What are Sustainability-Linked Bonds?

Sustainability-Linked Bonds (SLB) are a forward-looking performance-based instrument. The bonds' financial or structural characteristics (such as the coupon rate) are adjusted depending on the achievement of pre-defined sustainability targets. The adjustment can be in both directions, e.g., an increase in coupon rate if targets are not met or a decrease in coupon rate if targets are met. The key difference with green/social/sustainability bonds is that the proceeds can be used for general corporate purposes.

Sustainability-linked bonds are a fairly new instrument in the market with the first linked bond issued in the US market by Enel in September 2019. The bond’s coupon rate was linked to the achievement of two sustainability targets by Enel. Shortly afterwards, Enel followed up with an issuance in Europe in October 2019.

As market interest in SLBs continued to grow, the Sustainability-Linked Bond Principles (SLBP), administered by ICMA, were released in June 2020.

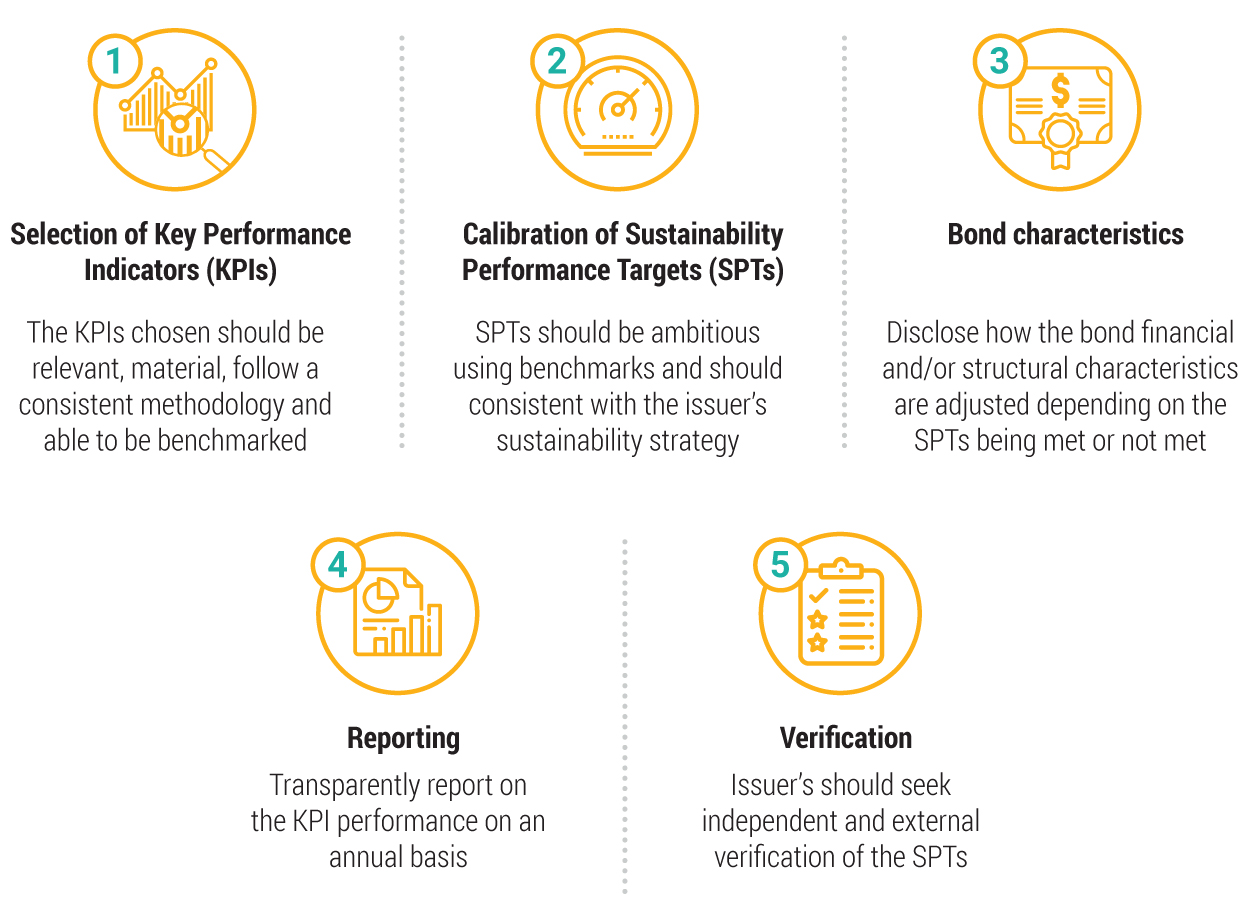

These SLB Principles aim to further develop the key role that debt markets can play in funding and encouraging companies that contribute to sustainability and include five core components:

While there are also critical voices of the new format as it can be used for general corporate purposes and may only include a penalty for companies if they don’t achieve the targets, rather than providing an incentive, others argue that the new format enables new types of companies to enter the market and thus diversifies the options for investors.[1]

In order to support issuers in their pursuit to credibly issue sustainability-linked bonds, Sustainalytics offers a Second-Party Opinion Service.

Sustainalytics' Second-Party Opinion (SPO)

What Sustainalytics' SPO for Sustainability-Linked Bonds covers:

- Statement of alignment with the five core components of the Sustainability-Linked Bond Principles including relevance of KPIs and alignment of Sustainability Performance Targets with the issuer’s sustainability strategy

- Assessment of the issuer’s overall sustainability strategy

- Assessment of the impact of the Sustainability Performance Targets SPTs

The Benefits of a second-party opinion for sustainability-linked bonds are many fold and include amongst others:

For more information on Sustainalytics’ SPOs on sustainability-linked bonds, please connect with our regional service desks.

[1] Sources:

https://www.environmental-finance.com/content/news/hsbc-enel-sdg-bonds-could-be-a-backward-step.html;

https://nordsip.com/2019/11/05/enels-sdg-bond-looking-for-additionality/;

https://www.ifre.com/story/2085912/enel-ditches-green-bonds-for-controversial-new-format-l5n26o403;

Recent Content

Risk and Opportunity in Biodiversity: How Sustainable Finance Can Help

This article outlines how biodiversity loss poses material risks to business and how it connects to many other issues that companies can’t ignore. In addition, it covers how biodiversity conservation presents substantial economic opportunities, and how businesses can address and access these opportunities by issuing linked instruments that integrate biodiversity considerations.

Today’s Sustainable Bond Market: Boosting Confidence in Sustainable Bond Issuances

In this article, we examine the kinds of sustainable bonds offered in the market, some of the key regulations being developed in different markets and the current initiatives to improve the quality and credibility of issuances.

Webinar Recap: How Integrating ESG Can Drive Opportunity for Private Companies

Recently, Morningstar Sustainalytics hosted a webinar – ESG in the Lifecycle of a Private Company: How Stakeholder Demands Drive Sustainability in Private Markets – to address some of the questions private companies might have surrounding ESG and how it could impact their business.