The EU Action Plan for Sustainable Finance has kept those of us in the European sustainable investment market busy over the past year. While we acknowledge that the EU Action Plan is not the holy grail of sustainable investment regulation (see our blog post on MiFID II’s unintended consequences here), in this blog post, we will nevertheless highlight the merits that we see in the EU regulatory package.

Asset Manager's Expanded Fiduciary Duty

The first and most obvious benefit of the new regulatory regime is that the Sustainable Finance Disclosure Regulation (SFDR) recognizes the need to include sustainable risk management in the fiduciary duty of asset managers. By requiring all funds to report on sustainability risk, regardless of their investment strategy, the European Commission has sent a strong signal to the industry that from now on, one cannot disregard the impact that environmental, social, and governance risk will have on the financial value of investments in the long run.1 This requirement on its own is quite an improvement when compared to other regions, but the European Commission did not stop there.

Double Materiality Framework Prevents Greenwashing

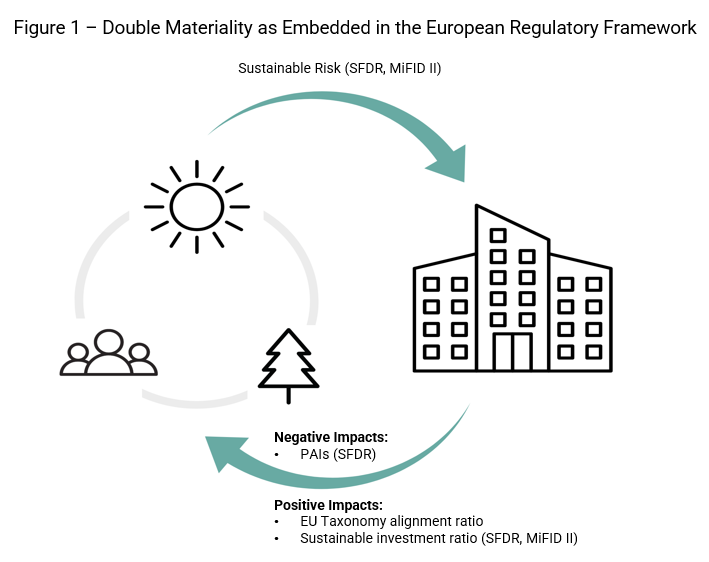

With the creation of the EU Taxonomy and the SFDR’s required Principal Adverse Impacts (PAIs) disclosures, the European Commission has created a stringent framework to evaluate the positive and negative impacts of an investment. Coupled with the mandatory management and reporting of sustainability risk, the Commission has validated the double materiality methodology to evaluate sustainable funds.2 The EU Action Plan confirms that investors must undertake a distinct evaluation of the risk a company can represent for the environment and society on one hand, and the risk for the future financial performance of the investment posed by environmental and social deterioration on the other hand (see Figure 1 below). In a market that is prone to greenwashing, an analytical framework that avoids oversimplification is a much-needed step to foster greater ESG education and comparability in the market. It also reduces the ambiguity around ESG terminology that has been a breeding ground for greenwashing tactics.

Double Materiality Approach Improves Investment Strategy Clarity

The double materiality framework leveraged in the MiFID II regulation has also encouraged all market participants to review their gamut of funds with a consistent approach. This is quite a change in a market where marketing strategies for ESG products have often focused on positive attributes pertinent to attracting sustainable investors, while downplaying the negative impacts of the investments; for example, promoting climate funds that invest in renewable energy solutions without disclosing exposure to fossil fuel companies. The implementation of this new sustainable investment framework that encompasses a wide range of indicators has forced asset managers to have a more granular understanding of the outcome of their investment strategies and investors a clearer view on the real-life outcomes of their investment. This evolution is undoubtedly raising the standard of the European sustainable investment market.

Taxonomy Exposed Climate Funds' Low Alignment Ratio

A clear benefit of the EU Taxonomy is that it has forced many asset managers to acknowledge that the majority of their so-called climate funds had, in fact, a very low level of revenue aligned with climate change mitigation or adaptation activities. With this information now available, one can expect that alignment ratios will be higher for new sustainable funds in the future, as monitoring a KPI is the first step to improving it.

Sustainable Investment Ratio Should Improve Consistency

The benefits of the sustainable investment ratio are more ambiguous due to the lack of a precise calculation methodology from the European Commission, leaving room for potential greenwashing. However, on the positive side, this ratio has pushed many managers towards clearly and transparently defining a methodology that should be applied consistently across all their funds. This is a great win for transparency and consistency and will force firms to completely reconsider how they market ESG products.

EU Framework Pushes Investors and Issuers into Action

Finally, this new regulatory patchwork will inevitably move investments toward sustainable activities and ultimately move the needle on transitioning and future-proofing the economy (e.g., Fit for 55). As asset managers now need to report on the real-life outcomes of their investment strategies (e.g., exposure to fossil fuel) and optimize their allocation accordingly, issuing companies will scramble to maximize the positive impacts of their activities while minimizing the negative ones in order to remain attractive to investors.

Download our latest ebook

Linking Investments to Real-World Outcomes

While the EU Action Plan is not perfect, it has clear benefits that should not be underestimated. The European Commission had an impossible task of balancing between a very prescriptive approach that would have probably required years to develop, and moving ahead with regulation that would require adjustments but would also result in short-term improvements. It is important to recognize that this regulation is proving to be a great push not only for transparency and consistency, but also for linking investments to real-world outcomes.

Looking Forward

We should certainly expect the regulation to evolve as lessons are drawn from the current implementation. The European Securities and Markets Authority (ESMA) has already made some significant changes in the SFDR, from a pure disclosure obligation based on the self-classification of funds (e.g., Article 8 and 9), to requiring a minimum ratio of sustainable investment in Article 9 funds. The European Commission even recently suggested additional requirements to meet a minimum 50% threshold of sustainable investment for funds using the term sustainable in their title.

Fostering the environmental transition of European economies is the Everest of our time and we’re only starting to establish the base camp. More difficulties and mistakes will be made along our journey to the summit, but it’s not a reason to stop here.

References

1 European Parliament. 2019. Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability-related disclosures in the financial services sector. November 27, 2019. https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32019R2088&from=fr.

2 European Commission. 2021. Commission Delegated Regulation (EU) of 21.4.2021 amending Delegated Regulation (EU) 2017/565 as regards the integration of sustainability factors, risks and preferences into certain organisational requirements and operating conditions for investment firms. April 21, 2021. mifid-2-delegated-act-2021-2616_en.pdf (europa.eu). See article 1.

.png?sfvrsn=3fa56df_2)