Corporate sustainability depends on accurate, independent data to evaluate and improve a company’s ESG performance.

The world’s leading corporations, lenders and banks rely on our ESG Risk Ratings to identify and understand the financially material ESG issues (MEIs) that can affect their organization’s long-term performance.

Learn more about why Sustainalytics’ ESG Risk Ratings are the industry standard.

Latest Insights

ESG in Conversation: When It Comes to Sustainable Investing, It's A Material World

The SEC’s New Rules on Climate

ESG in Conversation: The AI Revolution Comes to ESG

Overview of Sustainalytics’ ESG Risk Ratings

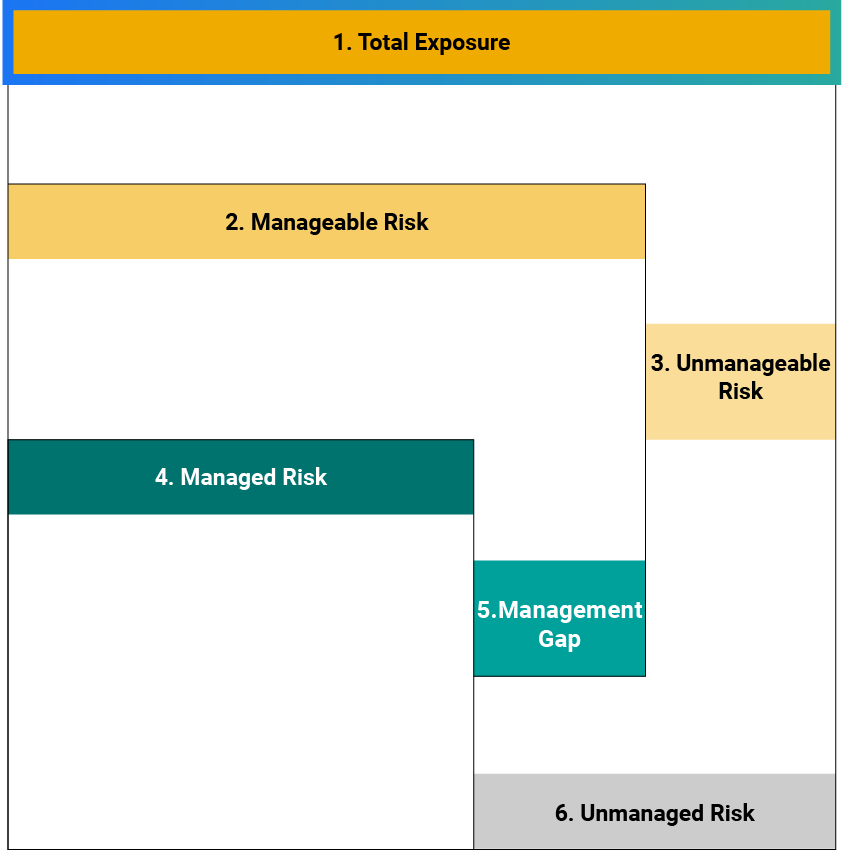

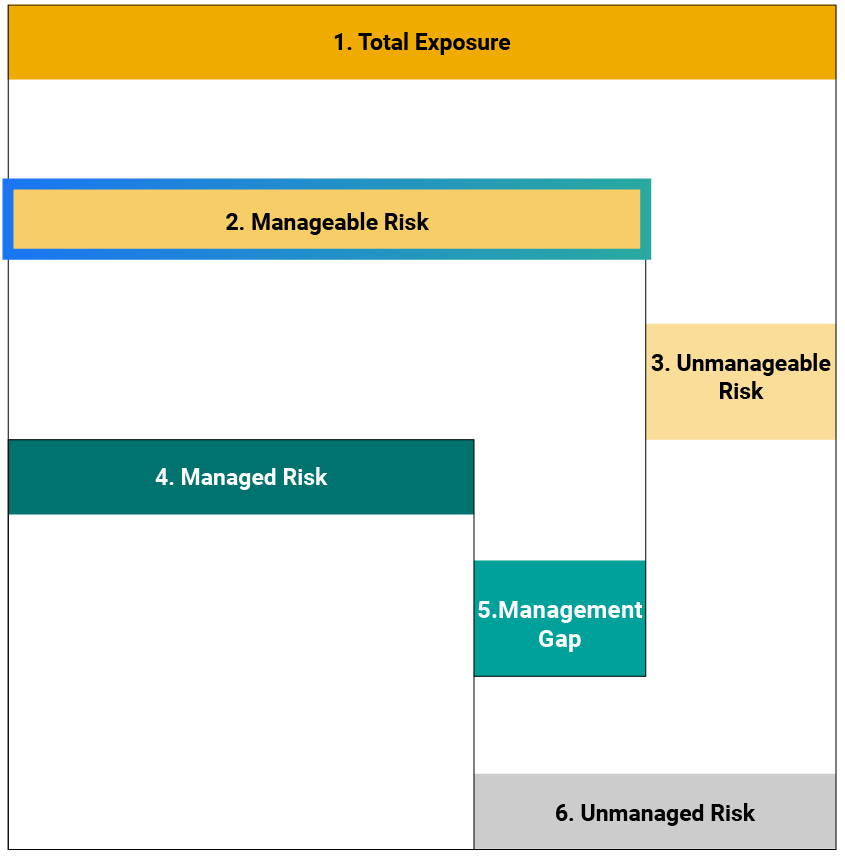

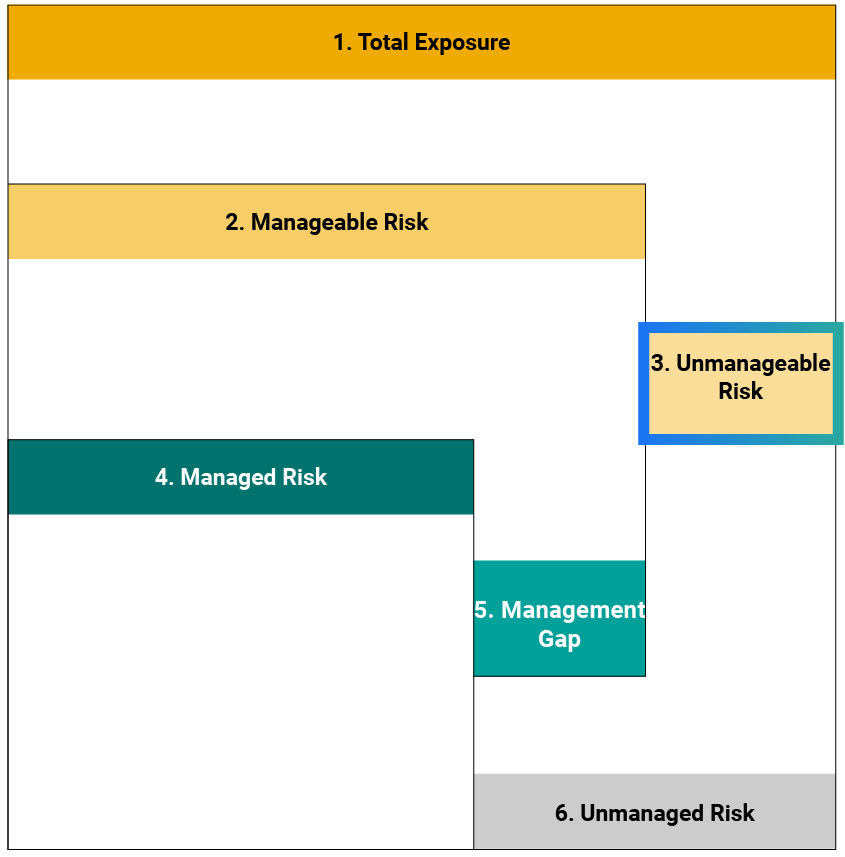

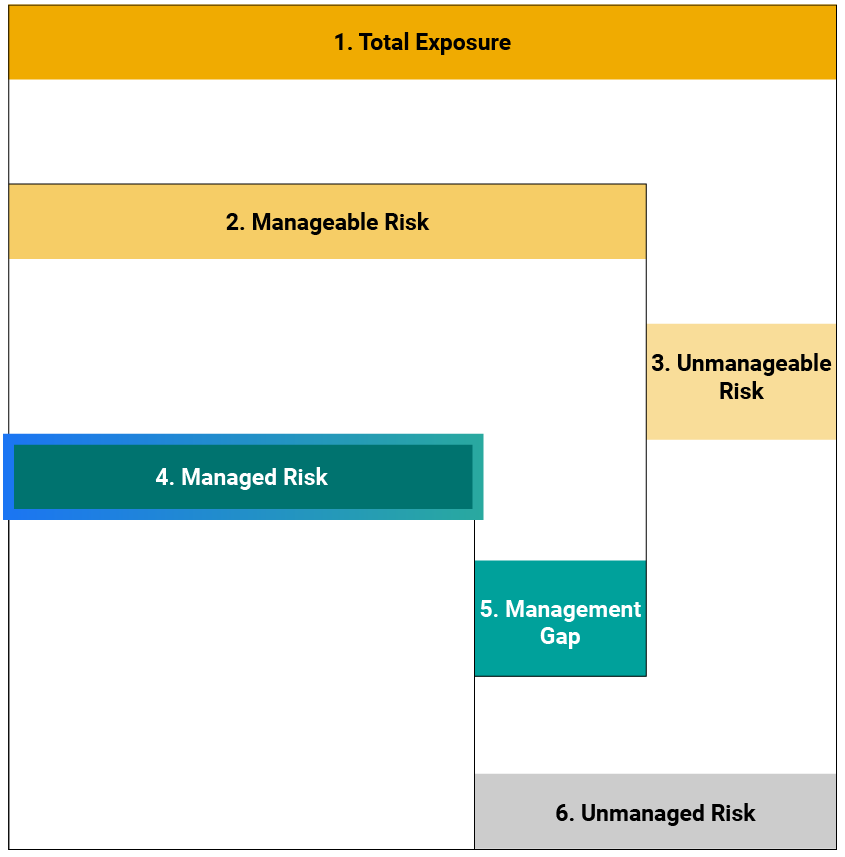

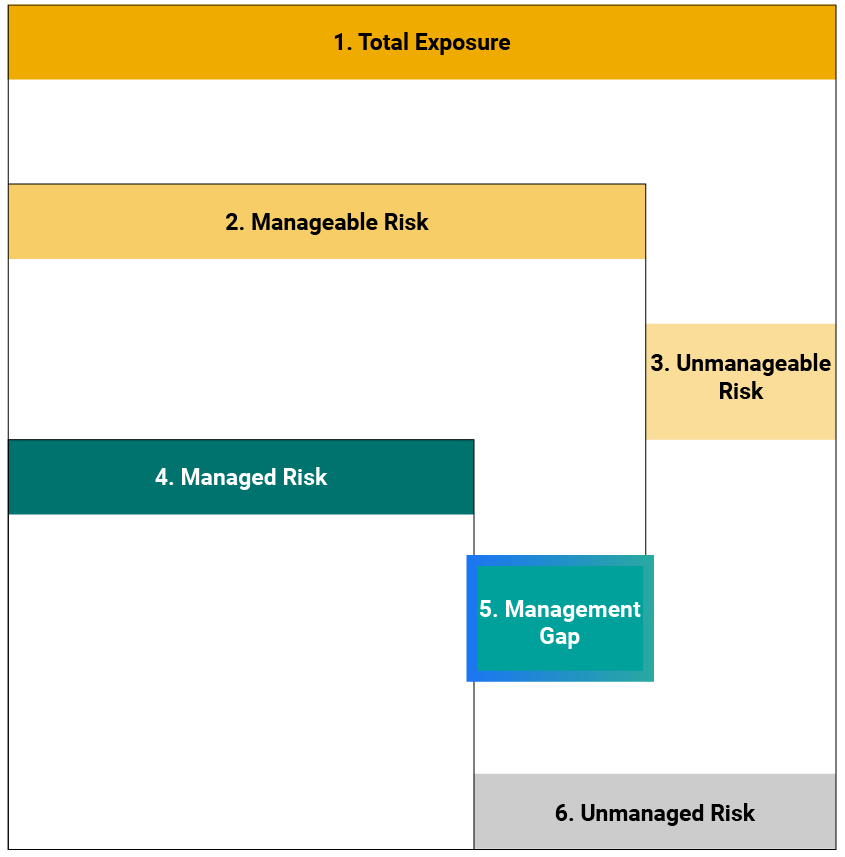

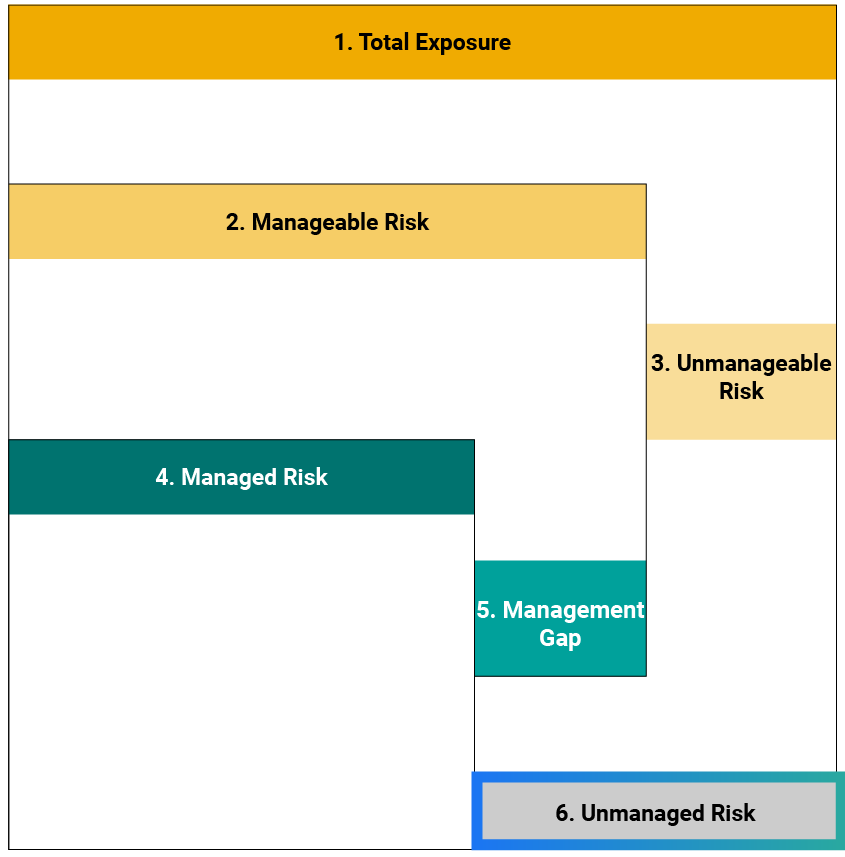

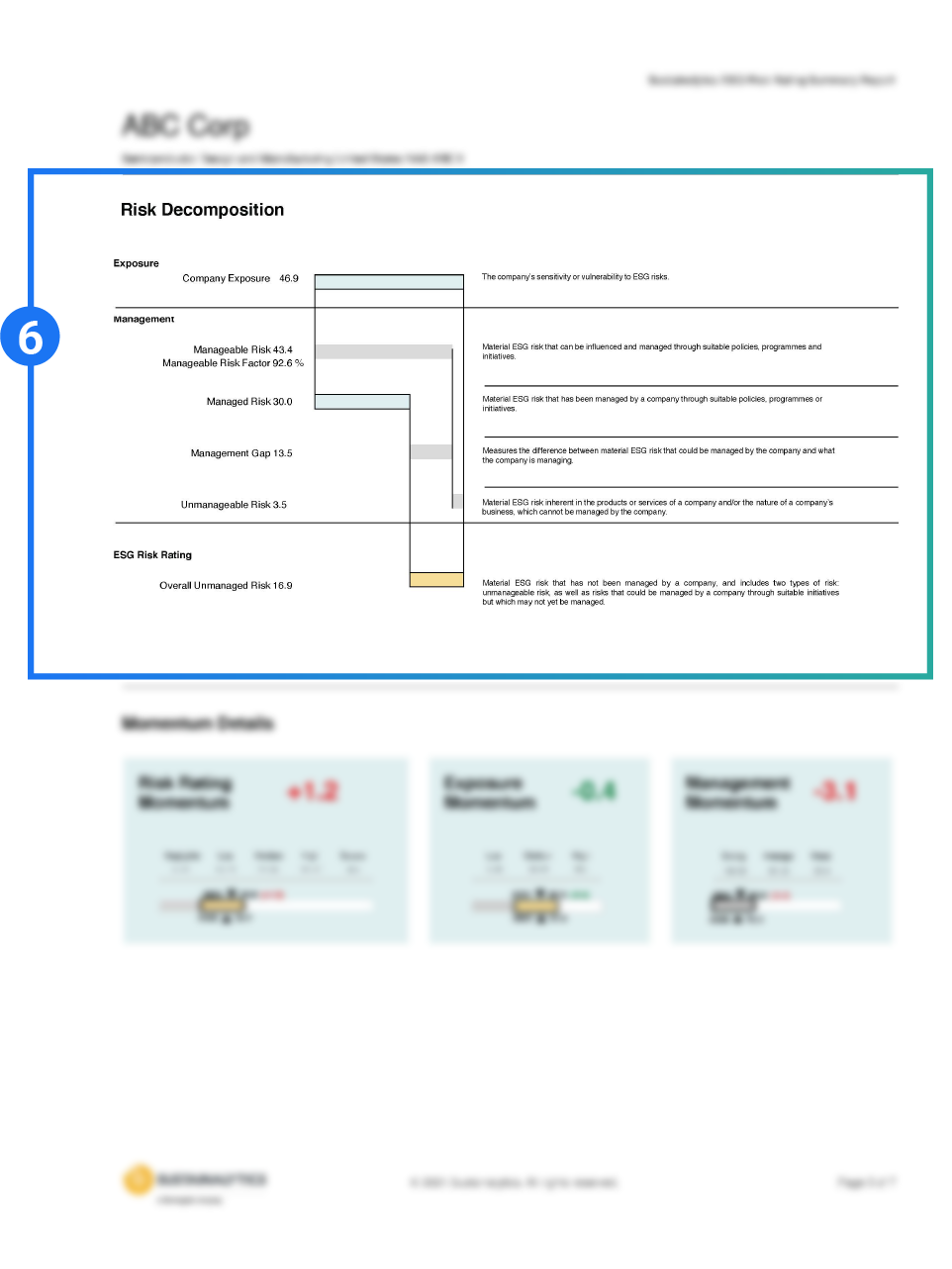

The rating offers clear insights into company-level ESG risk by measuring the size of an organization’s unmanaged ESG risk. This is measured by a unique set of MEIs, so it only considers issues which have a potentially substantial impact on the company’s economic value.

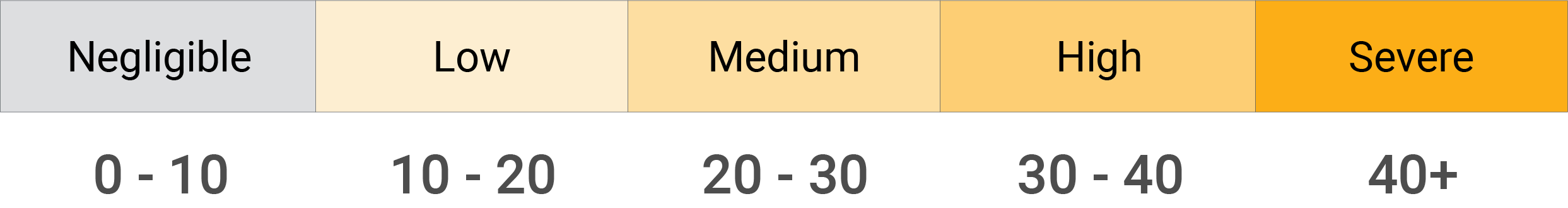

The rating scores the ESG performance of more than 14,000 companies, from negligible to severe risk. The rating is comprised of three central building blocks: corporate governance, MEIs, and idiosyncratic issues (black swans).

Comprehensive Coverage

Sustainalytics’ ESG Risk Ratings span more than 14,000 companies and covers most major global indices. Our ratings framework is supported by 20 material ESG issues, with detailed information on 138 sub-industries.

Categorize the Risk

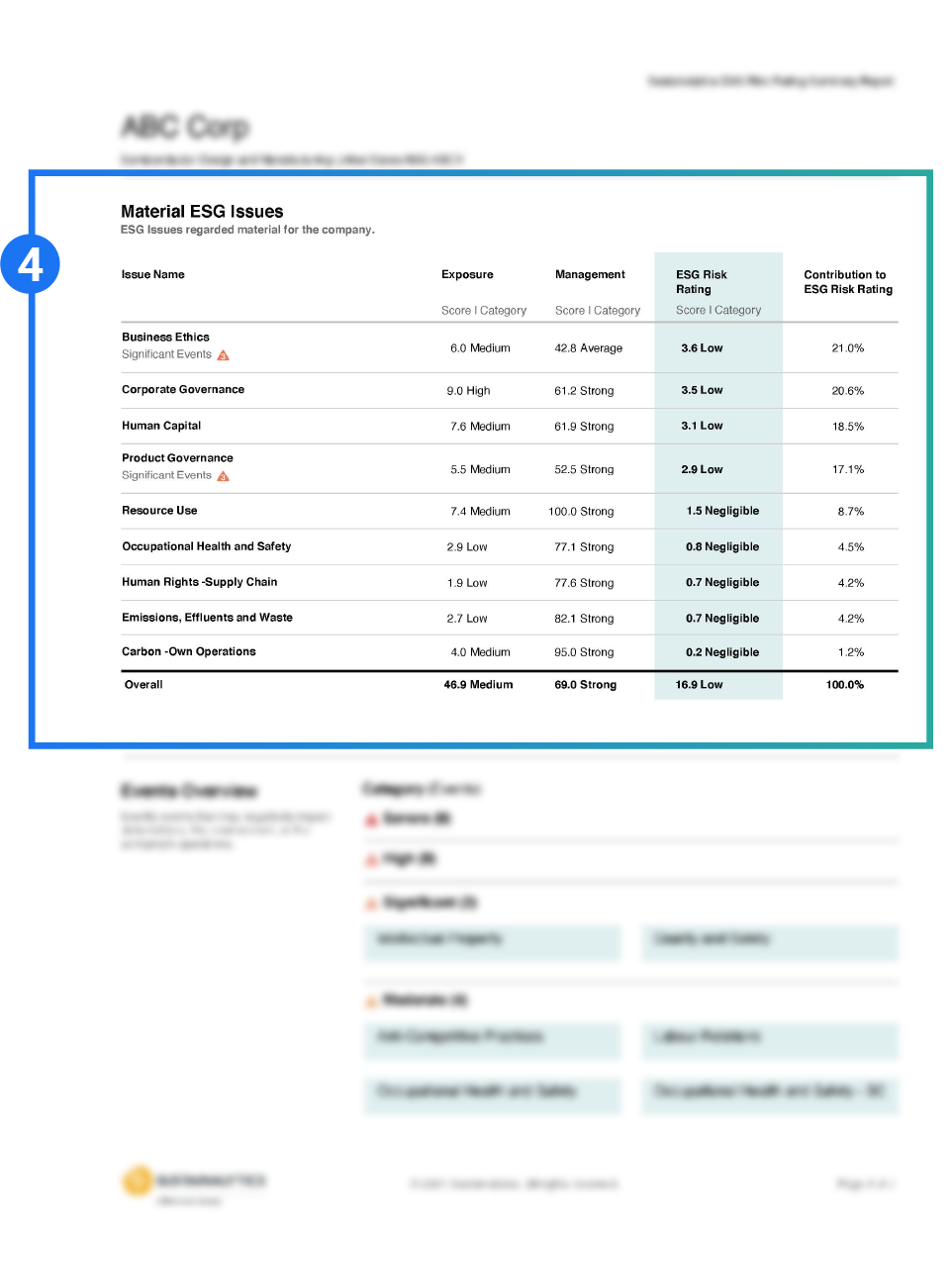

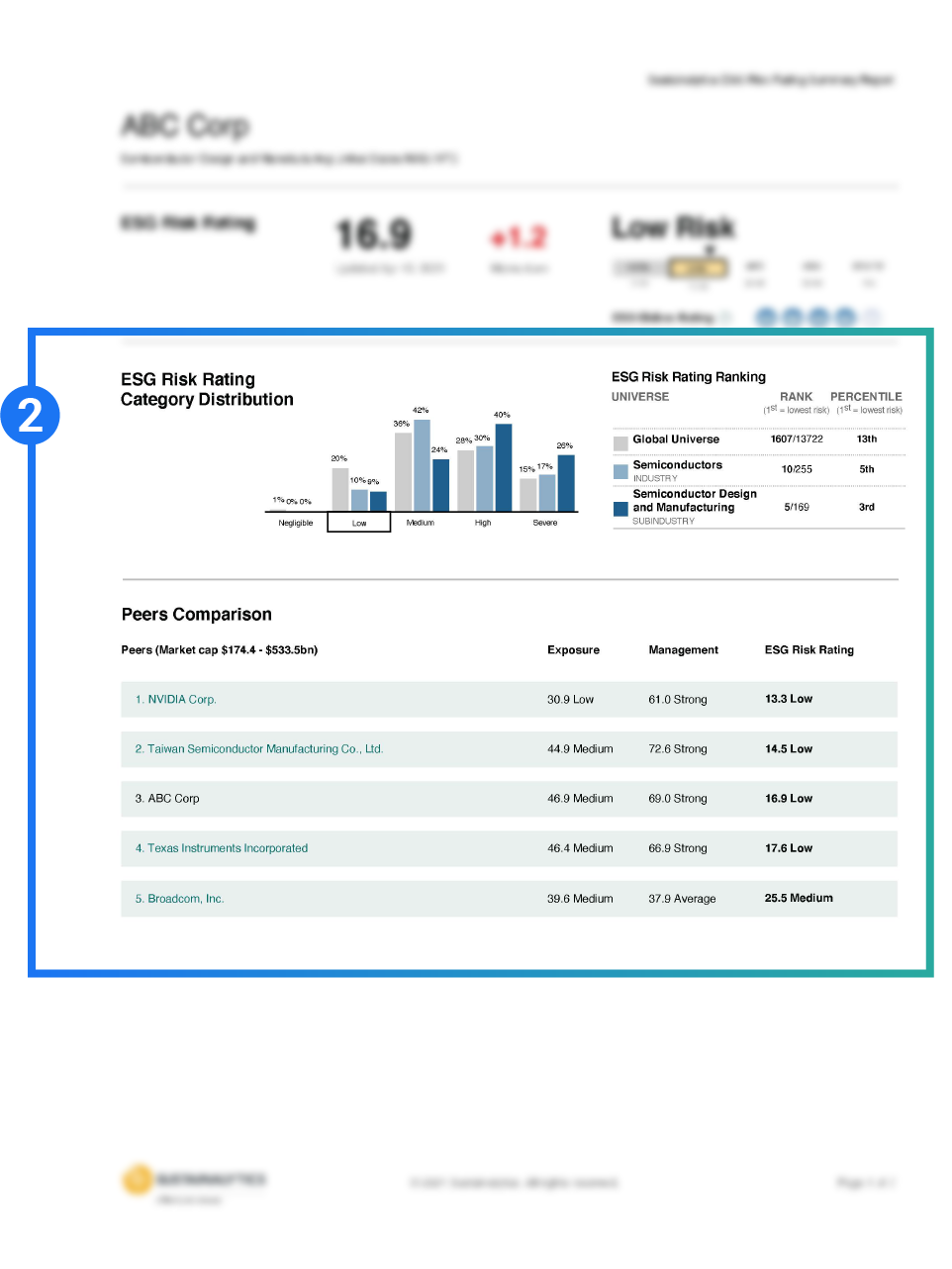

ESG Risk Ratings are categorized across five risk levels: negligible, low, medium, high, and severe. View your rating, and expand your access to long-term responsible investors by improving your ESG risk management.

Benchmark Your ESG performance

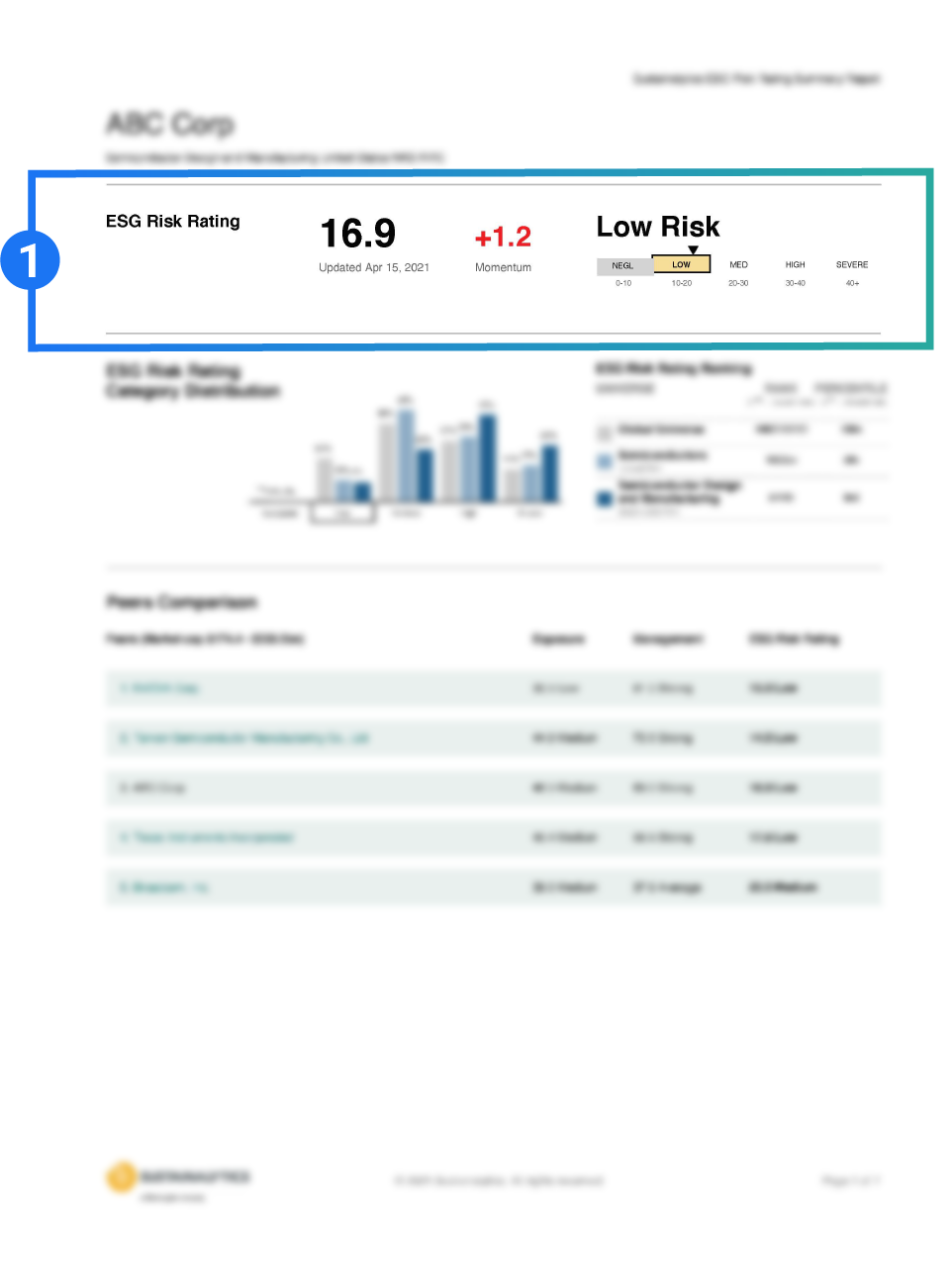

Our Peer Performance Insights products use a company’s ESG Risk Rating to measure their performance against industry peers, helping to inform future ESG decisions and drive internal process improvements.

Deep, Industry-specific Research

The ESG Risk Ratings are underpinned by more than 350 indicators (depending on the sub-industry) and 1,300 datapoints.

Financial Materiality Framework

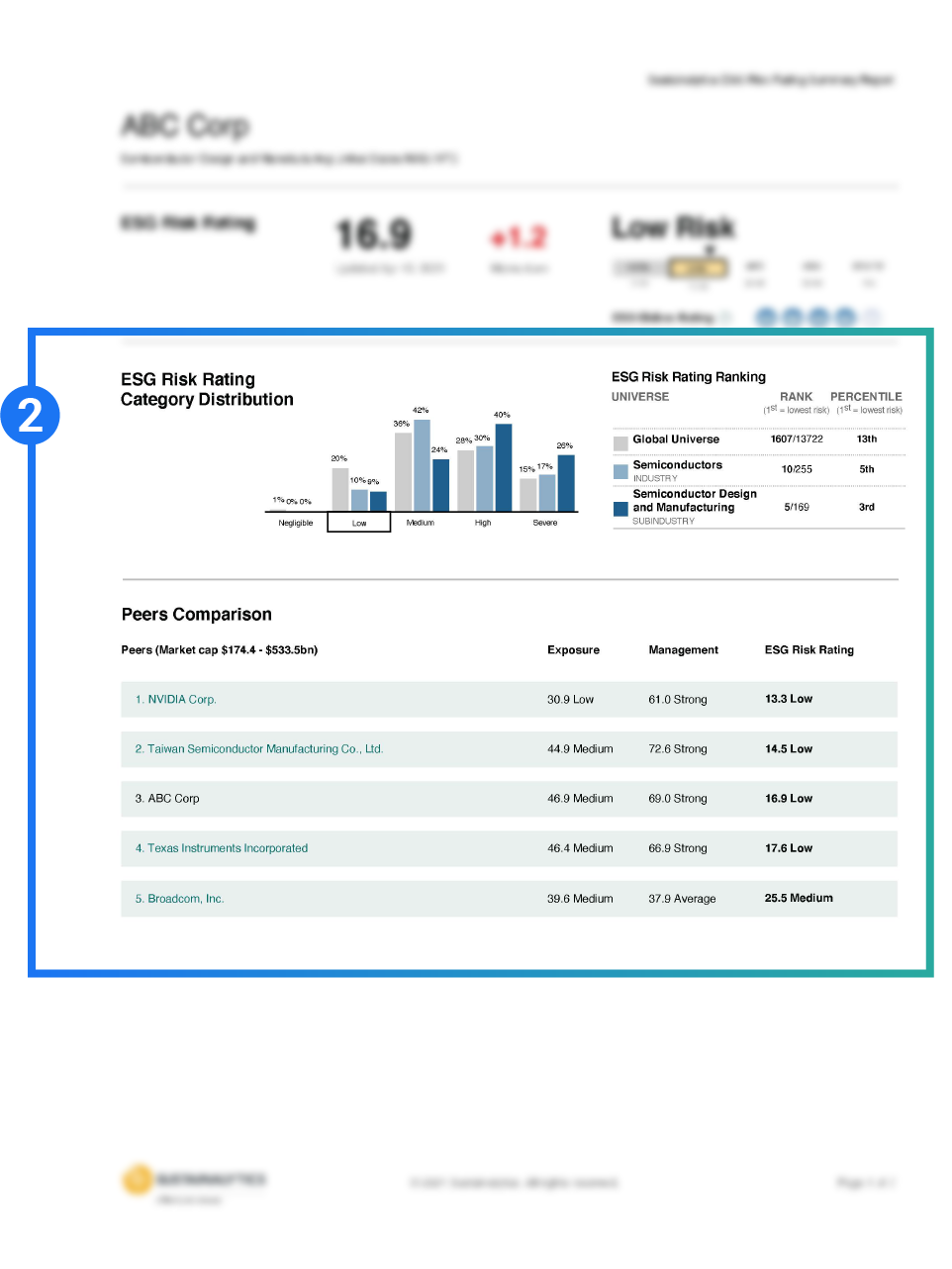

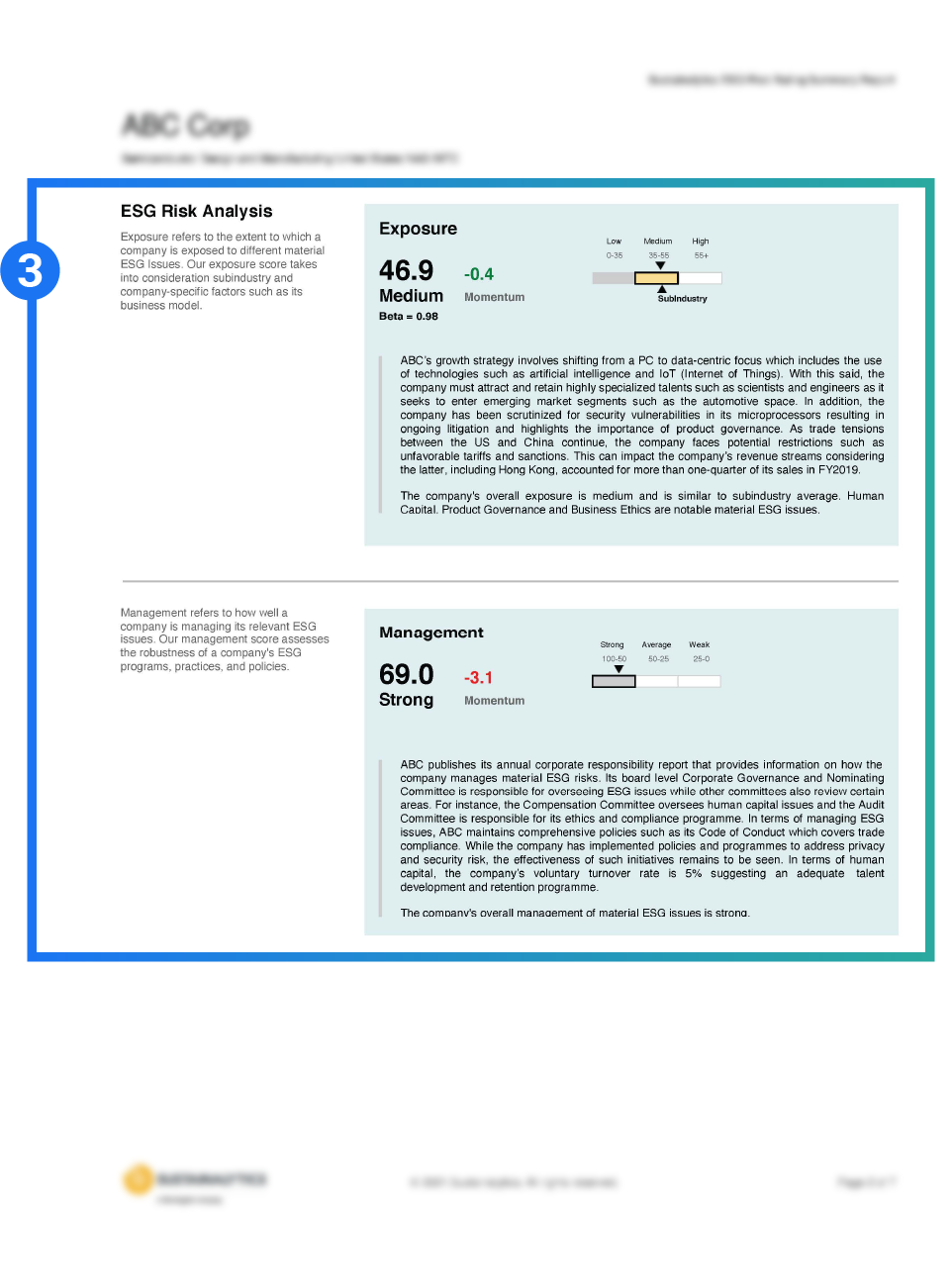

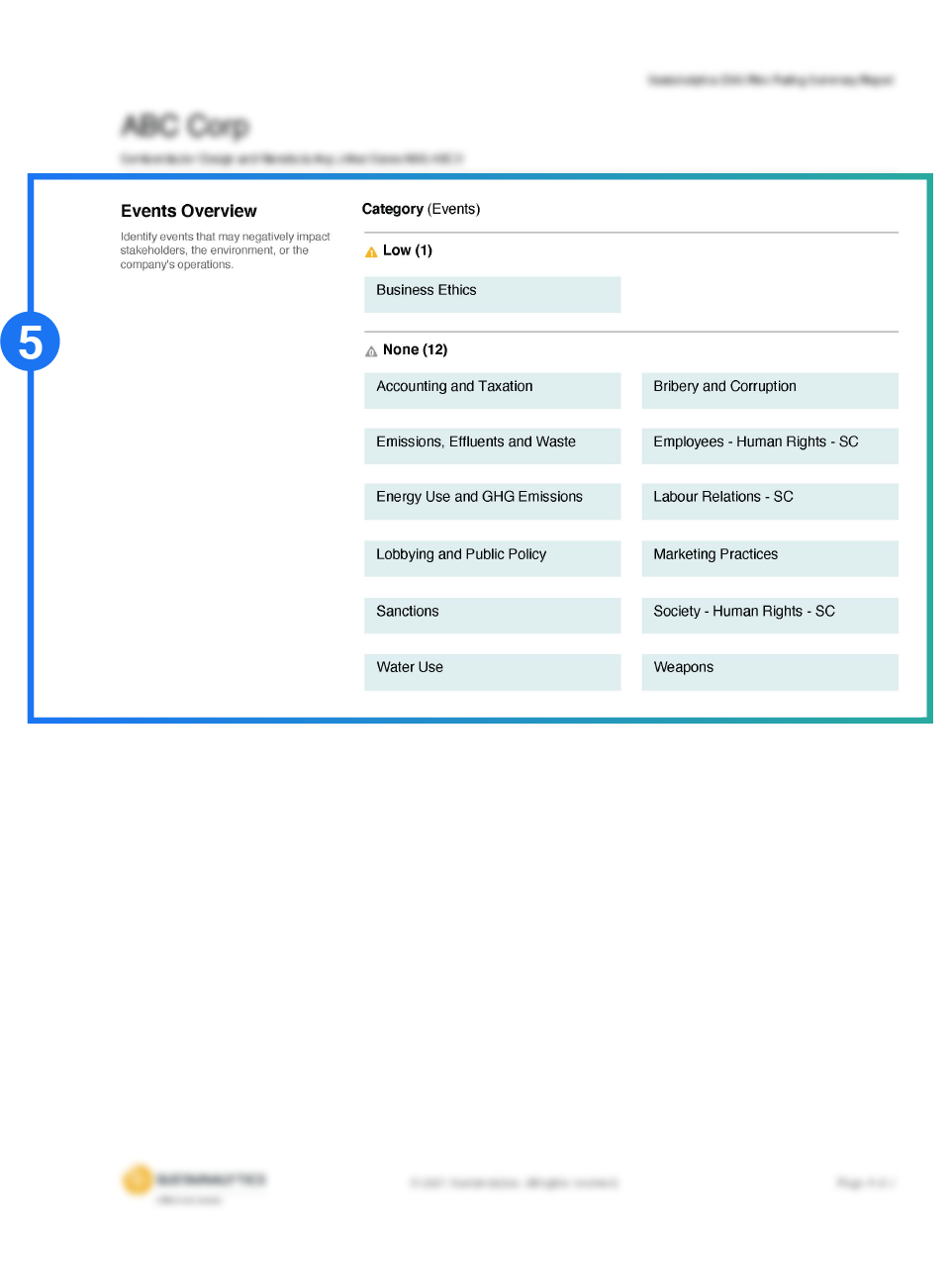

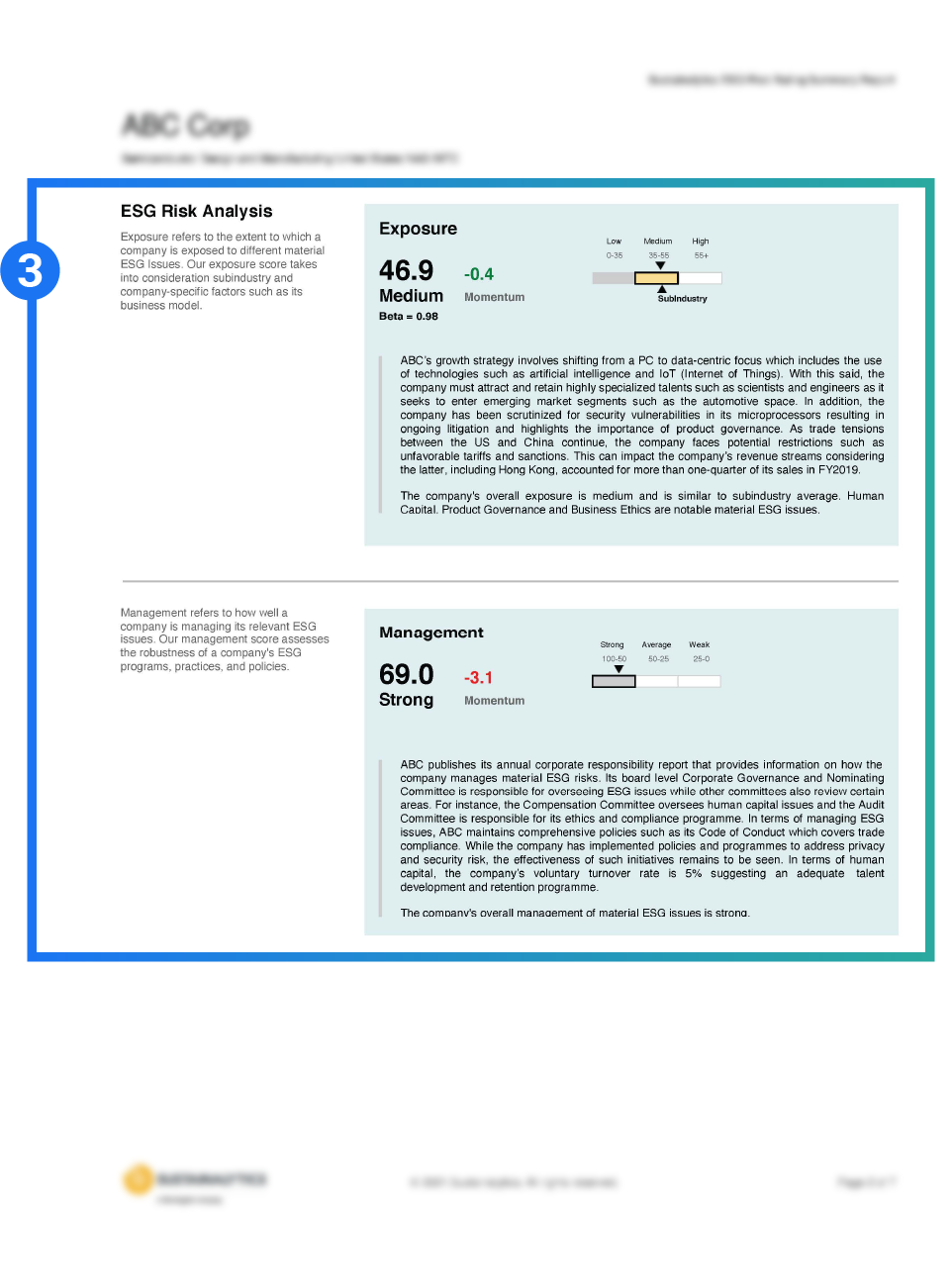

Examine the ESG issues posing the most material risks to your company’s performance. Our ESG Risk Ratings first measure a company’s exposure to industry-specific ESG risks, and then how well a company is managing those risks.

Forward-looking Signal

The exposure dimension of the ESG Risk Ratings is forward-looking because it considers a company’s susceptibility to the most material ESG risks, including risks that have yet to affect its financial performance.

Tailored Company Assessment

Our exposure assessment is tailored to match a company’s unique business model, considering its product portfolio, financial strength, geography, and historical controversies.

Comparable Ratings

Measure your rating against your peers: compare within your industry or sub-industry, at both the overall ESG and issue-specific risk levels.

How It Works

Report Insights

Company ratings are categorized across five risk levels: negligible, low, medium, high, and severe and represented by our ESG Globes icons.

A company’s risk is measured against its industry peers and against the global universe.

Qualitative analysis, underpinned by analyst insights and quantitative data, describes the reasons why a company is exposed to specific material ESG issues and explains how well a company is managing these issues.

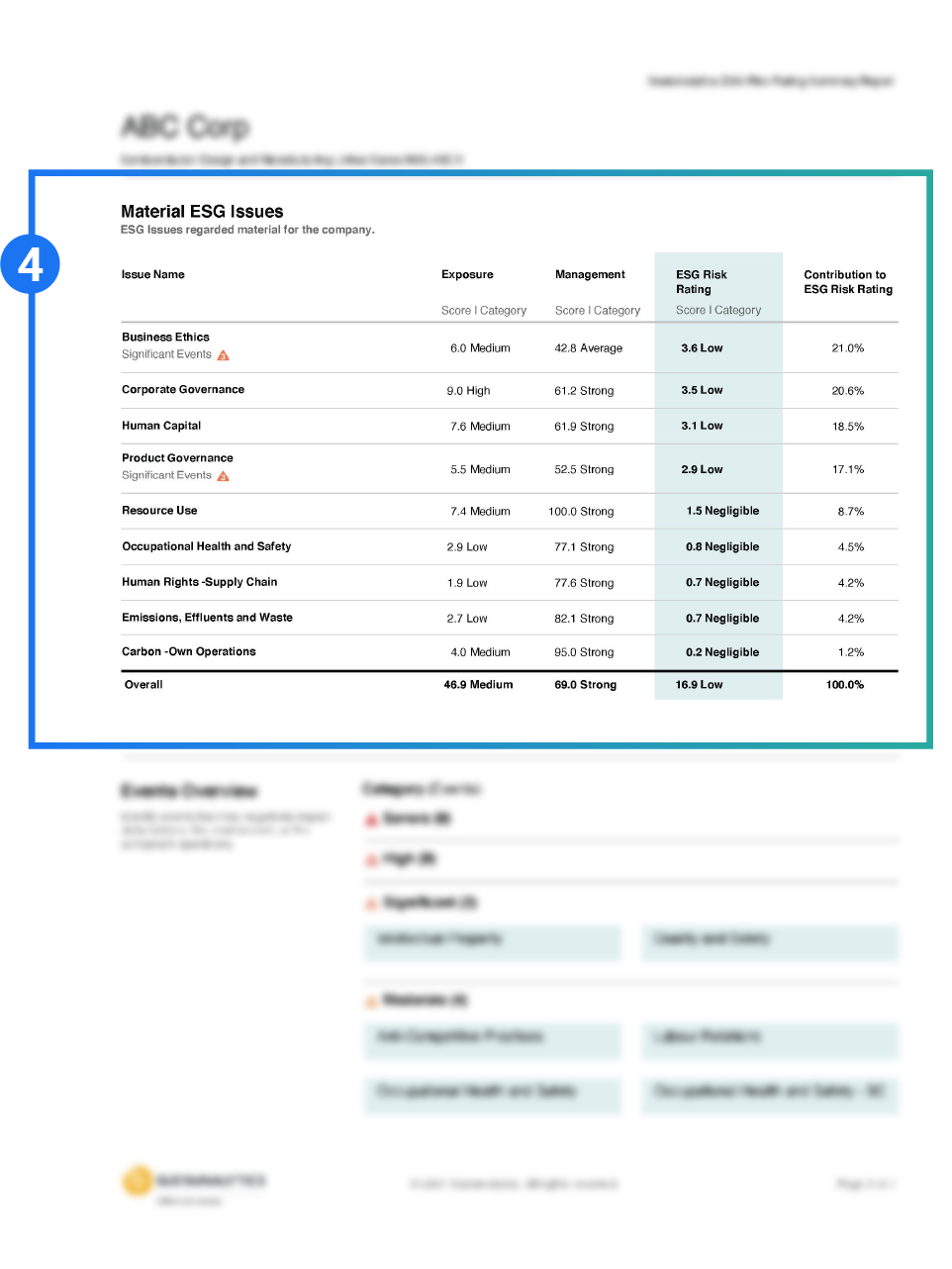

Material ESG Issues (MEIs) are identified and brought into focus.

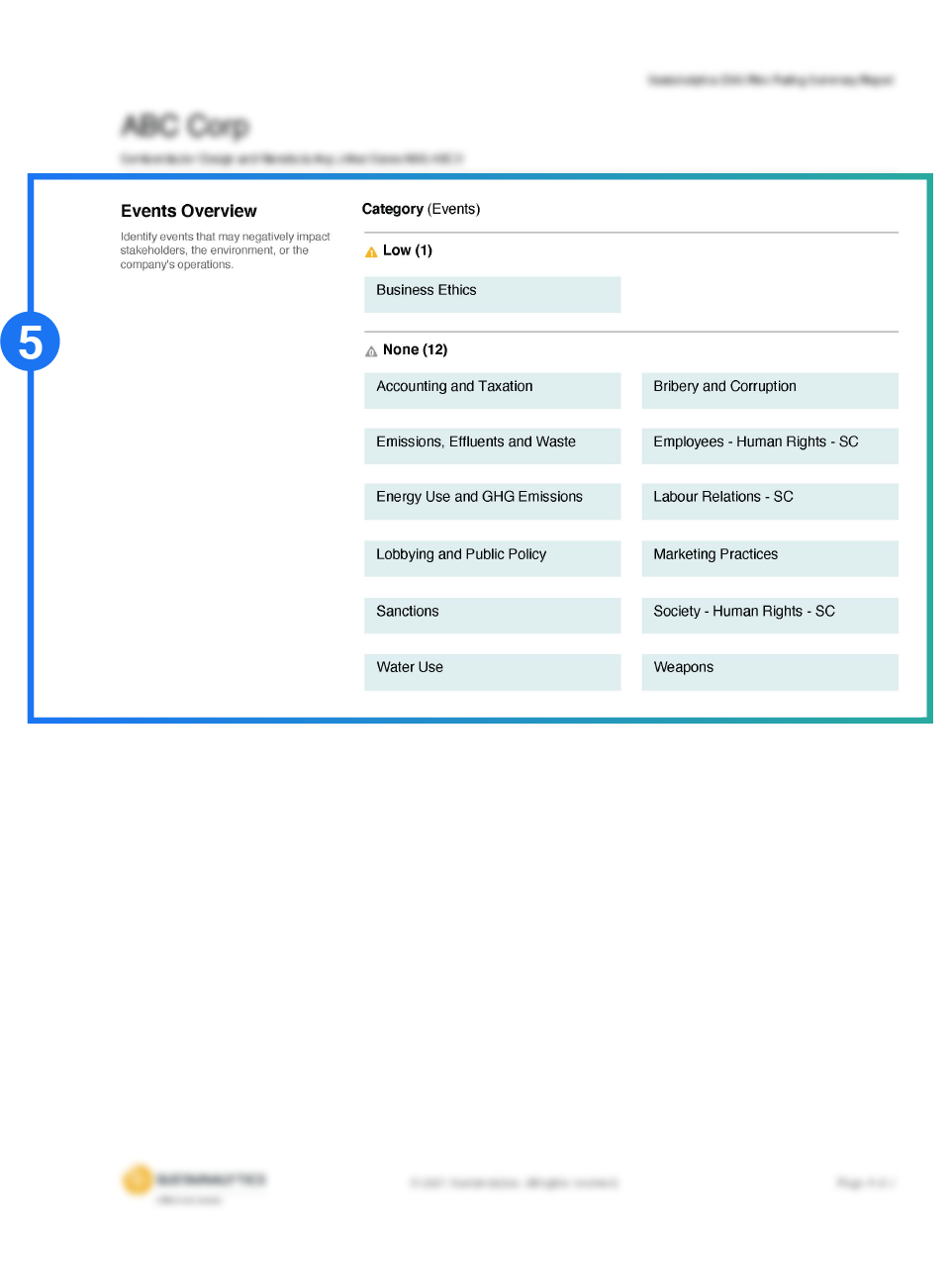

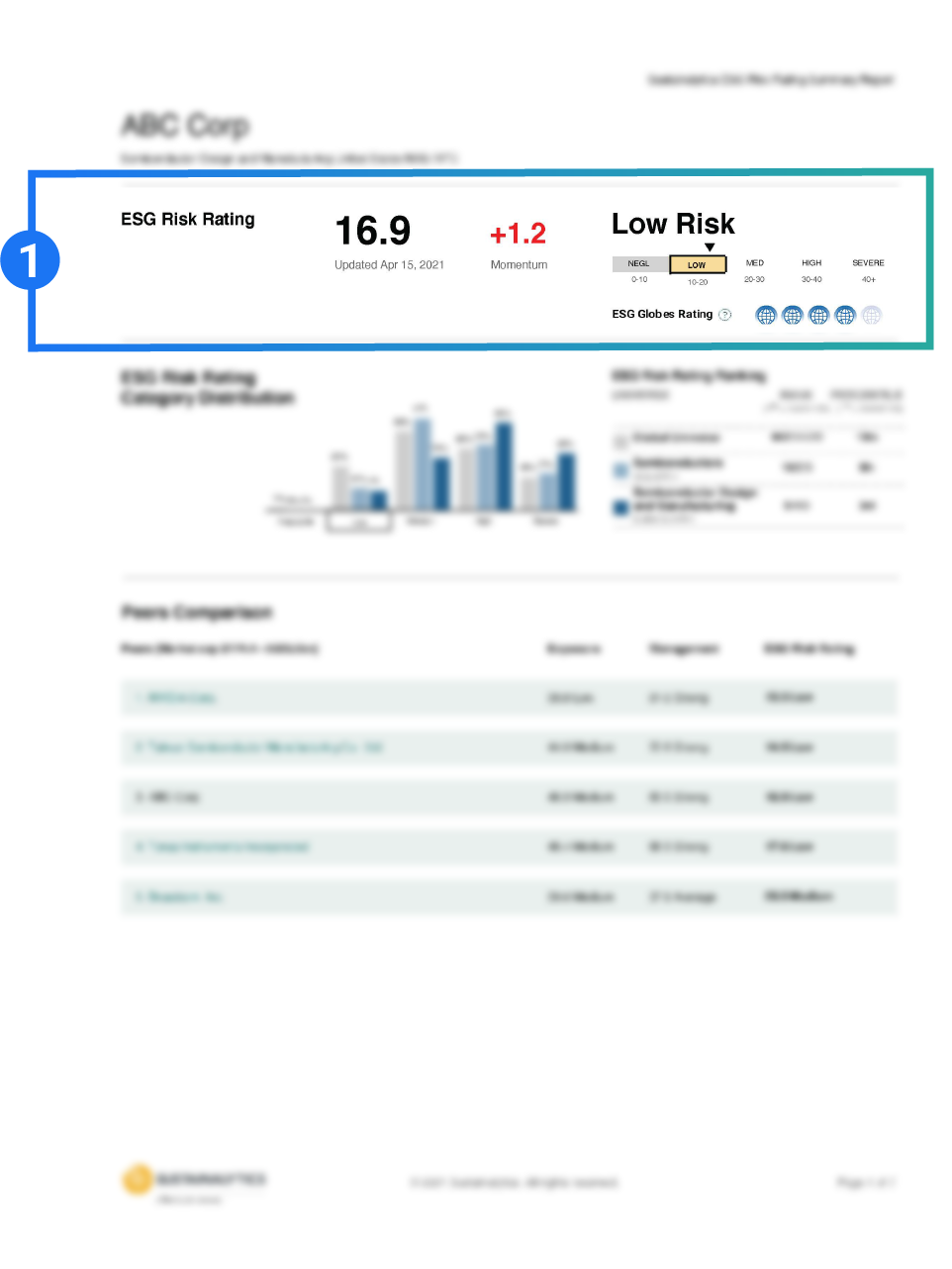

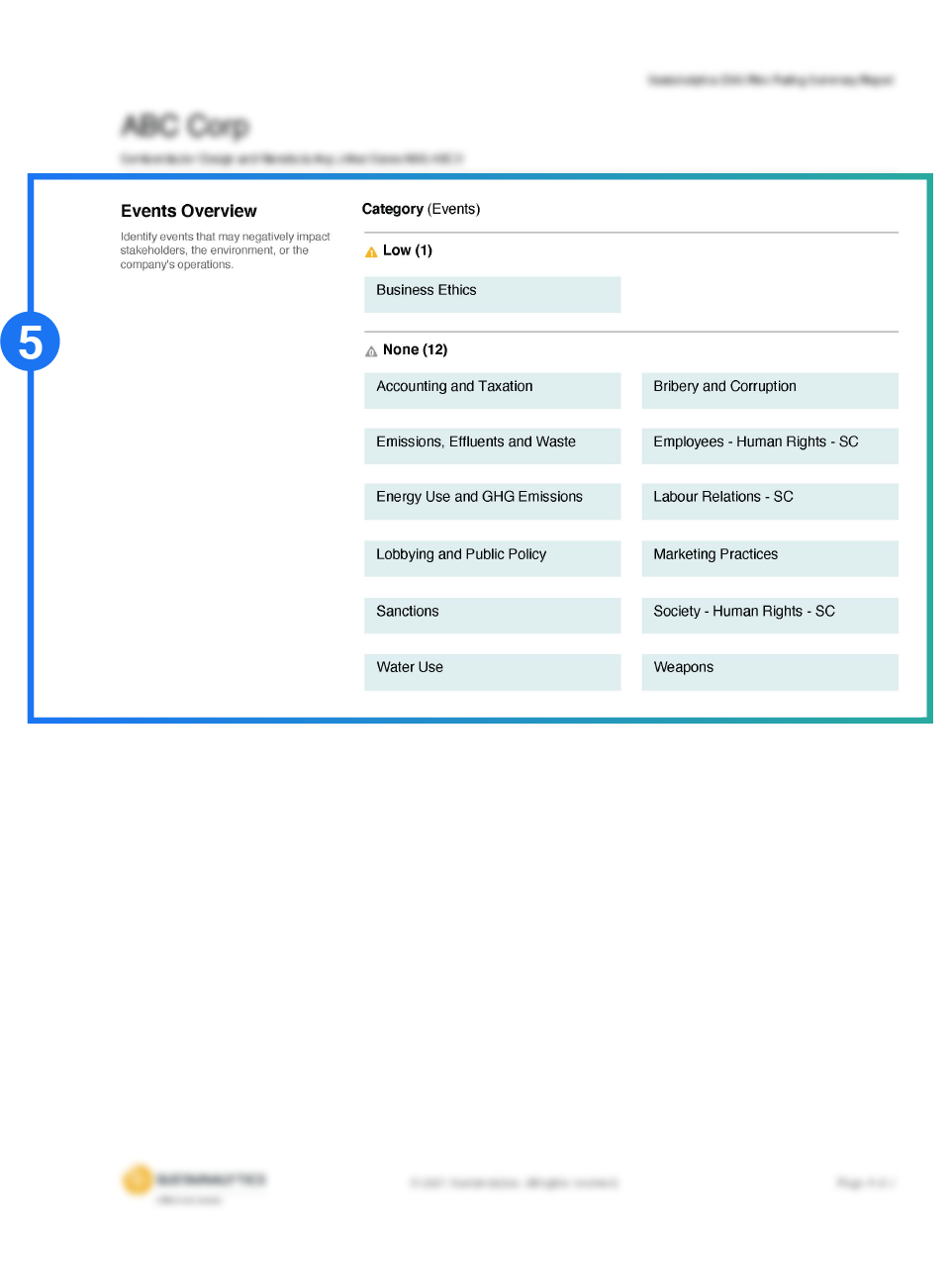

Transparency into company events that may impact a company’s operations, stakeholders or the environment.

The magnitude to which a company is exposed to ESG risk and how well the company is managing that risk is measured and explained.

Use Cases

Banking Solutions

Banks and lenders can use our ESG Risk Ratings and data as a part of a broader analysis of their clients as well as for innovative product solutions such as sustainability-linked loans.

Buyer Supply Chain

Share the company’s ESG Risk Rating with buyer(s) looking for greater insight into the sustainability of their supply chain.

Internal ESG performance

Analyze your company’s ESG performance to determine areas of improvement and compare your score to industry peers. Identify areas of improvement and tie them to management or board renumeration.

Investor Relations

Leverage your company’s ESG Risk Rating to support capital raising activities such as the issuance of green, social, or sustainability bonds.

Sustainable Financing

Leverage your company’s ESG Risk Rating to access favorable rates for sustainability-linked loans or issue sustainability-linked bonds.

Marketing and Promotional

Raise awareness about your company’s ESG performance among internal and external stakeholders to help support your organization’s marketing and public statements.

Discover how to get your company started with ESG, from developing and implementing a plan, to measuring and communicating progress.

Why Sustainalytics?

A Single Market Standard

Consistent approach to ESG assessments across the investment spectrum.

Award-Winning Research and Data

Firm recognized as Best ESG Research and Data Provider by Environmental Finance and Investment Week.

End-to-End ESG Solutions

ESG products and services that serve the entire investment value chain.

30 Years of ESG Expertise

800+ ESG research analysts across our global offices.

A Leading SPO Provider

As recognized by Environmental Finance and the Climate Bonds Initiative.

Related Insights and Resources

Reducing Emissions Through Sustainable Finance: A Guide for Companies in Carbon Intensive Industries

This corporate guide discusses the difficulties in measuring, reporting, and reducing GHG emissions in hard-to-abate sectors and provides key takeaways so that companies can take advantage of the opportunities sustainable finance offers.

Risk and Opportunity in Biodiversity: How Sustainable Finance Can Help

This article outlines how biodiversity loss poses material risks to business and how it connects to many other issues that companies can’t ignore. In addition, it covers how biodiversity conservation presents substantial economic opportunities, and how businesses can address and access these opportunities by issuing linked instruments that integrate biodiversity considerations.

Today’s Sustainable Bond Market: Boosting Confidence in Sustainable Bond Issuances

In this article, we examine the kinds of sustainable bonds offered in the market, some of the key regulations being developed in different markets and the current initiatives to improve the quality and credibility of issuances.

Related Products

Peer Performance Insights

Compare your performance to industry peers to drive ESG performance improvements.

Learn More

ESG Licenses

Use Sustainalytics’ ESG Risk Rating for marketing & promotion, sustainability-linked loans, and more.

Second-Party Opinions

Get a second-party opinion on your ESG bond framework from the world's largest provider.

Learn More