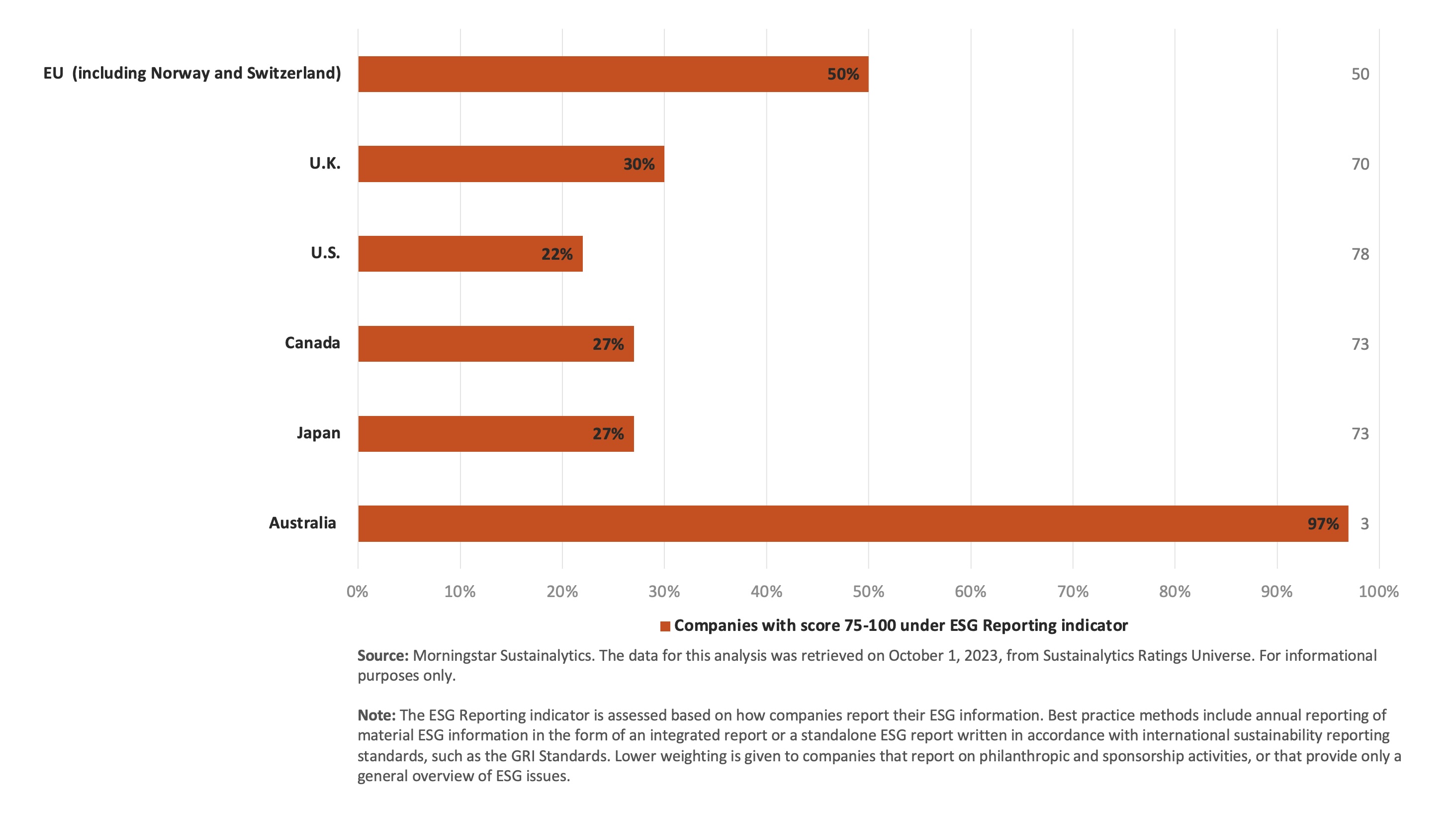

Given the high level of interoperability between ESRS and GRI, evaluating company reporting practices can provide insights into corporate preparedness for the ESRS. Morningstar Sustainalytics data indicates that companies from the EU and other regions potentially affected by the CSRD have a wide range of readiness levels. Half of EU-domiciled companies included in Sustainalytics’ Ratings universe9 are assessed as strong performers in ESG reporting that is aligned with international sustainability reporting standards, such as the GRI standards.

In comparison, of companies domiciled in jurisdictions outside the EU – where a significant number of listed entities will likely fall within CSRD scope – Australian issuers signal very high reporting readiness. U.S. companies, on the other hand, exhibit the least preparedness (see Figure 1). The data underscores a notable variation in the ESRS readiness levels of companies.

Figure 1. Reporting Readiness of Issuers Domiciled in the EU and Select Non-EU Jurisdictions Likely Affected by CSRD

The EU exhibits a mix of strong and potentially less prepared reporters, while Australia stands out for its robust reporting practices aligned with established standards. In contrast, businesses domiciled in the U.S., U.K., Canada, and Japan appear to have significant disclosure gaps, which will require considerable efforts to achieve compliance in the coming years. Businesses will benefit from taking swift action to achieve readiness for ESRS reporting, viewing it not merely as a compliance burden but as an opportunity to develop more sustainable business models.

How Companies Can Prepare for the CSRD

With the ESRS set to take effect on January 1, 2024, companies should be compelled to act swiftly and address reporting gaps. Conducting a comprehensive double materiality assessment aligned with ESRS and obtaining buy-in from senior executives are critical initial steps. Furthermore, achieving disclosure readiness will require investments in credible ESG data management systems to meet the assurance requirement. Some first steps companies can take to prepare include the following:

Conduct a Double Materiality Assessment: Companies should assess their current materiality approach and identify any gaps in their methodology to establish a baseline for ESRS alignment. A double materiality exercise will involve gathering input on financial and non-financial risks, impacts, and opportunities from various functions within the organization. To facilitate this, companies should inform, educate, and engage internal stakeholders.

Integrate ESG Data Into Centralized Data Collection Systems: As different parts of the organization become involved in providing ESG-relevant information, it's crucial for companies to establish appropriate processes for gathering and integrating relevant data.

Consider a Phased-In Approach: To work towards CSRD compliance, companies should consider adopting shadow reporting for one or more financial years. A phased-in approach can help companies systematically address any gaps and signal to investors that they are actively working towards ESRS compliance.

The Investor Perspective on CSRD Uptake

ESRS aligns data points with the reporting needs of financial market participants, benchmark administrators, and financial institutions under the SFDR, the Benchmark Regulation (BMR), and specific disclosure requirements within the Capital Requirements Regulation (CRR). It is welcomed by investors. While the CSRD’s broadened scope addresses investors’ concerns about data access, high-quality ESG information may not be immediately available. The ESRS digital taxonomy10 is being developed for easier data extraction and comparability, but it will take time.

The commission’s decision to make climate change-related issues subject to company materiality assessments under ESRS, rather than a topic for mandatory disclosure,11 has drawn criticism, as investors depend on such data for SFDR, BMR, and CRR compliance.

Finally, from an investor's perspective, the scope and accessibility of CSRD reporting will enable financial market participants to better prepare for meeting disclosure obligations under the EU Action Plan. Despite concerns regarding the mandatory disclosure scope and the immediate usability of ESRS-compliant data, the implementation of the CSRD represents a major milestone in EU and global reporting harmonization efforts. Greater access to quality ESG data will potentially accelerate the transition to a sustainable economy.

Want more up-to-date insights and research on important ESG topics from Sustainalytics’ experts? Sign up for The Whole Picture, a monthly newsletter covering the latest trends to help support your investment decision-making. Join thousands of asset owners, asset managers, and wealth managers who rely on Sustainalytics to provide thought leadership on the ESG topics that matter to their investments.

Resources

- EUR-Lex. “Directive (EU) 2022/2464 of the European Parliament and of the Council Of 14 December 2022 Amending Regulation (EU) No 537/2014, Directive 2004/109/EC, Directive 2006/43/EC and Directive 2013/34/EU, As Regards Corporate Sustainability Reporting.” December 16, 2022. https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32022L2464

- European Commission. “Q&A Adoption of European Sustainability Reporting Standards.” July 31, 2023. https://ec.europa.eu/commission/presscorner/detail/en/qanda_23_4043.

- European Commission. “Directive (EU) 2022/2464 of the European Parliament and of the Council Of 14 December 2022 Amending Regulation (EU) No 537/2014, Directive 2004/109/EC, Directive 2006/43/EC and Directive 2013/34/EU, As Regards Corporate Sustainability Reporting.” July 31, 2023. https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/13765-European-sustainability-reporting-standards-first-set_en.

- European Commission. “Questions and Answers on the Sustainable Finance Package.” June 13, 2023. https://ec.europa.eu/commission/presscorner/detail/en/qanda_23_3194.

- EUR-Lex. “Regulation (EU) 2020/852 of the European Parliament and of the Council Of 18 June 2020 On the Establishment of a Framework To Facilitate Sustainable Investment, and Amending Regulation (EU) 2019/2088.” June 18, 2020. https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex%3A32020R0852.

- European Commission. “Proposal for a Directive on Corporate Sustainability Due Diligence and Annex.” February 23, 2022. https://commission.europa.eu/publications/proposal-directive-corporate-sustainability-due-diligence-and-annex_en.

- European Commission. “Q&A Adoption of European Sustainability Reporting Standards.” July 31, 2023. https://ec.europa.eu/commission/presscorner/detail/en/qanda_23_4043.

- EFRAG. “04/09/2023 - EFRAG-GRI Joint Statement of Interoperability.” April 9, 2023. https://efrag.org/news/public-444/EFRAG-GRI-Joint-statement-of-interoperability-?AspxAutoDetectCookieSupport=1

- The Morningstar Sustainalytics Ratings universe comprises approximately 5,000 large and medium market cap investable issuers in developed and emerging markets. The data for this analysis was retrieved on September 21, 2023, from Sustainalytics' Ratings Universe. For informational purposes only.

- EFRAG. “Presentation and Pre-Approval of the Draft ESRS XBRL Taxonomy Cover Note.” November 20, 2023. https://www.efrag.org/Assets/Download?assetUrl=%2Fsites%2Fwebpublishing%2FMeeting%20Documents%2F2311021035354554%2F05-01-%20SR%20TEG%20-%2020.11.2023%20Cover%20Note%20-Draft%20ESRS%20XBRL%20Taxonomy.pdf

- European Commission. “Q&A Adoption of European Sustainability Reporting Standards.” July 31, 2023. https://ec.europa.eu/commission/presscorner/detail/en/qanda_23_4043.