As the unprecedented situation in Ukraine continues to unfold, Russia’s energy industry has remained remarkably untouched by the waves of sanctions currently being deployed against the country, despite being arguably its most important sector. While the European Union and its allies have been cautious to avoid disrupting energy flows (unlike how sanctions are currently disrupting the flow of capital), international oil companies are responding to the crisis in their own capacity.

International energy companies are fleeing Russia rapidly and extensively

As of March 24, 2022, about a month after Russia launched its invasion of Ukraine, most major international energy companies had already made announcements concerning their planned exit from Russia, including:

BP: Exiting its 19.75% in Rosneft; its current CEO, along with the former CEO of BP, both resigned from the board of Rosneft effective immediatly. 1

Shell: Exiting all joint ventures with Gazprom and its related entities; this includes partial stakes in the Sakhalin-II liquefied natural gas facility, the Salym Petroleum Development and the Gydan energy venture, along with involvement in the Nord Stream 2 pipeline project. 2

Exxon: Discontinuing operations of its Sakhalin-1 venture and will move to exit from its position in the project; the company will no longer invest in new developments in Russia. 3

Equinor: Exiting its existing Russian ventures and would make no new investments into Russia. 4

Eni: Intends to sell its share in the joint and equal shareholding with Gazprom in the Blue Stream gas pipeline (connecting Russia to Turkey). 5

Schlumberger: Immediate suspension of new investments and technology to its Russian operations. 6

Halliburton: Immediate suspension of future business in Russia, in compliance with sanctions prohibiting transactions and work, including with certain state-owned Russian customers. 7

TotalEnergies, which has a significant presence in Russia, 8 announced that it would no longer provide capital for projects in Russia and will no longer enter into new contracts for Russian energy products, among other actions. 9 However, it appears, for the time being, it will not exit from its equity interests in the country, including its 19.4% stake in Novatek, Russia’s largest independent natural gas producer.

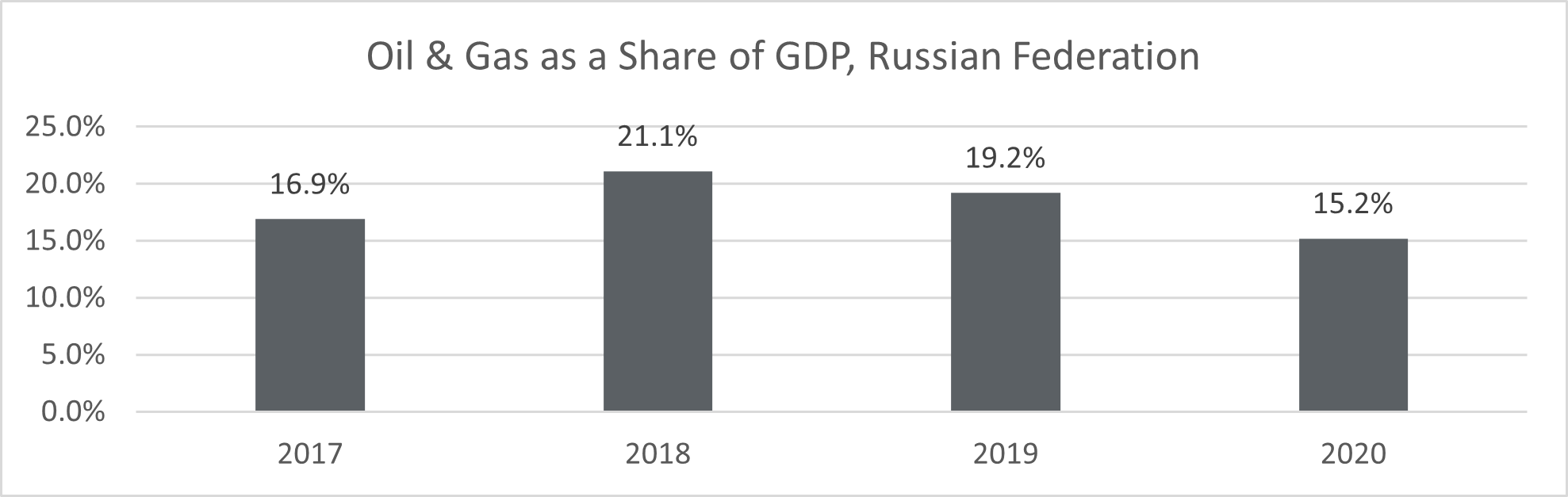

As an industry, energy (oil and gas) has accounted for an average of 18.1% of Russia’s overall GDP between 2017 and 2020, 10 making it one of the country’s most important industries.

Source: Federal State Statistics Service of Russia (Rostat)

Source: Federal State Statistics Service of Russia (Rostat)

Why is taking a hard stance on Russia critical as an energy company?

When it comes to corporate citizenship (i.e., a company’s responsibility to society), strong ESG performance through management programmes and initiatives can only do so much. This is especially true for companies in the oil and gas industry, where certain risks and negative externalities are unavoidable. To capture exposure to such risks in the context of Ukraine, Sustainalytics’ has introduced a new methodological component to its ESG Risk Ratings called Systemic Event Indicators.

.png?sfvrsn=eab5c0e_2)

In situations like Russia-Ukraine, simply continuing operations becomes a source of systemic risk. This is true in two instances:

- When companies have a significant presence in Ukraine, resulting in risks relating to business continuity, asset integrity and the safety of employees and the environment. Exposure to this type of risk has been introduced into Sustainalytics’ ESG Risk Ratings through the Business Resilience systemic event indicator.

- When companies have a significant presence in Russia, resulting in risks relating to economic measures and sanctions imposed by countries and supranational organizations as a result of Russia’s invasion of Ukraine. Exposure to this type of risk has been introduced into Sustainalytics’ ESG Risk Ratings through the Fallout/Repercussion of Ukraine Conflict systemic event indicator.

For the energy industry, the second systemic event indicator is the more impactful indicator, given the significance of the industry to Russia’s economy. In addition to being a key export sector, payments common to the energy industry—such as taxes, royalties, and other transfers of funds—are a major source of revenue for the Russian government. As a result, Russian energy firms have been targeted by a wide range of sanctions and economic restrictions.

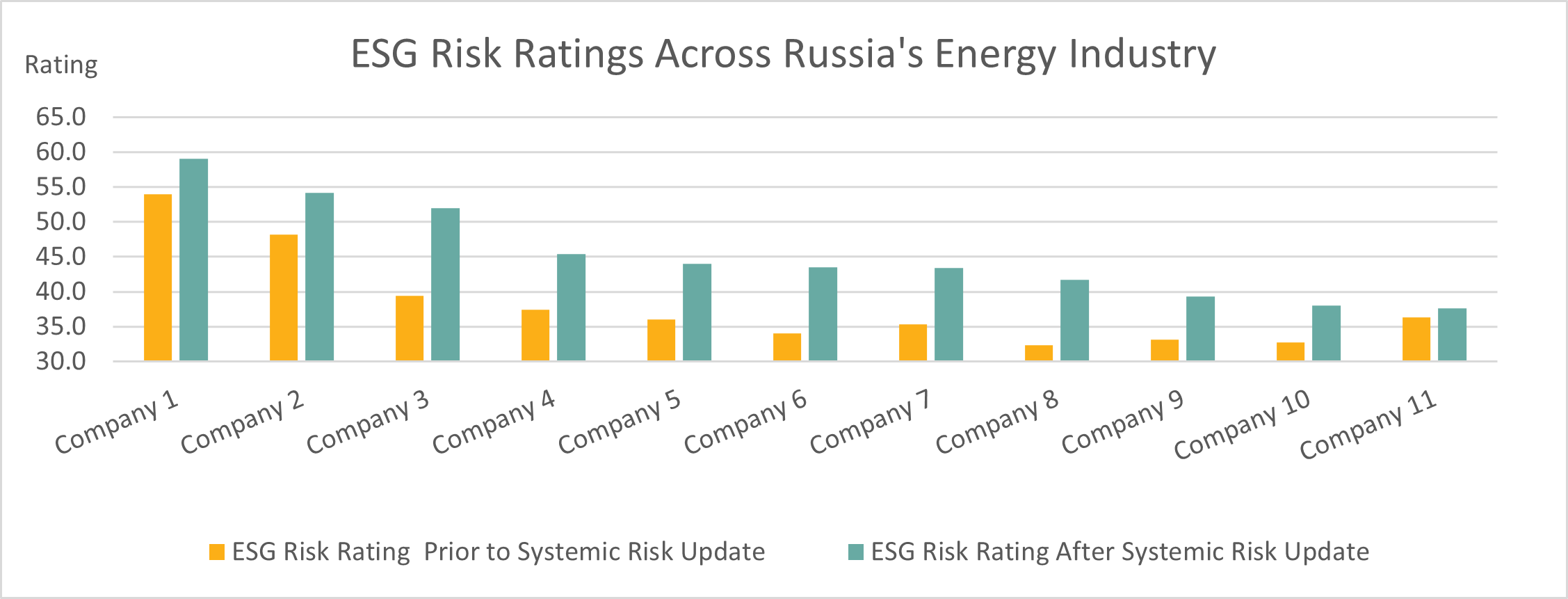

Prior to the repercussions of the Ukraine conflict materializing, almost all Russian energy companies were classified as High Risk under the ESG Risk Rating’s scoring system (i.e., scores between 30 and 40), with only two falling within the Severe Risk category (i.e., scores above 40). These scores were largely driven by existing exposure to sanctions (from Russia’s 2014 annexation of Crimea) as well as less-than-average management performance, particularly on ESG issues like carbon and climate change.

Source: Sustainalytics

After the indicator’s introduction and the inclusion of systemic risk relating to the conflict into the ESG Risk Ratings' methodology, most companies are now categorized as Severe Risk.

While many companies now grapple with the fallout of the conflict, many are also showing tremendous support for the people of Ukraine through donations, humanitarian aid and other forms of support. Although the importance of these types of actions cannot be overstated, companies who potentially have more material contributions to the underlying conflict, such as companies who operate in Russia’s key industries, should not solely rely on these actions to “offset” their impact. As is the case with addressing GHG emissions, avoidance prioritized over offsetting is observed as best practice.

Though the situation in Ukraine remains dire, it is encouraging to see most international energy companies respond in a meaningful way in this instance, mitigating risk while also prioritizing people over profit. However, Sustainalytics will continue to follow developments relating to Russia’s energy industry, along with other industries involved in the conflict. This includes research coverage and additional commentary on international companies who elect to continue operating in Russia, as well as Russia state-owned enterprises.

To learn more about the new Systemic Events methodology as it applies to Sustainalytics’ ESG Risk Ratings, get in touch with our Client Services team.

Sources:

1. BP plc (2022), Press Release: BP to exit Rosneft shareholding. https://www.bp.com/en/global/corporate/news-and-insights/press-releases/bp-to-exit-rosneft-shareholding.html

2. Shell plc (2022), Media Release: Shell intends to exit equity partnerships with Gazprom entities. https://www.shell.com/media/news-and-media-releases/2022/shell-intends-to-exit-equity-partnerships-held-with-gazprom-entities.html

3. Exxon (2022), News Release: ExxonMobil to discontinue Sakhalin-1, make no new investment in Russia. https://corporate.exxonmobil.com/News/Newsroom/News-releases/2022/0301_ExxonMobil-to-discontinue-operations-at-Sakhalin-1_make-no-new-investments-in-Russia

4. Equinor (2022), News Release: Equinor to start existing joint ventures in Russia. https://www.equinor.com/en/news/20220227-equinor-start-exiting-joint-ventures-russia.html

5. Eni (2022), Corporate Website: Our Work in Russia. https://www.eni.com/en-IT/eni-worldwide/eurasia/russia.html

6. Schlumberger (2022), Corporate Website: Schlumberger Announces Update on Russia Operations. https://www.slb.com/newsroom/press-release/2022/pr-2022-0318-update-on-russia

7. Halliburton (2022), Corporate Website: Halliburton Announces Update on Russia Operations and Sanctions Compliance. https://www.halliburton.com/en/about-us/press-release/halliburton-announces-update-russia-operations-sanctions-compliance

8. TotalEnergies (2022), Corporate Website: TotalEnergies in Russia. https://totalenergies.com/russia

9. TotalEnergies (2022), Press Release: Russia: TotalEnergies Shares Its Principles of Conduct. https://totalenergies.com/media/news/press-releases/russia-totalenergies-shares-its-principles-conduct

10. Rostat (2021), Report: Determining the share of the oil and gas sector in the gross domestic product of the Russian Federation. https://rosstat.gov.ru/storage/mediabank/1b5RpebS/Maximov-tezisy.pdf