On March 17, 2023, Silicon Valley Bank (SVB) announced its decision to file for Chapter 11 bankruptcy protection. Up until then, SVB had US$212 billion of assets and ranked as the 16th largest in the United States.1 The announcement surprised market players and was reminiscent of the early days of the financial crisis of 2008.

SVB was not merely a regional bank. It was also praised as the go-to commercial bank for tech startups in the U.S. and championed as a climate advocate and supporter. Just two years ago, SVB announced a five-year Community Benefits Plan of US$11.2 billion. In 2022, it also committed to provide US$5 billion in sustainable finance and set a goal to achieve carbon-neutral operations by 2025.2 Its demise may deprive many startups of a valuable source of financing and may create spillover effects in the information technology (IT) and sustainability areas. This can be seen, for instance, in the reduced amounts of capital deployed by venture capital (VC) firms. Startups in the U.S. raised only US$37 billion from VCs in the first quarter, the lowest in 13 consecutive quarters.3

SVB's failure could create a domino effect in the IT and banking sectors, whereby the default of one company would trigger the default of another one across sectors, and so on. In this article, we explore that possibility for the cleantech sector.

Effects on the Cleantech Industry

A comprehensive assessment of SVB’s involvement in cleantech would amount to tracking all its investments and loans, a nearly impossible task. To alleviate this issue, we base our analysis on the numbers and amounts of capital invested in cleantech private deals. Although our figures provide only a fraction of the total amount invested by SVB, they help get a sense of SVB’s investment categories.

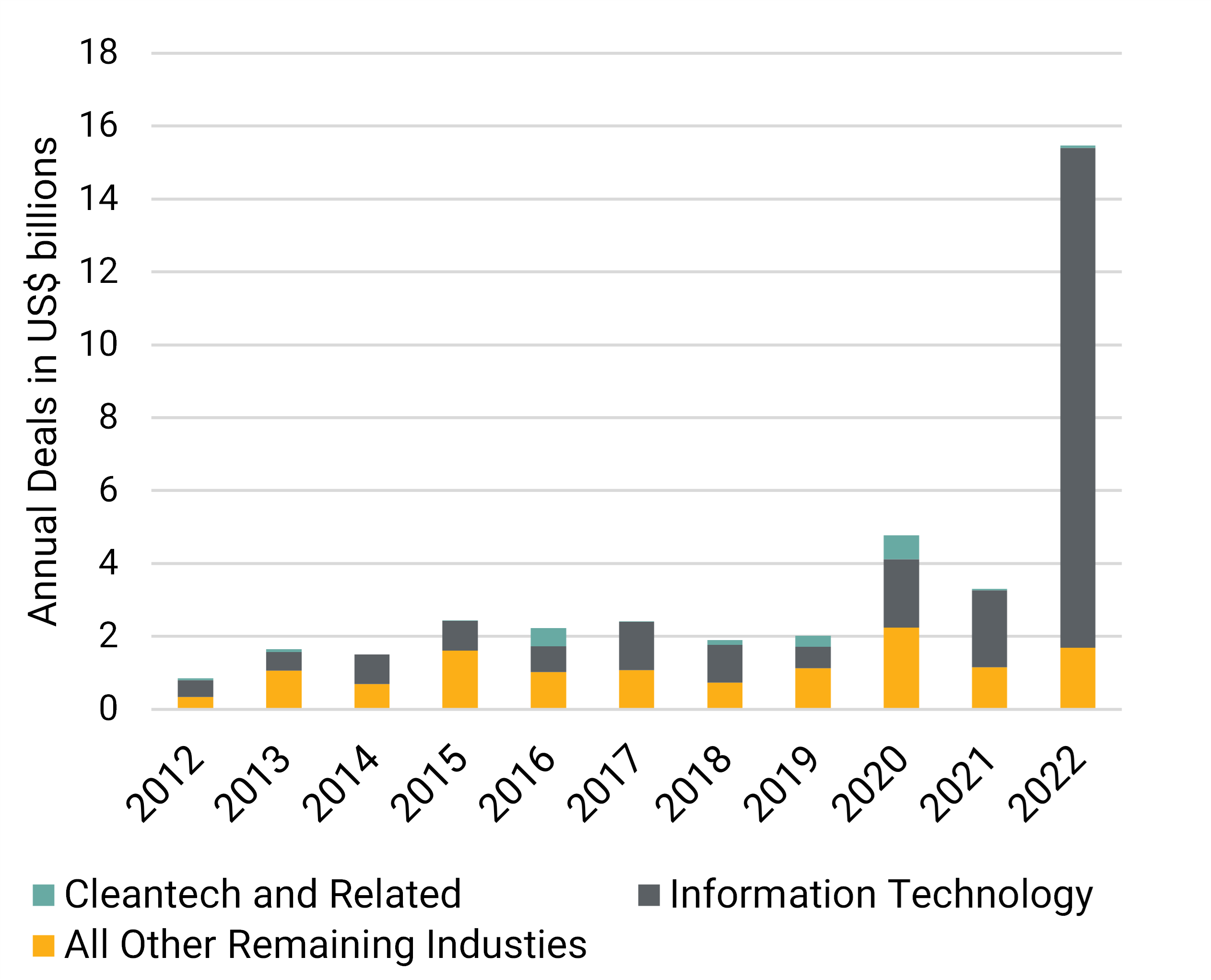

Figure 1 reports SVB’s private deal investments in the IT sector and cleantech vertical from 2012 to 2022 and shows that SVB is sectorally concentrated. The relative weight of the IT sector has increased in recent years to reach an all-time high figure of 89% in 2022. Many financial analysts have highlighted this lack of diversification and identified it as one of the reasons for SVB’s collapse.

Figure 1. SVB’s Capital Invested in Private Deals in Cleantech Versus IT

Source: Morningstar PitchBook. For informational purposes only. Commercial Bank Service Provider view only. Cleantech and Related is the sum of cleantech, climate tech, and impact investing verticals.

In comparison to the IT sector investment, cleantech’s remained limited. Over the 2012-2022 period, SVB invested US$24.87 billion in the IT sector and merely US$1.84 billion in the cleantech area. Similarly, when considering the numbers instead of the dollar amounts of deals, we find that the cleantech area attracted only 118 out of 4,390 deals. So although the cleantech area was on the rise, it was not the main activity for SVB.

Conversely, the effects of SVB on the global cleantech market – estimated at US$358.8 billion in 2020 – might be modest too.4 The effects on the cleantech industry in the U.S., particularly Silicon Valley’s entrepreneurial ecosystem, might be more substantial.

Effects on the Banking and IT Sectors

SVB’s assets and investment figures must be put into perspective. Although SVB’s total assets were equal to US$212 billion as of Q4 2022, they accounted for a small percentage of the entire U.S. banking sector, which amounted to US$23.6 trillion.5 Moreover, despite a jump of US$13.7 billion in IT investments in 2020, SVB’s share remained small with regard to the U.S. information technology sector, estimated at US$1.9 trillion. Hence, the direct effects in the banking and IT sectors seem limited for now.

The Likelihood of Spillover Effects

Our analysis shows that the size of SVB is relatively small and unlikely to cause systemic risk.6 A natural question is whether SVB’s failure would fuel indirect effects in the banking, startup, and cleantech industries.

For now, two factors have contributed to mitigating some of the spillover effects. First, the promise made by the Federal Deposit Insurance Corporation (FDIC) to reimburse all SVB’s depositors, including 1,550 climate tech clients, has reduced the contagion risk and uncertainty in the financial markets.7 Next, the announcement of the acquisition of SVB by First Citizens Bancshares provided a viable solution to SVB’s failure.8

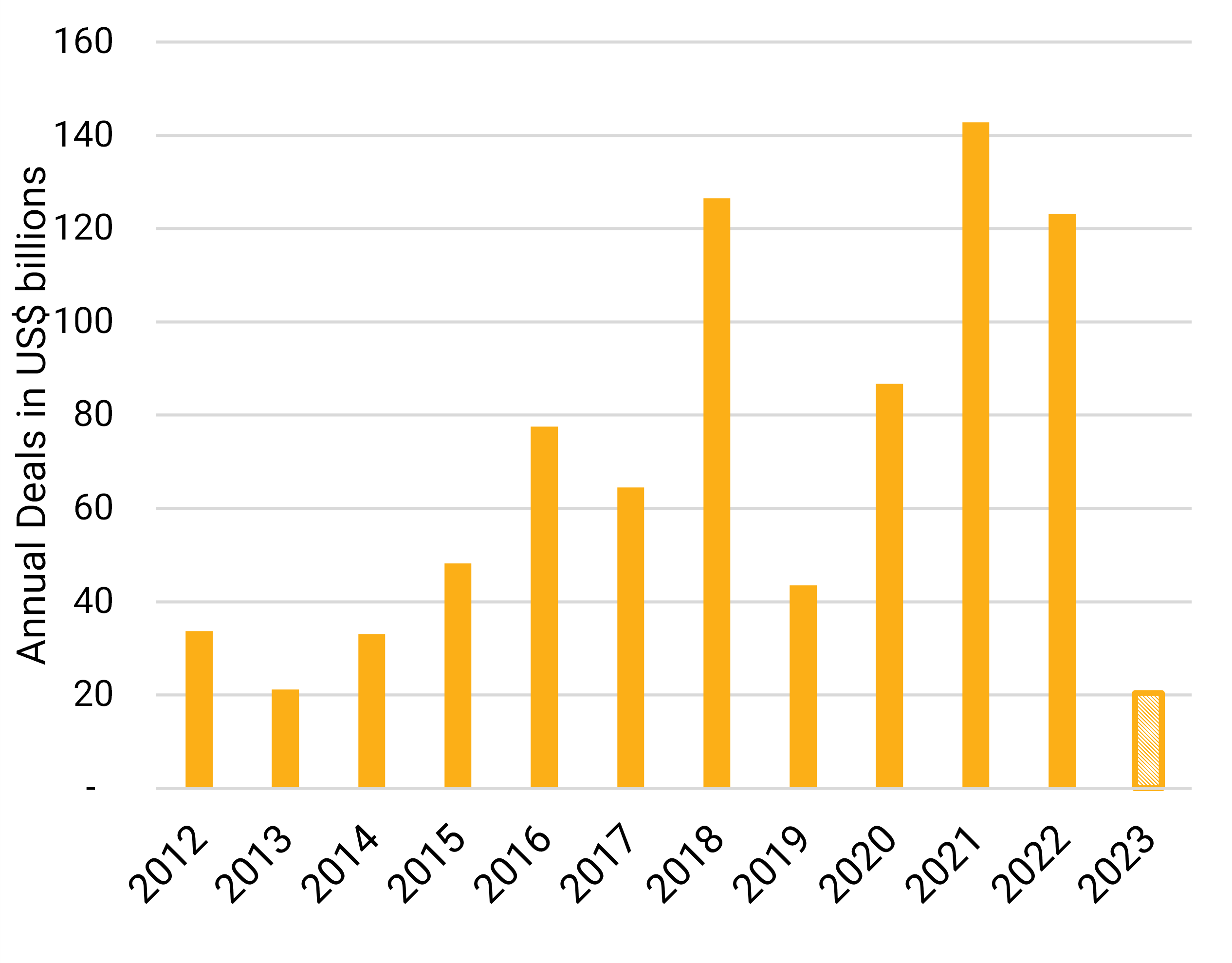

To conclude, a big component of the growth in the U.S. cleantech industry is not related to SVB and is likely to stay. For instance, Figure 2 depicts a steady increase in capital investment in the cleantech industry in the U.S. from 2012-2022. This indicates increased levels of investment interest. Moreover, companies that SVB financed may, over the short term, switch to competitors such as Brex Inc. or Mercury.9 In any case, SVB’s collapse created a wake-up call in the banking industry, and its effects may persist for some time.

Figure 2. Capital Invested in Cleantech in the U.S.

Source: Morningstar PitchBook. For informational purposes only.

Acknowledgments

The authors would like to thank their Sustainalytics colleagues who helped in the preparation of the report. Feedback on the blog was provided by Theodora Batoudaki, Hendrik Garz, Sercan Soylu, Jermaine Reyes, Claudia Volk, and Cristina Zabalaga.

References

- Marketscreener. 2023. ”SVB Securities and SVB Capital's funds and general partner entities are not included in the Chapter 11 filing and continue to operate in the ordinary course.” March 20, 2023. https://www.marketscreener.com/quote/stock/SVB-FINANCIAL-GROUP-10840/news/SVB-Financial-Group-Files-First-Day-Motions-to-Support-Continued-Operations-of-SVB-Capital-and-SVB-43291364/

- Silicon Valley Bank. 2023. Facts at a Glance. https://www.svb.com/newsroom/facts-at-a-glance

- Louise, N. 2023. “Tech startup funding plunges by 55%, deepening fear of another dot-com bubble burst.” April 7, 2023. Tech Startups. https://techstartups.com/2023/04/07/tech-startup-funding-plunges-by-55-deepening-fear-of-another-dot-com-bubble-burst/

- Global Newswire. 2022. “Global Clean Energy Technologies Market to Reach $453.5 Billion by 2027.” October 19, 2022. Global Newswire. https://www.globenewswire.com/news-release/2022/10/19/2537542/0/en/Global-Clean-Energy-Technologies-Market-to-Reach-453-5-Billion-by-2027.html

- Select USA. 2023. Software and Information Technology Industry. https://www.trade.gov/selectusa-software-and-information-technology-industry

- Anstey, C., Bloomberg. 2023. “Larry Summers dismisses systemic risk of SVB failure—as long as depositors are protected.” March 10, 2023. Fortune. https://fortune.com/2023/03/10/larry-summers-svb-silicon-valley-bank-systemic-risk-depositors-too-big-fail/

- Livingston, K. 2023. “Silicon Valley Bank marketed itself as a climate tech-friendly bank. How will its collapse impact the industry?”. March 14, 2023. ABC News. https://abcnews.go.com/Business/silicon-valley-bank-marketed-climate-tech-friendly-bank/story?id=97850409

- Hirsch, L. 2023. “Silicon Valley Bank Sold to First Citizens in Government-Backed Deal.” March 27, 2023. New York Times. https://www.nytimes.com/2023/03/27/business/silicon-valley-bank-first-citizens.html

- Kauflin, J. 2023. “Silicon Valley Bank Collapse Produces and Early Winner: Digital Banks.” March 15, 2023. Forbes. https://www.forbes.com/sites/jeffkauflin/2023/03/15/silicon-valley-bank-collapse-produces-an-early-winner-digital-banks/?sh=618ef18872c9

- Jiang, E., Matvos, G., Piskorski, T., Seru, A. 2023. “Monetary Tightening and U.S. Bank Fragility in 2023: Market-to-Market Losses and Uninsured Depositor Runs?” Stanford Institute for Economic Policy Research, Working Paper 23-13 (March): https://siepr.stanford.edu/publications/monetary-tightening-and-us-bank-fragility-2023-mark-market-losses-and-uninsured

.tmb-thumbnl_rc.png?Culture=en&sfvrsn=12471767_1)