Europe is facing two major crises—an energy crisis, worsened by Russian energy supply disruptions and the challenge of tackling climate change. Renewables have the potential to accelerate EU's energy independence and reduce emissions. Still, there is also an urgent need to secure an adequate energy supply, especially in the coming winter months when heating demand increases. In the short-term, many EU countries are turning to other fossil fuel producers in the Middle East OPEC+ and the US, as well as domestic coal production. For firms deciding which energy projects to invest in, they face a complex question: are energy supply disruptions advancing the EU’s transition to a lower-carbon economy and its energy independence or furthering the continent’s dependence on fossil fuels?

Europe’s Dependence on Russian Energy

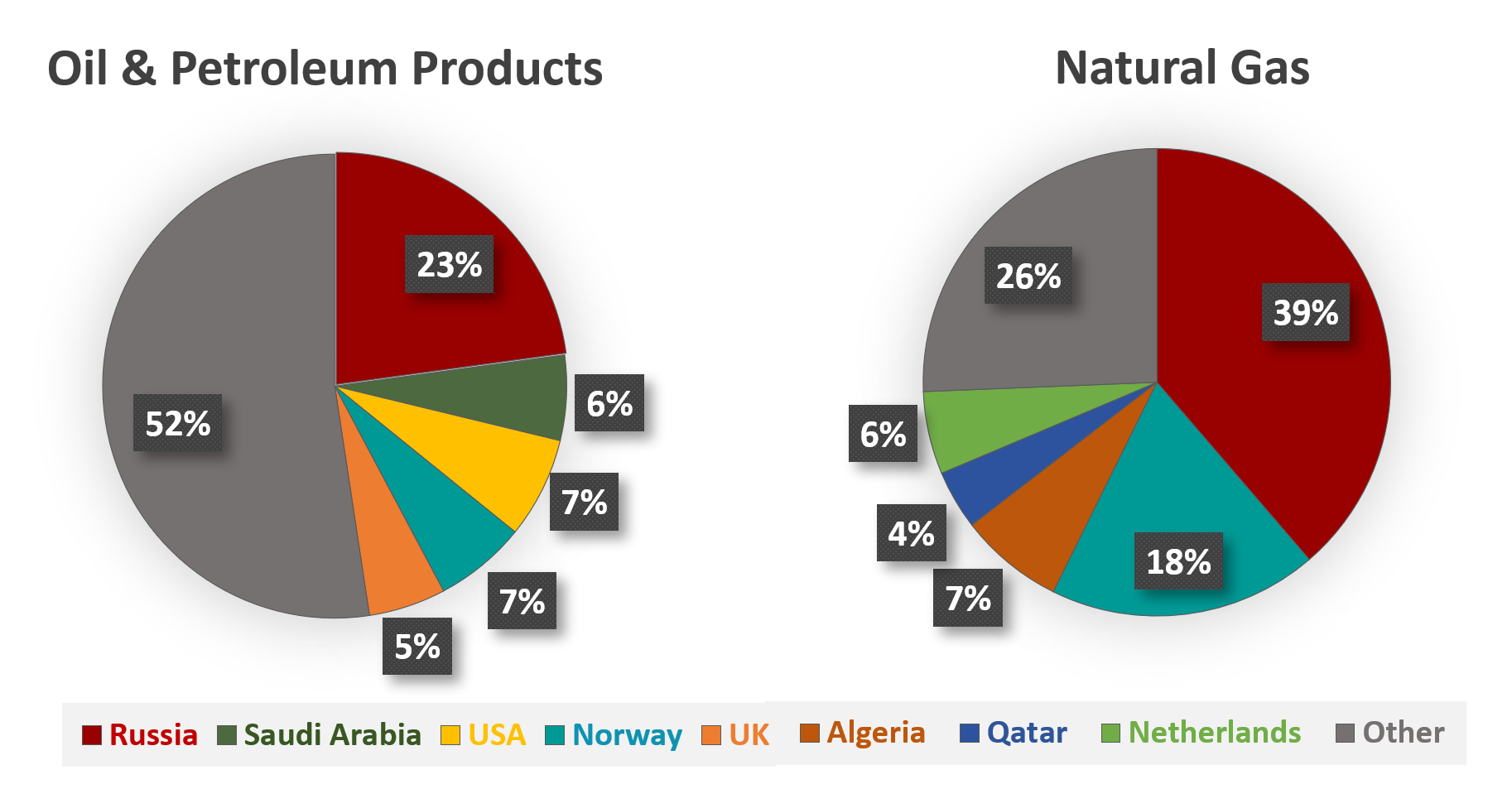

Russia is the EU’s largest energy supplier. In FY2020, around 40% of natural gas imports to the EU came from Russia, and almost one-quarter of oil and petroleum product imports, as shown in Figure 1.

Figure 1: EU Energy Imports by Partner Country (2020)

Source: Eurostat1,2

Note: The top 10 countries making up “other” countries for oil and petroleum product imports are (from largest to smallest): Kazakhstan, Nigeria, Netherlands, Belgium, Iraq, Azerbaijan, Algeria, Germany, Italy, Spain; for natural gas imports the countries are: US, UK, Nigeria, Germany, Libya, Trinidad and Tobago, France, Hungary, Denmark, Equatorial, Austria.

This reliance allowed Russia to weaponize its energy products. Between April and June 2022, a number of European countries experienced gas suspensions or reductions, including Germany, the largest EU buyer of Russian gas- with a 60% reduction in gas supply through the Nord Stream 1 pipeline.3 The suspensions resulted from customers refusing to meet Russia’s demand of payment in roubles, despite their existing supply contracts being signed under the agreement of payment in US dollars or euros. In addition, Russian entities claimed the latest supply reductions are due to technical issues; however, many argue Russia is using energy as a political tool against countries backing Ukraine. As the supply suspensions and reductions continue, there is growing concern that governments will need to begin rationing energy supplies.

Turning to Coal Production

Given rising gas prices, coal usage in 2021 increased by about 10-15%4 while production increased by around 8%.5 Now, as Russia continues to suspend or reduce gas supplies to its European customers, the threat of a winter energy crisis is causing more European countries to turn to coal. This includes the two countries that make up the largest portion of coal production in the EU- Germany (103 Mt), followed by Poland (98 Mt).6,7 Austria and the Netherlands also made similar plans to extend the production of coal to replace Russian gas in the short term.8

Status of the EU Energy Transition

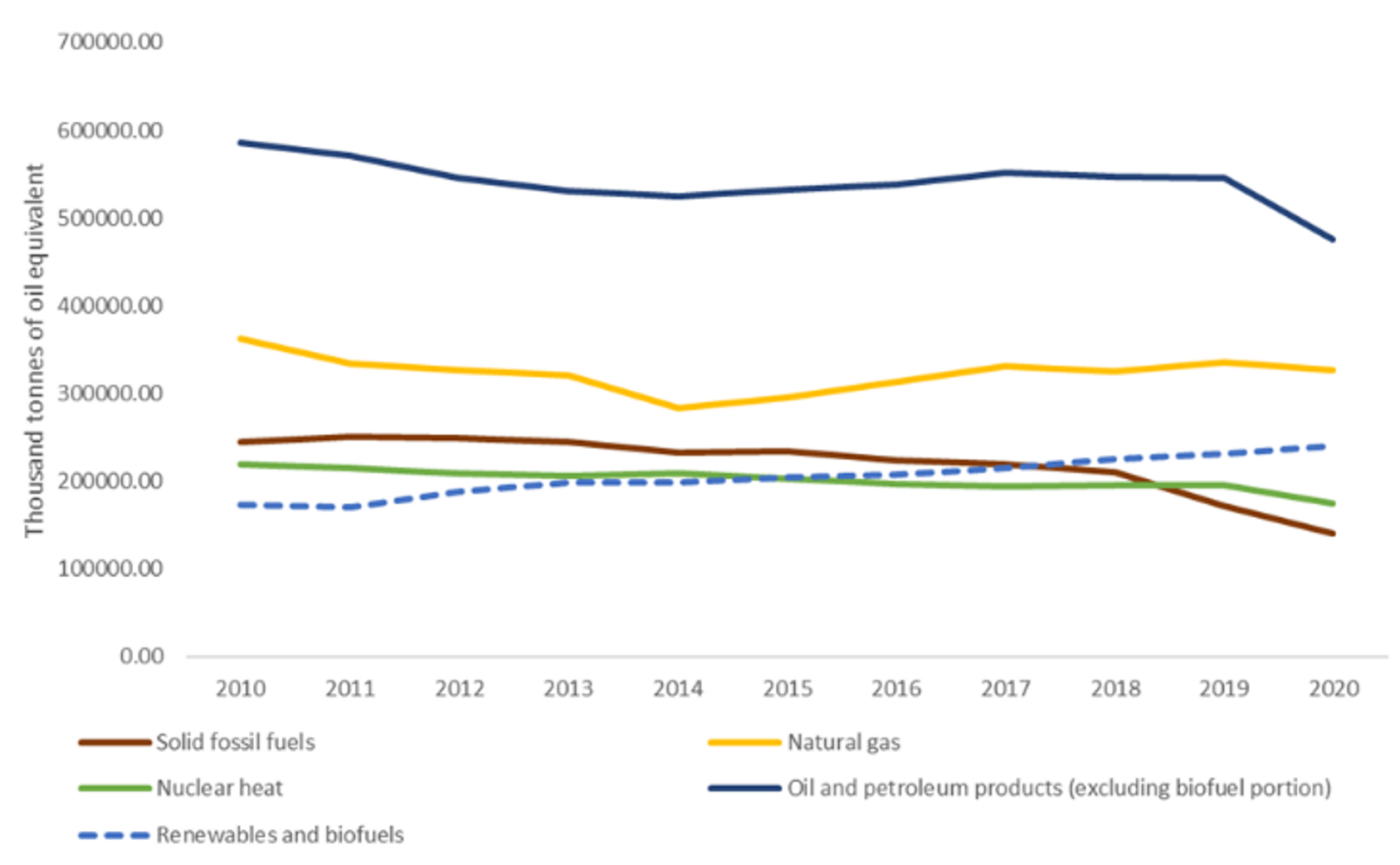

Although crude oil and natural gas remain the primary energy source, with fossil fuels making up 70% of gross available energy,⁹ there has been much positive momentum in the share of renewable energy in EU’s energy mix.

Figure 3: Gross Available Energy in the EU (2010-2020)

Source: Eurostat9

On May 18, the EU released the REPowerEU Plan, which aims to reduce its reliance on Russian gas and accelerate the transition to sustainable energy.10 The REPowerEU plan includes reducing fossil consumption by expanding renewables, energy efficiency, electrification, and gas alternatives (sustainable biomethane, renewable hydrogen). The plan also purposed to increase the EU’s target for renewable energy to reach 45% of energy consumption by 2030 (renewables as of 2020 were at 22%) to help meet its medium-term goal of cutting greenhouse gas (GHG) emissions by at least 55% (compared to 1990) and becoming carbon neutral by 2050.11

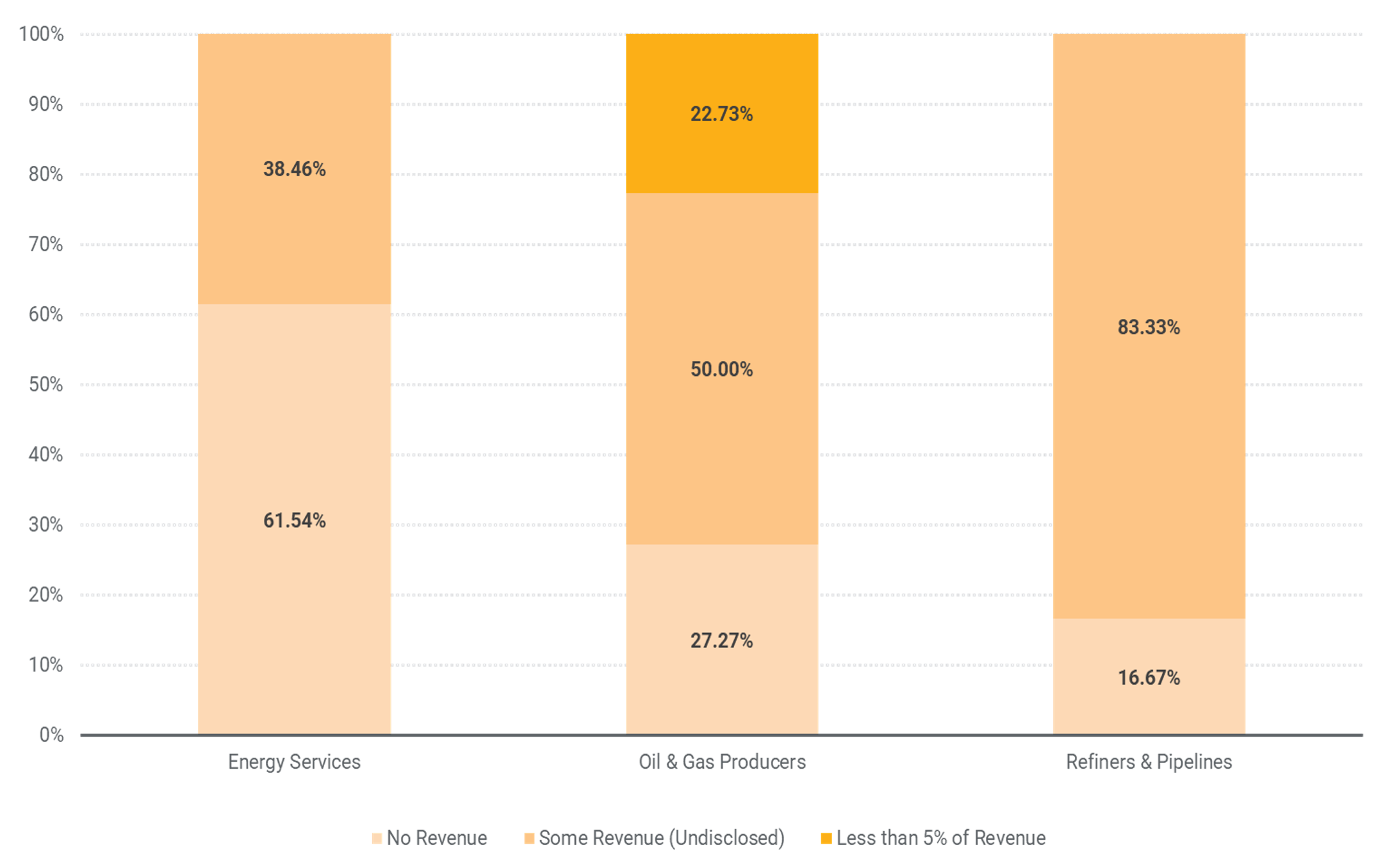

Regarding the EU’s plan to accelerate the energy transition, it is important to consider how far oil and gas companies have progressed in making renewable energy, other low-carbon energy products and services, and energy efficiency technologies available to customers. Sustainalytics evaluates this within its ESG Risk Ratings using the Sustainable Products & Services indicator. This is captured under one of two carbon-related Material ESG Issues (MEIs) that Sustainalytics has identified for most oil and gas companies. In our review of European oil and gas companies, we found that over 60% of companies generated some revenue from sustainable products or services. However, nearly half did not disclose specific revenue figures. While hydrocarbons in the short term will likely continue to account for the majority of the revenue generated by companies in the industry, there appears to be some industry movement towards diversified product offerings.

Figure 3: Breakdown of European Oil & Gas Companies Offering Sustainable Products & Services (%)

Source: Morningstar Sustainalytics

Investors Play a Role in Strengthening the EU’s Energy Strategy

Russia’s invasion of Ukraine, and the subsequent fallout, have highlighted issues with the EU’s energy strategy, given the risks associated with a reliance on Russian energy imports. The EU continues to experience an energy crisis amid Russia’s use of natural gas resources as a political weapon. Fatih Birol, the executive director of the International Energy Agency, said that gas rationing for industrial users could become a reality this winter if measures are not rapidly taken to improve energy efficiency. He also suggested that European energy security could be achieved through accelerated use of renewable energy and existing oil and gas fields, rather than new fossil fuel projects which would compete with climate policy.12 However, for an accelerated energy transition to succeed, it must be supported and embraced by the energy industry and by investors.

Learn how investors leverage Sustainalytics' ESG Risk Ratings to measure a company’s exposure to industry-specific material ESG risks and how well a company is managing those risks.

Sources:

1. Eurostat (2022), Data Browser: Imports of oil and petroleum products by partner country. https://ec.europa.eu/eurostat/databrowser/view/NRG_TI_OIL__custom_938408/bookmark/table?lang=en&bookmarkId=85542020-ba3b-40ec-babd-e72e5cc45423

2. Eurostat (2022), Data Browser: Imports of natural gas by partner country. https://ec.europa.eu/eurostat/databrowser/view/NRG_TI_GAS__custom_938385/bookmark/table?lang=en&bookmarkId=d84ea630-1f0a-4827-891d-f4a8e930dfe7

3. Financial Times (2022), Germany moves closer to gas rationing over Russian disruption. https://www.ft.com/content/09ac0ab9-ad4a-4586-9a14-3921a4d60216

4. Bloomberg (2021), Gas Is So Scarce in Europe That Coal Is Making a Comeback. https://www.bloomberg.com/news/articles/2021-06-15/gas-is-so-scarce-in-europe-that-coal-is-making-a-comeback

5. Bloomberg (2022), Climate Action Suffers from China to US. https://www.bloomberg.com/news/articles/2022-02-11/climate-action-suffers-from-china-to-u-s-as-politics-hits-energy-crisis?srnd=premium-europe&sref=Mkhc1AWW#xj4y7vzkg

6. IEA (2020), Coal production in the European Union by country, 2018-2021. https://www.iea.org/data-and-statistics/charts/coal-production-in-the-european-union-by-country-2018-2021

7. CNBC (2022), Germany plans to fire up coal plants as Russia throttles gas supplies. https://www.cnbc.com/2022/06/20/ukraine-war-germany-turns-to-coal-as-russia-throttles-gas-supplies.html

8. Bloomberg (2022), Dutch Are Reviving Coal Power Amid Russian Gas Squeeze. https://www.bloomberg.com/news/articles/2022-06-20/dutch-are-reviving-coal-power-amid-russian-gas-squeeze

9. Eurostat (2022), Energy Data Browser. https://ec.europa.eu/eurostat/databrowser/explore/all/envir?lang=en&subtheme=nrg.nrg_quant.nrg_quanta.nrg_ind.nrg_ind_&display=list&sort=category&extractionId=NRG_IND_FFGAE__custom_508218

10. European Commission (2022), REPowerEU: A plan to rapidly reduce dependence on Russian fossil fuels and fast forward the green transition. https://ec.europa.eu/commission/presscorner/detail/en/IP_22_3131

11. European Commission (2022), Renewable energy targets. https://energy.ec.europa.eu/topics/renewable-energy/renewable-energy-directive-targets-and-rules/renewable-energy-targets_en#:~:text=The%202030%20targets,-Building%20on%20the&text=The%20Commission%20presented%20Europe's%20new,overall%20energy%20mix%20by%202030.

12. Financial Times (2022), Europe at risk of winter energy rationing, energy watchdog warns. https://www.ft.com/content/078e2d50-f161-4257-8364-c80b5bfecc7f