A country’s long-term prosperity impacts both its ability to service its debt as well as companies’ ability to flourish.

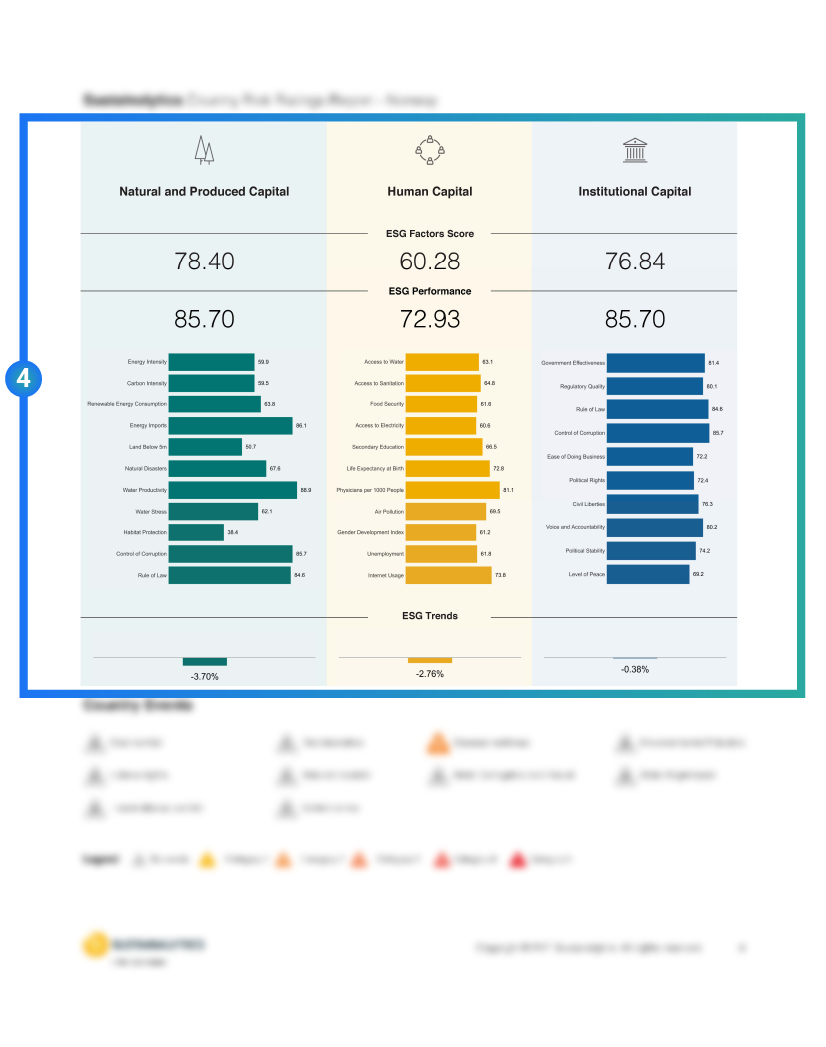

Sustainalytics’ Country Risk Ratings assesses countries’ prosperity by considering its access to – and management of – natural, human and institutional wealth, which corresponds to our assessment of Environmental, Social and Governance factors in our company ESG ratings.

Investors can use this research to supplement traditional sovereign bond- and macro-economic analyses. The alignment between country and company assessments also simplify reporting in fixed income portfolios.

Latest Insights

Material Matters: The Role of ESG Materiality in Sustainable Investment Strategies

Cobalt ESG Risks Threaten Electric Vehicle Supply Chain

Key Benefits

In-Depth Qualitative Research

Country research includes qualitative assessments of country events, e.g. civil conflicts

Valuation of Country Wealth

Assessments provide insight into the health of a country’s economy and welfare

Integrated ESG Analysis

Wealth and ESG is incorporated into a risk metric to understand the risks to a country’s long-term prosperity and economic development

Top 20 Countries

The top 20 most sustainable countries based on Sustainalytics' Country Risk Ratings are:

| Country | Sovereign Region | Risk Score (/100) | Risk Category | |

|---|---|---|---|---|

| 1 | Norway | Europe and Central Asia | 8.82 | Negligible |

| 2 | Switzerland | Europe and Central Asia | 9.31 | Negligible |

| 3 | Luxembourg | Europe and Central Asia | 9.51 | Negligible |

| 4 | Sweden | Europe and Central Asia | 10.61 | Low |

| 5 | Australia | East Asia and Pacific | 10.69 | Low |

| 6 | Iceland | Europe and Central Asia | 10.98 | Low |

| 7 | Denmark | Europe and Central Asia | 11.32 | Low |

| 8 | Canada | North America | 11.59 | Low |

| 9 | Finland | Europe and Central Asia | 12.23 | Low |

| 10 | Austria | Europe and Central Asia | 12.41 | Low |

| 11 | New Zealand | East Asia and Pacific | 12.42 | Low |

| 12 | United States | North America | 12.46 | Low |

| 13 | Netherlands | Europe and Central Asia | 12.75 | Low |

| 14 | Germany | Europe and Central Asia | 12.76 | Low |

| 15 | Ireland | Europe and Central Asia | 12.84 | Low |

| 16 | United Kingdom | Europe and Central Asia | 12.89 | Low |

| 17 | France | Europe and Central Asia | 13.49 | Low |

| 18 | Singapore | East Asia and Pacific | 13.89 | Low |

| 19 | Belgium | Europe and Central Asia | 14.42 | Low |

| 20 | Japan | East Asia and Pacific | 14.44 | Low |

Country Screening & Sanctions Research

Subscribers to the Country Risk Ratings also receive our Country Screening & Sanctions Research. This research enables investors to ensure compliance by screening countries on international treaties as well as UN, US and EU sanctions.

How it Works

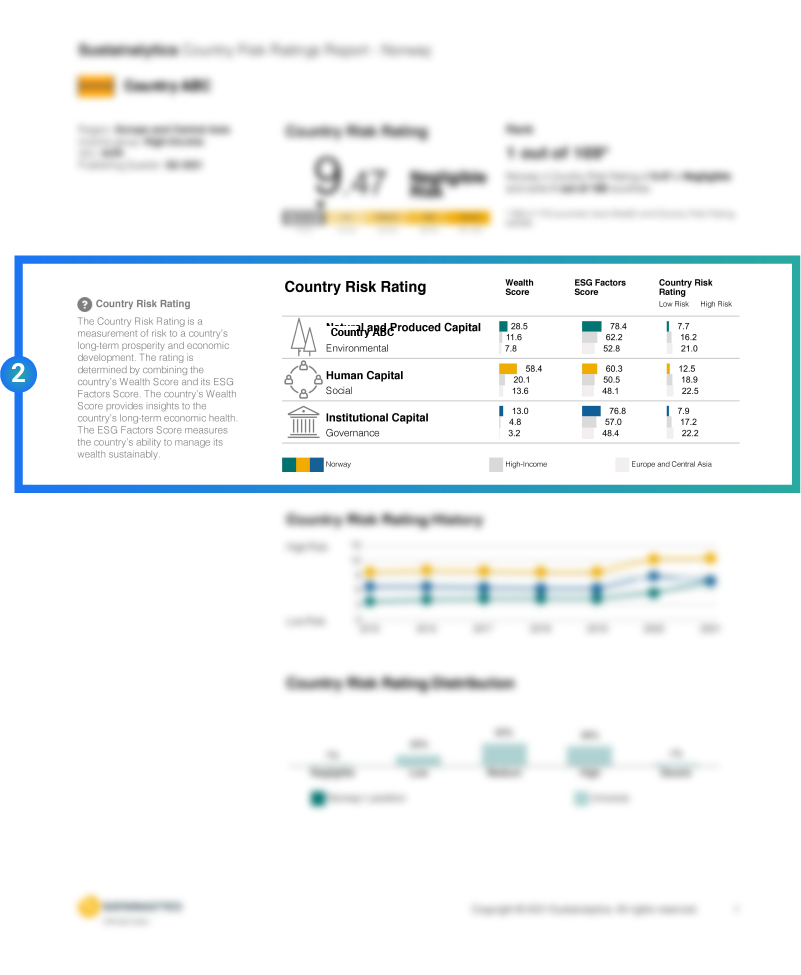

1. Sustainalytics utilizes wealth data provided by the World Bank and groups a country’s assets (or National Wealth) into three categories:

Natural & Produced Capital

e.g. infrastructure, energy independence and natural resources

Human Capital

e.g. access to water and sanitation, mean years of schooling and life expectancy

Institutional Capital

e.g. rule of law, corruption and political liberties

2. A country’s ability to utilize and manage its wealth in an effective and sustainable manner is determined by:

ESG Performance

ESG Trends

ESG Events

e.g. civil conflicts, natural disasters

Investor Use Cases

ESG Integration/Sovereign Analysis

Supplement credit risk analysis by focusing on a country’s wealth and management of wealth through an ESG lens, which may not be explicitly captured in credit rating

Macro-economic Analysis

Combine ESG, wealth and economic indicators for a more holistic assessment of country risk

Anticipate Emerging Risks

The Country Risk Ratings are forward-looking, enabling you to anticipate and manage emerging risks with regular assessments of country events.

Portfolio Analysis & Reporting

Combine data from Sustainalytics’ ESG Risk Ratings on corporate bonds and Country Risk Ratings on sovereign bonds for risk assessment and reporting of fixed income portfolios

Report Insights

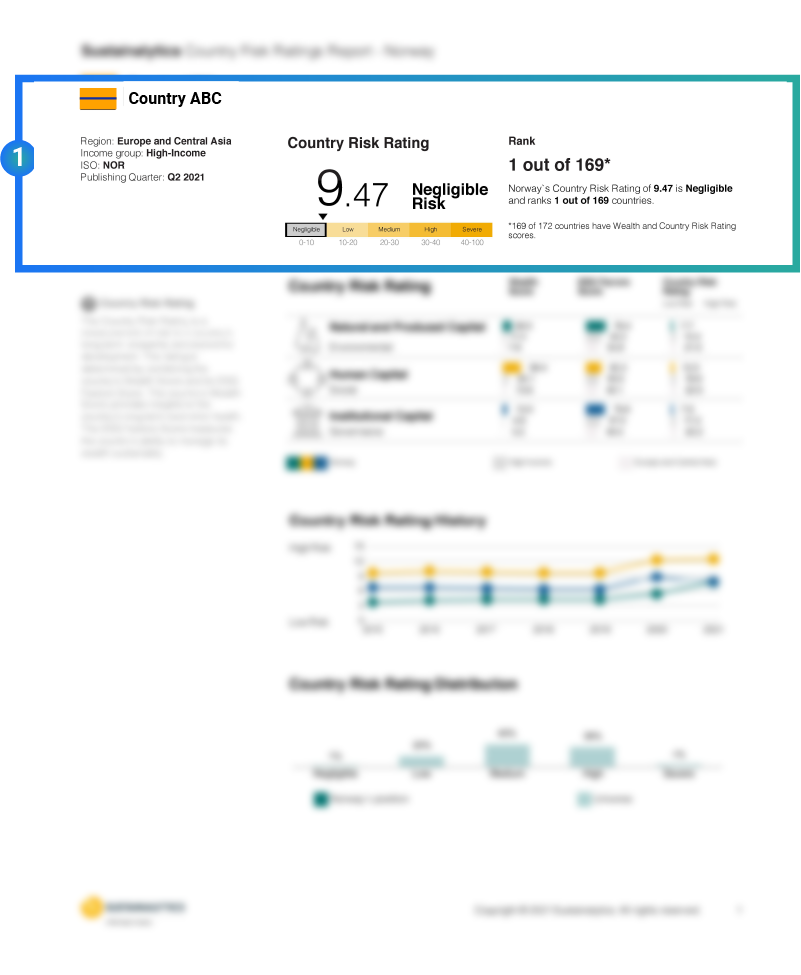

Countries are categorized across five risk levels: Negligible, Low, Medium, High, Severe.

Risk Scores are broken down by different types of capital: Natural and Produced, Human, and Institutional.

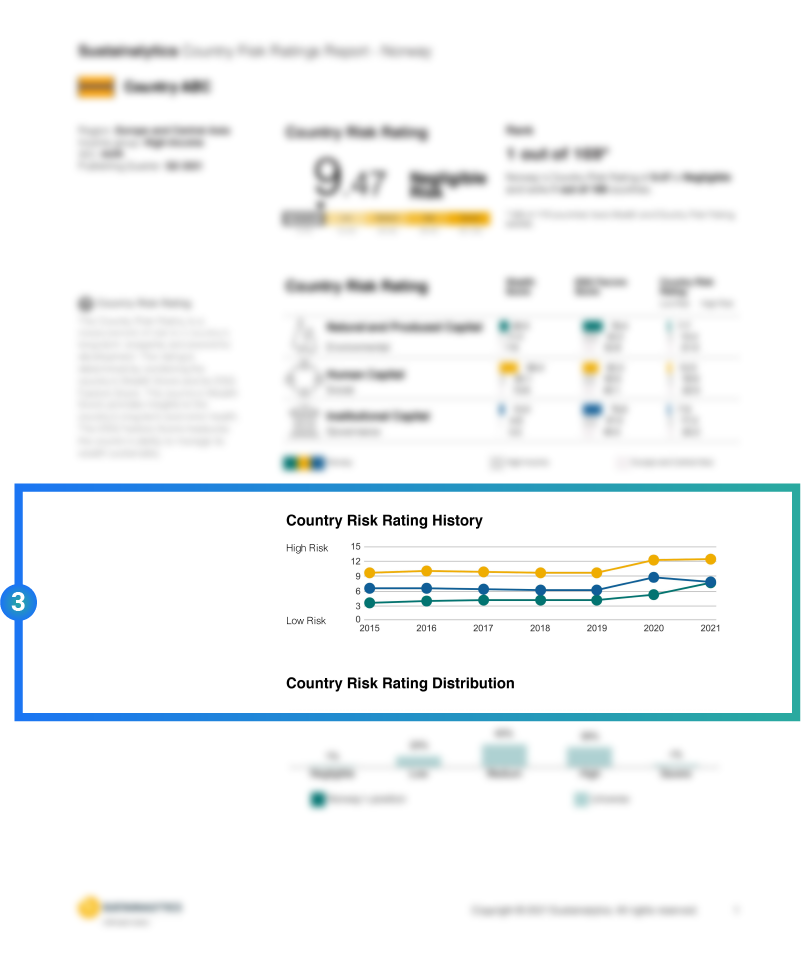

See how Country Risk Ratings evolve over time.

See Country Risk Ratings broken down by indicators.

Why Sustainalytics?

A Single Market Standard

Consistent approach to ESG assessments across the investment spectrum.

Award-Winning Research and Data

Firm recognized as Best ESG Research and Data Provider by Environmental Finance and Investment Week.

End-to-End ESG Solutions

ESG products and services that serve the entire investment value chain.

30 Years of ESG Expertise

800+ ESG research analysts across our global offices.

A Leading SPO Provider

As recognized by Environmental Finance and the Climate Bonds Initiative.

Related Insights and Resources

Climate Change, Innovation, and Cybersecurity in the Defense Industry: New Opportunities for ESG Investors

While perhaps not a widely considered link between the defense industry and climate change, several Eurosatory conference sessions addressed how climate change can intensify security risks and threats.

Cobalt ESG Risks Threaten Electric Vehicle Supply Chain

Transport electrification is at the forefront of the international climate transition agenda. Because of this, global demand for cobalt is projected to grow fourfold by 2030, which raises the question, are mineral supply chains robust enough to fuel a sustainable EV revolution?

ESG Implications of Russia’s Invasion of Ukraine on the Automotive Industry

The Russia-Ukraine conflict has put more pressure on a sector that was already constrained by the disrupted supply chains, brought about by pandemic-induced congestions and shortages. Additionally, the surge in fuel price is already affecting customers, although it may accelerate the adoption of electric vehicles (EVs) as a side effect. However, the scarcity of minerals, which are necessary for semiconductor manufacturing, may further exacerbate the chip shortage that has afflicted the automotive industry since 2020.

Related Solutions

Country Screening

Screen countries for compliance to international treaties and agreements as well as UN, US and EU sanctions.

ESG Risk Ratings

Take a coherent and consistent approach to assessing financially material ESG risks.

Climate Solutions

Leverage our carbon research to align your portfolio to the future low-carbon economy.