On 30 June 2022, the US Supreme court passed its ruling1 in the West Virginia versus Environmental Protection Agency (EPA) case. The court determined that the EPA could not enact the Clean Power Plan - a regulation introduced in 2015 that has not been in effect since its introduction due to litigation and was eventually stayed by the Supreme Court in 2016.

The Clean Power Plan was created using a directive from the Clean Air Act that enabled the EPA to set emission limits for air pollutants based on the best available technology to reduce emissions. The EPA aimed to cap carbon emissions and curb greenhouse (GHG) emissions by changing the composition of the existing operational power generation assets by forcing the closure of coal plants through strict emission caps, resulting in a system-wide transition to renewable energy.

The 2015 Clean Power Plan was subsequently repealed by the EPA, even as the case was being litigated at the US Court of Appeals at the DC Circuit on the grounds that it had exceeded its authority. It was replaced with the Affordable Clean Energy Rule in 2018.2,3 However, the Supreme Court’s accepted the case earlier this year and the subsequent judgement was made through the lens of the major questions doctrine, which challenged the EPA’s powers to determine the composition of the entire electricity network. The Supreme Court’s decision has effectively disabled the regulators’ ability to enact such a transition and ruled that such a directive could only be brought into effect via legislation passed by Congress.

The ruling has been perceived by many as a blow to the EPA’s ability4 to enable a rapid transition to clean energy across the country and as potentially opening the door to legal challenges to all future regulations that may be introduced.5 Aside from greenhouse gas emissions, thermal power plants have risks that are closely associated with their other environmental impacts, specifically from non-carbon air emissions and coal ash produced when the fuel is combusted. And the ruling does not impact the EPA’s ability to regulate air pollution and effluents of these assets.

US Utilities have been progressively retiring coal capacity and transitioning to renewable energy and gas over the past several years, even as the Clean Power Plan was stayed. There have been many reasons for this, including the unfavorable economics of coal-power generation. Other significant factors are the impact of existing, non-GHG environmental regulations and pressure from NGOs and the public to curb emissions and effluents from coal plants. The economic and legal effects of the existing Clean Air Act and Coal Ash Residuals regulations have played a role in the shift away from coal generation. Furthermore, under the Biden administration, these regulations have been tightened, posing more challenges for utility companies with coal ash ponds and older coal capacity with high sulphur dioxide, nitrous dioxide, ash, mercury, and lead emissions.

Leveraging Sustainalytics’ ESG Risk Ratings, we compare risk exposure scores for the 15 largest US utilities (in revenue), for which relevant data is available. This sample demonstrates a link between a utility’s risk from carbon-related issues and its environmental risk regarding air and water pollution management and regulations. While the location of the company and associated regulations can affect exposure scores in specific ways, the composition of a utility company’s power generating capacity is a significant factor for both issues.

Figure 1. US Utilities’ Carbon and Emissions, Effluents and Waster Exposure scores

Source: Sustainalytics ESG Risk Rating Data

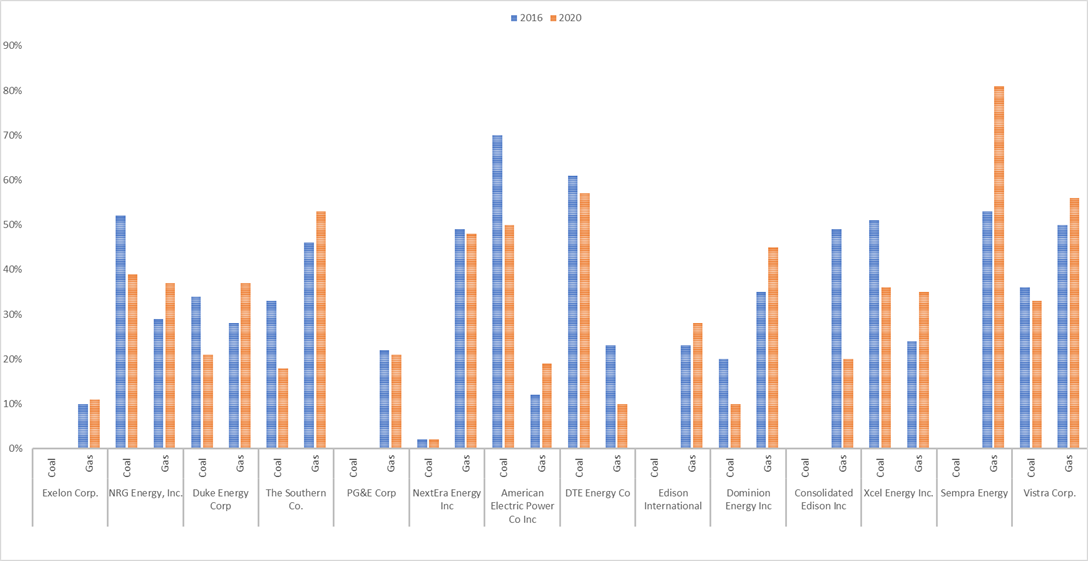

Of the 15 companies listed above that reported coal-based power generation in 2016, all but one reported a reduction in coal in 2020. The trend data indicates that despite the Supreme Court staying the EPA’s Clean Power Plan, the move away from coal power plants has continued.

Figure 2. Difference between coal and gas generation in 2016 and 2020

Source: Data collated by Sustainalytics, sourced from companies’ public disclosures.

The risks associated with carbon regulations and legislatures have depended on the states in which they operate. For example, those states that have pushed for the transition by incentivizing renewable energy development are showing the highest rates of decline in coal-based generation. The Biden administration’s aim to rapidly transition the energy system through federal policies, such as its goal to achieve carbon-free generation by 2035, was expected to be assisted by federal regulations. However, with the EPA’s authority now restricted by the ruling, large-scale transition is likely to be driven by individual states, via environmental regulations that the EPA already enforces, and new ones expected to pass, such as methane emission limits on pipelines.7

Get in touch to learn more about Sustainalytics' sophisticated methodology for rating absolute ESG risk, and how it can enable best-in-class analysis for investors. Company ratings are comparable across peers and subindustries and allow for easy aggregation at the portfolio level.

Sources:

1. West Virginia v. Environmental Protection Agency :: 597 U.S. ___ (2022) :: Justia US Supreme Court Center

2. Environmental Protection Agency (EPA) https://www.epa.gov/stationary-sources-air-pollution/proposal-affordable-clean-energy-ace-rule

3.Environmental Protection Agency (EPA) https://www.epa.gov/sites/default/files/2018-08/documents/ace_overview_0.pdf

4. National Public Radio, 30th June 2022 https://www.npr.org/2022/06/30/1103595898/supreme-court-epa-climate-change

5. Forbes 5th July 2022 https://www.forbes.com/sites/joshuacohen/2022/07/05/supreme-court-decision-on-epa-could-have-implications-for-other-regulatory-agencies-like-fda/?sh=1afbdd8340d2

6. Whitehouse Press Briefing 8th December 2021 https://www.whitehouse.gov/briefing-room/statements-releases/2021/12/08/fact-sheet-president-biden-signs-executive-order-catalyzing-americas-clean-energy-economy-through-federal-sustainability/#:~:text=By%20transforming%20how%20the%20federal,free%20electricity%20sector%20by%202037. Environmental Protection Agency (EPA)https://www.epa.gov/controlling-air-pollution-oil-and-natural-gas-industry/epa-proposes-new-source-performance