As the first National Prescription Opiates Multidistrict Litigation (MDL) cases are set to get underway in late October, we take a closer look company involvement in U.S. opioid crisis and how it has evolved since our first article on the topic in 2017. We also provide an overview of how the ESG risks highlighted in our initial article have materialized over the last two fiscal years (FY2018 and FY2019) for the companies involved.

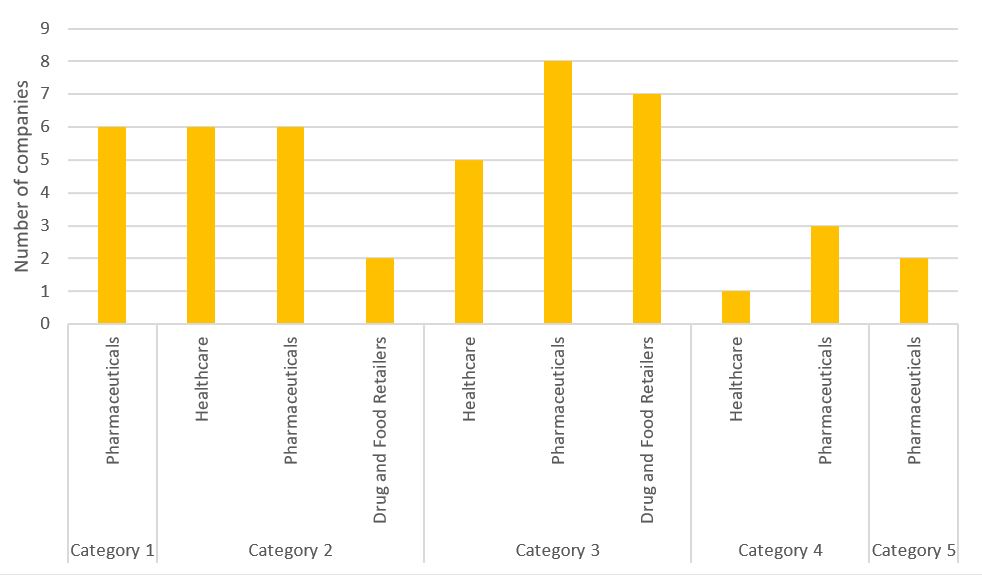

As shown in Figure 1 below, 46 companies within Sustainalytics’ Controversy Universe are involved in opioid-related controversies (as of July 2019); with most having a controversy rating of Category 3.[i] Since 2017, four companies have been downgraded to Category 4 and 5, reflecting the severity of their involvement and significant associated risks to the companies. Two pharmaceutical companies, Indivior and Insys Therapeutics, are rated Category 5, our most severe Controversy Rating. Insys was downgraded in October 2017 and subsequently filed for Chapter 11 in June 2019, making it the first company to file for bankruptcy due to opioid-related liabilities. In September 2019, Purdue Pharma also filed for bankruptcy as part of its plans to settle ligation with plaintiffs.

Source: Sustainalytics database

Companies at various stages of the drugs value chain – from manufacturing, distribution and retailing – have been accused of contributing to the opioid crisis. Pharmaceutical companies account for more than half of opioid related controversies (55%), while drug distributors account for 26%, and food and drug retailers 19% (see graph below).

Figure 2: Sectors involved in the opioid crisis by percentage

Source: Sustainalytics database

As Figure 3 shows, pharmaceutical companies have the highest percentage of Category 3, 4, and 5 controversies.

Of the four companies at Category 4, three are pharmaceutical companies (Mallinckrodt, Endo Internationals, and Johnson & Johnson) and one is a drug distributor (McKesson). Two pharmaceutical companies are at Category 5 (Indivior and Insys Therapeutics). The food and drug retailers involved are mainly rated at Category 2 and 3. In most instances, companies with exposure to opioid drugs, regardless of the sector, have had the related controversies downgraded over the past two years.

Source: Sustainalytics database

Mounting Legal Risks

Fifteen of the 46 companies with opioid-related controversies have been named as defendants in the National Prescription Opiates MDL, which was initiated in December 2017 and now consolidates over 2,000 lawsuits filed across 50 U.S. states. Prosecutors have accused manufacturers of overstating the benefits of opioids, downplaying the risks and aggressively marketing the drugs. Furthermore, drug distributors and retailers have been accused of failing to monitor and detect suspiciously high orders of opioids.

The corporate defendants in the National Prescription Opiates MDL are:

- Opioid Manufacturers: Teva (Cephalon & Actavis, Watson), Allergan, Endo, Johnson & Johnson (Janssen), Purdue Pharma, and Mallinckrodt.

- US Drug Distributors: the “Big Three” drug distributors — AmerisouceBergen, McKesson Corp., and Cardinal Health — which together allegedly distributed more than 80% of the drugs at issue.

- Food and Drug Retailers: Albertsons Companies INC, Costco Wholesale Corporation, CVS Health Corporation, Rite Aid Corp, The Kroger Co, Walgreens Boots Alliance INC, and Walmart.

The number of lawsuits included in the National Prescription Opiates MDL has increased by 900% between January 2018 to July 2019, with a steady increase over the last year. The potential master settlement could reach up to USD 100 billion, presenting significant financial risk to the defendants. The first cases will be tried in October 2019.

Figure 4: Number of lawsuits contained in the MDL

Source: United States District Court for the Northern District of Ohio database

The graph below shows the controversy level for each company involved in the National Prescription Opiates MDL, with most of them at a Category 3 and only three at Category 4 (J&J, Endo, Mallinckrodt, McKesson). Companies with Category 4 ratings are at more financial risk as their involvement in the opioid crisis is assumed to be greater. This is supported by the release of U.S. Drug Enforcement Agency (DEA) data detailing the market share of opioid manufacturers and distributors.

New DEA data sheds light on company exposure

The dataset, known as ARCOS,[ii] provides a transaction-by-transaction account of opioid manufacturing, distribution and sales. In July 2019, a snippet of this data, covering the period from 2006 to 2012, was released to the public. The data revealed the market share held by opioid manufacturers and distributors of the two most common opioids pills, oxycodone and hydrocodone.

According to the dataset, Mallinckrodt and Endo with their respective subsidiaries SpecGx and Par Pharmaceutical, manufactured over 41 billion oxycodone and hydrocodone pills between 2006 and 2012, which represents nearly 54% of all oxycodone and hydrocodone pills manufactured during this period. Mallinckrodt’s subsidiary SpecGX alone produced 37.7% of pills in the market.

The DEA dataset also exposed McKesson as the largest opioid drug distributors, shipping 14 billion oxycodone and hydrocodone pills between 2006 and 2012. Moreover, six distributors were responsible for 75% of the total distribution of oxycodone and hydrocodone pills during this time. Together, McKesson (with a market share of roughly 18%), Walgreens Boots Alliance (16%) Cardinal Health (14%), AmerisourceBergen (12%), CVS Health (8%) and Walmart (7%) distributed a total of 57.5 billion pills.

For drug and food retailers, there has been more uncertainty over their exact role and responsibility in the opioid crisis. In early 2019, the Delaware Superior Court judge granted a motion to dismiss negligence and consumer fraud claims against pharmacies as the case lacked an affidavit of merit but allowed for the case to continue against manufacturers. However, the DEA dataset has helped decipher how exposed these retailers were in terms of opioid distribution. The two leading U.S. pharmacy chains, Walgreens Boots Alliance and CVS Health, are more exposed relative to other retailers. Both operate large drug distribution networks and held a notable market share in opioid distribution between 2006 and 2012.

The legal risks posed to the companies became more evident when the DEA data was publicized, giving a clear picture of the level of company involvement. The DEA database is a key piece in the National Prescription Opiates MDL and may well be used to help prosecute defendants. Companies involved in opioid related events will likely incur some financial responsibility for opioid abuse, but it is difficult to estimate the individual cost to each company as the strength of the legal arguments against them is still untested. The total liabilities for companies could be anywhere from USD 5 billion to 50 billion. The first National Prescription Opiates MDL trial, involving two Ohio counties and scheduled to begin on October 12, 2019, will set the stage of how municipalities may fare in federal court.

Notes

[i] Sustainalytics’ Controversies Research identifies companies involved in incidents that may negatively impact stakeholders, the environment or the company’s operations. A controversy is an event or aggregation of events relating to an environmental, social and governance topic. Controversies are rated on a scale from 1 (low impact on the environment and society) to 5 (severe impact on the environment and society with serious business risk).

[ii] ARCOS: https://www.deadiversion.usdoj.gov/arcos/index.html

.tmb-thumbnl_rc.png?Culture=en&sfvrsn=12471767_1)