The COVID-19 pandemic is likely to further amp up the market’s interest in ESG investment research. It’s not just that ESG funds and indices have generally outperformed their non-ESG counterparts since the COVID-19 sell-off began in mid-February.[i] It’s also that the pandemic itself has drawn attention to ESG issues ranging from biodiversity and habitat loss to employee relations and supply chain management.

In this environment, portfolio managers can expect to face even greater incentives to integrate ESG factors into their investment process and improve the ESG “performance” of their portfolios, for example, by improving their Morningstar Sustainability Rating.[ii]

However, from a relative valuation standpoint, the trend towards increased ESG integration may present challenges. Before the COVID-19 sell-off, there was already some evidence that top ESG stocks were beginning to trade at a substantial premium relative to stocks with the highest levels of unmanaged ESG risk.[iii]

While valuations have compressed in recent months, our analysis suggests that this trend persists: lower ESG risk companies in Sustainalytics’ comprehensive universe currently trade at an average P/E ratio of 19.0, compared to 18.1 for higher ESG risk firms.

We would not go so far as to say that this gap constitutes a bubble – far from it in fact. But clearly, the idea is out there that portfolio managers may have to pay a premium for stocks that will most significantly improve the ESG performance of their portfolios.

Introducing ESGarp Scores

This is precisely why we chose to look at where managers can get the biggest “ESG bang for their buck” in our recent portfolio research report ESG in the COVID-19 recovery. ESGarp scores – a portmanteau of ESG and the growth at a reasonable price (GARP) investment strategy – pinpoint those markets where investors have the greatest probability of finding stocks with attractive ESG scores that also trade at a relatively low P/E multiple relative to their same-sector global peers.

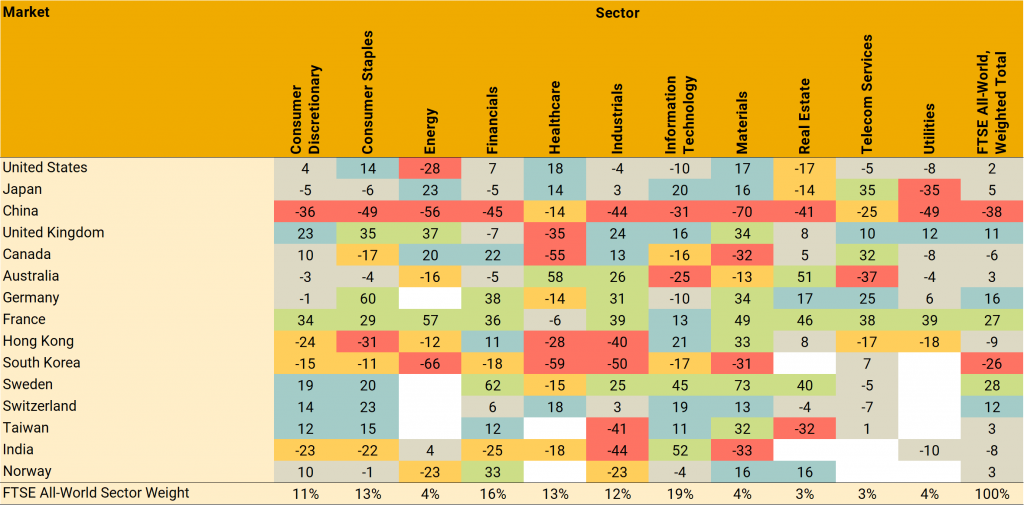

Exhibit 1: ESGarp scores

Source: Sustainalytics, Morningstar Direct

As shown in Exhibit 1, Sweden and France stand out from the pack: they are the markets where investors can currently get the greatest ESG bang for their buck, with respective total ESGarp scores of 28 and 27.

Germany, Switzerland and the United Kingdom demonstrate good prospects for finding low ESG risk firms that trade at lower relative valuations. The German Financial sector, Swiss Consumer Staples sector and UK Energy sector have particularly high ESGarp scores.

The US ranks 10th out of the 15 markets shown in Exhibit 1, with a total ESGarp score of 2. Although the ESG Risk Rating scores of US companies are slightly favourable when compared to companies in other markets, they exhibit above-average P/E ratios in most sectors, notably Real Estate and Information Technology.

China ranks last in our evaluation, with a total ESGarp score of -38. Ultimately this is due to relatively high levels of ESG risk and higher relative valuations. Lower P/E ratios are apparent in some of China’s sectors, including Health Care (ESGarp score of -14), Real Estate (-41) and Energy (-56), but they are not enough to counteract the sizeable levels of ESG risk relative to same-sector global peers.

The ESGarp scores presented in Exhibit 1 map suggest that the ESG bubble argument that some have made could be an occurrence that narrowly applies to only certain corners of the global equity market. In many instances, we were able to single out investments with attractive ESG qualities at enticing valuations merely by looking at peers in other global markets, adding a new case for global investing beyond the traditional textbook diversification benefits.

Maximizing value

In this blog post and accompanying report, we have sought to introduce some preliminary ideas about how investors can navigate the COVID-19 recovery from an ESG and relative valuation point of view. The extent to which top ESG stocks trade at a premium is a question that we think will be increasingly monitored in the months and years to come, and we expect to see continued innovation in measures such as ESGarp scores that seek to marry ESG risk and equity valuations.

Sources:

[i] https://www.barrons.com/articles/sustainable-companies-are-beating-the-market-during-the-crisis-will-it-last-51585241734

[ii] https://www.morningstar.com/company/esg-investing

[iii] https://www.ft.com/content/73765d6c-5402-11ea-90ad-25e377c0ee1f