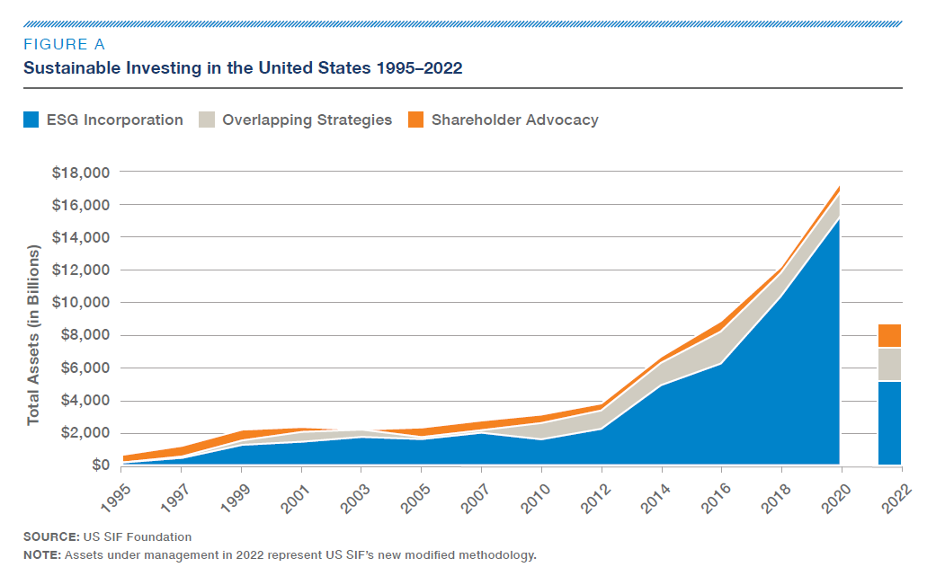

The US Sustainable Investment Forum (US SIF) reported that in 2022, sustainable investing assets amounted to US$8.41 trillion — a significant decrease from the peak of US$17.1 trillion in 2021 (Figure 1). This decline is partly attributed to a recent reevaluation in what can be considered a sustainable investment and a decision by several large asset managers to report fewer sustainable assets to avoid accusations of greenwashing.1 These changes have raised concerns about the potential for investment strategies, products, or funds to be associated with greenwashing.

Figure 1. Sustainable Investing in the United States 1995 - 2022

Source: US SIF Foundation

In the context of integrating environmental, social, and governance (ESG) considerations into the investment management process, greenwashing refers to the act of making sustainability claims about an investment product or approach that are not adequately supported. Greenwashing can be intentionally misleading, but it can also be unintentional. This is particularly true in a business environment that is transitioning to a regulated arena. Such transitionary periods are often fragmented and opaque, increasing the likelihood of errors and non-compliance.

The decline in sustainable investing assets is also partly attributed to the impact of the EU’s Sustainable Finance Disclosure Regulation (SFDR),2which led to enhanced disclosure requirements for sustainable investment products in Europe. As similar proposals are being considered by the Securities and Exchange Commission (SEC) in the United States, and with related enforcement ramping up, it has become mission critical for investors to back-up their sustainable investment claims.

By taking an active role through constructive and collaborative ESG stewardship activities, investors can unequivocally show their commitment to sustainable practices, while also contributing to positive outcomes in the investment landscape. In this article, we’ll examine how investors’ ESG stewardship activities can reassure stakeholders of an authentic sustainable investment approach and mitigate greenwashing claims.

Approaches and Considerations for ESG Stewardship

Stewardship is where ESG insights become action. It involves direct engagement between investors and the companies they invest in, aiming to drive positive change and safeguard the long-term value of these companies. Regardless of the specific investment strategy, active engagement and collaboration with issuers on ESG matters enables investors to genuinely incorporate sustainability into their strategies beyond what portfolio construction and management alone can achieve. This approach also adds an extra layer of assurance for stakeholders seeking to distinguish genuine sustainability efforts from mere greenwashing. Some approaches to ESG stewardship include the following:

Reactive Stewardship

In a reactive stewardship approach, investors engage with companies to remediate severe incidents that breach norms related to human rights, labor rights, the environment, business ethics and more. For instance, if an investor holds shares in a company involved in mining critical materials for lithium ion batteries, but the company faces accusations and legal action related to forced labor in its operations, the investor can engage directly with the company to address the issue. This engagement allows investors to better understand the company’s plan to remediate the issue, and provide collaborative, actionable steps where needed. If the company remains non-responsive over time, the investor may consider escalating through various means including investor letters, the proxy voting process, or divesting from the issuer.

Proactive Stewardship

When investors take a proactive engagement approach, they aim to mitigate financially material ESG risks to protect and promote the long-term enterprise values of issuers. For example, an investor with an energy transition fund may have significant exposure to issuers still heavily reliant on fossil fuels. By engaging with these companies on long-term risk mitigation areas, such as the roll out of science-based greenhouse gas reduction targets, the investor can provide evidence of its efforts to improve the companies' long-term sustainability performance, thereby reducing the risk of greenwashing accusations.

Thematic Stewardship

Thematic stewardship engages corporate issuers throughout a value chain to address risks and maximize opportunities around broad thematic areas. Thematic areas can include biodiversity and natural capital, the circular economy, human rights, and more. For instance, an investor with significant exposure to the agriculture sector may engage with influential issuers in that value chain to understand and make progress around their specific risks. They may also look at nature-positive opportunities in alignment with the Taskforce on Nature-Related Financial Disclosures. The investor can then apply these learnings across a portfolio.

Stewardship Through Voting Policy

Leveraging a voting policy that is aligned with activities at annual general meetings (AGMs) is another key element of ESG stewardship. For example, a portfolio manager may vote against an executive compensation proposal for an issuer with high emissions because the company failed to establish a science-based greenhouse gas reduction policy. Integrating voting into the overall stewardship platform allows investors to consider an issuer's ESG implementation (or lack thereof) and exercise their rights as shareholders accordingly.

Enhancing Stewardship Through Proxy Voting and Engagement

For equity investors, proxy voting serves as a crucial mechanism to exercise their ownership rights. Its effectiveness is maximized when complemented by an engagement approach. By using voting strategically, investors can reinforce ongoing dialogues with companies or escalate discussions that may not be progressing as intended. Voting also enhances an investor's overall influence when addressing the growing number of ESG-related proposals presented during AGMs.

Additionally, when issuers know that their investors are willing to partake in good faith dialogues, it makes it much easier to work collaboratively to solve complex sustainability challenges.

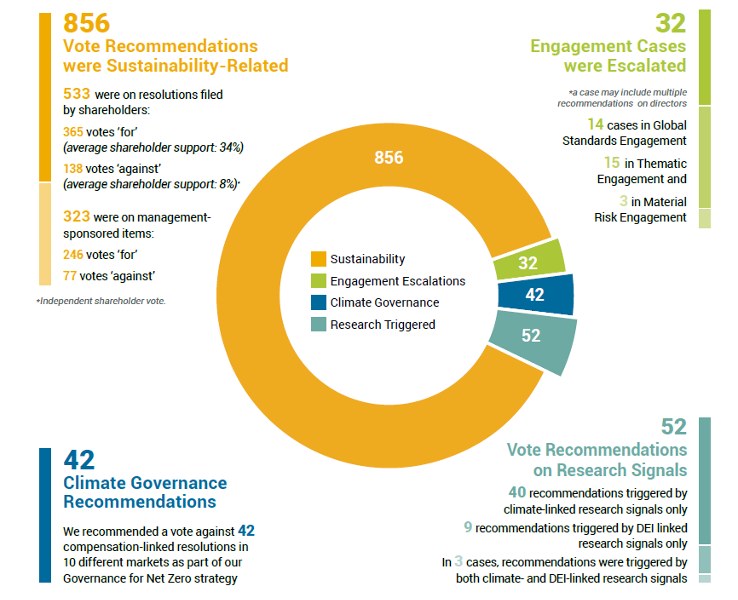

The expansion of the ESG proxy voting arena is evident in the increase of Morningstar Sustainalytics' ESG-related vote recommendations to clients. In Q2 2023 alone, 936 recommendations across 530 shareholder meetings were delivered, representing a 28% increase compared to the same period in 2022, a year in which 856 total vote recommendations were delivered.4

Figure 2. Morningstar Sustainalytics Vote Recommendations 2022

Source: Morningstar Sustainalytics. For informational purposes only.

Engagement at the issuer level is not limited by asset class, and its value for fixed income investors can be just as significant as for equity investors. For fixed income investors, engaging with companies and indicating a possibility of divestment if adequate actions are not taken can substantially impact the cost of capital for the issuer. This underscores the importance of meaningful dialogue and proactive engagement, regardless of the investor's asset class.

Incorporating Stewardship into the Investment Management Process

Now that we understand how good stewardship can mitigate greenwashing for a diverse range of investors, it’s important to note that there are myriad ways in which investors can incorporate stewardship into the investment management process, including pre- and post-investment.

Using stewardship as a complement to the pre-investment due diligence stage can help define the universe of securities eligible for investment. By directly engaging with companies, investors can gain valuable insights into a company's willingness to improve on material ESG issues.

For instance, if an issuer is facing a major controversy, such as a product safety incident or a business ethics scandal that has negatively impacted its reputation and financial performance, traditional investment policies might exclude it immediately. However, through engagement, investors can gauge the issuer's transparency and commitment to addressing the issue. This could inform the investment committee's decision on whether the company remains in the investable universe until further performance can be assessed.

In the post-investment stage, incorporating engagement insights into the ESG integration strategy is common practice. Analyzing company readiness, risk exposure, and system-level opportunities, such as a company's ability to perform in a low-carbon economy, can provide valuable inputs for future decision-making and influence portfolio management decisions.

Even passive strategies can harness the power of ESG stewardship through an overlay approach. Identifying the riskiest issuers in an ESG context and actively engaging with them across a benchmarked index is an emerging method by which systematic investors combine active ownership with passive strategy exposure.

A sincere approach to ESG stewardship remains one of the most effective ways to integrate sustainability principles into the investment management process, ultimately removing any doubts about an organization's commitment to executing a coherent sustainability strategy. Most importantly, a well-executed stewardship strategy not only benefits investors, but also contributes to the broader advancement of sustainable practices in the investment landscape.

Stewardship in partnership with a service provider is a proven and increasingly popular way for investors to enhance their share of voice, increase the number of engaged issuers, and complement existing internal stewardship expertise and capacity for activities such as reporting and data management. Morningstar Sustainalytics offers a comprehensive ESG Stewardship Offering, representing over 130 clients and approximately US$4.5 trillion (EUR4.2 trillion) under engagement. Morningstar Sustainalytics is a signatory of the UK Stewardship Code. Connect with our stewardship team to learn more about how we can support the next evolution of your ESG activities.

References

US SIF. 2022. 2022 Report on US Sustainable Investing Trends. https://www.ussif.org/store_product.asp?prodid=46

US SIF. 2022. 2022 Report on US Sustainable Investing Trends. https://www.ussif.org/store_product.asp?prodid=46

Morningstar Sustainalytics. 2023. ESG Voting Policy Overlay Summary: Q2 2023.

Ibid