Is Your Firm Fulfilling its TCFD Reporting Requirements?

With the Task Force for Climate-related Financial Disclosure (TCFD) recommendations being mandated across different jurisdictions worldwide, investors need to assess and disclose the physical climate risks facing their portfolio companies. However, implementing a comprehensive strategy for measuring and managing physical climate risks can be challenging.

Morningstar Sustainalytics makes complying with the TCFD reporting requirements easier. Our Physical Climate Risk Metrics (PCRM) data set provides forward-looking scenario analysis on direct physical climate risks based on the assets a company owns or leases around the world.

Why Look to Morningstar Sustainalytics as Your TCFD Compliance Partner?

Extensive Coverage

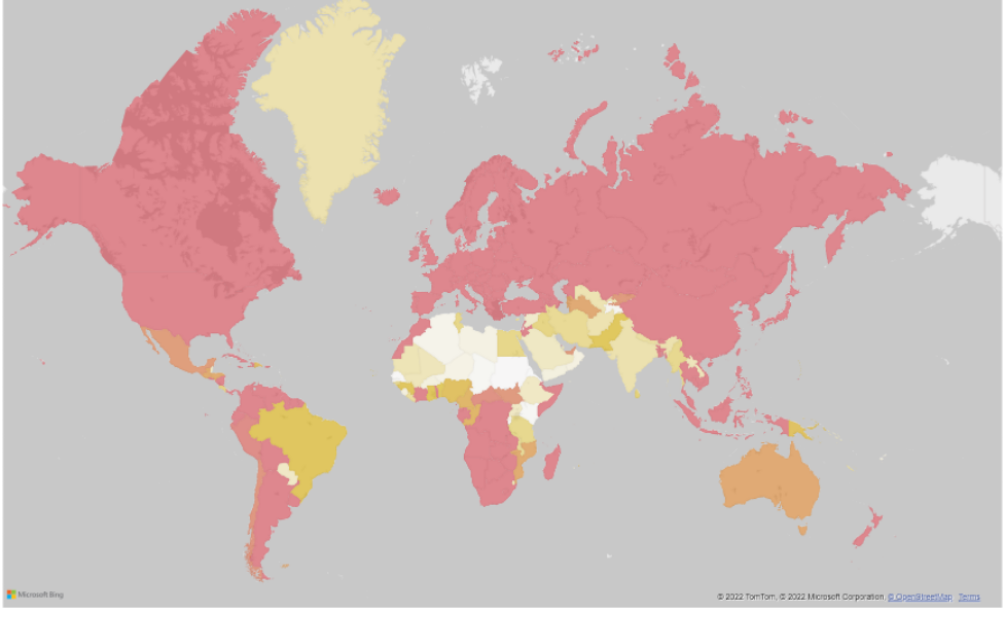

The metrics cover a universe of 12,700+ global companies, spanning major stock market indexes.

High-Resolution

We provide estimations of future probability and severity of 7 natural hazards at a local level, incorporating weather and contextual geographic data.

Database of Over 12 million Assets and Facilities

The asset-level database is one of the largest in the industry, including damage to assets and facilities and the estimated reduction in business activity.

Straightforward Analytics

The outcomes are expressed as three metrics, including High Risk Assets, Asset Damage Risk, and Productive Capacity Loss.

Insights from the Physical Climate Risk Metrics

Leveraging the Physical Climate Risk Metrics, you can understand how each issuer’s Asset Damage Risk and Productive Capacity Loss, based on the assets they own and lease around the globe, are likely to be impacted by hazards over the next century. Below are some key findings from our research:

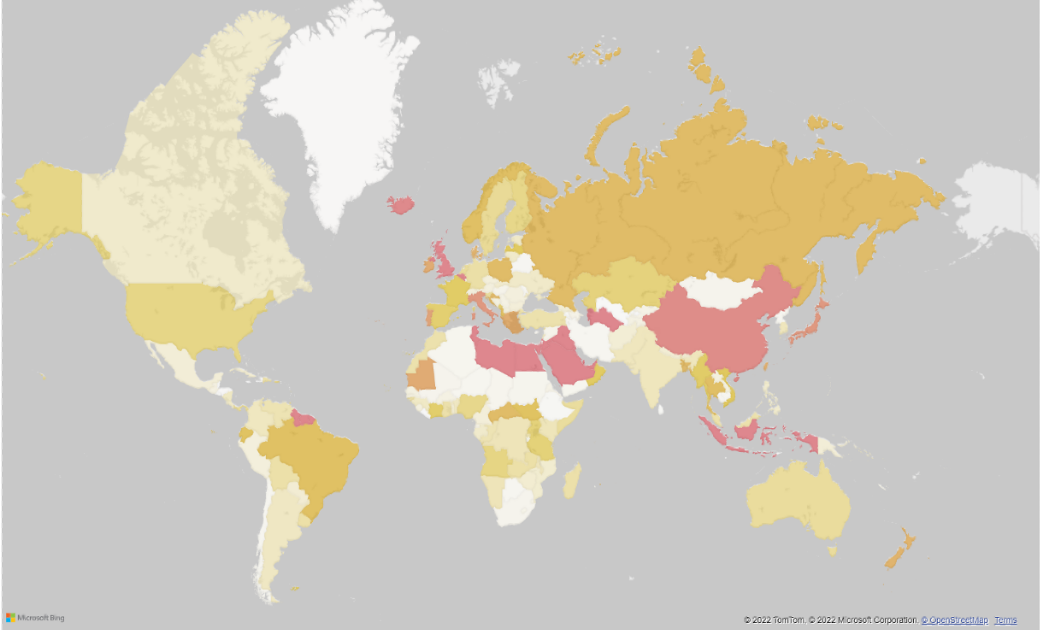

Morningstar GMI % Increase in Average Asset Damage Risk by 2050

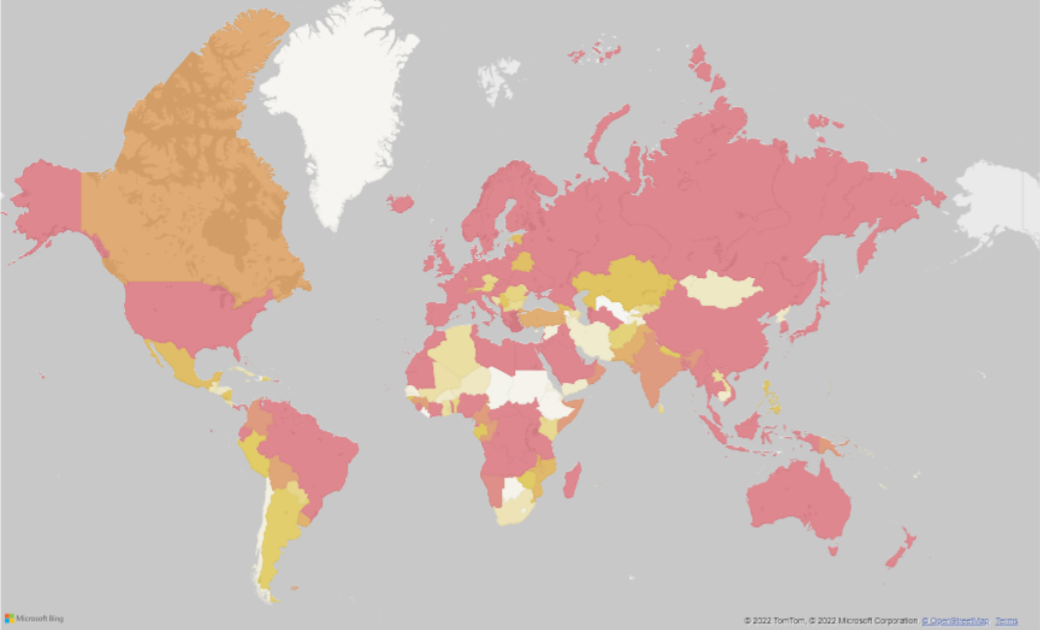

Morningstar GMI % Increase in Average Asset Damage Risk by 2100

(*Note this analysis was performed on 7,250 issuers out of the 8,074 constituents in the Morningstar Global Market Index)

By 2100, the average increase in asset damage risk for constituents in the Morningstar Global Market Index (GMI) will reach 200% or more, with some assets facing these extreme risks as early as 2050.

For example, GMI companies with assets based in the United Kingdom, China, Saudi Arabia all see average increases of over 200% by 2050.

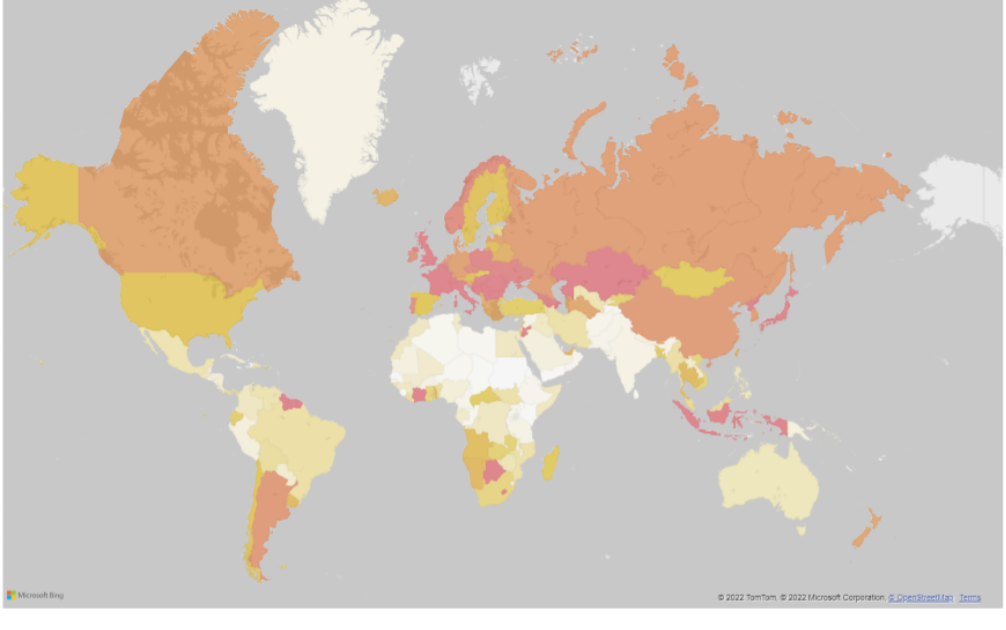

Morningstar GMI % Increase in Average Productive Capacity Loss by 2050

Morningstar GMI % Increase in Average Productive Capacity Loss by 2100

(*Note this analysis was performed on 7,250 issuers out of the 8,074 constituents in the Morningstar Global Market Index)

Constituents in the GMI also face higher average risk of Productive Capacity Loss by 2050 and 2100.

By 2050, companies who have assets in Europe will face average increases in Productive Capacity Loss of over 200%. And by 2100, companies with assets in Europe, Asia, and the Americas will exceed a 200% increase in Productive Capacity Loss.

Investors can use the Physical Climate Risk Metrics to inform the Strategy, Risk Management, and Metrics and Targets thematic areas of TCFD, and they can conduct hazard and geolocation analysis on the risks facing their portfolio companies. In addition, investors can utilize this forward-looking scenario analysis, which is comparable across different companies and industries, to support:

Additional reporting requirements

Product creation

Engagement activities

Security selection

Need to better understand your portfolio's exposure to climate-related physical risks?

Talk to our team to learn how Physical Climate Risk Metrics can help you assess and disclose investments exposed to a range of physical hazards across the globe and over time.

Guide | Physical Climate Risk Metrics: Preparing Your Portfolio for a Changing Climate

The world’s climate is changing, and the physical impacts of these changes are being felt with more frequency and more intensity around the globe. For investors, it is becoming clear that the physical climate risks to their holdings are likely to increase in the coming years, even as the global community works toward Paris-aligned net-zero emissions by 2050. So how can companies and investors assess their exposure to physical climate risk?

Brochure | Physical Climate Risk Metrics

As climate change challenges the modern investment landscape, evolving marketplace expectations will require investors to disclose both transition and physical climate risks associated with their investments. To help investors better understand their exposure to physical climate risks, Sustainalytics, in collaboration with XDI, an award-winning global leader in physical climate risk analysis, are introducing Physical Climate Risk Metrics (PCRM) as Sustainalytics’ first Physical Climate Risk offering to align with evolving reporting needs. XDI's analysis supports decision-making in finance, business, and governments worldwide, with detailed, investment-ready information for physical climate risk.