Introducing Morningstar Sustainalytics' E-Sight, a cutting-edge peer comparison tool now available through the Issuer Gateway platform. E-Sight empowers companies to quickly gain insights into their peers’ performance on key ESG and climate topics, drawing data from our proprietary research products (ESG Risk Rating, Low Carbon Transition Ratings, and Impact Metrics).

E-Sight taps into Morningstar Sustainalytics' vast research database and absolute ratings, allowing you to compare over 15,000 company ratings across industries. Stay ahead of the competition with clear, actionable data on the sustainability landscape.

E-sight’s three-tiered approach offers a progressively focused view of your company’s sustainability data. Begin with a 1,000-foot view, comparing high-level material topics (Competitive Insights); zoom in to explore industry performance and leading practices on these topics (Gap Analysis); and finally, drill down to assess individual metrics across selected peers (Indicator Insights). Each layer brings your organization closer to actionable insights that drive strategic, evidence-based decisions.

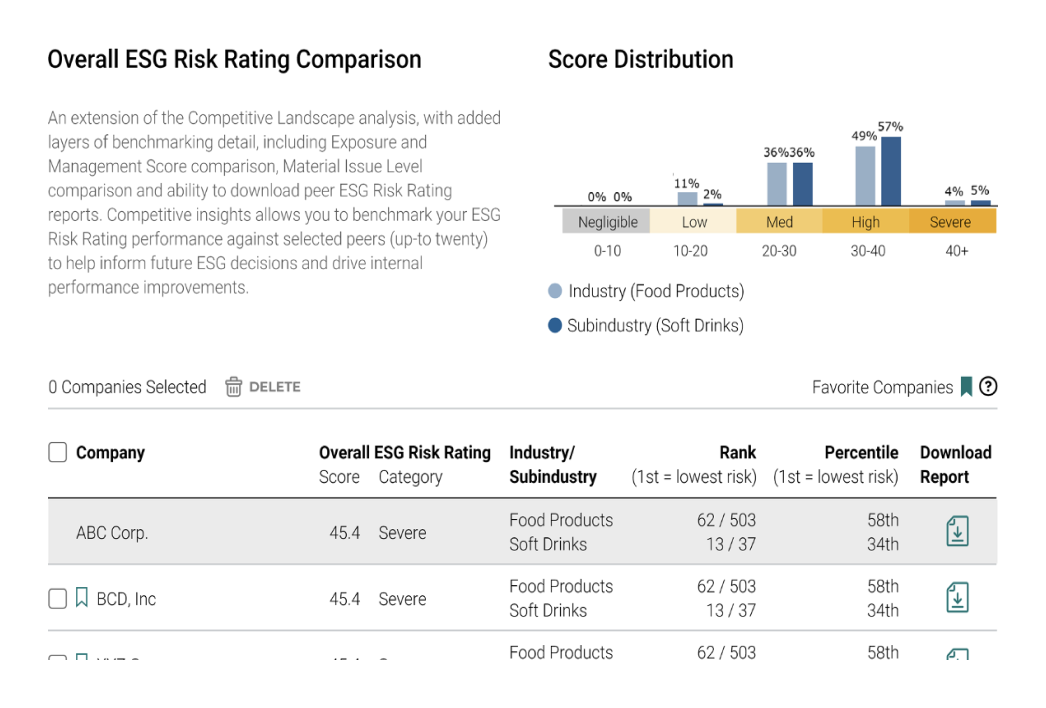

Competitive Insights

Compare your performance to your peers’ on a material topic level, with the possibility to download full peers’ research reports.

Gap Analysis

Identify your most significant gaps in relation to your industry peers and leading practices, at indicator-level. Understand which indicators you should focus your analysis on.

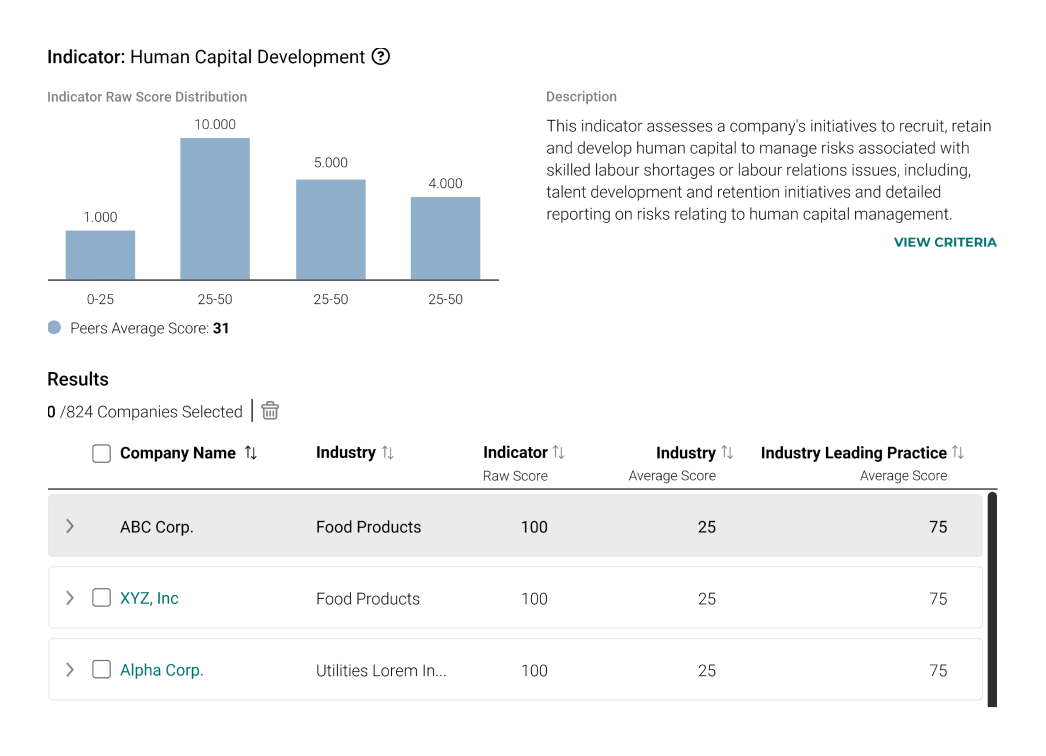

Indicator Insights

Compare individual indicators and criteria (tick boxes) across a custom group of unlimited peers from our research universe of 15,000+ companies. Easily identify priorities and key action items.

Over 300 climate, risk and impact data points available for comparison. | |

Unlimited peers within a ratings universe of over 15,000 companies.. | |

Indicator scores and criteria (tick boxes). | |

Intuitive interface with ample options for sorting and filtering data. | |

Downloadable gap analysis and peer comparison Excel reports. | |

Downloadable peer PDF research reports. |

Discover more about our Peer Performance Insights Tool

Webinar Replay: Enhanced Assessment Framework for UoP SPOs

The enhanced assessment framework is designed to help you navigate the complexities of sustainable finance market by providing a rigorous, science - based approach that ensures your sustainability framework stands out in a crowded market. Our enhanced approach goes beyond labels to deliver clear, measurable insights into the real-world impact of your investments, enabling you to mitigate the risks of greenwashing, meet evolving transparency demands, and confidently demonstrate long-term progress.

ESG in Conversation: Shining a Light on Shareholder Rights

Tune in to hear experts share their perspectives on sustainable investing trends and the changing regulatory landscape, as well as changes in proxy voting activities, the influence of dual class share structures and their impact on say on pay votes.

ESG Risk Rating License

Sustainalytics’ ESG Risk Ratings License allows companies to use the ESG Risk Rating and reports for various internal and/or external corporate purposes.

Top-Rated Companies

The Top-Rated ESG Badge is awarded on an annual basis to companies who excel at managing their ESG Risk Ratings.

ESG Risk Ratings

Morningstar Sustainalytics' ESG Risk Ratings offer industry-leading research and detailed data on more than 13,000 companies, supported by 20 material ESG issues.

Why Sustainalytics?

A Single Market Standard

Consistent approach to ESG assessments across the investment spectrum.

Award-Winning Research and Data

Firm recognized as Best ESG Research and Data Provider by Environmental Finance and Investment Week.

End-to-End ESG Solutions

ESG products and services that serve the entire investment value chain.

30 Years of ESG Expertise

800+ ESG research analysts across our global offices.

A Leading SPO Provider

As recognized by Environmental Finance and the Climate Bonds Initiative.