Strategically located at the centre of Asia Pacific, with a young population of more than 675 million across 11 countries[i], Southeast Asia is an economic block with one of the world’s fastest GDP growth rates[ii]. In recent years, the region has been attracting the attention of global investors. At the same time, in the context of responsible investing moving from a niche activity to the mainstream, research on the environmental, social, and governance (ESG) performance of Southeast Asia companies is limited.

In this article, we have a deeper look at the ESG disclosure and performance of major Southeast Asia countries, focusing on the ASEAN-6 countries (Singapore, Malaysia, Thailand, Vietnam, Indonesia, and the Philippines).

ESG Disclosure Regimes

All six countries require a particular form of ESG disclosure and governments provide guidelines to help issuers prepare sustainability information. All exchanges of the six countries are members of the Sustainable Stock Exchange Initiative. However, countries like Indonesia and the Philippines only had a requirement after 2020; therefore, we might see further improvement in ESG disclosure in these markets in the next few years.

Notably, in the 2019 sustainability disclosure performance ranking by Corporate Knights[iii], the Stock Exchange of Thailand ranks ninth of 47 stock exchanges worldwide, the highest of all exchanges in the APAC region. The Singapore Exchange, Philippine Stock Exchange, and Indonesia Stock Exchange rank 24, 30 and 36, respectively.

Singapore

The Singapore Exchange published the Sustainability Reporting Guide[iv] in 2016, which requires every listed issuer to prepare an annual sustainability report on a comply-or-explain basis. The Guide suggests issuers select a globally recognised sustainability reporting framework that is appropriate for and suited to their industry and business model and explain their choice. Issuers are also required to identify material ESG factors in financial terms. According to the Guide, the sustainability report should set out the issuer’s policies, practices, performance and targets related to the material ESG factors identified.

Malaysia

According to the listing requirements[v] issued by Bursa Malaysia, issuers are required to disclose a narrative statement of the management of material economic, environmental and social (EES) risks and opportunities (Sustainability Statement) in their annual reports. For the Main Market listed issuers, they must include in their Sustainability Statement the information of governance structure, the scope of the Sustainability Statement and the management of material EES risks and opportunities. Bursa Malaysia provides a Sustainability Reporting Guide and six toolkits to help issuers prepare the Sustainability Statement.

Thailand

In a new Corporate Governance Code[vi] issued in 2017, Thailand’s Securities and Exchange Commission (SEC) requires that company boards ensure sustainability reporting, as appropriate, using a framework that is “proportionate to the company’s size and complexity and meets domestic and international standards.” Additionally, the Stock Exchange of Thailand provides resources on its Sustainable Business Development Center website to encourage best practices. As per the SET’s guidelines, many companies choose to use the Global Reporting Initiative (GRI) as their reporting framework.

Vietnam

In compliance with provisions set out in Circular No.155/2015/TT-BTC[vii] issued by the Ministry of Finance of Vietnam, public companies should produce an annual report disclosing their environmental and social impact and objectives regarding corporate sustainability. In 2016, the State Securities Commission of Vietnam, in cooperation with the International Finance Corporation of World Bank Group, published an Environmental and Social Disclosure Guide, which is compiled based on the GRI G4 and encourages independent external assurance.

Indonesia

In Indonesia, all listed companies are required to publish Sustainability Reporting starting from 2020 according to Indonesia Financial Services Authority (Otoritas Jasa Keuangan - "OJK") rule number 51/POJK.03/2017: Implementation of Sustainability Finance for Financial Services Institutions, Issuers and Public Companies[viii]. Moreover, financial services providers must also submit a Sustainable Finance Action Plan, which describes their plan for implementing sustainable finance. The rule also provides guidance for sustainability reporting, including a list of content that issuers should consider disclosing.

Philippines

In the Sustainability Reporting Guidelines for Publicly-Listed Companies[ix] it released in 2019, the Philippines Securities and Exchange Commission requires all publicly listed companies to submit sustainability information together with their annual report on a comply or explain basis. A penalty for incomplete annual reporting will be imposed on companies that fail to do the same. The Guidelines also provides a Reporting Template which is built upon four globally accepted frameworks, including GRI Standards and the Task Force’s recommendations on Climate-related Financial Disclosure (TCFD).

ESG Performance Comparison

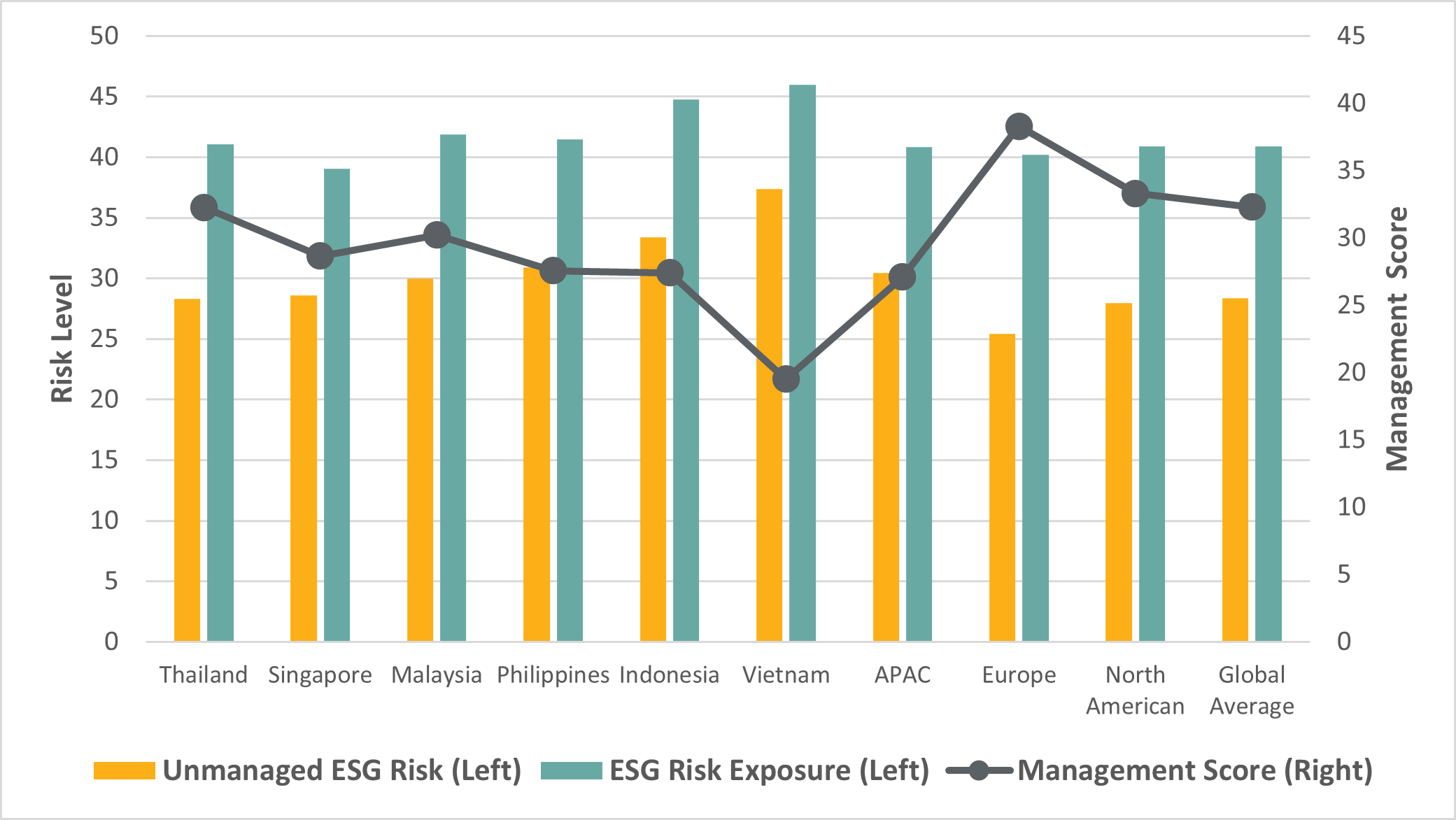

We compare the ESG performance of the ASEAN-6 countries leveraging Sustainalytics’ ESG Risk Ratings, which required the assessment of two dimensions: ESG risk exposure and ESG risk management. Exposure reflects the extent to which a company is exposed to material ESG risks. The Management component incorporates company commitments and/or actions that demonstrate how the company approaches and handles ESG issues. The scores below are all simple average of corresponding scores of all companies of the same country/region in our research universe.

Our findings show that Thailand leads the ASEAN-6 countries in terms of average ESG performance, contributed by moderate risk exposure level and relatively good management score. Vietnam and Indonesia show higher unmanaged ESG risk due to lower management score and higher exposure to high ESG risk industries such as steel, mining, oil and gas, electric utilities, and food.

Compared to the other regions, the ASEAN-6 countries on average, have a higher ESG risk than companies in Europe and North American, while in line with the APAC average. Five out of six countries, except for Thailand, lag behind the global average level.

Exhibit 1: ESG Performance Comparison

Source: Sustainalytics

Many believe that Southeast Asia, as one of the world’s most important economic engines, has a prosperous future. As countries continue to step up their efforts to improve the transparency and management of ESG risks and opportunities, people in this area could also enjoy a more sustainable and harmonious future.

Sources:

[i] World Population Review (2021), “South Eastern Asia Population 2021”, World Population Review, accessed (03.05.21) at https://worldpopulationreview.com/continents/south-eastern-asia-population

[ii] International Monetary Fund (2021), “Real GDP growth”, [ii] International Monetary Fund, accessed (03.05.21) at https://www.imf.org/external/datamapper/NGDP_RPCH@WEO/OEMDC/ADVEC/WEOWORLD/APQ/SAQ/SEQ/CAQ/EUQ/TWN/EAQ

[iii] Corporate Knights (2019), “2019 World Stock Exchanges”, Corporate Knights, accessed (30.04.21) at https://www.corporateknights.com/reports/2019-world-stock-exchanges/

[iv] Singapore Exchange (2020), “Practice Note 7.6 Sustainability Reporting Guide”, Singapore Exchange, accessed (30.03.21) at http://rulebook.sgx.com/rulebook/practice-note-76-sustainability-reporting-guide

[v] Bursa Malaysia (2021), “Listing Requirements”, Bursa Malaysia, accessed (31.03.21) at https://www.bursamalaysia.com/regulation/listing_requirements

[vi] The Securities and Exchange Commission of Thailand (2017), “Corporate Governance Code 2017”, the Securities and Exchange Commission of Thailand, accessed (31.03.21) at https://www.sec.or.th/cgthailand/EN/Pages/CGCode/CGCodeIndex.aspx

[vii] The Ministry of Finance of Vietnam (2015), “Circular No.155/2015/TT-BTC”, the State Securities Commission of Vietnam, accessed (31.03.21) at https://ssc.gov.vn/ssc/contentattachfile/idcplg?dID=103390&dDocName=APPSSCGOVVN162103170&Rendition=No.155-2015-TT-BTC&filename=C155mf6Oct15DisclosureInformationSecurities%20(ban%20day%20du).pdf

[viii] Indonesia Financial Services Authority (Otoritas Jasa Keuangan) (2017), “Implementation of Sustainability Finance for Financial Services Institutions, Issuers and Public Companies”, International Finance Corporation, accessed (07.04.21) at https://www.ifc.org/wps/wcm/connect/bab66a7c-9dc2-412f-81f6-f83f94d79660/Indonesia+OJK+Sustainable+Finance+Regulation_English.pdf?MOD=AJPERES&CVID=lVXU.Oy

[ix] Republic of the Philippines Securities and Exchange Commission (2019), “Sustainability Reporting Guidelines for Publicly-Listed Companies”, Republic of the Philippines Securities and Exchange Commission, accessed (07.04.21) at https://www.sec.gov.ph/corporate-governance/sustainability-report/