Companies today have a deeper understanding of the materiality of their Environmental, Social, and Governance (ESG) policies and practices and are stepping up to meet the expectations of their key stakeholders, including employees, investors, and the community. As awareness of ESG factors has grown, so too has the importance companies place on communicating their corporate responsibility successes. Leveraging a recognized third-party rating service can add credibility to a company’s ESG story. That’s why investor relations officers, corporate sustainability officers, and marketing teams, among others, are increasingly licensing their Sustainalytics’ ESG Risk Rating for a variety of stakeholder use cases.

Sustainalytics’ ESG Risk Ratings subscriptions provides your companies with a license to leverage the ESG Risk Rating and reports for various internal and/or external corporate purposes. Increasingly, companies are leveraging their ESG performance data as part of their capital raising activities, marketing and promotion programs, investor relations outreach and employee communications initiatives.

Latest Insights

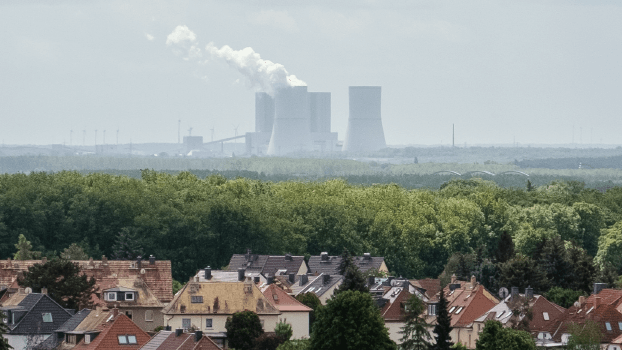

How an Energy Transition Company Further Solidified Its ESG Leadership

Webinar Recap: How Integrating ESG Can Drive Opportunity for Private Companies

Corporate ESG Reporting: Improving the Dialogue Between Companies and Their Investors

Key Benefits and Features

Showcase your ESG commitment

Make a statement to the market and investors about your dedication to sustainability. Realize sustainable growth opportunities while effectively managing ESG risks. Gain a deeper understanding of your company’s performance on material ESG factors as well as areas for improvement.

Leverage your ESG Score

Increase the credibility of your sustainability efforts to investors and stakeholders by leveraging Sustainalytics’ globally recognized brand with our “Rated by Sustainalytics” badge. Additionally, if your company is included in our annual list of Top-Rated companies, use our Top-Rated Badge in company reports, marketing material and investor relations packages.*

Access reports to support your communications

Engage with your company’s ESG data and understand the way investors view your practices. Get a contextual view into how various ESG risk factors and indicators impact your ESG rating over time with an Annual Score Change Report. The ESG Event Alert Report provides updates that highlight any ESG score changes due to controversies that may occur.

Use Cases

Management and Board Remuneration

Identify areas of improvement in the company’s ESG performance and tie these longer-term enhancements to the board or senior executives’ reward packages.

Investor Relations

Align your ESG practices and profile with investor expectations. Leverage your ESG rating to broaden your company’s appeal to new types of investors thereby broadening your shareholder base.

Debt and Equity Roadshows

Publish your ESG Risk Rating in (sustainability) bond roadshows to give investors’ confidence that your company is effectively managing sustainability-related risks.

Loan Cost Reduction

Utilize your company’s ESG Risk Rating to access favorable terms for sustainability-linked loans or issue sustainability-linked bonds.

Marketing and Corporate Communications

Raise awareness about your company’s ESG performance among internal and external stakeholders to help support your organization’s marketing and public profile.

Why Sustainalytics?

A Single Market Standard

Consistent approach to ESG assessments across the investment spectrum.

Award-Winning Research and Data

Firm recognized as Best ESG Research and Data Provider by Environmental Finance and Investment Week.

End-to-End ESG Solutions

ESG products and services that serve the entire investment value chain.

30 Years of ESG Expertise

800+ ESG research analysts across our global offices.

A Leading SPO Provider

As recognized by Environmental Finance and the Climate Bonds Initiative.

Related Insights and Resources

Reducing Emissions Through Sustainable Finance: A Guide for Companies in Carbon Intensive Industries

This corporate guide discusses the difficulties in measuring, reporting, and reducing GHG emissions in hard-to-abate sectors and provides key takeaways so that companies can take advantage of the opportunities sustainable finance offers.

Risk and Opportunity in Biodiversity: How Sustainable Finance Can Help

This article outlines how biodiversity loss poses material risks to business and how it connects to many other issues that companies can’t ignore. In addition, it covers how biodiversity conservation presents substantial economic opportunities, and how businesses can address and access these opportunities by issuing linked instruments that integrate biodiversity considerations.

Today’s Sustainable Bond Market: Boosting Confidence in Sustainable Bond Issuances

In this article, we examine the kinds of sustainable bonds offered in the market, some of the key regulations being developed in different markets and the current initiatives to improve the quality and credibility of issuances.

Related Products

ESG Peer Insights

Compare your performance to industry peers to drive ESG performance improvements.

Top-Rated Companies

The Top-Rated ESG Badge is awarded on an annual basis to companies who excel at managing their ESG Risk Ratings.

ESG Risk Ratings

Identify your corporate sustainability risk with ESG research and data on more than 12,000 companies.