Evolving regulation around decarbonization and other environmental frameworks could present higher risk exposure for airlines as examined using Morningstar Sustainalytics' ESG Risk Ratings. Deploying sustainable aviation fuel-related programs may alleviate such risks and optimize investor preparedness under related regulation.

In December 2021, United Airlines operated the first commercial flight using 100% sustainable aviation fuel (SAF) for one of the aircraft’s two engines. This is an important step towards the aviation industry’s commitment to decarbonize by 2050. Meeting that 2050 goal will require a collective effort and more ambitious measures than those currently in place, including carbon offsetting, route optimization, fuel efficiency and fleet renewals that involve a shift to more eco-friendly aircraft. However, all of these measures still revolve around fossil fuels as a source of energy. This is where SAFs enter the picture. According to the International Air Transport Association (IATA), SAFs have a higher energy density and the potential to reduce emissions by as much as 80% compared with traditional jet fuel.1 The escalation of the war in Ukraine, which led to a drastic jump in jet fuel prices, has further highlighted the need to reduce the industry’s dependency on traditional fuels and accelerate the search for alternative fuels and technologies.

Airlines are facing political pressure to incorporate SAFs

In July 2021, the European Commission (EC) presented its ReFuelEU Aviation regulation proposal, as part of its “Fit for 55” package, which puts forward a set of fuel blending requirements that will compel all aircraft fueling at EU airports to use a set percentage of SAF. These requirements, voted on by the European Parliament in July 2022, are set to increase over time, from 2% in 2025 to 37% in 2040 and ultimately 85% by 2050. If the ReFuelEU proposal becomes a mandate in the EU, companies would be required to source and incorporate SAFs into their operations located in EU member states. Airlines based in the EU have criticized the proposal, arguing that non-European peers can more easily refuel outside the EU and thereby avoid exposure to the regulation. Consequently, the proposal could be considered unfair treatment that undermines European airlines’ competitiveness internationally.

US President Joe Biden proposed a Sustainable Aviation Fuel tax credit in September 2021 to help cut costs and increase SAF production in the US. Furthermore, the government will offer up to USD 4.3 billion in funding opportunities to support SAF projects. In November 2021, the US announced its Aviation Climate Action Plan, which for the first time sets out to achieve net zero greenhouse gas emissions from the US aviation sector by 2050. To meet that target, SAF production will need to increase to at least 3 billion gallons annually by 2030, and there will need to be sufficient supply to meet industry demand.6 Additionally, the Inflation Reduction Act, which came into effect in August 2022, includes USD 297 million for the Sustainable Aviation Fuel and Low-Emissions Aviation Technology Grant Program. The law also includes a provision that raises the existing tax credit for SAF fuel blenders and suppliers (currently set at USD 1 per gallon) by 25 cents if the fuel reduces GHG emissions by at least 50% compared with petroleum-based fuel and to 75 cents if the reduction is more than 50%.7

SAFs are an essential element of airlines’ carbon-cutting strategies

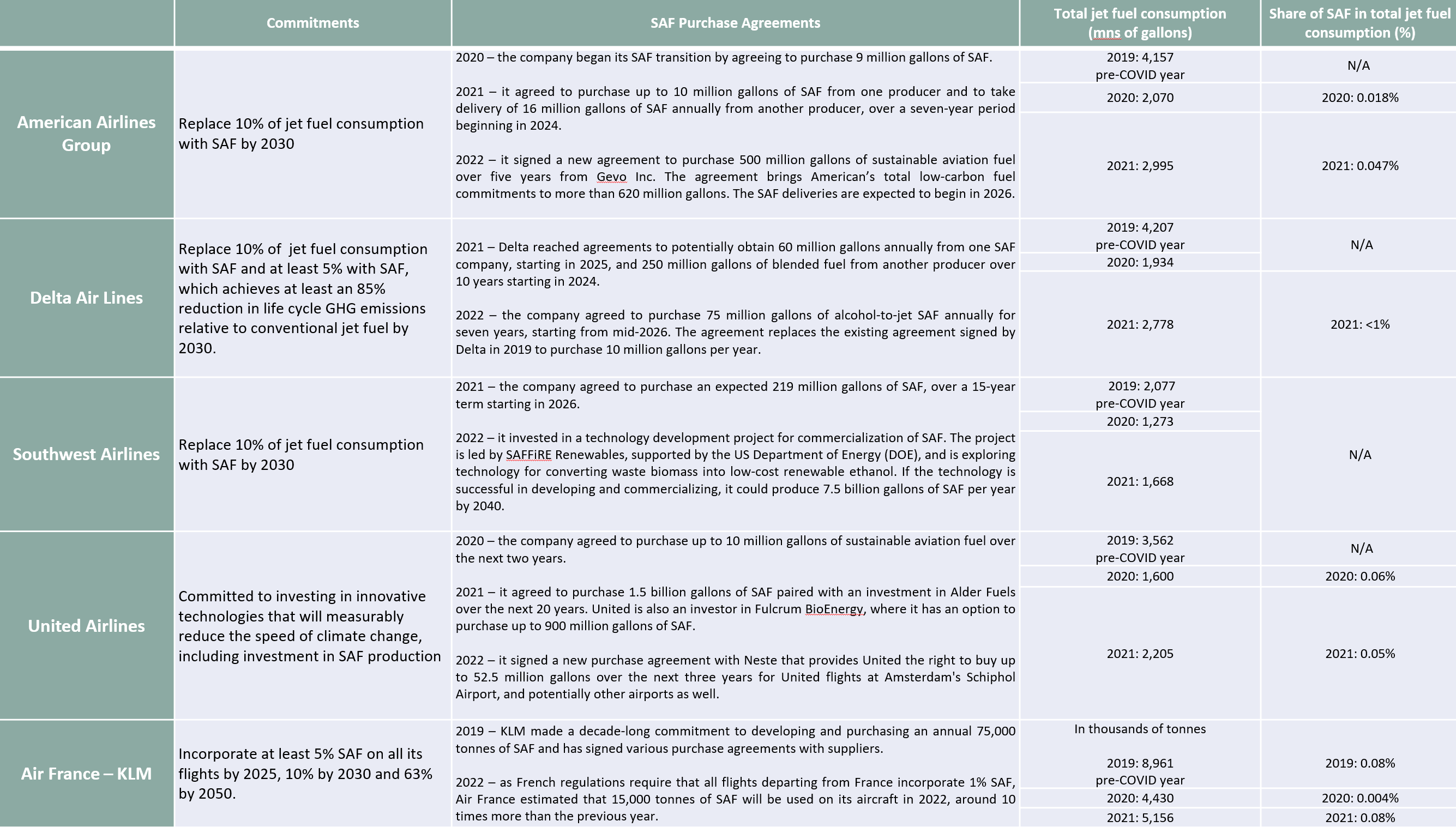

Since 2016, over 45 airlines have flown using a blend of SAFs and traditional jet fuel for more than 370,000 commercial flights.1 In the last year, a majority of airlines, as well as airfreight and logistics companies operating air fleets, highlighted the use of SAFs in their GHG reduction and green logistics program to comply with global GHG emissions targets and legislation (Table 1). In April 2021, Deutsche Bahn Schenker and Lufthansa Cargo launched a regular freight connection worldwide from Europe to China, for which the fuel requirements are covered entirely by SAF. This reportedly saves around 174 metric tonnes of conventional kerosene and avoids 78 tonnes of GHG emissions each week.

Table 1: Airlines’ SAF-related commitments

Source: Airlines’ corporate websites, press releases, CSR and annual reports

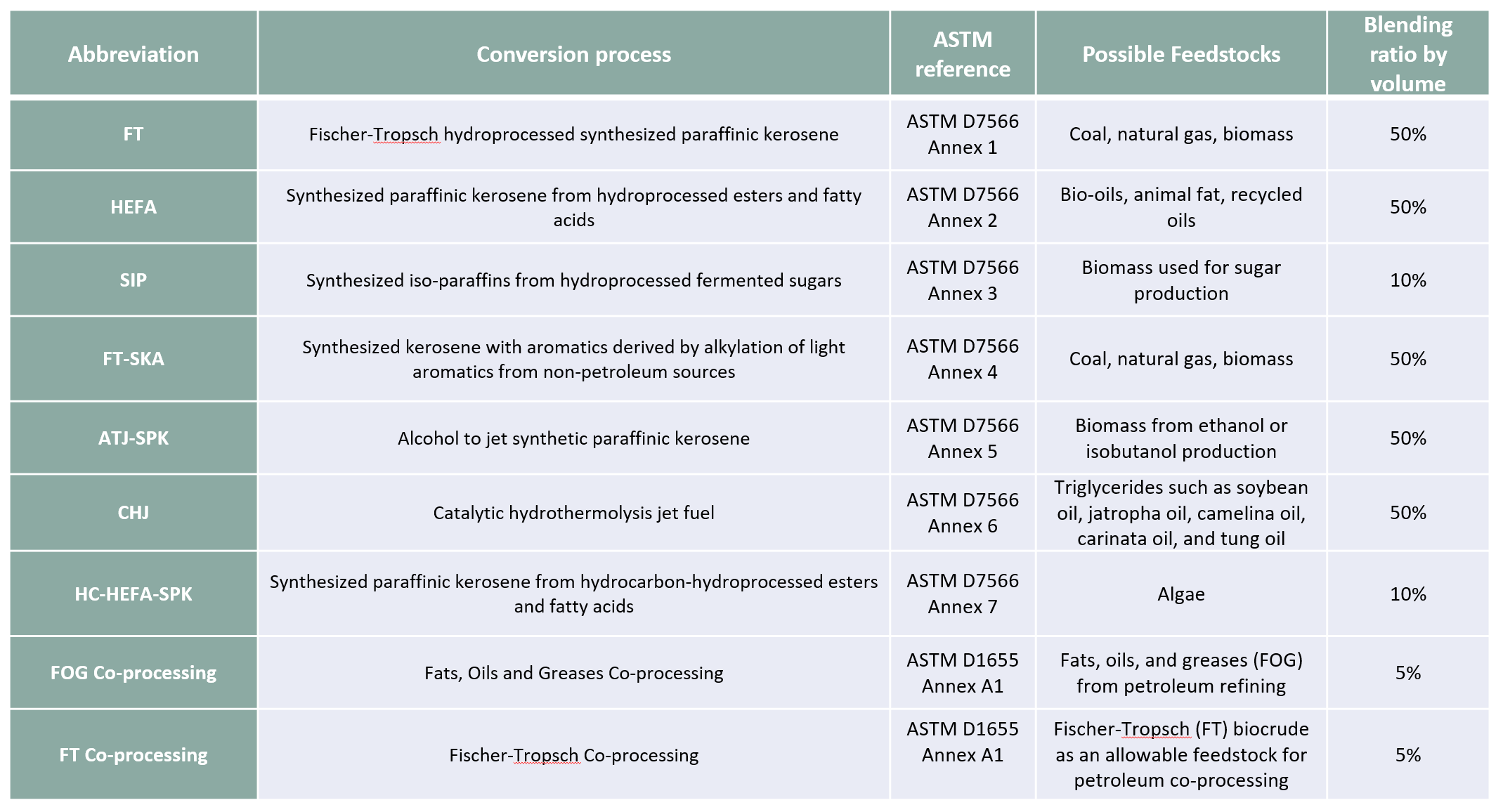

Although aircraft are currently only certified to operate commercial flights on a maximum of 50% SAF mixed with conventional jet fuel, Boeing has stated that its commercial airplanes will be certified to fly on 100% SAF by 2030.2 Also, an Airbus-led project, in collaboration with Rolls-Royce, is testing the emissions performance of 100% SAF use.3 To produce SAF for use in civil aviation, nine production pathways are in compliance with ASTM D4054 standards* (Table 2), as of September 2022.8

Table 2. Nine certified SAF production pathways

Source: International Civil Aviation Organization (ICAO), European Aviation Safety Agency

However, not all certified pathways can be considered fully sustainable. For example, the use of feedstocks such as coal and natural gas could become controversial, drawing negative publicity to the entire enterprise of SAF development and use across the aviation industry. The use of food crop-based fuels is also controversial, due to the potential pressure it puts on agricultural land and biodiversity.

Limitations and the future of SAFs

With regard to aerospace companies, manufacturing SAF-capable jets and optimizing engines for its consumption may provide opportunities for investors. Aircraft manufacturers and fuel producers have started testing SAF on a relatively large scale and the IATA estimates that 100 million liters (26.4 million gallons) of SAF were produced worldwide in 2021; however, this represents nearly 0.1% of aviation fuel requirements globally.4,5 Also, SAFs remain costlier than conventional jet fuel due to the low production scale, which constrains supply. While SAF industry stakeholders continue to invest in increasing production capacity, the high cost of SAF relative to conventional jet fuel remains a major barrier to its adoption in the short and medium term.

Widespread adoption of SAF by airlines will require significant cost reductions; otherwise, the high prices may need to be passed on to passengers, which could favor airlines that rely heavily on cheaper fossil jet fuel. Thus, policy support and subsidies, combined with decreasing subsidies for kerosene, remain key factors. Wider adoption of SAF could also be limited simply because the technology has not yet been proven successful at a larger scale.

*ASTM D4054 “Standard Practice for Qualification and Approval of New Aviation Turbine Fuels and Fuel Additives”. This was developed as a guide by the engine and airplane OEMs (original equipment manufacturers) with ASTM International member support. It provides producers of alternative fuels with guidance as to what is expected in terms of required testing and OEM involvement.

Sources:

1. https://www.iata.org/en/programs/environment/sustainable-aviation-fuels/

2. https://boeing.mediaroom.com/2021-01-22-Boeing-Commits-to-Deliver-Commercial-Airplanes-Ready-to-Fly-on-100-Sustainable-Fuels

3. https://www.rolls-royce.com/media/press-releases/2021/19-10-2021-rr-joins-boeing-and-world-energy-for-successful-100percentage-sustainable-aviation-fuel.aspx

4. https://www.iata.org/en/iata-repository/pressroom/fact-sheets/fact-sheet---alternative-fuels/

5. https://www.forbes.com/sites/michaelgoldstein/2021/09/23/can-oil-industry-giants-like-shell-provide-sustainable-jet-fuel-by-2025/?sh=5c9770473e00

6. https://www.whitehouse.gov/briefing-room/statements-releases/2021/09/09/fact-sheet-biden-administration-advances-the-future-of-sustainable-fuels-in-american-aviation/

7. https://www.commerce.senate.gov/2022/8/sen-cantwell-democrats-deliver-wins-to-boost-sustainable-aviation-fuel-support-coastal-and-climate-resiliency-and-improve-weather-forecasting-in-inflation-reduction-act

8. https://www.icao.int/environmental-protection/GFAAF/Pages/Conversion-processes.aspx