As we discussed in a previous article, investors aiming to achieve net-zero across their portfolio should look beyond the stated commitments, emissions pathways, and reduction targets of investee companies. When assessing whether companies can reduce their emissions enough to align with a 1.5-degree Celsius global temperature rise above pre-industrial levels, investors will need to give more weight to the actions and management practices companies are currently implementing. But the steps needed to effectively manage business operations to achieve net-zero goals and avoid low-carbon transition risks will differ based on a company’s industry or subindustry.

In this article, we analyze data from our new Low Carbon Transition Ratings (LCTR) to identify industries with a large portion of companies that have strong management of transition issues and examine the factors contributing to their strong management scores. We’ll also discuss what constitutes good climate risk management and how the country of operation can influence outcomes.

Measuring the Path to Net-Zero

The LCTR is the combined assessment of two components: a company’s exposure to specific carbon risks and opportunities and its management of those risks.

When assessing a company's exposure to low-carbon transition risks, we are interested in the potential impact of its current emissions (as projected to go unabated until 2050) in relation to its carbon budget. A company’s carbon budget is determined based on a 1.5-degree Celsius pathway for its subindustry, the regions where it operates, and the company's relative share in those regions' emissions. Some companies face inherently greater exposure to carbon risk by nature of their industry or subindustry, while some types of operations (i.e., coal companies) are simply not compatible with a net-zero scenario.1

The Management Score: A Measure of How a Company Deals With Carbon Transition Risks

We also assess the issuer's ability to manage that exposure by calculating its management score. The overall management score is a measure of how much of the company’s exposure can be managed, based on its investment alignment to net-zero and our assessment of the company’s transition preparedness (defined in the next section).

The management score of the LCTR ranges from 1 to 100 and is normalized so that it can be compared across industries. The management score comprises two parts with equal weighting: transition preparedness which is scored based on the company’s level of disclosure of key management indicators, and investment alignment which is scored on the basis of the company's disclosure of its climate investment plans.

The management indicators (e.g., GHG emissions targets, carbon price integration, GHG performance incentive plan, among others) are determined and weighted based on the company’s subindustry. For instance, banks are assessed on what proportion of their lending portfolio is allocated to green investments, an indicator which is not relevant to oil and gas producers. On the other hand, oil and gas producers will be assessed on their methane management programs while diversified financials are not assessed on this indicator.

Having a high management score does not equate to a business or industry being environmentally friendly or a sustainable investment. However, it does indicate that the company has the governance structures and management programs in place to address the transition risks it is exposed to. Adversely, having a low management score implies that the company's governance and plans are inadequate and may lead to higher exposure or higher future emissions.

Seeing How They Diverge from Net-Zero: Companies' Implied Temperature Ratings

The final rating for LCTR is expressed as an Implied Temperature Rating (ITR) – the temperature by which the Earth would warm if the global economy were on a similar pathway as the company being rated. Poor management results in a company’s exposure increasing and a higher ITR, while strong management leads to a lower exposure assessment and lower ITR.

Industries With Strong Carbon Transition Risk Management

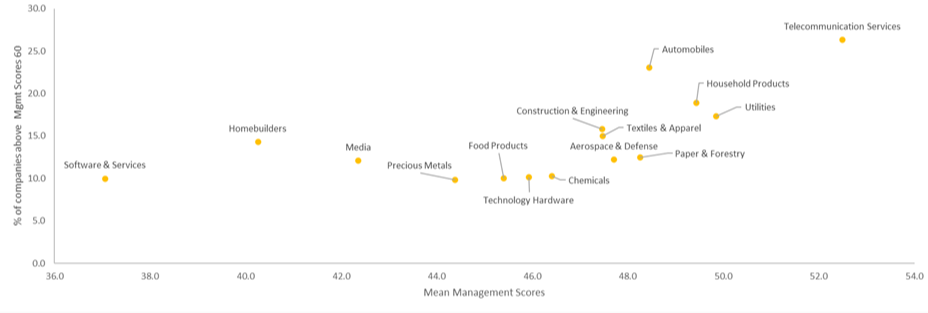

Figure 1. Average LCTR Management Performance Score of the 15 Largest Industries in the LCTR Universe

Source: Morningstar Sustainalytics. For informational purposes only. Each of the industries listed comprise more than 2% of representation in the universe.

Telecom services, utilities, household products, automobiles, and construction and engineering are the industries with the highest proportion of companies with strong management scores for the LCTR. This indicates that these are the industries where companies have come the furthest in terms of identifying and managing material climate risks. However, the data also suggests that, despite the strong management performance of some companies in these industries, many others still have room to improve. For example, in the telecommunications industry, roughly 25% of companies have a strong management score (score above 60), while for the automobiles sector the number is 22%.

Companies that are performing poorly in these industries are assessed to not be managing their material risks. An example of this could be if a company with high scope 3 emissions has set reduction targets only for scope 2 emissions. In automobile manufacturing for instance, a company can score poorly even if it has all but eliminated scope 2 emissions but plans to produce internal combustion engine cars for the foreseeable future.

Essential Indicators to Look at for Climate Risk Management

As mentioned earlier, overall, we find that the levels of climate risk management performance are fairly low, with the average management score across all industries and indicators sitting at around 45. So, what are the management practices and strategies that differentiate top performing companies from poor performers within these industries?

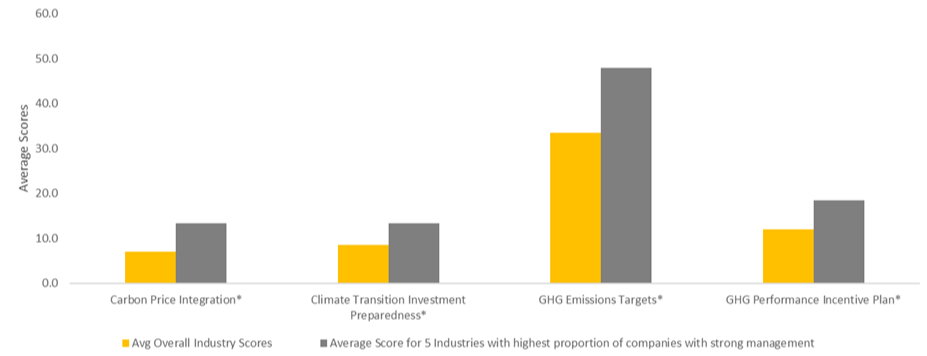

If we look at the industries with the largest percentage of companies that have management scores above 60, we find that companies that are performing well are doing so on what we call essential indicators. The indicators in question are described below:

- GHG emissions targets – An assessment of the company's GHG reduction targets and the extent to which they are aligned with net-zero scenarios.

- Carbon price integration – An assessment of the extent to which companies integrate carbon prices in strategic planning.

- GHG performance incentive plan – An assessment of whether management incentives are linked with the achievement of emissions reduction plans.

Figure 2. Comparison of Indicator Disclosure Performance Between the 5 Industries With the Highest Average Management Scores Versus Average Overall Industries

Source: Morningstar Sustainalytics. For informational purposes only. * Represent essential indicators.

What Companies With Strong Climate Management Are Disclosing

Focusing on the highest weighted essential indicators, we see that companies with better management scores do particularly well on:

Emissions Reduction Targets

Across industries with better management scores, we see that typically more than half of the companies have set an absolute or intensity-based GHG reduction target (or both). These companies have also set clear timelines for achieving these targets. The leading industries also have a higher proportion of companies that have set deep decarbonization targets. Telecommunications and household products do well in disclosing most of the elements assessed under this indicator.

Use of Carbon Pricing in Decision Making

Companies within the five industries with the highest management scores have much higher rates of reporting on utilizing carbon pricing in decision making. They also publicly disclose the carbon price they use and the source of the carbon price at higher rates. This highlights their commitment to making transition-compliant investment decisions. High emitting industries like automobiles and utilities have higher rates of disclosure on using carbon pricing for decision making.

Governance Structures to Achieve Net-Zero Targets

A company may set emissions reduction targets but our confidence in the likelihood of it achieving those targets diminishes if the company’s management is not incentivized adequately to achieve those targets. Companies with strong management performance do well by backing up their targets with remuneration and incentives (both monetary and non-monetary) for the company’s CEO, board members, and senior management. Most of the companies with strong management scores do well on this indicator.

Countries Getting Tough on Climate Are Making a Difference

An important point to note is that two of the five industries with the highest proportion of companies with strong management scores (automobiles and utilities) are traditionally high emitters and linked to high fossil fuel usage. These industries are also the ones most closely linked to decarbonization in the medium term due to greater global focus, the availability of viable climate friendly products and production technologies, and the global regulatory push across major economies.

This regulatory push for both climate action and reporting, with an extra focus on these two high-emitting sectors, also manifests in a general skew of better management scores in countries where tougher regulations on climate risk reporting and climate mitigation policies have been enacted or proposed.

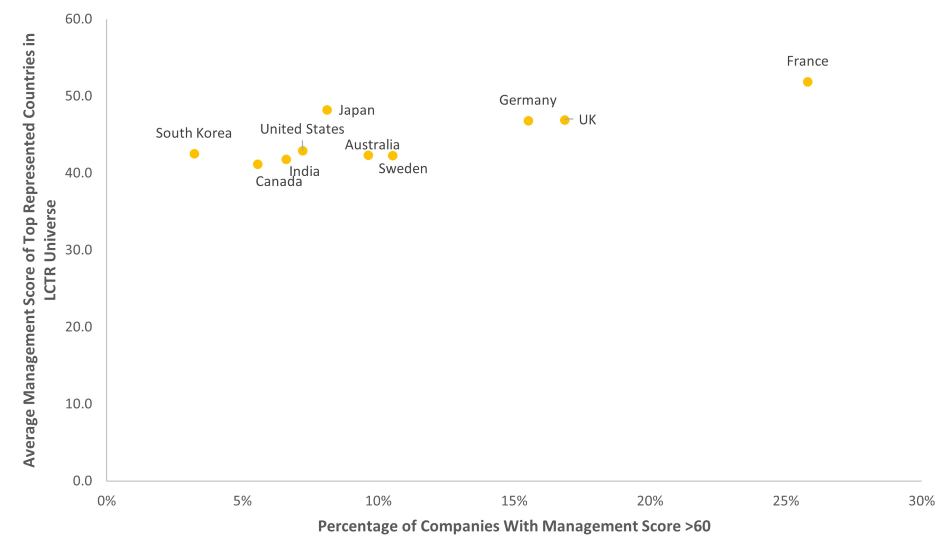

Figure 3. Countries With a High Proportion of Companies with High Management Scores (>60)

Source: Morningstar Sustainalytics. For informational purposes only.

Companies in countries such as France and the United Kingdom (and the European Union region in general) which have mandated reporting on climate risk or reporting on Taskforce on Climate-related Financial Disclosure frameworks, clearly outperform others where the regulatory push related to climate risk reporting is missing.

To Truly Assess Transition Risk, More Disclosures From More Companies Are Needed

While our data shows that some industries, companies, and regions are leading when it comes to managing climate risks, it is important to note that overall management scores across the globe remain low. Companies can learn from leaders and do well by setting out clear, ambitious decarbonization targets and plans for product/process decarbonization, clarifying how carbon prices are being used for investment decision making, and adequately linking management incentives with the achievement of the targets.

At the same time, the increasing frequency of extreme weather events, rising fossil fuel prices, and stricter climate regulations in all countries will influence which strategies companies set for themselves and how transparent they are about their climate-related risks.

In Sustainalytics’ recently launched Low Carbon Transition Ratings, the research and analysis of over 85 company-level climate management indicators are a cornerstone of the methodology, providing investors with comprehensive assessments of companies’ transition preparedness across all subindustries. The overall analysis shows that most industries are in the lower range of average management scores, highlighting the need for more companies to disclose their climate risks and a significant increase in the quality and types of information that are disclosed.

Acknowledgements

The author would like to thank the following colleagues for their contribution to the research and data analysis for this blog post:

- Smarika Kulshreshtha, Senior Content Specialist, Climate Solutions

- Rahul Godha, Content Specialist, Climate Solutions

- Sourav Das, Senior Research Associate II, Climate Solutions

Note

1 The Coal sub-industry is incompatible with a net-zero scenario as the product itself is so highly emitting that all efforts to control or capture emissions from this industry via technology or carbon pricing in the long term will be commercially unviable.

.tmb-thumbnl_rc.png?Culture=en&sfvrsn=12471767_1)