Investors are shifting focus from merely reducing emissions to investing in companies well-positioned for the transition. This requires deep research and clear analysis across key indicators, assessing not just commitments, but concrete actions.

The right tools can help ensure portfolios are prepared for the complexities of the evolving market.

Morningstar Sustainalytics’ flagship Low Carbon Transition Ratings (LCTR) provide the solution – empowering investors and financial institutions to allocate capital to companies taking genuine action to reach their low carbon goals.

Highly Versatile Dataset

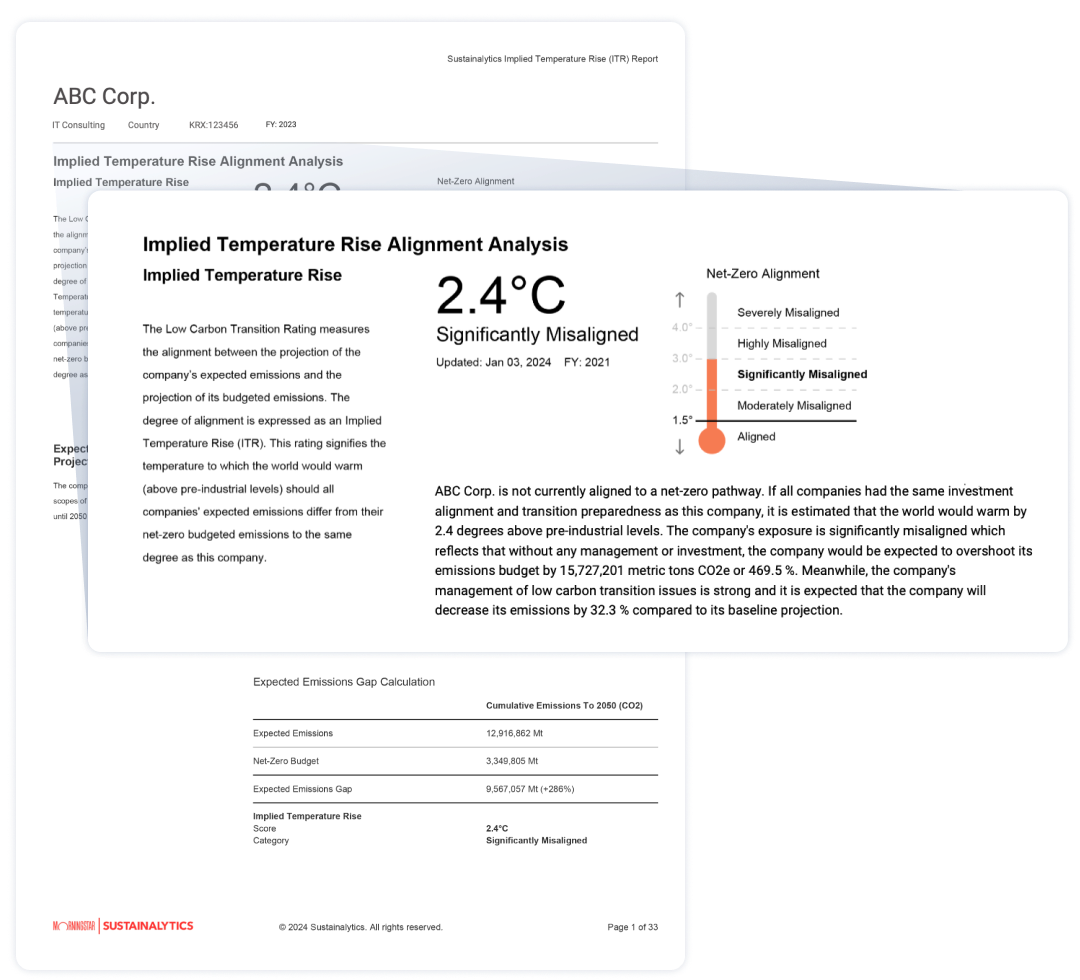

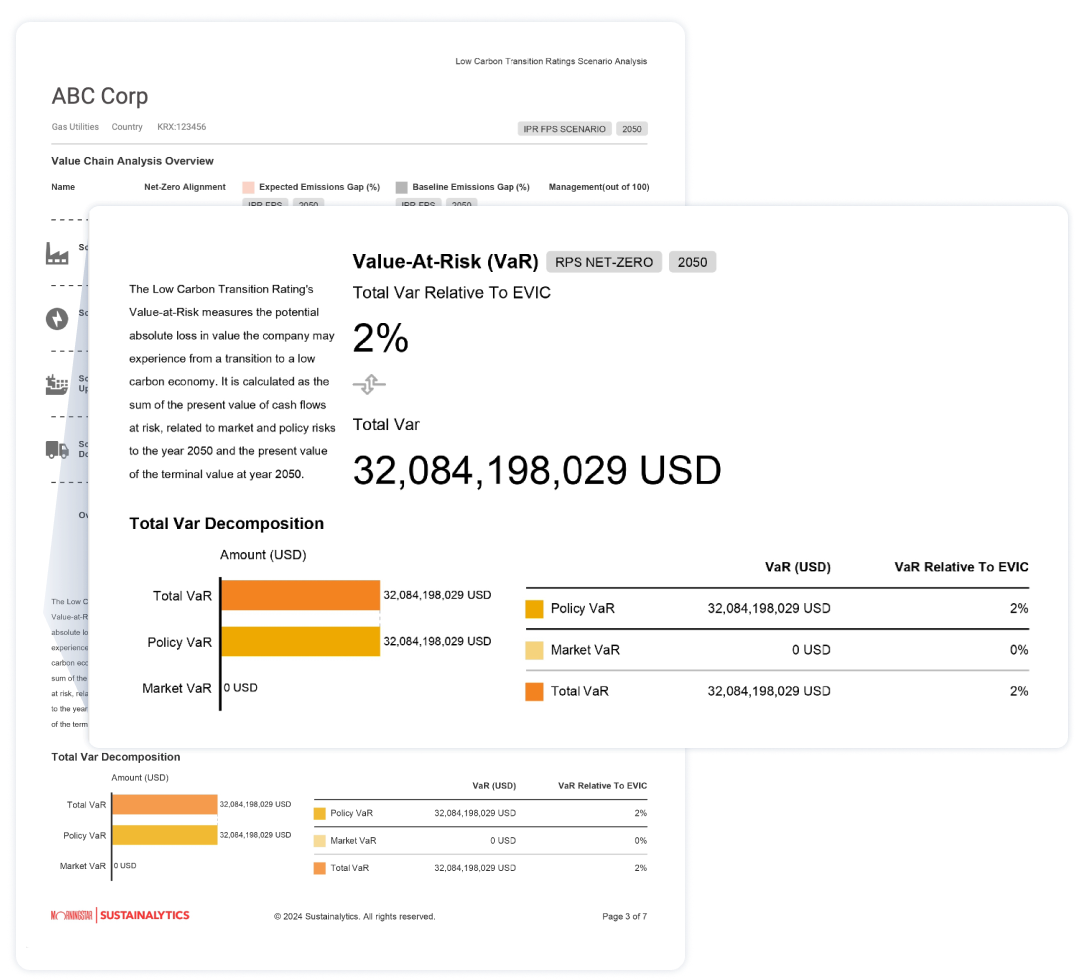

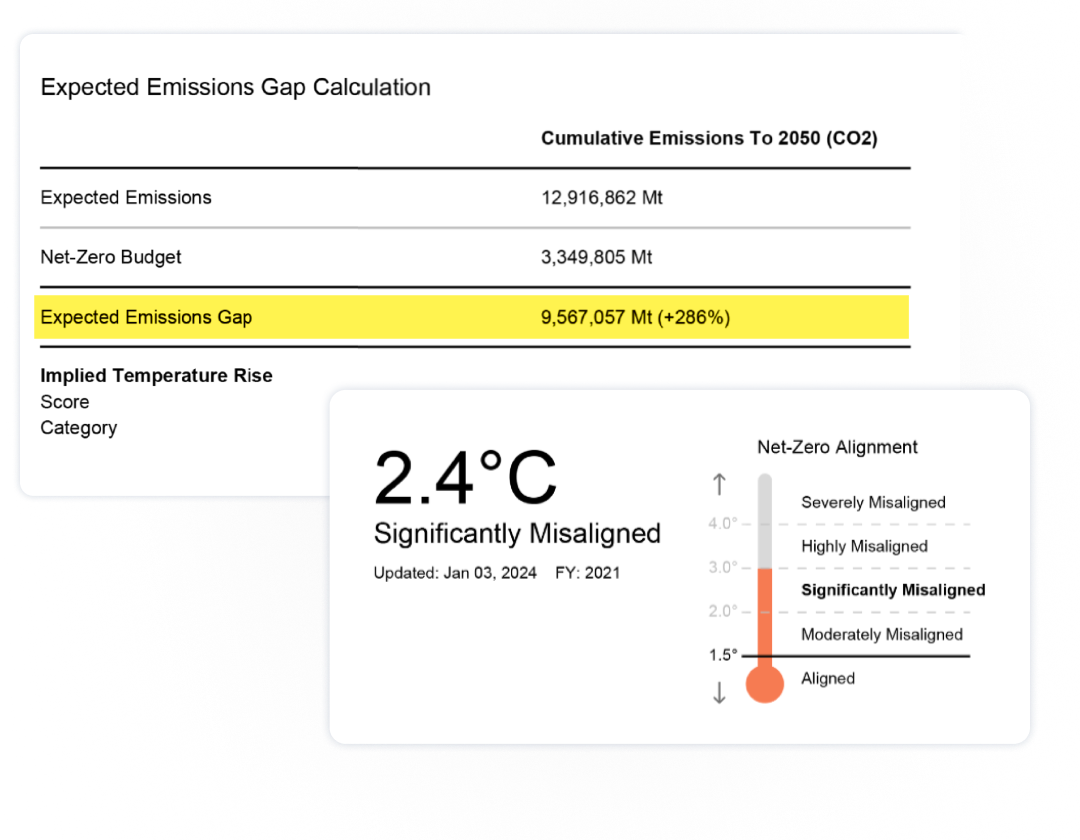

The LCTR is an end-to-end solution combining granular issuer-level data, high-level directional metrics like Implied Temperature Rise (ITR), and sector level insights for portfolio analysis and reporting.

Company Action is a Priority

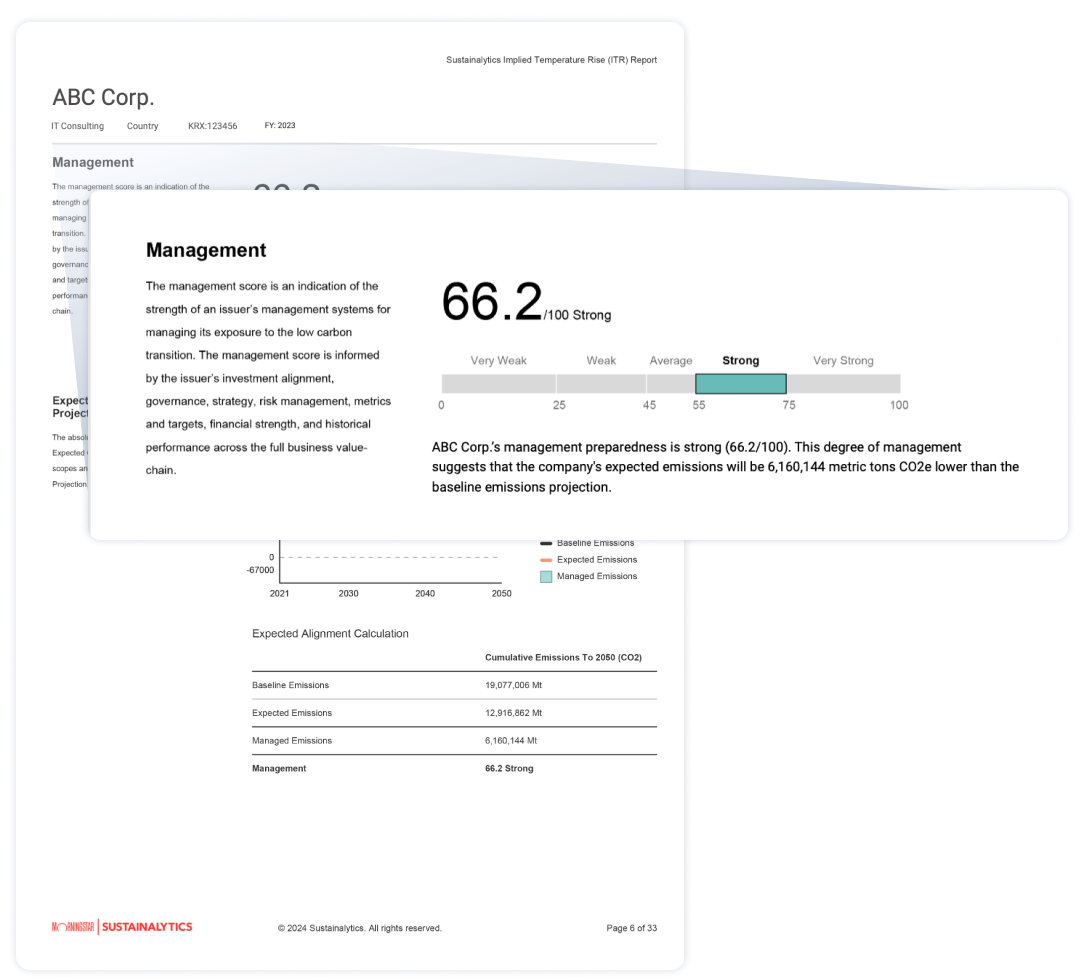

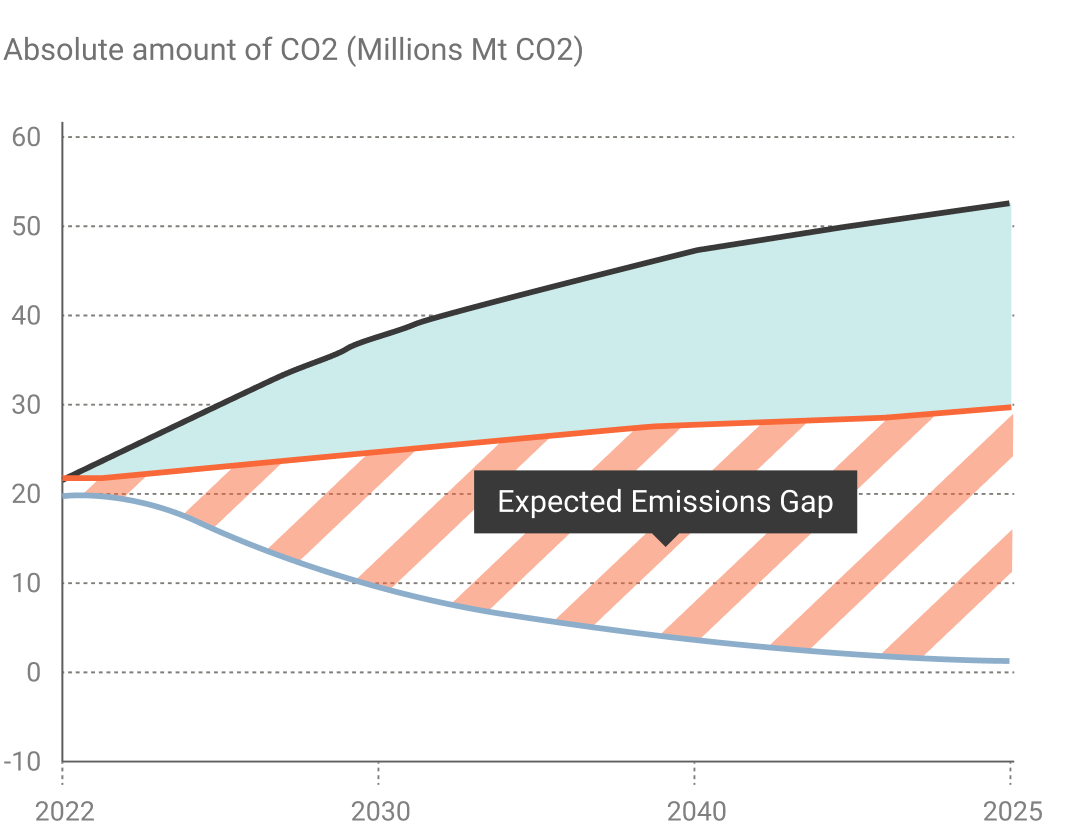

While most research on the market focuses on companies’ low carbon ambitions, the LCTR assesses a company’s alignment with external standards, its future vulnerability from a shift to a low carbon economy, and the actions it is taking to manage transition risk.

Comprehensive Company Assessment

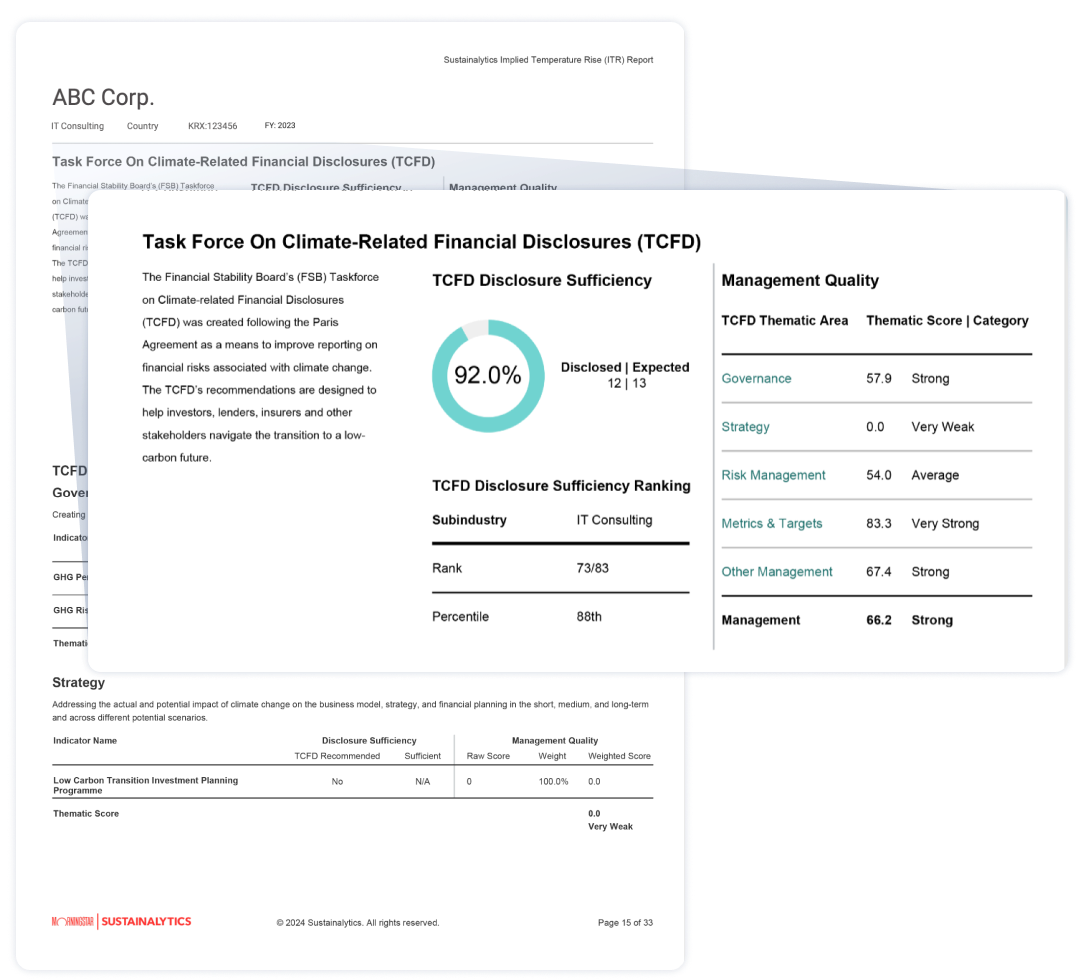

By looking beyond stated targets, the LCTR provides a multi-dimensional assessment of a company’s implemented policies, governance systems and investment plans across its entire value chain.

Experienced and Dedicated Team

The LCTR’s unparalleled insights build on Morningstar Sustainalytics’ 30-year history of assessing management risks. Each analysis is developed by a team of 120 professionals and specialists, offering over 200 data points for every company in our universe of over 10,000 issuers across various low carbon scenarios.

Deep Insight into Transition Plan Credibility

This gives LCTR users maximum transparency into the credibility of a company’s transition plans and management preparedness, making it easy to integrate granular insights into all stages of the investment process and map companies or funds to globally accepted frameworks like IIGCC’s NZIF 2.0.

External Reporting and CommitmentsConvert LCTR analysis into regulatory reports using Morningstar Direct and use LCTR data to facilitate compliance with global alliances like the Net Zero Asset Manager Initiative and the IIGCC. |

Transition Plan AssessmentAssess a company’s true exposure by going beyond the company’s stated commitments to examine management policies, investment exposure and abilities to adapt to changing regulations, which allows LCTR users to see behind the rhetoric. |

Research Integration and Risk AssessmentUtilize LCTR insights to analyze a company’s alignment with various low carbon scenarios like 1.5 degrees Celsius, identifying both underperformers and leaders in low carbon readiness showcased in the Morningstar Low Carbon Transition Leaders Indexes. |

Screening and BenchmarkingUse LCTR analyses to establish forward-looking low carbon benchmarks for your portfolios, screen the investable universe based on exposure to or management of transition risks and reconcile the array of 3rd party standards and requirements into a single, clear set of metrics and scores. |

Portfolio Company and Borrower CommunicationsUse customizable templates to transform LCTR data into analyses that precisely illustrate where and how deficiencies in issuer transition plans can be addressed, to communicate effectively with companies, borrowers and other stakeholders. |

Thematic InvestingHarness LCTR data to develop investment products that advance the low carbon transition, integrating multi-sector peer insights and regional policy analysis to enhance their effectiveness and profitability. |

Our Experts Are Ready to Help You

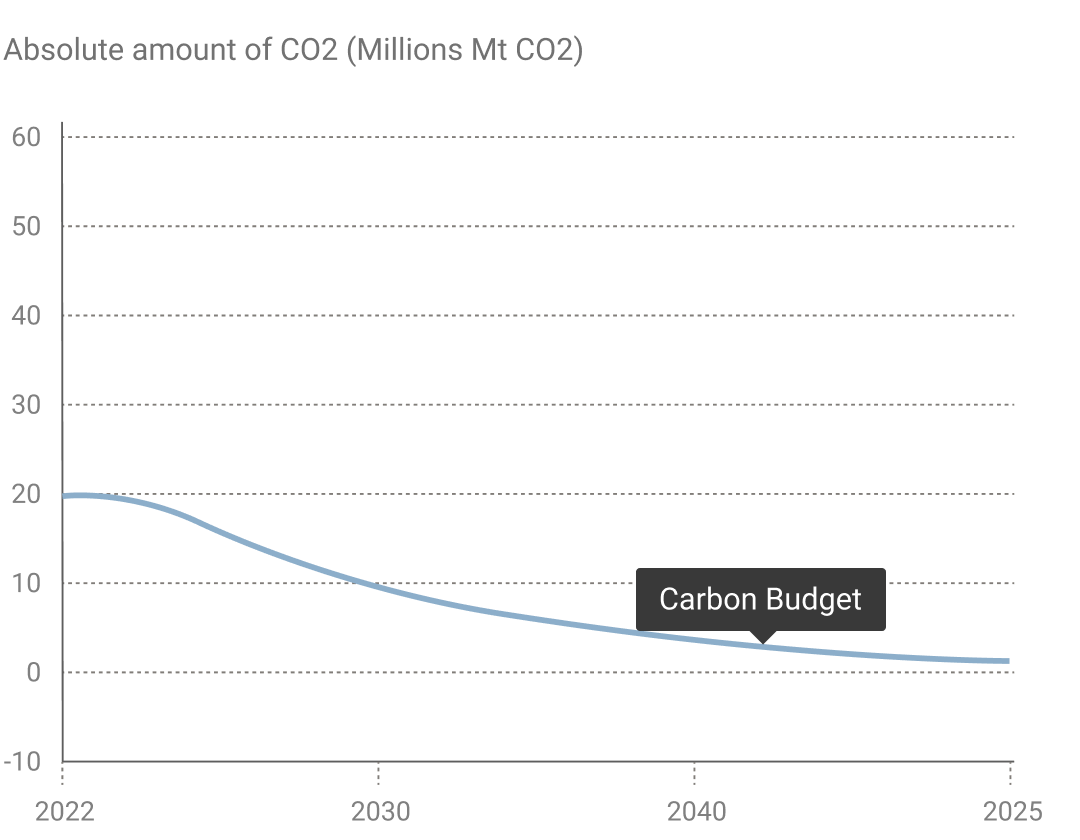

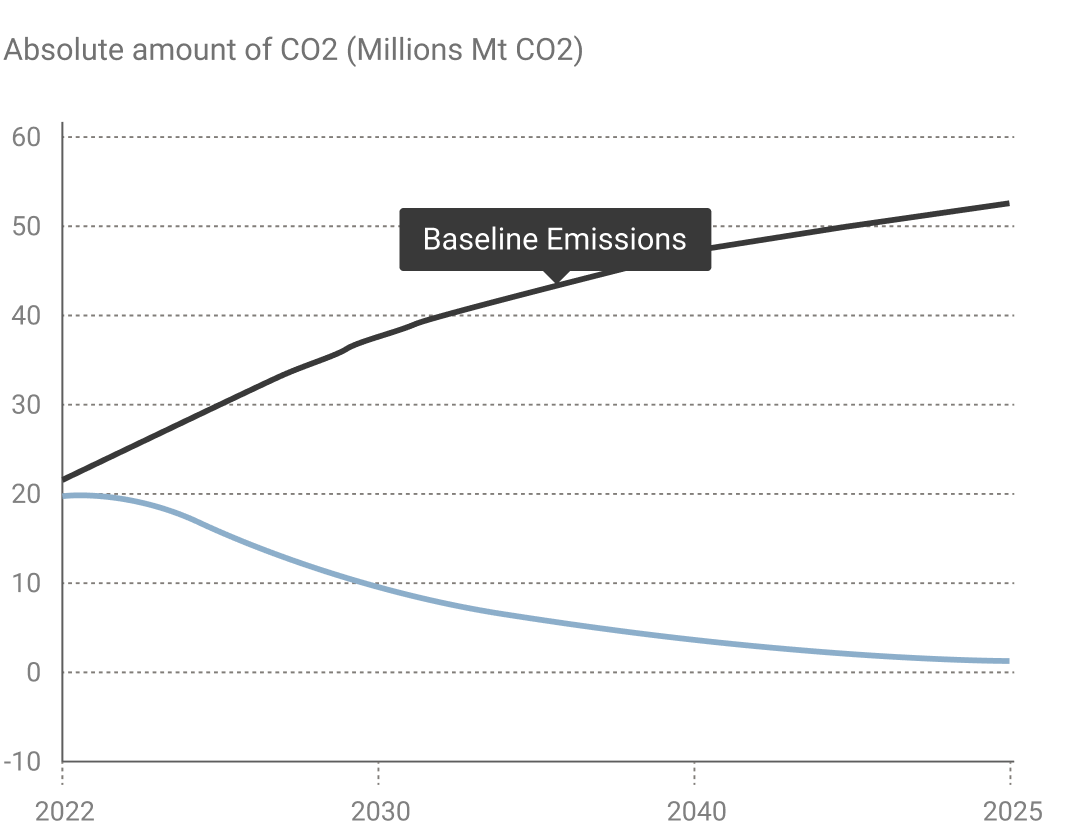

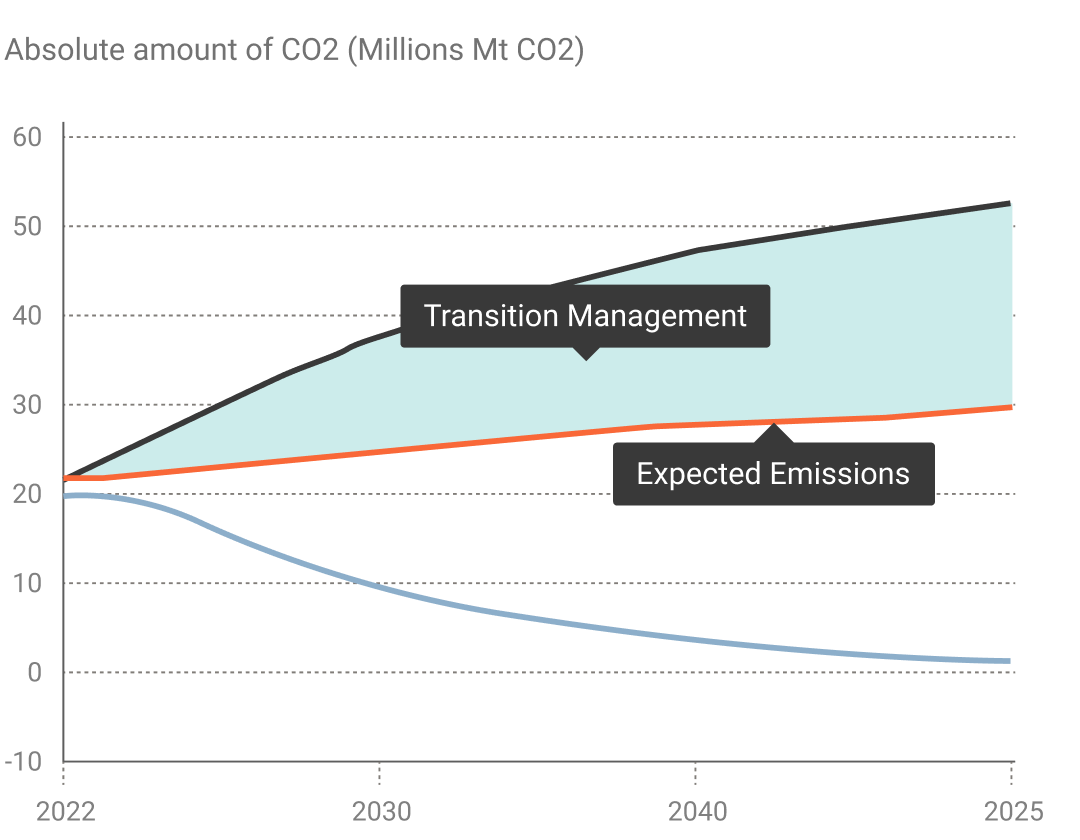

Morningstar Sustainalytics’ LCTR provides a comprehensive measure of low carbon transition exposure and management preparedness. We do this by analyzing a company’s expected alignment to a low carbon pathway and its management actions to reduce emissions.

Here’s how we assign a Performance ITR and Alignment Score:

Global Access Clients

Access our ratings using Morningstar Sustainalytics' screening and reporting tools.

Data Services Access

Integrate LCTR into your preferred internal system through our FTP or API services.

Monitoring Systems

Ratings are available via Morningstar Direct, MPS, and Data Feeds.

Third Party Systems

Ratings are currently in Snowflake and will soon expand to FactSet, Aladdin, and Bloomberg.

Our Experts Are Ready to Help You

Dive deeper into the climate-nature nexus, by addressing both topics in a synergetic way. Support Cclimate research integration by supplementing the Low Carbon Transition Ratings with nature-related signals to tilt/screen your portfolio or move towards joint TNFD/TCFD reporting. Other benefits include:

- Assessing palm oil-related deforestation risks and gaining insight into company deforestation management systems

- Focusing on critical sectors that can have an impact on both nature and climate (e.g., agriculture)

- Identifying involvement in sustainable activities at the core of the climate-nature nexus (afforestation, wetlands adaptation)

- Additional insights on how the company is managing water, a resource that will be affected by climate change