As world leaders prepare to meet in Glasgow for COP26 to discuss accelerating climate action towards the goals of the Paris Agreement, an emerging energy crisis persists around the world. Energy prices–relating to oil, natural gas, and coal–have spiked amidst a supply crunch in the market, disrupting economic and day-to-day activities in several regions globally.

The reasoning behind the lack of supply across the global energy market has varied widely, ranging from flooding in key coal production regions,1 lower output from wind energy,2 and broader geopolitical circumstances surrounding natural gas.3 However, the potential effects of a global energy crisis are likely to be universal, with progress on economic “reopening” and decarbonization being two areas of particular concern. As a result, ESG-orientated investors, particularly those who are actively engaging with oil, gas, and coal producers to transition their business models, must remain diligent for potential risks that may be on the horizon.

Although currently less risky, natural gas cannot serve as a short-term solution to a long-term problem.

Earlier this year, the International Energy Agency (IEA) released a comprehensive roadmap on how to transition to a net zero energy system by 2050 while ensuring stable and affordable energy supplies, providing universal energy access, and enabling robust economic growth. As one of its many milestones, the roadmap established that no new investments in fossil fuel supply projects should occur as of 2021.4 Understandably, given the current crisis, this milestone is now being criticized by governments and energy producers alike, many of whom are attempting to leverage the current widespread globally energy shortage as a reason to increase or grow fossil fuel production.

While accepting that new investments which perpetuate long-term emission releases are not consistent with a 1.5C scenario (as identified by the IEA), the role of natural gas in ensuring energy security over the short term should not be ignored. As such, as part of Sustainalytics’ ESG Risk Rating, we generally view natural gas production as relatively less exposed to material financial risk in the short term than other fossil fuels production types.

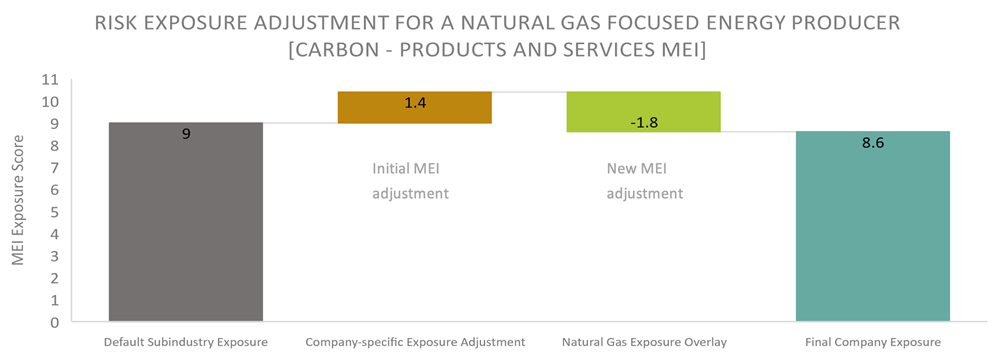

In our assessment of Carbon–Products and Services, a material ESG issue (MEI) which looks at risks relating to product and/or service-related GHG emissions, we account for this by adjusting a company’s exposure, dependent on the revenue they derive from natural gas. This adjustment is considered for both integrated energy producers and pure exploration and production companies. In the example below, the company had higher exposure to this MEI based on our initial assessment of its exposure indicators (e.g., financial performance, events). However, after accounting for the fact that over 60% of its revenue came from natural gas, its exposure to the MEI was determined as slightly lower than the default or standard subindustry exposure.

Source: Sustainalytics

Source: Sustainalytics

However, as noted recently by the European Commission’s president Ursula von der Leyen,5 over-reliance on gas instead of aggressively diversifying energy supplies towards renewables has now left many nations vulnerable, signaling the importance of moving forward on the energy transition rather than backwards.

ESG must remain a priority for investors as fossil fuel producers address shortages within the market

As governments try to limit the effects of the crisis on consumers, energy producers will feel more pressure to meet demand. Unfortunately, increasing production may also negatively impact other MEIs beyond carbon. MEIs of most concern include:

- Emissions, Effluents and Waste: increased levels of transportation, processing, and refining of energy products will likely generate higher exposure to this MEI. Raising production output without also elevating pollutant mitigation efforts may result in excessive releases, including those relating to non-GHG air emissions and hydrocarbon spills.

- Occupational Health and Safety: an expansion of production levels or quotas could result in more frequent and severe health and safety incidents under this MEI if conducted without necessary safeguards and processes. This is particularly relevant for coal mining in China where, despite the continuing occurrence of frequent and deadly accidents,6 production is being significantly increased.7

- Business Ethics: while Sustainalytics’ generally views oil, gas and coal producers as having a low level of material risk exposure to this MEI (partially due to the general lack of pricing discretion within most commodity markets), the current supply crunch may encourage unethical price hikes or supply hoarding, particularly in markets with weaker consumer protections. Sustainalytics assesses such incidents–along with incidents relating to the MEIs mentioned above – through its Controversy Research.

The role of ESG investors in the energy transition is more important than ever.

With skepticism on the reliability and value of low carbon energies now permeating within the market, it is more important than ever for responsible investors to hold oil, gas, and coal producers accountable for their carbon emissions through ambitious GHG-reduction targets. As Fatil Birol, head of the International Energy Agency (IEA), noted in a recent interview,8 treating the current supply crisis as a consequence of the energy transition will only create additional obstacles to achieving the transition’s goals.

Moreover, as noted earlier, risks and issues resulting from the energy crisis are not limited to affecting progress on addressing climate change. Energy producers must overcome the dual challenge of meeting global energy needs while mitigating other ESG risks, including the release of harmful air pollutants--considered the most significant environmental threat to human health, alongside climate change.9

.png?Status=Master&sfvrsn=57d9699_1)

Sources:

1. Global Times (2021), China’s coal hub Shanxi emerges from floods, easing coal supply concerns. https://www.globaltimes.cn/page/202110/1236562.shtml

2. Financial Times (2021), Europe’s electricity generation from wind blown off course. https://www.ft.com/content/d53b5843-dbe0-4724-8adf-75c66127ea80

3. Nasdaq (2021), Energy Transition Did Not Cause the European Crisis. https://www.nasdaq.com/articles/energy-transition-did-not-cause-the-european-crisis-2021-10-19

4. IEA (2021), Pathway to critical and formidable goal of net-zero emissions by 2050 is narrow but brings huge benefits. https://www.iea.org/news/pathway-to-critical-and-formidable-goal-of-net-zero-emissions-by-2050-is-narrow-but-brings-huge-benefits

5. Euronews (2021). Europe's energy crisis: Continent 'too reliant on gas”. https://www.euronews.com/2021/10/20/europe-s-energy-crisis-continent-too-reliant-on-gas-says-von-der-leyen

6. BNN Bloomberg (2020), Coal Mining Accidents Tests China’s Control of Its Cheapest Fuel. https://www.bnnbloomberg.ca/coal-mining-accidents-tests-china-s-control-of-its-cheapest-fuel-1.1535008

7. The Global and Mail (2021), China orders immediate jump in coal production in bid to fight power crunch. https://www.theglobeandmail.com/business/industry-news/energy-and-resources/article-china-orders-immediate-jump-in-coal-production-in-bid-to-fight-power/

8. Nasdaq (2021), Energy Transition Did Not Cause the European Crisis. https://www.nasdaq.com/articles/energy-transition-did-not-cause-the-european-crisis-2021-10-19

9. World Health Organization (2021), New WHO Global Air Quality Guidelines aim to save millions of lives from air pollution. https://www.who.int/news/item/22-09-2021-new-who-global-air-quality-guidelines-aim-to-save-millions-of-lives-from-air-pollution