Driving down Scope 3 emissions is key to the net zero transition

Climate concerns continued to dominate proxy voting in the 2022 proxy season. With more clarity on sectoral commitments required to achieve the global net zero goal, shareholders’ requests have become noticeably more specific. A larger number of resolutions asked companies to adopt and report on emissions reduction targets and transition plans that reference the latest forward-looking guidance, such as the IEA’s Net Zero by 2050 Roadmap1 and the Climate Action 100+ Net Zero Company Benchmark.2

The World Economic Forum estimates that Scope 3 emissions account for between 75% and 80% of all emissions generated by the oil and gas sector.3 When combined with the sector’s significant operational emissions, its no wonder oil and gas companies have been the main targets of resolutions as investors try to understand and mitigate climate risks.

However, in the modern economy, where outsourcing is common and operations are often spread across multiple jurisdictions, Scope 3 emissions, from supply chain pollution to the impact of a product’s use by clients, form the biggest share of total emissions in many other industries. For example, data from the CDP, formerly the Carbon Disclosure Project, shows that almost all financial institutions’ emissions are Scope 3 emissions: coming from investing, lending, and underwriting activities.4 Poor disclosure of full value chain emissions therefore leaves shareholders with an unclear picture of a company’s climate transition risk exposure and strategic resilience.

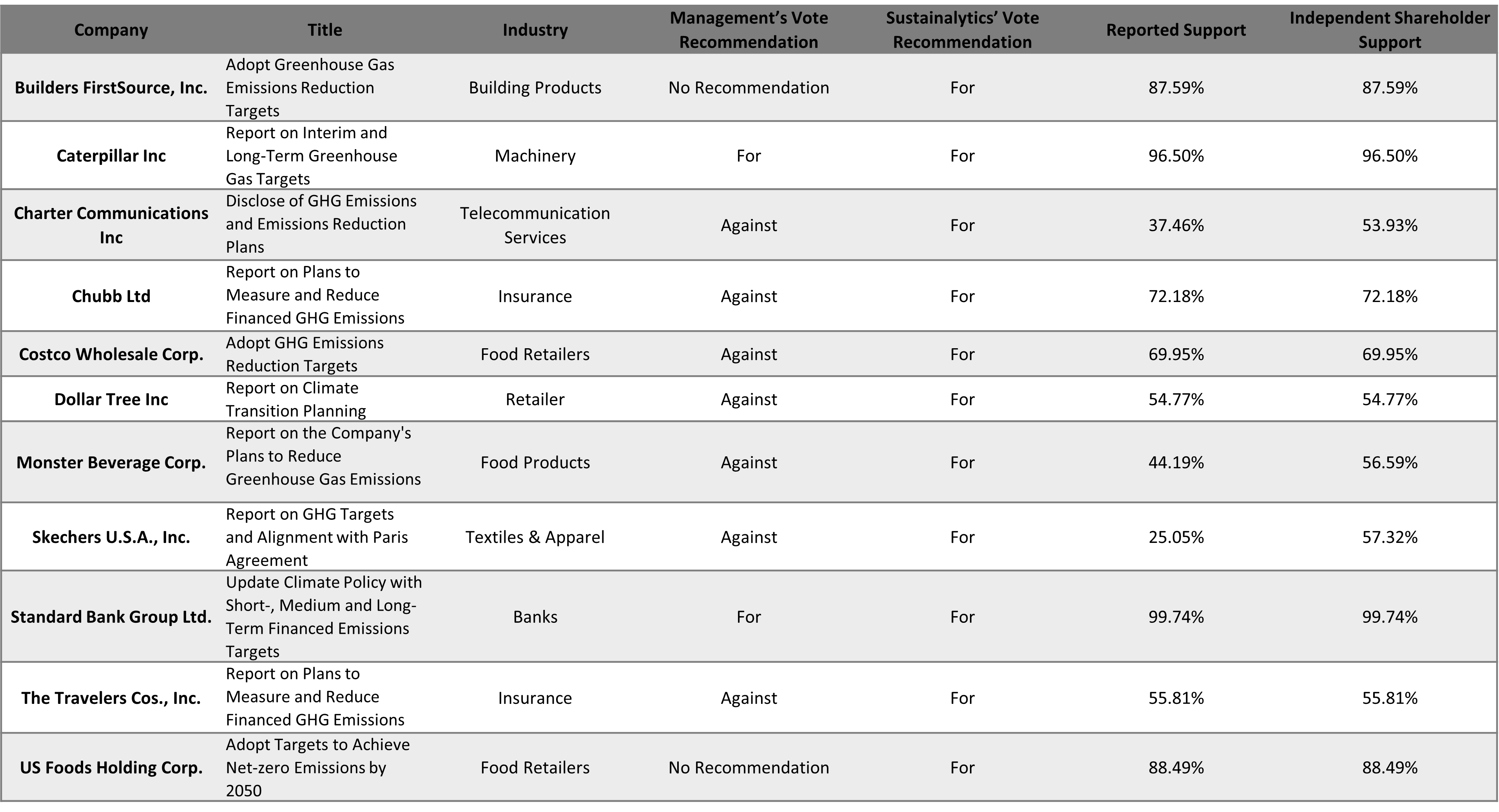

Morningstar Sustainalytics’ Stewardship Services made 182 ESG-focused voting recommendations related to climate change in the first half of 2022, including 96 climate-focused shareholder proposals. Of these, 29 resolutions requested disclosure or adoption of emissions reduction targets, receiving 40% shareholder support on average or 44% support when adjusted to reflect only independent shareholders’ votes (i.e., excluding large voting blocs controlled by company insiders). We observed that 11 resolutions seeking emissions targets passed with majority support from independent shareholders in the 2022 proxy season.

Selected Resolutions Requesting Emissions Reduction Targets, H1 2022

Source: ESG Voting Policy Overlay. Data as of 31 July 2022

At Costco Wholesale’s AGM, shareholders voted on a resolution filed by Green Century Capital Management, asking the company to:

“…adopt short, medium, and long-term science-based greenhouse gas emissions reduction targets, inclusive of emissions from its full value chain, in order to achieve net-zero emissions by 2050 or sooner and to effectuate appropriate emissions reductions prior to 2030.”5

For a company like Costco, Scope 3 emissions are embedded in purchased goods and services within its supply chain. Similarly, the resolution highlighted that Costco’s competitor, Walmart, discloses that 95% of its emissions trace back to its supply chain.

The resolution achieved 70% shareholder support, notwithstanding Costco’s board recommending against the resolution. The company has since agreed to set targets to reduce its Scope 3 emissions.

Standard Bank Group shareholders voted on a resolution filed by Aeon Investment Management and Just Share NPC requesting that the Company:

“…update [its] March 2022 Climate Policy to include short-, medium-, and long-term targets for the Company's financed greenhouse gas emissions from oil and gas, aligned with the Paris Agreement goal of limiting the global temperature increase to 1.5 degrees Celsius above pre-industrial levels.”6

In this case, Standard Bank Group supported the motion following an engagement process in which the specific wording of the resolution was agreed upon.

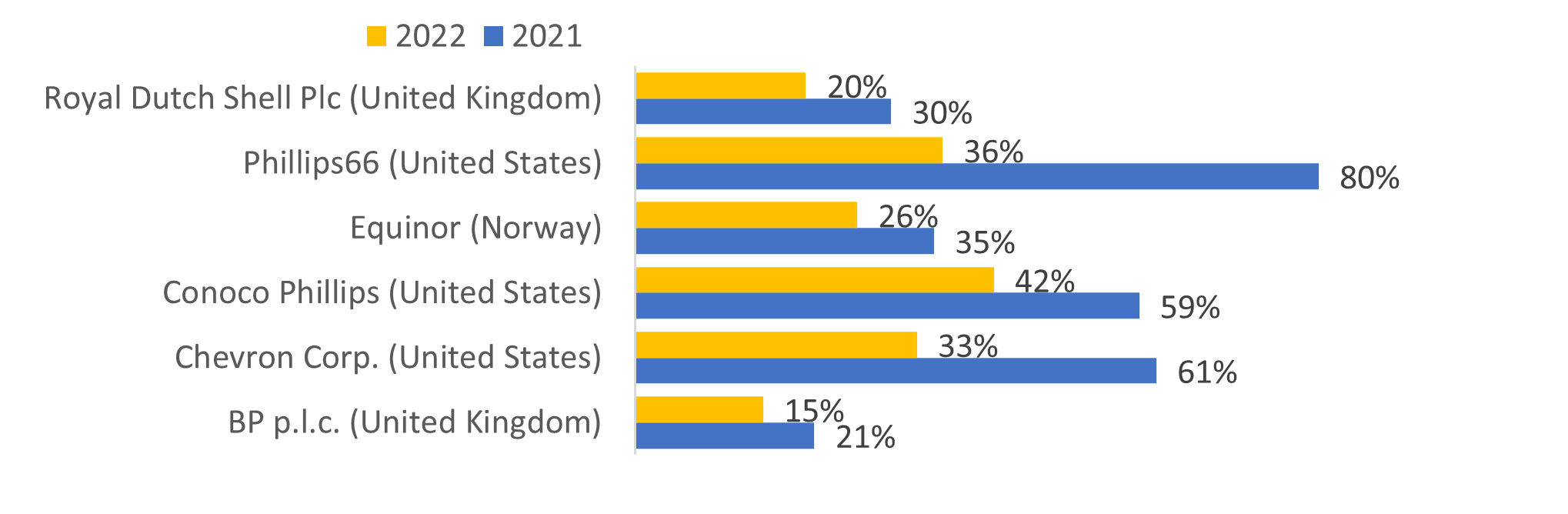

By contrast, resolutions voted at six oil and gas companies - requesting short, medium and long-term targets on Scope 1, 2 and 3 emissions - show a noticeable easing of investor pressure from 2021 to 2022, as displayed in Chart 1 below.

Emissions Target Setting Resolutions Voted at Oil and Gas Companies in 2021 and 2022

Source: ESG Voting Policy Overlay. Data as of 31 July 2022

Note: Equinor’s support estimated for independent shareholders, excluding Norwegian Government’s votes.

While this is likely driven by investors’ energy security concerns, and in some cases by individual company improvements around their climate transition plans, we observe that investors are adjusting their approach to target full-value chain emissions on a much broader scale.

Setting New Climate Reporting Standards

Global efforts are underway to ensure that consistent climate-related information be included in audited financial statements.

In March, the US SEC released a proposal to enhance and standardize climate-related disclosures. Perhaps the most notable feature of the proposal is that it covers Scope 3 emissions where material, or where companies have set Scope 3 emissions reduction targets.7 Comments submitted to the rulemaking consultation that followed show that investors overwhelmingly support Scope 3 emissions disclosure.8

Also in March, the newly formed International Sustainability Standards Board (ISSB) launched consultation processes on proposals for general sustainability and climate-specific disclosures, with plans to finalize the new standards by the end of 2022. The ISSB has since voted to include in the new standard for climate reporting the requirement that companies disclose their Scope 3 emissions. Once released, the standards will provide baseline disclosure requirements supporting standardized reporting compatible with jurisdiction-specific obligations.9

In the EU, the recently approved corporate sustainability reporting directive (CSRD) amends earlier non-financial reporting requirements to require companies to provide more detailed sustainability-related coverage, including corporate strategy compatibility with global net zero targets. It also introduces disclosure certification requirements and improves the accessibility of disclosures.10

Investors are taking a broader approach to weaning global markets off fossil fuels, directing emissions reduction resolutions beyond major oil and gas companies. They are demanding emissions targets and disclosures from companies in industries such as telecommunications, textiles and apparel, and food products, realizing that Scope 3 is the key to the global energy transition. As mandatory, standardized climate reporting rules take effect across major markets, Scope 3 disclosures will no longer be voluntary and in turn, strengthen investor efforts to drive the net zero transition.

Sources:

1. IEA (2021). Net Zero by 2050. A Roadmap for the Global Energy Sector. Accessed (2022-12-12) at: https://www.iea.org/reports/net-zero-by-2050

2. ClimateAction100+ Net Zero Company Benchmark. https://www.climateaction100.org/net-zero-company-benchmark/

3. World Economic Forum (2021). How the oil and gas industry can take a lifecycle approach to reducing emissions. 25 August 2021. Accessed (2022-12-12) at: https://www.weforum.org/agenda/2021/08/oil-gas-industry-lifecycle-approach-reducing-emissions/

4. CDP (2020). The Time to Green Finance. CDP Financial Services Disclosure Report 2020. Accessed (2022-12-12) at: https://www.cdp.net/en/research/global-reports/financial-services-disclosure-report-2020

5. Costco Wholesale Corporation (2022) Proxy Statement. https://www.sec.gov/Archives/edgar/data/909832/000090983221000017/costproxy2021.htm#i2f7c340eb4a542eb97726625d070c9cc_918

6. Standard Bank Group (2022) Shareholder information and notice of AGM. Accessed (2022-12-12) at: https://reporting.uat.standardbank.com/agm/

7. SEC (2022). SEC Proposes Rules to Enhance and Standardize Climate-Related Disclosures for Investors. Press Release. 21 March 2022. Accessed (2022-12-12) at: https://www.sec.gov/news/press-release/2022-46

8. Williams, C.A and Eccles, R.G. (2022). Review of Comments on SEC Climate Rulemaking. Harvard Law Review Forum. 12 December 2022. Accessed (2022-12-12) at: https://corpgov.law.harvard.edu/2022/11/23/review-of-comments-on-sec-climate-rulemaking/

9. IFRS (2022). ISSB delivers proposals that create comprehensive global baseline of sustainability disclosures. Press Release. 31 March 2022. https://www.ifrs.org/news-and-events/news/2022/03/issb-delivers-proposals-that-create-comprehensive-global-baseline-of-sustainability-disclosures/

10. Council of the EU (2022). New rules on corporate sustainability reporting: provisional political agreement between the Council and the European Parliament. Press Release. 21 June 2022. https://www.consilium.europa.eu/en/press/press-releases/2022/06/21/new-rules-on-sustainability-disclosure-provisional-agreement-between-council-and-european-parliament/