Earth Day 2019 is focused on protecting the species that make up our natural environment. With nearly three-quarters of the Earth’s surface covered in water, it’s a natural resource that we can’t take for granted. Human activity has irrevocably impacted this natural resource, affecting the quality and quantity of water available for consumption and for the natural habitat. In this article, we examine the role companies can play in addressing this water crisis and the potential opportunities for investors to support solutions.

Water may not be a top-of-mind concern for most investors, but it could turn out to be one of the most important investment themes of the 21st century. The nature of the challenge is that global water demand, which is projected to increase by more than 50% by 2030[i], already outstrips today’s global (renewable) water supply. This increase will be driven by population growth, economic development, continued urbanization and the rising per-capita meat consumption.

According to the United Nations World Water Development report for 2019[ii], fresh water reserves account for approximately 2.5% of global water resources, but only 0.6% of total natural fresh water resources are usable by humans. Fresh water reserves are falling largely because of overexploitation, pollution and climate change. Asia and Africa are faced with the most severe water scarcity challenges.

With over two billion people currently living in countries experiencing high water stress, and about four billion people experiencing severe water scarcity during at least one month of the year, the impact on people and environments is acute. Thirty per cent of the global population does not have access to safe drinking water. Six out of ten people do not have access to safely managed sanitation services. The World Health Organization[iii] estimates that around 2 million people die from waterborne diseases each year.

In this article, we explore the booming global market for sustainable water solutions and provide insights on opportunities available to investors to help mitigate the growing challenge of access to clean, fresh water. Companies that respond early and take steps to explore the market opportunities associated with these water challenges are more likely to gain a competitive advantage and achieve commercial success while also supporting sustainable development.

Sustainable water solutions – A booming market

In 2019, the World Economic Forum highlighted water scarcity as one of the most important risks facing the global economy. With this warning, it’s important for investors to consider how their portfolios might be impacted by water-driven risks and opportunities. According to OECD[iv] and CITI[v], a total investment of USD 7.5 to 9.7 trillion in water technologies and infrastructure will be required to mitigate the global water crisis. In developed countries, significant capital is needed to upgrade and maintain water infrastructure. For developing countries, especially China and India, the capital investment will focus on improving treatment systems, construction of new infrastructure and access to new fresh water supplies. The current global water industry is estimated to be about USD 700 billion[vi]. CITI estimates that market opportunities related to the water industry could reach USD 1 trillion by 2025.

Addressing the growing water crisis could offer attractive investment opportunities for the financial industry as well as options for investing in providers of water solutions with clear social and environmental advantages. Investing in companies that provide sustainable water technologies and products is required for achieving the Sustainable Development Goals (SDG), like SDG 6 which focuses on improving access to clean water and sanitation globally. Fresh water is indispensable, hence solutions that improve water efficiency and access to safe and affordable drinking water is needed in the short term.

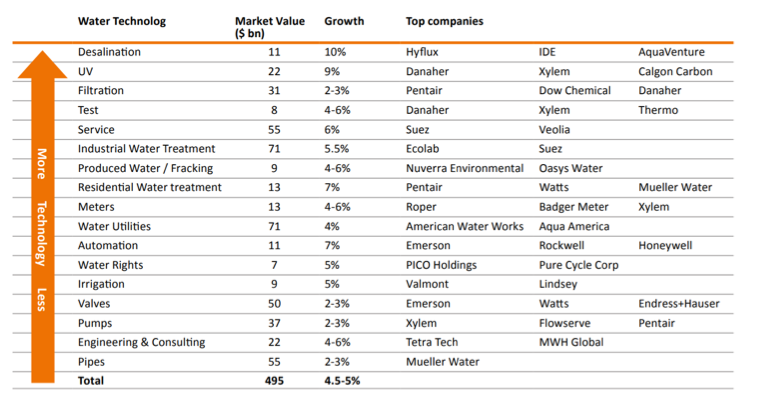

As shown in the figure below, the market for water products and technologies can be divided into sub-sectors, depending on the level of technological sophistication. According to NN Investment Partners[vii], the water products shown in the lower part of the table are considered well commoditized with intense competition, focused mainly on price. The products listed in the top half of the table have more technological differentiation, more value-added opportunities and less competition.

Water subsector size, growth and technological differentiation

Drinking water treatment

Increased population and urbanization have resulted in the generation of significant amounts of wastewater and pollution. Water treatment and filtration technologies play an important role in safeguarding human life from diseases such as cholera and giardiasis. Rising disposable income and growing health concerns with respect to impure water consumption is expected to enhance the global market by 2025, with Asia predicted to lead global demand. Government regulations to safeguard the supply of fresh water are predicted to further enhance market growth. Due to technological advancements and R&D investments, the water sector is currently developing highly efficient and low-cost treatment technologies for both commercial and residential use. Several manufacturers provide treatment and carbon-filtration products that can function without a constant supply of electricity, hence improving access to water in remote and rural areas[viii]. Companies like Pentair offer solutions to address global fresh water and wastewater challenges, including disinfection solutions with ozone, chlorine or chlorine dioxide, ultraviolet radiation or purification using membrane and carbon filters.

Desalination

Desalination (the removal of salts from water) is considered an energy intensive and expensive method for improving access to fresh water supplies, however it is seeing a renaissance as urbanization and industrialization increase water use in water-stressed areas. Desalination is forecasted to grow by 10% annually until 2025. Manufactures are improving distillation and reverse osmosis technologies, boosting the efficiency of desalination and lowering costs over time. The use of renewable energy sources in the desalination sector is seen as an emerging and environmentally attractive solution to the energy intensity challenge.

Desalination has historically been concentrated in the Middle East and North Africa due to lack of fresh water – these regions account for half of current global desalination capacity. While desalination is not solving the water scarcity problem, a growing number of countries, including China, India and the US, will turn to desalination to improve access to fresh water. Companies involved in desalination that exhibit strong environmental management include Acciona, whose water business manages 70 desalination plants and specializes in reverse osmosis technologies; and Veolia Environment, which operates 1,700 desalination plants in over 80 countries.

Infrastructure

Companies that manufacture and supply water infrastructure, such as water pipelines, smart meters, pumps and valves, may also benefit as ageing water infrastructure in the developed world is replaced, and as greenfield water infrastructure projects are launched in developing countries. The expenditures needed for water infrastructure over the next 20 years is staggering, as much of the water and wastewater infrastructure in the developed world is more than 50 years old and in need of repair or replacement. The water infrastructure needs of the US alone have been estimated to be USD 500 billion over the next 20 years, while the global figure has been estimated at USD 25 trillion[ix]. In China, new water infrastructure is being built to reduce economic disparity between urban and rural populations and to mitigate the impact of urbanization on water availability and quality. While these estimates could prove to be inflated, demand for corporate water infrastructure solutions will almost certainly rise sharply in the years ahead, especially in developing countries. Companies involved in water infrastructure that have strong ESG performances include: American Water Works, the largest water and wastewater utility company in the US; Xylem, which designs and manufactures water pumps, valves and analytics equipment; and Sulzer, whose Pumps Equipment division produces pumps and systems for engineered, configured and standard pumping solutions.

Conclusion

Demand for fresh water is forecast to exceed reliable, accessible supply by about 50% globally by 2030[x]. As a result, demand for sustainable water solutions and technologies will increase in the years ahead. Those companies that recognize the growing market for sustainable solutions as an opportunity, and respond by offering innovative water solutions that address the challenges related to scarcity, quality and allocation of water, are potentially well-positioned to profit in the long run.

Many of these solutions already exist, and investors with a long-term horizon can find numerous attractive investment opportunities along the water value chain: products for drinking water purification, desalination, and infrastructure are just a few examples of how different water solutions can improve access to water. These sectors are all poised to benefit as the water scarcity problem worsens and investors would be well advised to explore opportunities in these growing markets.

Want to know whether your portfolio companies are providing sustainable water solutions through their products? Visit our Sustainable Products Research page to learn how we can help.

Sources

[i]The 2030 Water Resources Group – Charting Our Water Future

[ii]UN World Water Development Report 2019: Leaving No One Behind

[iii]World Health Organisation – Combating waterborne disease at the household level

[iv]Financing water Investing in sustainable growth – OECD ENVIRONMENT POLICY PAPER NO. 11 (2018)

[v]Solutions for a Global Water Crisis- Citi Global Perspectives & Solutions (2017)

[vi] Research & Markets: Global Outlook of the Water Industry (2018)

[vii] NN Investment Partners: Water: investing with impact (2017)

[viii]RobecoSAM – Water: the market of the future

[ix] Sustainalytics: Water Scarcity: Will Investors be Left High and Dry? (2016)

[x] Sustainalytics: Water Scarcity: Will Investors be Left High and Dry? (2016)