|

|

|

Across sectors, companies crossed a critical threshold in integrating environmental, social, and governance (ESG) metrics into their executive incentive plans – the share of publicly traded companies embedding climate metrics into their executives’ compensation plans more than doubled over the past two years.1 But while this practice is gaining momentum, some still worry that these incentives are not based on quantifiable targets, making it difficult to determine if they are really having the impact investors expect.

Morningstar Sustainalytics’ research from 2023 shows that 77% of large cap companies in Europe and approximately 86% in the U.S. do not have concrete, quantifiable ESG targets linked to their compensation structures.2 This raises concerns about the use of ESG metrics in remuneration schemes and fuels skepticism surrounding their ability to contribute to financial performance for both companies and investors.3

Despite these challenges, however, linking ESG metrics to compensation creates an opportunity for companies to move beyond generic targets and appeal to investors. It gives companies the opportunity to tailor their ESG performance metrics in a way that enhances their competitive advantage and helps them achieve their sustainability goals. In a recent assessment, we analyzed Sustainalytics’ data from 2021 to 2023 to examine if the quality of the ESG metrics integrated into compensation structures was benefiting companies and how investors were responding to the disclosed information.

In this article, we share our findings and discuss how implementing quantifiable ESG targets for compensation incentives can help companies and their investors achieve their sustainability goals. We also argue that, when implemented correctly, this approach not only benefits companies by providing measurable ESG outcomes and clear accountability, but also enhances investor confidence and willingness to invest in companies committed to sustainable practices.

The Current State of Executive Compensation Practices

According to recent disclosures,4 76% of the largest publicly traded companies were embedding some type of ESG metric into their leadership compensation policies in 2023, compared to 66.5% in 2021. While this increase signalled that companies were taking ESG risks more seriously, criticisms remained over both the transparency and reliability of the goals. Many of the compensation schemes lacked clearly defined and measurable targets, creating ambiguity over what executives were being rewarded for achieving.5

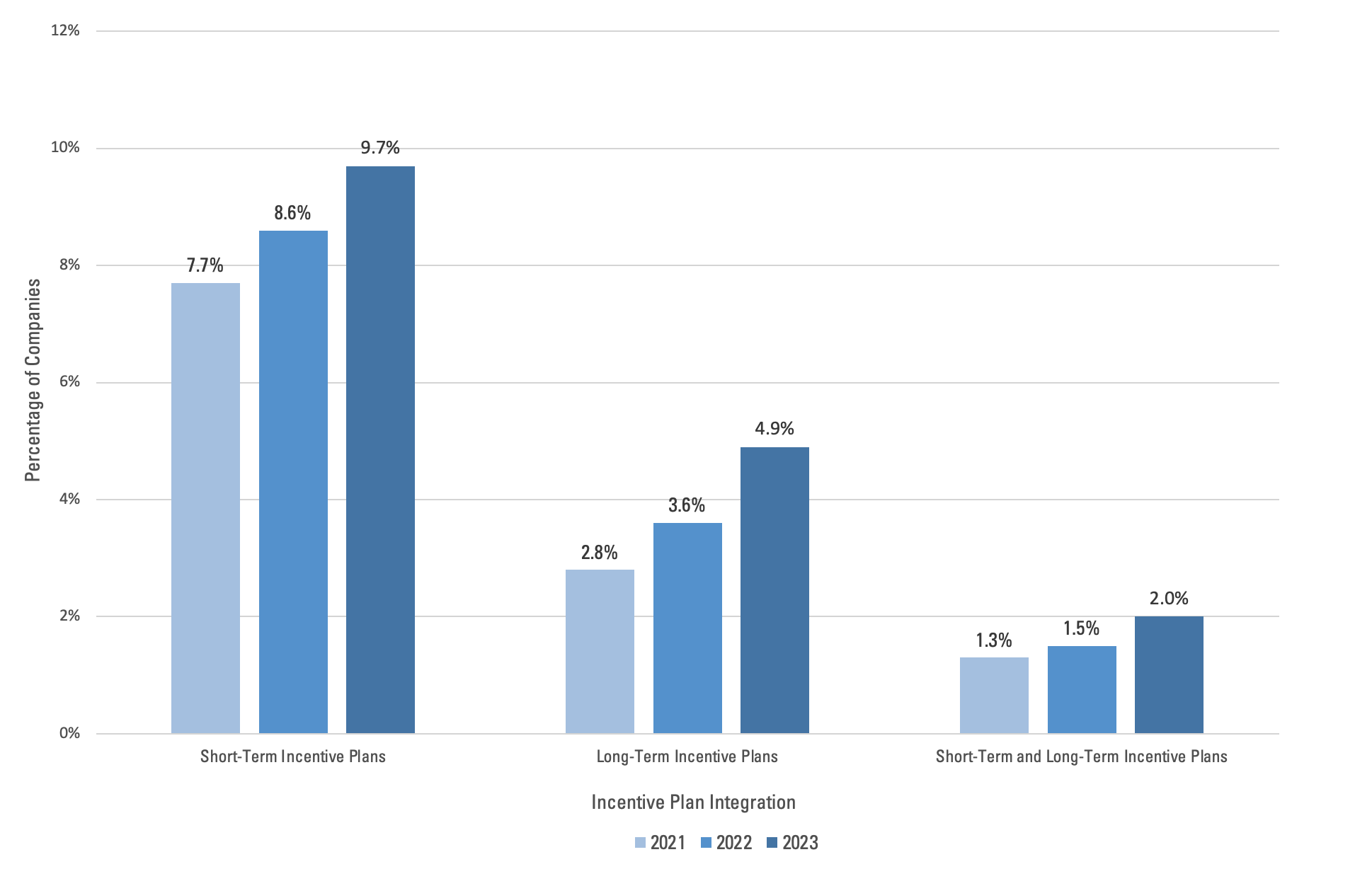

Through our engagement program in 2023,6 we’ve found that awards granted to CEOs and top executives were rarely linked to specific, pre-defined ESG targets. According to our research, merely 12.5% of companies disclosed their pre-set ESG targets in 2023. Only 9.7% of companies (see Figure 1 below) linked executive compensation to pre-set ESG targets in the Short-Term Incentive (STI) plans and just 4.9% linked it to Long-Term Incentive (LTI) plans. Furthermore, only 2% of the companies disclosed pre-set ESG targets for both STI plans and LTI plans.

Figure 1. Integration of Pre-Set ESG Targets in Executive Compensation Plans

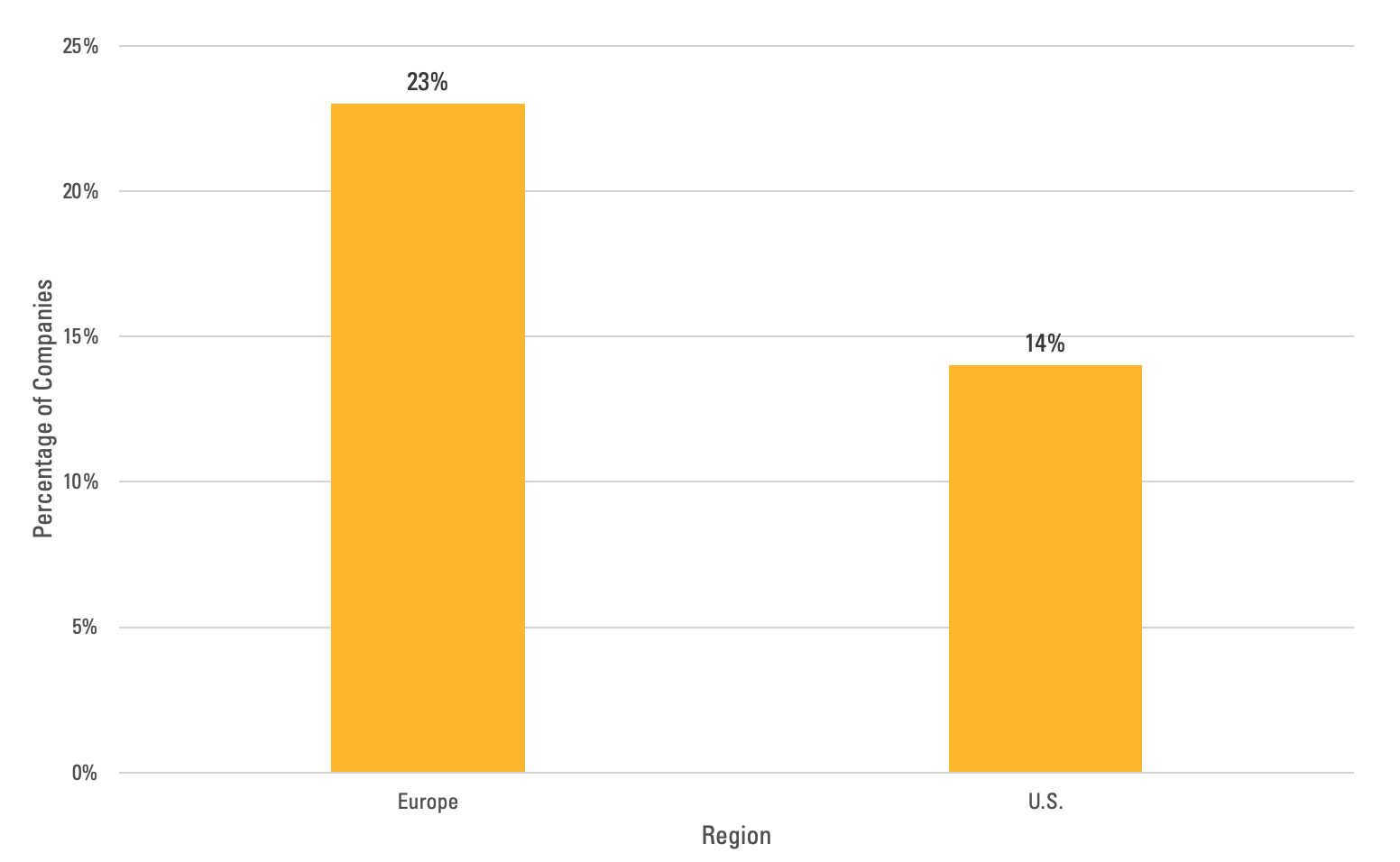

Our analysis also revealed regional differences. Only 23% of companies in Europe linked executive compensation to specific ESG metrics in at least one of their remuneration plans. In the U.S., only 14.2% of the companies analyzed in 2023 disclosed pre-set targets for their ESG issues (see Figure 2)7 in at least one compensation plan. Notably, the number of companies disclosing pre-defined ESG targets for both their short-term and long-term incentives is much lower. Only 1.4% of the U.S. companies and nearly 5% of the European companies analyzed in 2023 linked both STI plans and LTI plans to specific ESG targets.

Figure 2. Companies With Pre-Set ESG Targets in Executive Compensation in Europe and the U.S.

Due to these low numbers, companies have faced criticism over their compensation schemes. Investors have begun advocating for the use of more clearly defined ESG targets to improve transparency around key sustainability issues and to track companies’ progress. This demand from investors has been driven, in part, by changes in the regulatory landscape.

Compensation Policies and the Evolving Regulatory Landscape

In 2023, changes in legislation pushed for more sustainability-related disclosures in the financial services sector.8 Asset managers and asset owners are now required to make more detailed disclosures about ESG issues in their investments - particularly for those related to climate change. For example, when investing in a company committed to becoming net zero in 2050, investors must now disclose in which projects and programs their invested capital is allocated to. Additionally, they need to disclose what steps their portfolio companies are taking to achieve their sustainability goals.9 To drive accountability, they want to understand who is ultimately responsible for the achievement of these targets at the company level and how they are rewarded.10

Best Practices for Compensation Policies: The BP Example11

Through our engagement program and data analyzed in 2023, we observed a growing trend among companies to integrate ESG targets into their compensation structures. However, we found that many of these companies were still struggling to demonstrate the significance of their efforts and to establish predefined targets in both their STI plans and LTI plans.12

Few companies in our research analysis integrated ESG-linked incentives properly. Most companies that included clear ESG metrics in their STI plans operated in the utilities, oil and gas and real estate sectors.13 Notably, BP, a British oil and gas company, demonstrated proficiency with its STI plans. Throughout our engagement program, we used its remuneration reports as a best-in-class example. Here is what BP did right.

Effectively Linked ESG Targets to STI Plan Structure

In BP’s 2022 Directors’ Remuneration Report, its material ESG targets were quantitatively linked to remuneration in the STI plan.14 Additionally, although BP still required refinement in incorporating these metrics into its LTI plans, its Director’s Remuneration Report and its Director’s Remuneration Policy received an impressive 82% and 94% shareholder approval at its 2023 annual general meeting.15

Proper Weighting of ESG Issues in Its Scorecard

A scorecard is essential for monitoring and measuring progress towards ESG goals. A comprehensive report requires carefully crafted scorecards to measure progress.16 In 2023, we considered a 30% weight on material ESG issues on scorecards a best-in-class approach, especially when it was clearly defined and linked to quantifiable targets.17 On BP’s 2022 annual bonus scorecard we noted that safety and sustainability – the non-financial ESG key category – received a 30% weight, with two material issues weighting 15% each. Those issues were linked to expected outcomes, and then translated into the remuneration of the CEO, explaining the rewards granted in the past few years. The report also showed the strategic remuneration process from 2020 to 2022 and the targets from 2025 onwards.

Demonstrated Track Record, Scale, and Value

In BP’s report we also saw the company’s demonstrated track record, scale, and value for their low carbon energy transition from 2020 and to 2025 and the company’s policy implementation for 2023.

What’s Next for ESG-Linked Compensation

While companies are increasingly incorporating ESG targets into remuneration structures, vague incentive measures are hindering transparency and accountability. Establishing quantifiable targets for ESG performance in STI and LTI plans is crucial for aligning incentives with sustainability goals, while keeping track of the progress a company is making. For investors, tying well-defined ESG metrics to executive compensation provides insight into how companies are making progress on their sustainability goals and who is accountable for it. It also provides clarity on how companies are managing risks in an ever-changing regulatory landscape.

In our new thematic stewardship program, Sustainability and Good Governance, we will engage with companies to assess these issues and strengthen corporate governance frameworks and practices. The program was launched in February 2024, and we are in the early stages of the engagement process. For more information, visit our thematic stewardship program webpage.

References

- The Conference Board. 2024. “Climate Metrics Surge in Executive Compensation Plans – From 25% to 54% in Just Two Years.” January, 4, 2024. https://www.conference-board.org/press/ESG-metrics-in-exec-comp-2024

- Data is according to Morningstar Sustainalytics Ratings universe, which comprises approximately 5,000 large and medium market cap investable issuers in developed and emerging markets.

- Spierings, Merel. “Linking Executive Compensation to ESG Performance.” November 7, 2022. Harvard Law School Forum on Corporate Governance. https://corpgov.law.harvard.edu/2022/11/27/linking-executive-compensation-to-esg-performance/

- Tonello, Matteo. “Maximizing the Benefits of ESG Performance Metrics in Executive Incentive Plans”. December 20, 2023. The Conference Board. https://www.conference-board.org/publications/ESG-performance-metrics-in-executive-compensation-plans

- Tonello, Matteo. “ESG Performance Metrics in Executive Pay.” January 15, 2024. Harvard Law School Forum on Corporate Governance. https://corpgov.law.harvard.edu/2024/01/15/esg-performance-metrics-in-executive-pay/

- Data is according to Morningstar Sustainalytics’ Tomorrow’s Board Thematic Engagement program, which comprised of approximately 21 large issuers in developed and emerging markets. The program ran for three years and ended in December 2023.

- Data is according to Morningstar Sustainalytics Ratings universe, which comprises approximately 5,000 large and medium market cap investable issuers in developed and emerging markets.

- Morningstar Sustainalytics. “The EU Sustainable Finance Action Plan.” Accessed: April 3, 2024. https://www.morningstar.com/en-uk/learn/eu-sustainable-finance-action-plan

- European Commission. “FAQ: What Is the EU Taxonomy Article 8 Delegated Act and How Will It Work in Practice?. April 21, 2021. https://finance.ec.europa.eu/system/files/2021-07/sustainable-finance-taxonomy-article-8-faq_en.pdf

- Reali, P., Grzech, J., Garcia, A., Nuveen. “ESG: Investors Increasingly Seek Accountability and Outcomes.” April 25, 2021. Harvard Law School Forum on Corporate Governance. https://corpgov.law.harvard.edu/2021/04/25/esg-investors-increasingly-seek-accountability-and-outcomes/

- We use BP as an example on how to link ESG metrics to remuneration. We do acknowledge that BP has been linked to a severe controversy in the past (i.e., Deep Horizon oil spill in 2010) and many other recent controversies (e.g., hazardous waste releases in the US, Red Sea pollution in Egypt). Nevertheless, when it comes to ESG-linked incentives, the company is doing it properly and is a good example to highlight.

- Data is according to Morningstar Sustainalytics’ Tomorrow’s Board Thematic Engagement program, which comprised of approximately 21 large issuers in developed and emerging markets. The program ran for three years and ended in December 2023.

- Data is according to Morningstar Sustainalytics Ratings universe, which comprises approximately 5,000 large and medium market cap investable issuers in developed and emerging markets.

- BP. Director’s Remuneration Report 2022. March 10, 2023. bp-directors-remuneration-report-2022.pdf

- BP. AGM 2023 poll results. April 27, 2023. https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/investors/bp-agm-poll-results-2023.pdf

- O’Connor, P. Harris, L., Gosling, T. “Linking Executive Pay to ESG Goals”. June 29, 2021. PWC. https://www.pwc.com/gx/en/issues/reinventing-the-future/take-on-tomorrow/download/Linking-exec-pay-ESG.pdf

- KPMG. ESG in Executive Remuneration. June 2023. https://assets.kpmg.com/content/dam/kpmg/au/pdf/2023/esg-in-executive-remuneration-report.pdf