Morningstar Sustainalytics recently published the fourth annual update to its ESG Risk Rating Industry Reports covering 42 industries. The reports provide an in-depth analysis of key industry trends and show the distribution of ESG risk within and across industries on a range of material ESG issues. The reports also provide a reference point for the comparison of industries across our broad universe on different measures of unmanaged ESG risk. In this article, we highlight key cross-industry insights that emerge from this year’s reports and the research behind them. These insights can help investors contextualize different ESG risk signals, as well as identify the most relevant topics that are likely to impact those signals in the future.

Takeaway One: ESG Risk Scores Are Improving

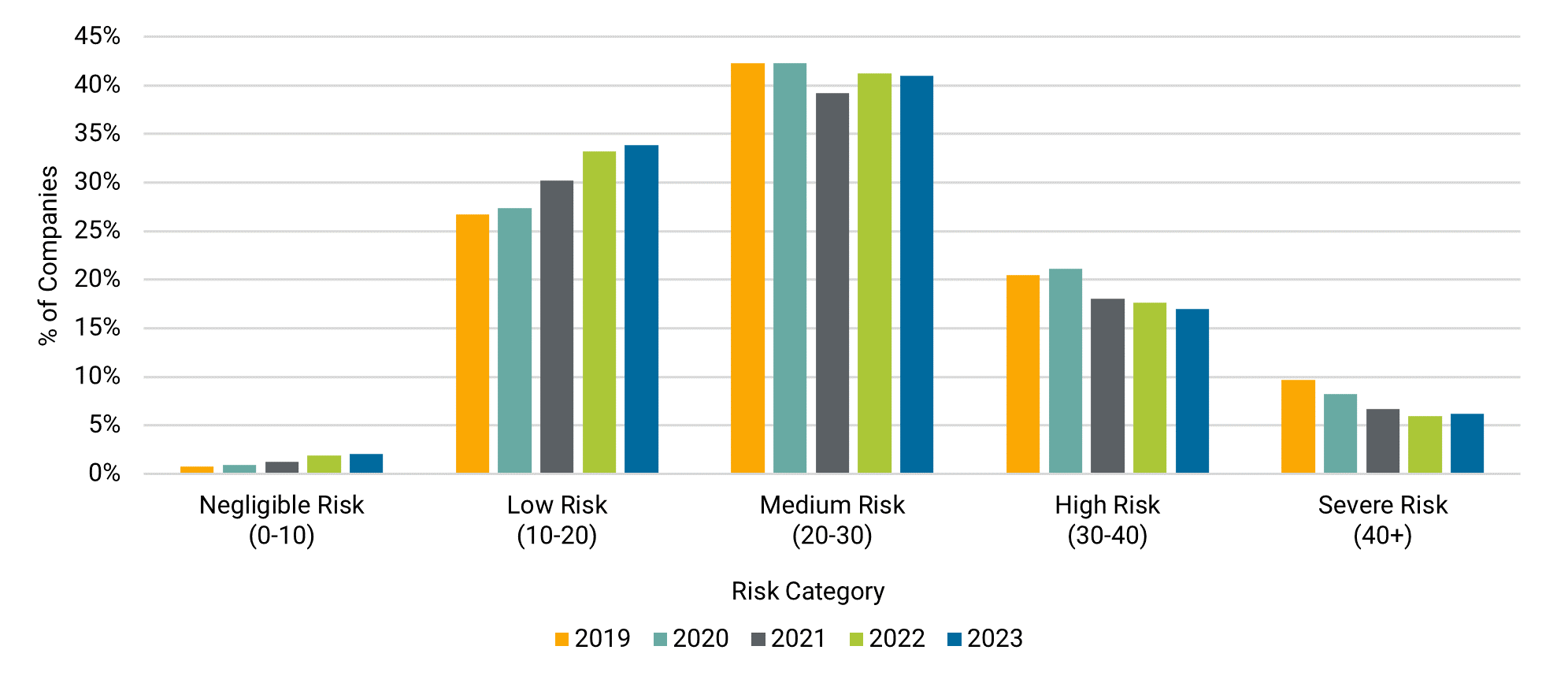

The distribution of ESG risk scores across our Industry Reports’ coverage universe1 has remained relatively stable over the past five years, with the majority of companies concentrated in the medium and low risk categories (Figure 1). However, we observe a persistent decrease in the percentage of companies classified as high and severe risk, coupled with an increase in the percentage of those classified as low and negligible risk.

Figure 1. Distribution of ESG Risk Scores by Category, Aug. 2019 - Aug. 2023

Source: Morningstar Sustainalytics. For informational purposes only.

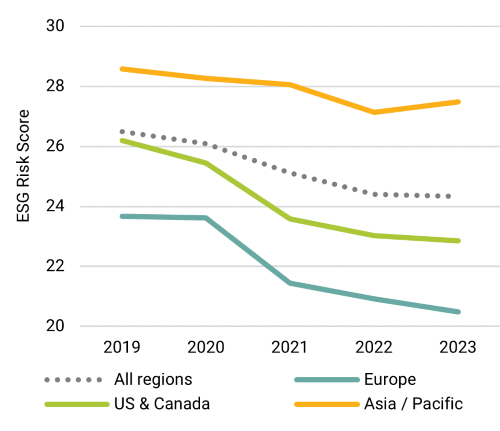

Indeed, between August 2019 and August 2023, the average global ESG risk score decreased from 26.6 to 24.3 points (Figure 2).2 This outcome is consistent with our expectations, given the evolution of the ESG landscape over the past five years, which was marked by significant strides in regulation, greater importance attributed to ESG factors by investors, as well as the development and wider adoption of sustainability accounting standards and frameworks.

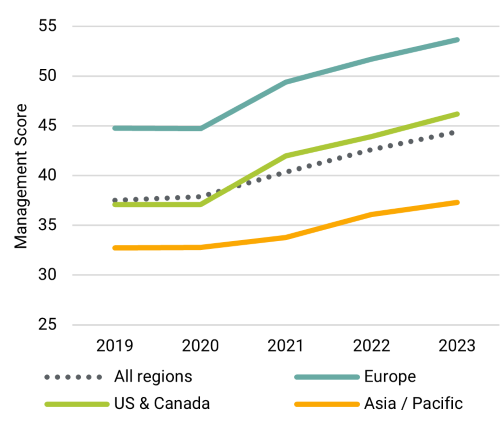

Against this backdrop, companies are increasingly integrating sustainability-related considerations into business decisions, establishing relevant policies and programs, and improving their ESG disclosures. This is reflected in the change in the global average management score, which increased from 37.5 in 2019 to 44.4 in 2023 (Figure 3).3

Figure 2. Evolution of ESG Risk Scores per Region, Aug. 2019 – Aug. 2023

Note: Africa/Middle East and Latin America and Caribbean excluded due to limited coverage of companies headquartered in these regions. | Figure 3. Evolution of Management Scores per Region, Aug. 2019 – Aug. 2023

Note: Management scores are grouped in three categories: Weak (0-25), Average (25-50), Strong (50+).

|

While the global average ESG risk score remains well within the medium risk range, we observe some regional differences. Companies headquartered in Europe and North America are seeing a more marked decrease in the average ESG risk score compared to companies headquartered in Asia Pacific, with European companies nearing the lower limit of the medium risk range. This can be explained by the greater improvement of management scores in Europe and North America, with an average increase of nine points in both regions. In comparison, the average management score of Asia Pacific companies has improved by 4.6 points.

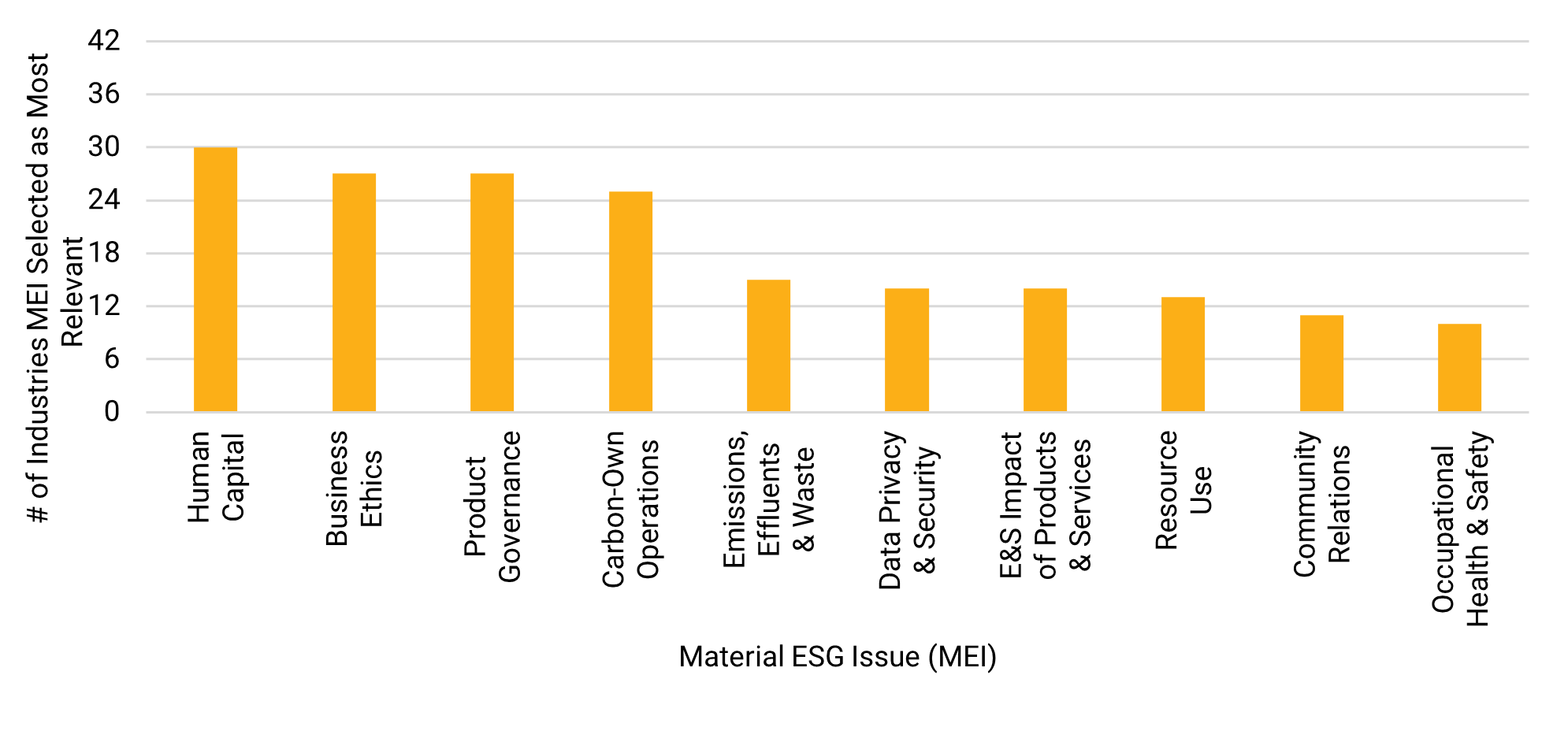

Takeaway Two: Human Capital, Business Ethics and Product Governance Are the Most Relevant MEIs Across Industries

For each report, out of 20 total MEIs, our analysts selected the five most relevant MEIs for that industry, mainly based on that particular industry’s level of exposure to each MEI. Human capital (i.e., risks related to labor skills, intensity and labor relations issues), business ethics (i.e., risks related to professional ethics, bribery and corruption) and product governance (i.e., risks related to the quality and safety of products and services) are regarded as the most relevant for the majority of industries, as shown in Figure 4 below.

Figure 4. Top 10 Most Relevant MEIs Across 42 Industries Based on Selection by ESG Research Analysts

Source: Morningstar Sustainalytics. For informational purposes only.

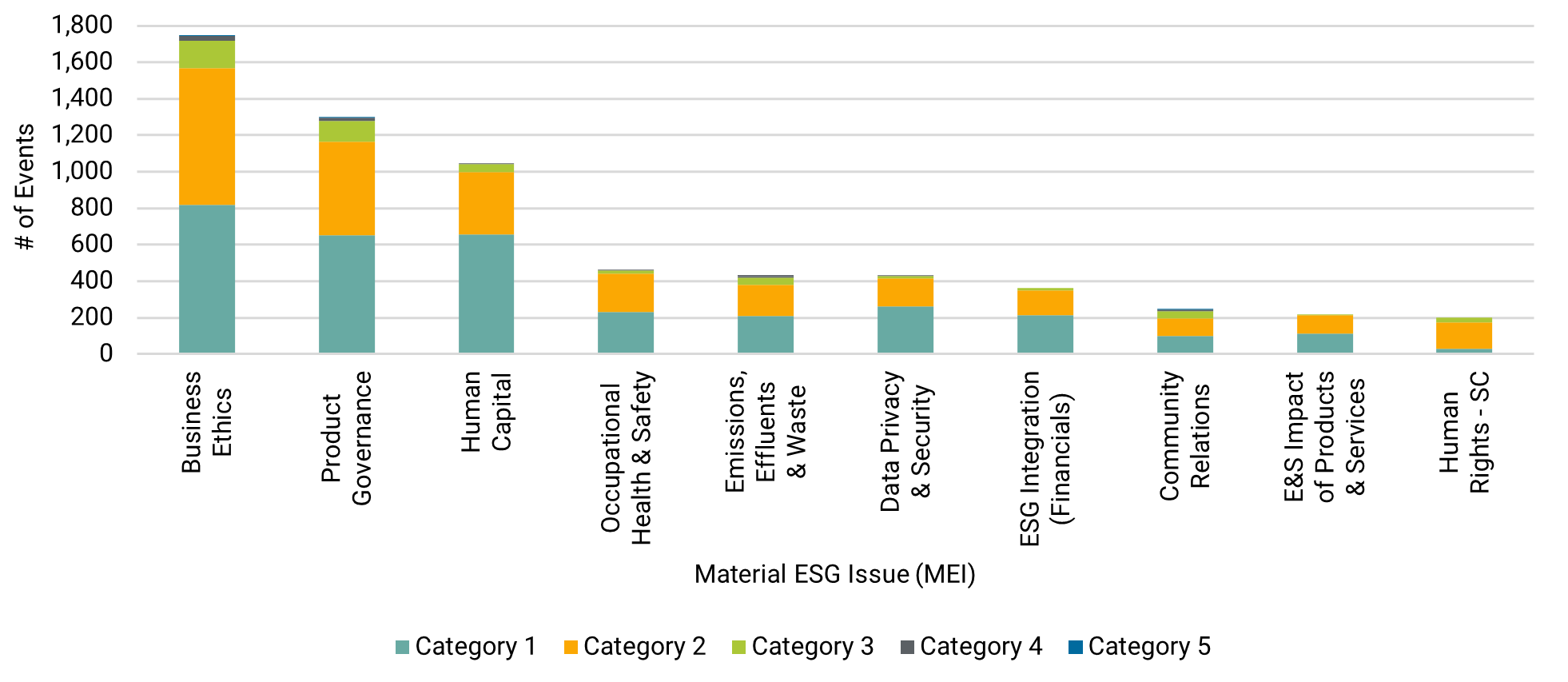

Perhaps unsurprisingly, the same three MEIs account for roughly 60% of the events captured within our controversy research (Figure 5). One reason is the importance of events in our exposure assessment framework, which considers the occurrence of misconduct or management failures as one indication of higher materiality and probability of an ESG issue.

Figure 5. Distribution of Controversial Events per MEI and Category

Source: Morningstar Sustainalytics.

Note: The chart includes the 10 MEIs with the highest number of events.

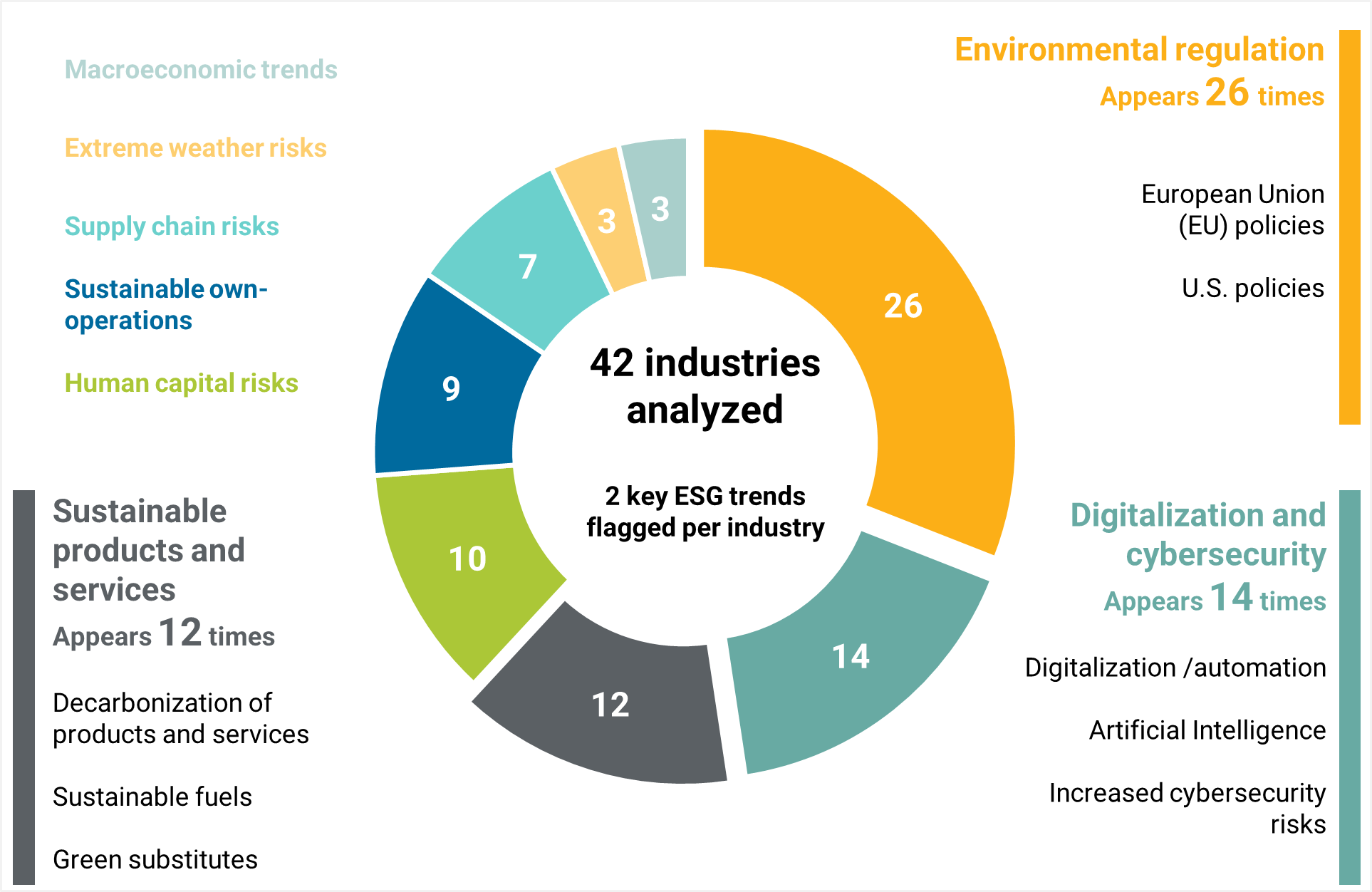

Takeaway Three: Environmental Regulation is the Most Significant Trend Across Industries

Industry trends and broader ESG developments also inform analysts’ choice of the most relevant MEIs. For each of the 42 industry reports, analysts are asked to focus on two key trends. We analyzed the 84 trends selected in 2023 and categorized them in eight overarching themes, illustrated in Figure 6 below.

Figure 6. Overarching Themes Emerging from Key ESG Trends

Source: Morningstar Sustainalytics. For informational purposes only.

Note: Count of appearances refer to the number of times each theme appears in reports.

Regulatory developments on environmental issues take center stage in this year’s reports, which were selected as a key trend for over half of the industries. Some of the most significant developments are occurring in the EU. One example is the Fit for 55 Package, which comprises an extensive set of regulatory measures meant to support the EU’s climate neutrality goals.4 The policy primarily affects heavy emitting industries such as transportation, transportation infrastructure and automobiles. Another example is the revision of the EU Packaging and Packaging Waste Directive, which aims to ensure that all packaging within the EU market is reusable or recyclable in an economically viable way by 2030.5 If approved, the policy will have significant impact on consumer goods industries. It will also create opportunities for containers and packaging companies, relating to paper and bio-based solutions.

In the U.S., the Inflation Reduction Act passed in 2022 is considered the most significant climate legislation in U.S. history, offering funding and other incentives for renewable energy and energy-saving technologies.6 The law is expected to positively impact the entire electric vehicle and renewable energy value chains, especially the auto parts, automobiles, electrical equipment and electric utilities industries. Mining companies are also affected, as tax credits are awarded for producers of the critical minerals required for these new technologies.

Digitalization and cybersecurity risks is the second most prevalent theme emerging from this year’s reports. Rapid advances in artificial intelligence technology have led to an increase in its application across industries, including aerospace and defense, healthcare, media, and diversified financials. The so-called “Fourth Industrial Revolution,” marked by the increased use of AI, cloud computing and e-commerce, creates innumerous gains in productivity and market access. However, as companies collect, process and store an ever-increasing amount of sensitive data, the risk of data breaches and ransomware attacks also increases.

Within sustainable products and services, the third most prevalent theme, decarbonization seems to be attracting most corporate investments, followed by substitution and recycling initiatives. Carbon pricing will likely lead to a pivot towards renewable fuels in the coming decades, with significant impact on oil and gas producers. Airlines and aerospace and defense companies are heavily involved in the development of sustainable aviation fuels, while heavy duty vehicle manufacturers are launching electric and hydrogen-powered machines. Within the chemicals industry, technologies are being developed to integrate bio-based feedstock into traditionally fossil-fuel-based products.

These themes are likely to continue to shape industries’ ESG risks and opportunities in the coming years. By combining comprehensive data analysis with expert insight, our ESG Risk Rating Industry Reports can help investors keep abreast of the most relevant developments in different industries and how these impact companies’ ESG risk. The 2023 ESG Risk Rating Industry Reports are available on Sustainalytics Global Access. For more information visit www.sustainalytics.com.

References

- The coverage universe comprises public companies in the comprehensive framework. The approximate number of companies included each year is as follows: 2019 - 4,000 companies, 2020 - 4,000 companies, 2021 - 4,300 companies, 2022 - 4,500 companies, 2023 - 4,500 companies.

- In Sustainalytics ESG Risk Ratings methodology, a lower ESG risk rating score is better.

- In Sustainalytics ESG Risk Ratings methodology, a higher management score is better.

- European Council. Fit for 55 (n.d.) https://www.consilium.europa.eu/en/policies/green-deal/fit-for-55-the-eu-plan-for-a-green-transition/#package.

- European Commission. Packaging waste (n.d.) https://environment.ec.europa.eu/topics/waste-and-recycling/packaging-waste_en.

- United States Environmental Protection Agency (EPA). Summary of Inflation Reduction Act provisions related to renewable energy. (n.d.) https://www.epa.gov/green-power-markets/summary-inflation-reduction-act-provisions-related-renewable-energy.

Source: Morningstar Sustainalytics. For informational purposes only.

Source: Morningstar Sustainalytics. For informational purposes only.  Source: Morningstar Sustainalytics. For informational purposes only.

Source: Morningstar Sustainalytics. For informational purposes only.