There is growing expectation from government, investors, and society at large for the private sector to take accountability for its contributions to biodiversity loss. This momentum could expose the private sector to nature-related transition risks whereby organizations’ activities are shown to be misaligned with developments to halt and reverse biodiversity loss. These risks may come in the form of market, technology, reputation, or policy and legal risks. For example, organizations are increasingly expected, and in some instances required, to disclose their biodiversity impacts and dependencies. This can lead to reputation and market risks for organizations contributing to biodiversity loss. Despite the shifting landscape giving rise to nature-related transition risks, Morningstar Sustainalytics’ data shows that most companies are not yet acting on biodiversity.

The Rise in Biodiversity Disclosure

In December 2022, 196 nations adopted the Kunming-Montreal Global Biodiversity Framework (GBF) at the UN Biodiversity Conference (COP15). The GBF is a multilateral agreement which set global goals to meet the vision of living in harmony with nature by 2050. To achieve these goals, the framework also contains 23 targets to be initiated immediately and completed by 2030.1 Participation of both financial institutions and businesses leading up to and during the conference was unprecedented, resulting in an agreement with concrete expectations for the private sector.

The GBF will trigger financial policy and regulatory action at the jurisdiction level which will have implications for the private sector. For example, through Target 15 of the framework, governments have committed to take legal, administrative or policy measures to ensure that large and transnational companies and financial institutions monitor, assess, and disclose their risks, dependencies and impacts on biodiversity across their value chains and portfolios.

Mandatory biodiversity disclosure is already becoming a reality in the European Union (EU). The Sustainable Finance Disclosure Regulation (SFDR) requires financial market participants and financial advisors to disclose activities that negatively affect biodiversity-sensitive areas. The recently adopted Corporate Sustainability Reporting Directive (CSRD) will eventually require applicable companies to report on biodiversity in line with the European Financial Reporting Advisory Group’s disclosure standards starting in 2024.

In September 2023, the Taskforce on Nature-related Financial Disclosures (TNFD) will release its final set of disclosure recommendations and guidance for market participants to start acting on nature-related risks and opportunities. As we have seen with the Taskforce on Climate-related Financial Disclosures (TCFD), jurisdictions may choose to mandate nature-related disclosure in line with the TNFD in the future. This may be particularly relevant to signatories of the GBF because of the disclosure expectations of Target 15.

Mandatory Due Diligence to Address Deforestation

In addition to the disclosure requirements mentioned above, mandatory due diligence procedures are coming into play. Beginning in 2025, the EU deforestation law2 will oblige companies to prove that their products are not linked to deforestation or forest degradation in order to be sold in the EU market. The United Kingdom is following close behind in implementing due diligence requirements on forest-risk commodities through the Environment Act3 and the United States is reviewing the FOREST Act4 which seeks to prevent the import of products derived from illegally deforested land.

How Prepared are Companies to Address Nature-Related Risks?

Disclosure requirements will call for in-scope companies to understand their impacts and dependencies on biodiversity and report the actions they are taking to reduce negative impacts and increase positive ones.

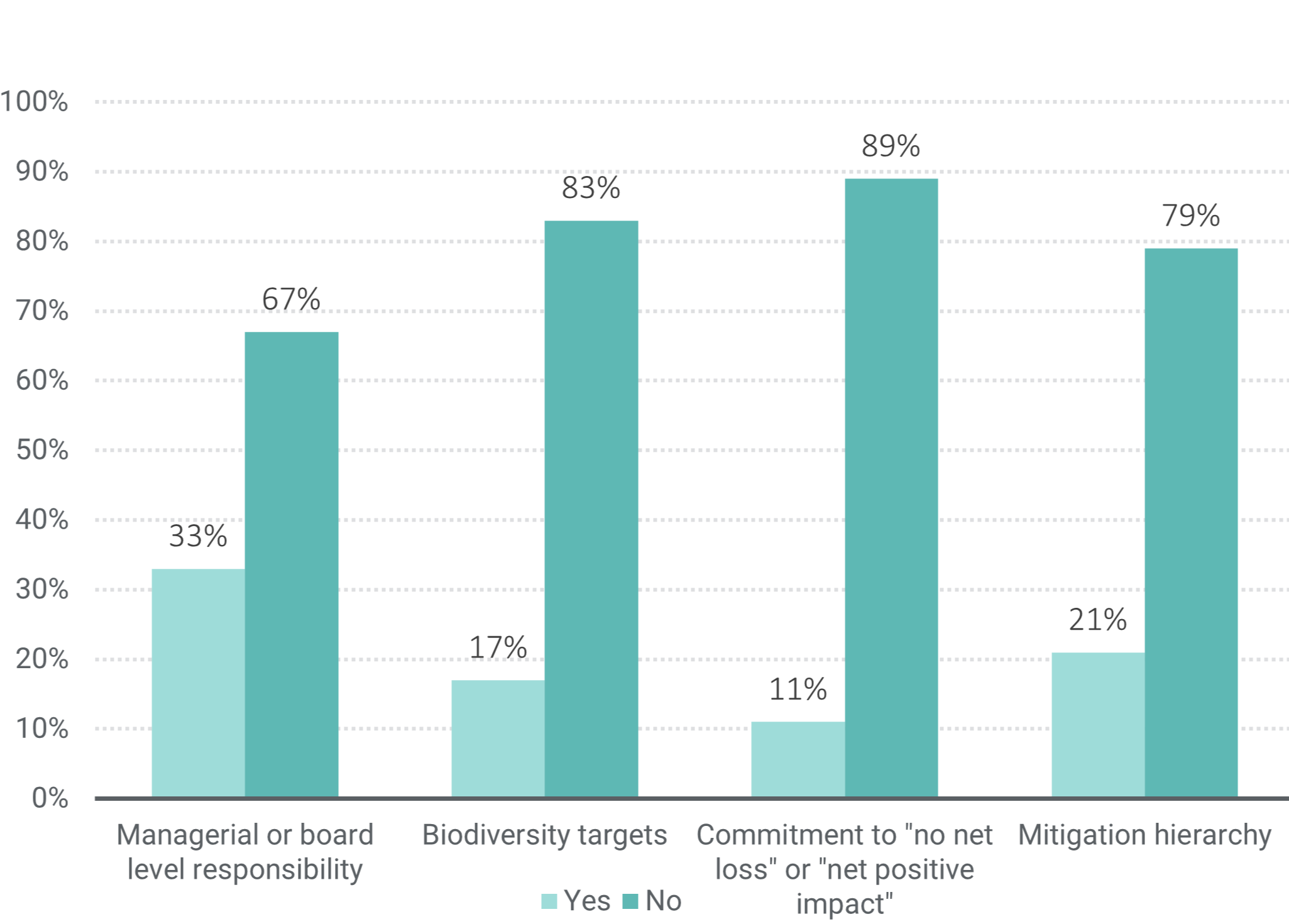

We analyzed companies’ alignment with these expectations using our ESG Risk Ratings data. Looking at indicators we deemed indicative of an effective biodiversity program, we found that most companies from industries where biodiversity issues are especially material have yet to act.

Figure 1. Percentage of Companies Meeting Specific Criteria Within Their Biodiversity Program

Source: Morningstar Sustainalytics. The data for this analysis was retrieved on the 15th February 2023 from Sustainalytics’ Ratings+ Universe and includes 677 companies from the following industries: Utilities, Transportation Infrastructure, Steel, Consumer Services, Traders & Distributors, Food Products, Oil & Gas Producers, Diversified Metals, Precious Metals, Paper & Forestry, Refiners & Pipelines, Commercial Services and Construction & Engineering. For informational purposes only.

Board Oversight of Biodiversity Lacking

The TNFD’s draft framework (v0.4) recommends that organizations describe their board’s oversight and management’s role as they relate to nature-related dependencies, impacts, risks, and opportunities.5 However, it seems that most companies do not currently incorporate biodiversity within their governance. Sustainalytics’ data shows that for companies assessed on the strength of their biodiversity program, only 33% have managerial or board level oversight on the topic.

Most Companies Not Disclosing Biodiversity Targets

The draft TNFD framework also recommends disclosure on targets and goals used by the organization to manage nature-related dependencies, impacts, risks, and opportunities. Our research shows that only 17% of companies have a biodiversity target and only 11% have formal commitment to “no net loss” or “net positive impact” on biodiversity.

More Companies Should Follow Guidance to Avoid Negative Biodiversity Impacts

The mitigation hierarchy is a guideline that prioritizes the avoidance and reduction of negative impacts prior to restoration and offsetting. It is designed to help users limit negative impacts on biodiversity as far as possible. Our research shows that only 21% of companies are currently implementing the mitigation hierarchy approach.

Low Rates of Biodiversity Due Diligence Across the Value Chain

The due diligence regulations will require companies to trace commodities and products that are linked to deforestation back to the point of production. However, Sustainalytics’ data shows that most companies assessed on the strength of their deforestation program are not able to verify that their goods are deforestation-free. Only 13% of companies assessed have a transparency and traceability program and only 16% are monitoring and measuring anti-deforestation programs for both own operations and direct and third-party suppliers.

Figure 2. Percentage of Companies Meeting Specific Criteria Within Their Deforestation Program

Source: Morningstar Sustainalytics. The data for this analysis was retrieved on the 15th February 2023 from Sustainalytics’ Ratings+ Universe and includes 337 companies from the following industries: Food Products, Food Retailers, Consumer Services, Household Products, Retailing and Consumer Durables.

Now is the Time for Companies to Act on Biodiversity

There is growing awareness of the gravity of biodiversity loss and the repercussions it will have at a societal and economic level. This is causing a shift at all levels of society, from changing consumer and investor preferences to governments introducing regulation to protect biodiversity. However, our research shows that companies highly exposed to biodiversity and deforestation risks are not in step with the regulations and expectations coming their way.

There are plenty of supporting tools and guidance for companies to start taking action and thereby reduce their exposure to emerging nature-related transition risks. The first step is for companies to understand their negative impacts and dependencies on biodiversity to enable an assessment of risks and opportunities. The TNFD’s LEAP approach6 (locate, evaluate, assess, and prepare) has been designed to support such an assessment. With this understanding, targets can be set and companies can act towards achieving them, reducing negative impacts and increasing positive impacts on biodiversity. The Science Based Targets Network7 is also finalizing methods which will enable companies to set science-based nature targets.

Companies that assess, disclose, and act on their impacts and dependencies on biodiversity will reduce their exposure to emerging nature-related risks and strengthen their market position. In turn, this company-level information will enable investors to more accurately identify and act upon their risks, and thereby promote nature-positive outcomes.

References

1 Convention on Biological Diversity. 2022. “COP15: Final Text of Kunming-Montreal Global Biodiversity Framework.” Official CBD Press Release, December 22, 2022. https://www.cbd.int/article/cop15-final-text-kunming-montreal-gbf-221222.

2 European Commission. 2021. “Proposal for a regulation on deforestation-free products”. https://environment.ec.europa.eu/publications/proposal-regulation-deforestation-free-products_en

3 Department for Environment Food & Rural Affairs. 2022. “Consultation on implementing due diligence on forest risk commodities” https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/1080235/due-diligence-uk-supply-chains-summary-of-responses.pdf

4 Congress.Gov. “The FOREST Act of 2021”. https://www.congress.gov/bill/117th-congress/senate-bill/2950/text?r=2&s=2

5 Taskforce on Nature-related Financial Disclosures. 2023. “TNFD Nature-Related Risk & Opportunity Management and Disclosure Framework.” March 28, 2023. https://tnfd.global/

6 Taskforce on Nature-related Financial Disclosures. 2023. “TNFD Nature-Related Risk & Opportunity Management and Disclosure Framework – framework and guidance.” March 28,2023. https://framework.tnfd.global/framework-and-guidance/leap-the-risk-and-opportunity-assessment-approach/#:~:text=In%20response%2C%20the%20TNFD%20has%20developed%20an%20integrated,respond%20to%20nature-related%20risks%20and%20opportunities%20and%20report.

7 Science Based Targets Network. https://sciencebasedtargetsnetwork.org/