A Regulatory In-between

For observers of the EU’s Sustainable Finance Strategy, 2022 kicked off boldly as the European Commission went ahead with plans to include natural gas and nuclear-related activities as potentially sustainable under their ‘Green Taxonomy’.

However, in midst of this furor, seemingly less attention has been paid to other components of the regulation that have quietly taken effect from the 1st of January 2022, presenting their own set of challenges. One example is the fund level disclosure requirements under the ‘Level 1’ Taxonomy Regulation (EU 2020/852).

According to Articles 5, 6 and 27 of the Taxonomy ‘Level 1’ text, it appears that from 1st of January 2022, Article 8 and 9 products (as defined in the Sustainable Finance Disclosure Regulation (SFDR)) need to disclose the proportion of investments that contribute to the first two objectives of the EU Taxonomy. This timeline is now misaligned with the SFDR ‘Level 2’ text, which has been affected by multiple delays and would typically work to define the calculation methods and rules for presenting Taxonomy alignment in fund disclosure documents.

The timeline below summarizes the apparent misalignment.

Figure 1: Timelines for Taxonomy Level 1 vs SFDR Level 2 regulation.

*Timeline based on latest date of application noted in EC letter dated 25/11/2021.

The above misalignment puts asset managers and other product manufacturers into an unusual regulatory limbo in 2022, hanging between two interlinked pieces of regulation with different start dates. During this time, interpretations of taxonomy disclosure obligations and expected timelines may vary. For investors wanting to disclose something in 2022, the difficulty is compounded by the fact that companies themselves are not being mandated to report alignment until 2023, due to timelines in the Article 8 Delegated Act.

Then there’s the politics. On the one hand, there may be some hesitation to be a first mover in disclosing taxonomy alignment, particularly if underwhelming figures are found. This may be especially relevant for Article 8 funds and the fact that nineteen of the twenty largest Article 8 funds have no mention of sustainability or ESG related terms in their names, let alone environmental or social objectives.

On the other hand, the proliferation of Article 8 and 9 products over the last year has led to raised eyebrows and the emergence of new pressures to avoid greenwashing, with accusations plentiful and formal investigations underway. In this climate, disclosing EU Taxonomy alignment can be a fundamental way to demonstrate the credibility of green products in a quantifiable and standardized way (and possibly the only way), and some asset managers will want to demonstrate this sooner rather than later.

That said, how product manufacturers might go about this in the current regulatory climate is an interesting question. So let’s observe some of the approaches being taken by players in the market so far in 2022.

Disclosure Examples

Below are some examples of approaches to disclosure and language used around taxonomy alignment in prospectuses published or updated since the 1st of January 2022. Note that the quotes cited are not exhaustive, with many manufacturers including more detail on the topic of Taxonomy alignment within their disclosure documents.

While this is not a statistically representative sample, we can observe that the following broad approaches are being taken:

- Not committing to any level of alignment

- Not committing to any alignment, but indicating that some level alignment is still possible

- Offering target alignment percentages

- Offering alignment ranges based on current coverage and available data

Article 8 Fund Examples

Franklin Templeton – Franklin K2 Electron Global UCITS Fund – Article 8 fund

Dated January 2022 – Accessed 23/02/2022

“In line with its ESG methodology, the Fund promotes environmental characteristics but does not commit to making environmentally sustainable investments as defined in the Taxonomy Regulation.”

HSBC Global Asset Management – HSBC OpenFunds, including several Article 8 funds

Dated 1 February 2022 – Accessed 23/02/2022

“As part of their investment aims, the following Funds intend to make investments that contribute to the environmental objectives of climate change mitigation and/or climate change adaptation. These Funds therefore invest in activities that, with effect from 1 January 2022, will be classified under the Taxonomy Regulation as activities that contribute to climate change mitigation and/or climate change adaptation.”

“…However, the Funds cannot, at this time, make any statements about the proportion of underlying investments that are in economic activities that qualify as environmentally sustainable under the Taxonomy Regulation or the proportion of their total investments that are aligned with the Taxonomy Regulation.”

AEGON Asset Management – AEGON Global Multi Manager Funds, including several Article 8 funds

Dated 21 July 2020, updated 1 January and 1 February 2022 – Accessed 23/02/2022

“As at the date hereof, there is insufficient data available to be able to assess investments using the technical screening criteria”

“…Therefore, the Fund Manager considers that the most prudent course of action, at present, is to disclose that 0% of such Funds’ investments are in environmentally sustainable economic activities for the purposes of the Taxonomy Regulation”

Robeco – Robeco All Strategies Funds, including several Article 8 funds

Dated January 2022 – Accessed 25/02/2022

“The Sub-fund does not commit to invest in Taxonomy aligned investments, however it cannot be excluded that among the Sub-fund's holdings certain investments are Taxonomy aligned.”

Blackrock – Blackrock Global Funds, including several Article 8 and 9 funds

Dated February 2022 – Accessed 23/02/2022

“While there may be investments in the Funds that are in economic activities that contribute to an environmental objective and may be eligible to be assessed against the technical screening criteria, BlackRock is not currently in a position to describe…the extent to which the investments of the Funds are in economic activities that qualify as environmentally sustainable and are aligned with the Taxonomy Regulation…”

“As at the date hereof, there is insufficient reliable, timely and verifiable data available for BlackRock to be able to assess investments using the TSC”

“In addition, the Regulatory Technical Standards (RTS) under the Sustainable Finance Disclosure Regulation (SFDR) which define the methodology for the calculation of the share of environmentally sustainable investments and the templates for these disclosures are not yet in force. As at the date hereof, BlackRock is not able to provide standardised and comparable disclosures on the Taxonomy alignments of the Funds.”

Article 9 Fund examples

Triodos – Emerging Markets Renewable Energy Fund, Article 9 fund

- January 2022 Addendum to Prospectus dated June 2021 – Access 24/02/2022

“The Sub-Fund aims at investing 100% in sustainable investments as defined in Article 2(17) of the SFDR, with the exception of holdings in cash, liquid assets and derivatives used on an ancillary basis for proper liquidity and portfolio management.”

Alliance Bernstein – AB SICAV I, including several Article 9 funds

Dated January 2022 – Accessed 24/02/2022

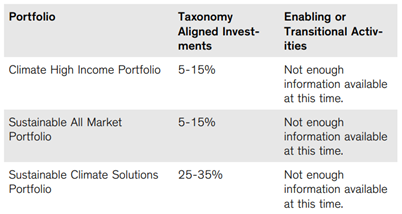

“These percentages ranges are based on currently available data and only a small portion of the above Portfolios’ holdings have enough data publicly available to assess alignment. As more data becomes available, it is expected that the below percentages will increase.”

Figure 2: Screen capture of alignment ranges being employed by Alliance Bernstein

for Taxonomy disclosures (cited above)

T. Rowe Price – Global Impact Equity Fund, Article 9 fund

Dated January 2022 – Accessed 23/02/2022

“As well as investing in securities that contribute to environmental objectives, the fund may invest in securities that contribute to social or other objectives. No minimum exposure to an objective is imposed upon the fund, which means the fund may at times invest only in securities that contribute to non-environmental objectives. As a result, the fund’s minimum proportion of investments aligned to the Taxonomy regulation could be 0%.”

Observations

We can observe in currently available disclosures that many product manufacturers are choosing the approach of not committing to any level of alignment. Perhaps what is interesting is that this doesn’t appear to be limited to Article 8 funds. A number of Article 9 funds, which have sustainable investments as an express objective, are also not committing to any taxonomy alignment levels above 0%.

This will be a disappointing outcome for many industry observers and end investors. However, given the regulatory ‘in-between’ the market finds itself in, perhaps not entirely surprising.

There are a range of additional factors that may be putting off product manufacturers from disclosing, with some of the following noted in product disclosures:

- The regulators being reluctant on the use of estimated taxonomy data, introducing the requirement of “equivalent” data

- A lack of taxonomy relevant reported data from companies, and the fact that mandatory alignment reporting for companies doesn’t start until 2023 (via the Non-Financial Reporting Directive)

- Widespread exposure of Article 8 and 9 funds to international companies that don’t fall under EU corporate reporting rules

Despite these constraints, some players are trying their hand and attempting to provide end investors with some indication of taxonomy alignment for the first time—which one could say speaks to the spirit of the regulation.

For now, though, it appears most players lie in wait. Perhaps the commencement of the SFDR ‘Level 2’ regulation from 1st of January 2023 will provide the industry with the clarity it needs to move forward. Until then, who else will be bold enough to lead the market and demonstrate their green credentials?

To learn more about how Sustainalytics’ comprehensive EU Taxonomy Solution can help with reporting your product’s EU Taxonomy alignment, feel free to get in touch today to speak with our knowledgeable Client Relations team.

.tmb-thumbnl_rc.png?Culture=en&sfvrsn=12471767_1)