Strong oversight and accountability are crucial to the management of material ESG issues as well as a company’s ability to execute its long-term business strategy. Sustainalytics flagged corporate governance concerns at both Volkswagen and Fiat months before the respective emissions scandals broke.

Sustainalytics’ Corporate Governance Research & Ratings enable investors to better assess portfolio companies’ corporate governance structures, practices and behaviors. These qualities have long been embraced by investors as potential sources of investment risk and, more recently, opportunity.

Our Corporate Governance Research & Ratings also form the baseline assessment for our ESG Risk Ratings.

Latest Newsletters

Governance in Brief – June 15, 2023

Governance in Brief – June 8, 2023

Governance in Brief – June 1, 2023

Key Features & Benefits

Better understand companies’ corporate governance systems and practices and the potential risks and opportunities they pose to long-term value creation.

Leverage insights from our independent analyses to inform your investment decisions as well as proxy voting and engagement activities.

Benchmark companies’ corporate governance performance on a variety of metrics to identify strengths as well as potential red flags.

Speak directly to our in-house team of subject matter experts.

Coverage

~4,200 COMPANIES

Global coverage of major indexes

Corporate Governance Reports

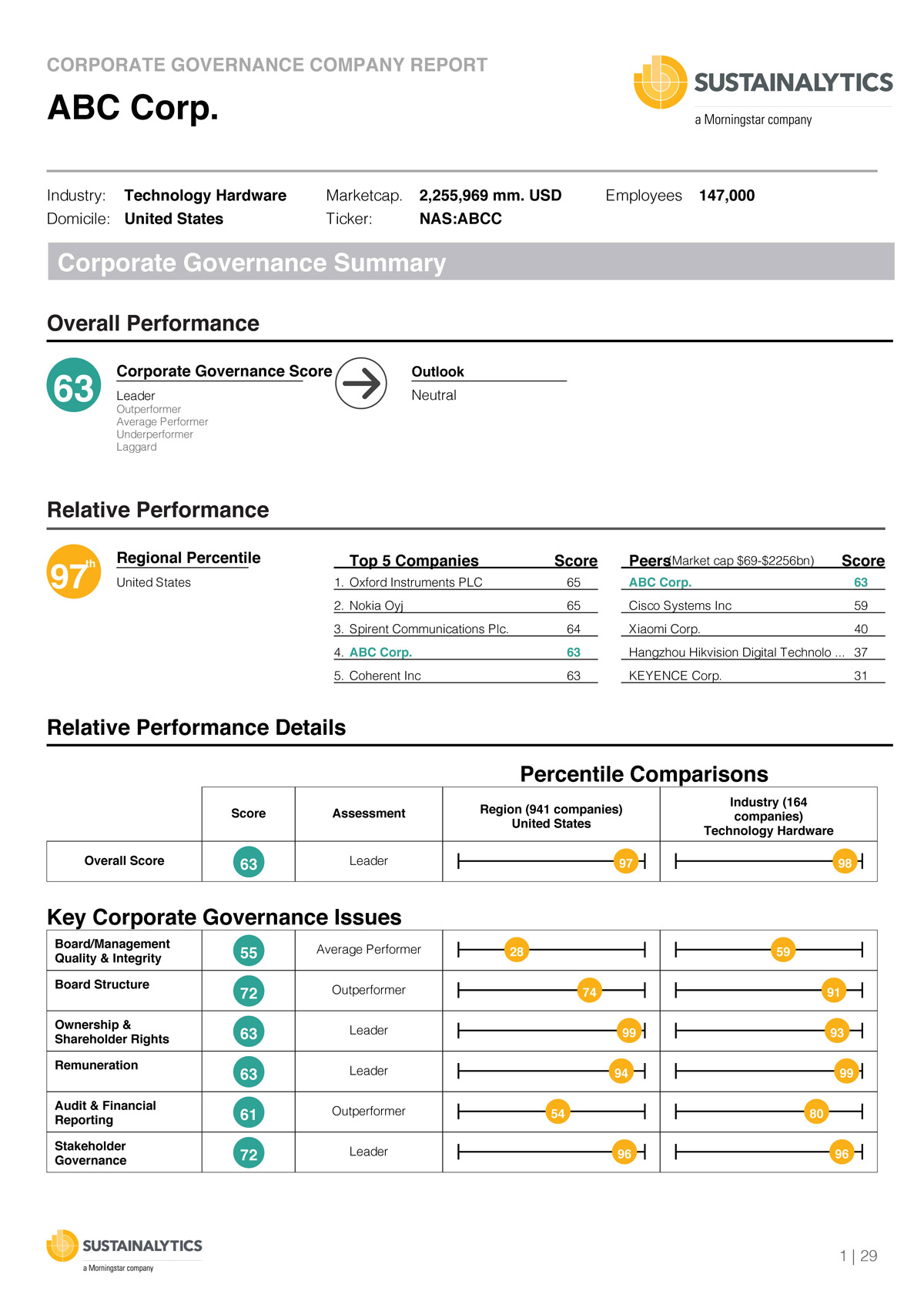

Data-driven contextual reports that provide corporate governance ratings and information on a global universe of approximately 4,200 companies. We assess a company’s corporate governance structures, practices and behaviors along six pillars that are deemed crucial for good governance: Board Integrity & Quality, Board Structure, Remuneration, Shareholder Rights, Financial Reporting and Stakeholder Governance. Select reports also include an analyst view and outlook for the company.

Corporate Governance Pillars

Board & Management Quality and Integrity

Do the board’s experience, track record and behavior sufficiently demonstrate its ability to provide strategic leadership and oversight?

Board Structure

Do the organization and structure of the board provide sufficient oversight, representation and accountability to shareholders?

Ownership and Shareholder Rights

Do the constitution of the company and its ownership structures respect the right of outside shareholders relative to the board, management, and major holders?

Remuneration

Do the company’s remuneration policies and practices provide appropriate incentives for management to build value?

Audit & Financial Reporting

Are the company’s financial reports reliable and subject to appropriate oversight?

Stakeholder Governance

Does the company’s management of extra financial risks and broader stakeholder relationships raise concerns regarding its governance of long-term value creation?

Delivery Options

Global Access

Access our research through our user-friendly investor interface with easy to use screening and reporting tools. You can also access onscreen & PDF reports

Data Services Regular data feed (SFTP/FTP) or API

Access our research through an internal or a third-party system of your choice: Bloomberg, Factset and Markit

Why Sustainalytics?

A Single Market Standard

Consistent approach to ESG assessments across the investment spectrum.

Award-Winning Research and Data

Firm recognized as Best ESG Research and Data Provider by Environmental Finance and Investment Week.

End-to-End ESG Solutions

ESG products and services that serve the entire investment value chain.

30 Years of ESG Expertise

800+ ESG research analysts across our global offices.

A Leading SPO Provider

As recognized by Environmental Finance and the Climate Bonds Initiative.

Related Insights and Resources

Governance in Brief – June 8, 2023

European Parliament approves CSDDD The European Parliament has approved the “Corporate Sustainability Due Diligence Directive.” Under the new rules, companies will be required to identify and address the negative impact of their activities and value chains on human rights and the environment. Additionally, companies will need to implement climate transition plans, and, in the case of companies with more than 1,000 employees, tie directors' variable compensation to target achievement.

Governance in Brief – June 1, 2023

Citigroup to IPO Banamex after Mexican gov’t interventions hamper sales deal Citigroup has announced a plan to spin off its Mexican business, Banamex, after a failure to sell the unit to conglomerate Grupo Mexico. Citigroup had been in talks with German Larrea, CEO and Chairman of Grupo Mexico, for over a year in an attempt to orchestrate the sale of the bank, which was first announced at the start of 2022.

Governance in Brief – May 25, 2023

Activist investor pushes for leadership and strategy changes at NRG Energy Activist investor Elliott Investment Management has disclosed a 13% stake in the US-based NRG Energy and called for leadership and operational changes at the company to remedy its “meaningful underperformance.” The investor urged NRG to add independent directors with experience in the power and energy sector to its board, noting that it has already identified five executives to guide the operational and strategic changes.

Related Products

ESG Voting Policy Overlay

Receive voting recommendations based on sustainability principles, ESG research and engagement signals.

Thematic Engagement

Our Thematic Engagement program includes several corporate governance related engagement themes.

ESG Risk Ratings

Take a coherent and consistent approach to assessing financially material ESG risks.