Recent reports[1] concerning record decreases in global greenhouse gas (GHG) emissions due to the COVID-19 pandemic have spurred hope for a “green shift” in our global economy, post-pandemic. The importance of this shift cannot be understated, given that capital investments made within the next five-to-ten years will determine the world’s carbon pathway to 2050 and beyond.

Oil and gas producers – being some of the largest contributors to the release of GHG emissions worldwide –undoubtedly have a major role to play in curbing global warming to below 1.5°C. With the recent wave of “net-zero” ambitions being announced from Europe’s major oil and gas players like BP, Shell, Total, and Eni, it appears that the message for reducing emissions is coming through loud and clear for these companies. However, persisting capital commitments to develop new oil and gas resources across the industry is cause for concern on whether sustained reductions in carbon can be achieved and if companies can truly reach net-zero by 2050.

“Net-zero” means something different to each oil and gas company who makes this commitment.

Net-zero, net positive, and carbon neutrality are terms that can easily trigger confusion when it comes to corporate commitments to reduce carbon. Understanding long-term emission trajectories can also be challenging, given the varying ambitions companies are setting.

Ideally, any strong commitment to reduce carbon will include at least three considerations:

- Supporting Long-term Decarbonization: the commitment should seek to meet a long-term carbon reduction target.

- Consistency with Climate Stability: the commitment should meet a science-aligned reduction pathway.

- Compatibility with Available Technologies: the commitment should be supported by proven reduction practices which can reasonably meet a science-aligned reduction pathway.

These three considerations facilitate the creation of a commitment that has a strong foundation to nurture a gradual decarbonization pathway. However, due to the nature of the energy transition, commitments and their supported approach can vary sector by sector, guided by externalities such as technological capability, reputation, and market conditions.

For the oil and gas industry, achieving net-zero may seem far-fetched, given the unavoidable exposure to carbon risk that fossil-fuel dependent business models face. From our review of corporate commitments to reduce carbon (including net-zero ambitions made by European oil majors), it appears that some commitments are playing fast and loose with the prospect for a low-carbon future, talking the talk, but disappointing on the follow-through.

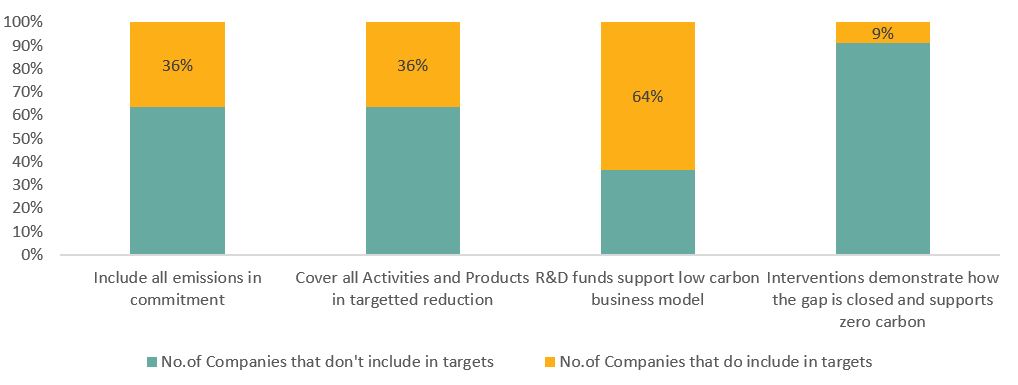

Review of Carbon Reduction Commitments, Major Energy Companies

Source: Sustainalytics

The above figure compared the existing commitments of major oil and gas companies against four key elements that support achieving decarbonization in the long-term. From this, we can see that:

- For most of those making commitments, not all emissions are considered. Only 36% of companies have commitments which account for scope 3 emissions.

- Similarly, only 36% of companies include achieving reductions across all business activities (including the sale of final products) within their commitment.

- Most companies include increases in R&D spending in their commitments, with a focus on renewables, carbon capture and hydrogen. However, less than 10% demonstrate how this spending is compatible with achieving a science-aligned reduction pathway (including those who commit to reaching net-zero by 2050).

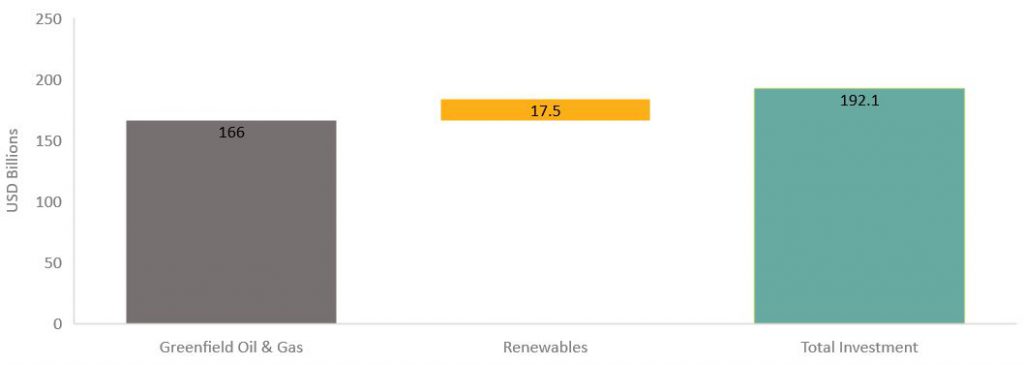

Investment in conventional exploration and production activities is expected to continue well into the future.

While the surge of recently announced net-zero ambitions does signal a willingness to address carbon risk, the industry’s major players continue to be largely focused on new exploration and production opportunities.

Within the next five years, capital expenditure on new oil and gas exploration and production by major energy companies is expected to far exceed investment in new renewable assets, positioning these companies to continue increasing emissions well into the future.

Capital Expenditure (2020-2025), Major Energy Companies

Source: Rystad Energy

Only approximately USD $17.5 billion in renewable capital expenditure is expected to be deployed by 2025, compared to an estimated USD $165 billion in new oil and gas development[2]. Without substantial offsets (which are underpinned by carbon capture technologies and capabilities that are largely unproven), it is estimated that no new investments will be compatible with achieving a science-aligned reduction pathway[3].

As external pressures suppress the price of oil, the risk that investments in new oil and gas assets will not generate return becomes more real. With governments seeking to adopt low-carbon strategies to curb future emissions, these assets may never be developed and can be considered value at risk[4].

Management of carbon remains strong for the time being.

Despite this apparent misalignment between capital commitments and desired emission pathways, those who have committed to achieving net-zero by 2050 are nonetheless those who demonstrate strong management on carbon-related material ESG issues (MEIs) for the time being.

Average Carbon MEI Management Score, Major Energy Companies

Source: Sustainalytics

Companies who have more robust commitments to reducing carbon (particularly those aiming to achieve net-zero) not only showcase stronger overall carbon risk management, they also demonstrate lower carbon intensity relative to their peers and also continuous show year-to-year intensity reductions. Yet, it should be noted that these achievements do not fully mitigate transitional risks associated with the movement towards a low-carbon economy.

Ambitious commitments are indeed a fundamental component of ensuring that the impacts of climate change are mitigated, particularly for those who contribute most significantly to the release of carbon. However, only substantial capital reallocations now can ensure future commitments are met while profitability is retained. Carbon risk has never been more evident for those within the oil and gas industry, with larger, more pronounced risks in the short-term beginning to materialize for those who do not transition their business activities.

Sources:

[1] https://www.scientificamerican.com/article/global-co2-emissions-saw-record-drop-during-pandemic-lockdown/

[2] https://oilprice.com/Alternative-Energy/Renewable-Energy/Only-One-Oil-Major-Is-Betting-Big-On-Renewable-Energy.html

[3] https://www.globalwitness.org/en/campaigns/oil-gas-and-mining/overexposed/

[4] https://www.bbc.com/news/business-53047894