The U.S. Securities and Exchange Commission (SEC) recently published the final version of its long-awaited Climate Disclosure Rule. The final rule differs significantly from its original draft and further departs from other standards about to be implemented around the globe – notably, regarding scope 3 emissions and transition plans. Still, material climate-related disclosures will be required for SEC registrants (which comprise approximately 10,000 companies) as part of their annual filing, allowing investors to look at audited, temporally aligned financial and climate disclosures for the same period, at the same time.

How the Final Rule Differs From the Draft

Larger registrants will be required to disclose scope 1 and/or scope 2 greenhouse gas (GHG) emissions on a phased-in basis if these emissions are material, along with attestation reports. Small filers are exempt from this requirement. Scope 3 emission disclosures were not included in the final rules. This is a fairly large departure from the initial proposal, which would have required all large registrants to disclose their scope 1 and scope 2 emissions, as well as scope 3, if material.

While many headlines have focused on the omission of scope 3 emission disclosures, the final rule, as expected, still mandates several qualitative and quantitative disclosures, including: material climate-related risks, financial impacts, mitigation and adaptation activities, board oversight, management roles, and climate-related targets or goals.

These disclosures provide added transparency for investors to assess public companies’ exposure and management to climate-related risks. Disclosures related to transition plans, scenario analysis, internal carbon price, and carbon offsets – which are obligatory only if deemed material or already used – are granted safe harbor from private liability. Registrants must also disclose the financial statement impacts of severe weather events and natural conditions, subject to specific disclosure thresholds.

What This Means for Investors

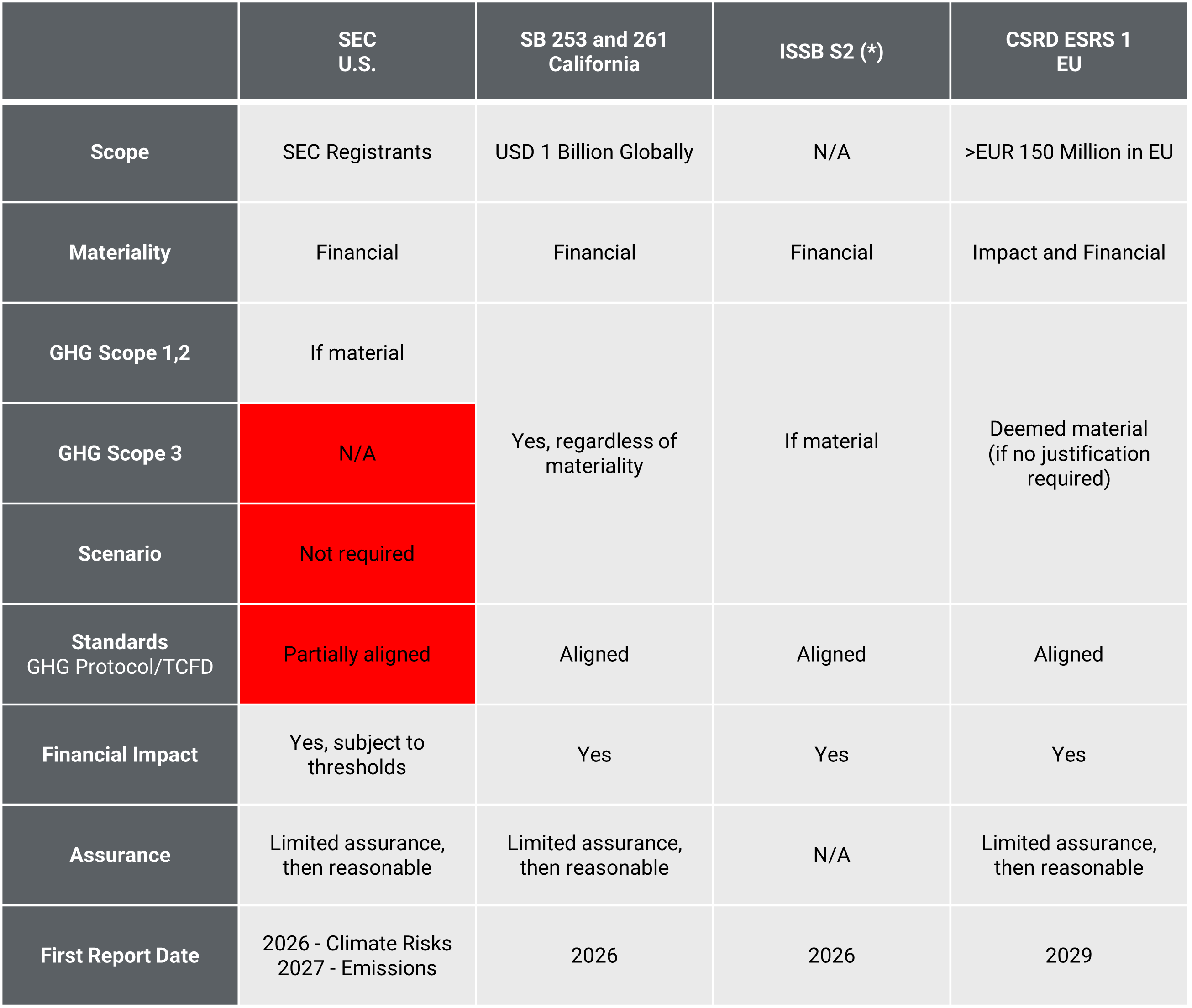

While the scope of the Climate Disclosure Rule falls short of asset owners/managers’ own regulatory requirements,1 more ambitious standards could sooner (e.g., ISSB S2,2 California SB 2533) or later (e.g., CSRD ESRS1) trump the SEC rule and require many U.S. companies to further disclose climate-related information (see Table 1 below). Additionally, the SEC rule is set to expand the amount of material management-related information available to investors. For example, only 5% of U.S.-based companies in the Low Carbon Transition Ratings disclose even partial information about their internal carbon price, and around 40% disclose information about their GHG risk management plans. The SEC disclosure rules will enable investors to have access to this information for a wider range of companies.

Table 1. How the SEC Climate Disclosure Rule Compares to Other Climate Standards

Relevant to U.S. Companies

Source: Summary compiled by Morningstar Sustainalytics. For informational purposes only.

In the meantime, investors can continue to partner with data providers to assess scope 3 emissions and climate transition plans to ensure that they have a more representative view of issuers’ climate risks and resilience and better respond to their obligations to manage climate-related risks.

Making Progress on Transparency

The SEC’s Climate Disclosure Rule is aligned with Morningstar’s objective of providing greater transparency for investors. The company is on the Technical Advisory Board of the Net-Zero Data Public Utility (NZDPU), whose mission is to, “provide a trusted, central source of company-level climate data that is transparent and openly accessible to all.” It is a resource for investors seeking company reported emissions data. Making this information easily accessible provides an incentive for more companies to report, especially on scope 3, as emissions reporting becomes standard practice for companies across the globe.

It is widely accepted among asset managers and investors that climate risk is investment risk. The SEC’s new rule can be seen as a step in the right direction, even if it backtracked from some provisions in earlier proposals.

How Morningstar Sustainalytics Can Help

Our Low Carbon Transition Ratings’ focus on management preparedness is closely aligned with the final SEC guidance, providing assessment of companies’ management including and beyond the elements required by the SEC guidance, such as assessment of a company’s climate governance practices and disclosure on the use of an internal carbon price.

Our Physical Climate Risk Metrics can be used by investors to identify companies that have high exposure to the impacts of physical climate change, which can be used as an initial screening tool to identify companies with the highest percentage of high-risk assets and high exposure from near term hazards such as flooding, forest fires and extreme heat.

Morningstar Sustainalytics offers a suite of Climate Solutions. Get in touch to discuss how we can help you assess your climate resiliency and transition needs.

References

- E.g., Jurisdictions mandating or encouraging consideration of scope 3 GHG emissions include key financial hubs such as the EU, U.K., Switzerland, Hong Kong, Singapore.

- Several jurisdictions including Australia, Canada, Hong Kong, Japan, Singapore, and the U.K. are expected to apply ISSB S2. Most jurisdictions aim to require a first report in 2026.

- Subject to litigation. De Bernier, P., Hurst, S., & Felix, F. 2024. "Lawsuit Challenges Recent California Disclosure Laws." February 16, 2024. Mayer Brown. https://www.mayerbrown.com/en/insights/publications/2024/02/lawsuit-challenges-recent-california-climate-disclosure-laws.