The construction industry can have a reputation for workforce insensitivity and is highly vulnerable to economic and social variabilities. The ESG Impacts of COVID-19 drive companies to adapt to significant challenges related to the demand for construction services. This construction sector research snapshot highlights relevant social issues that corporations face due to ripple effects from the pandemic using Sustainalytics’ ESG Risk Ratings and Controversies Research.

Financial Impacts

The analysis presented here is based on a selection of 80 companies within the Sustainalytics universe that have their business related to the following subindustries: Building Products, Construction Materials, Homebuilding and Non-Residential Construction. Although the overall impact on the demand for construction was negative, the companies’ revenue breakdown by region showed signs of resilience in the US, China, and Germany. In addition, besides the demand impact, many companies with operations abroad had their financial results affected by the depreciation of local currencies against the parent, especially in Latin American countries.

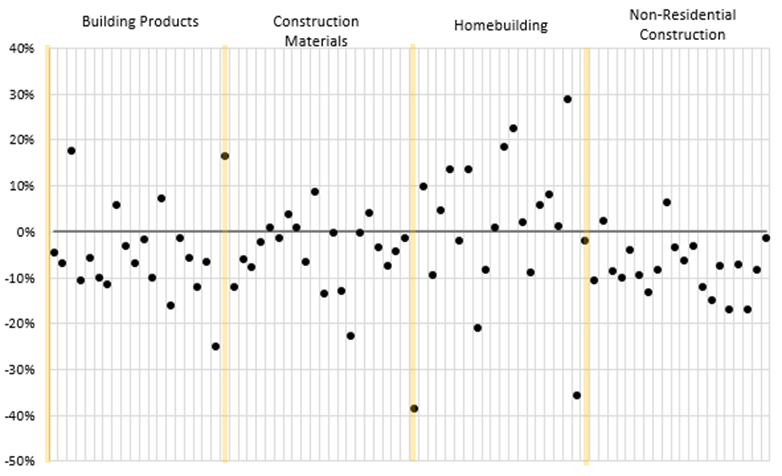

Figure 1 shows the FY2020 revenue growth (versus FY2019) of each company as a metric to assess the COVID-19 impacts on the demand for construction services.

Figure 1: Growth in Revenue 2020, (YoY %) – 80 companies within construction industry Sources: Financial reports from 80 analyzed companies

Based on the selected group of companies, Homebuilding is the only subindustry presenting an average increase in revenue, although the high standard deviation indicates a sizable variation across the companies. American firms benefited from a strong housing market, driven by low mortgage rates and a low inventory of homes for sale.[i] Japanese homebuilders also showed resilience in the period, considering low-interest rates on housing loans and government support for home buyers. On the opposite side of the spectrum, British homebuilders were negatively affected, mainly due to more restrictive lockdown measures adopted in the UK, which forced most companies to cease their operations in the second quarter of 2020.

Non-Residential Construction appears to be the most affected subindustry, with the highest average revenue decrease. 90% of the companies analyzed in this subindustry had their revenues decreasing in 2020. As the construction sector is sensitive to economic cycles, pandemic-related effects on supply chains, business continuity, and lower demand have contributed to this fall.

As the suppliers of the two subindustries discussed above, Construction Materials and Building Products companies tend to correlate their demand. In general, companies related to the North American real estate market had their revenue less impacted than the other companies, which increased the average growth of the analyzed pool. However, both subindustries were highly impacted, presenting a drop in revenue of around 4% on average.

Across the companies analyzed, common measures adopted to counteract the decrease in revenues include cuts to non-essential expenses, reduction of capital expenditures and executive payroll, obtention of loans, suspension of dividends, and labor-related measures. The latter will be discussed in the following section.

Social Impacts

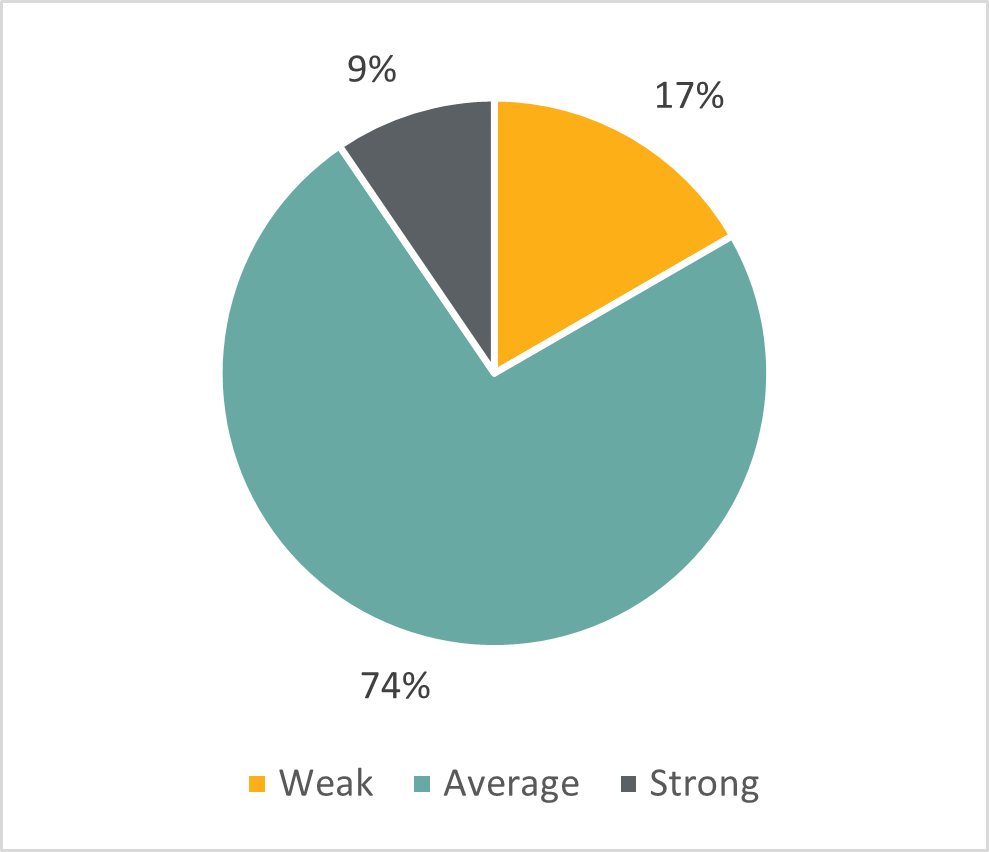

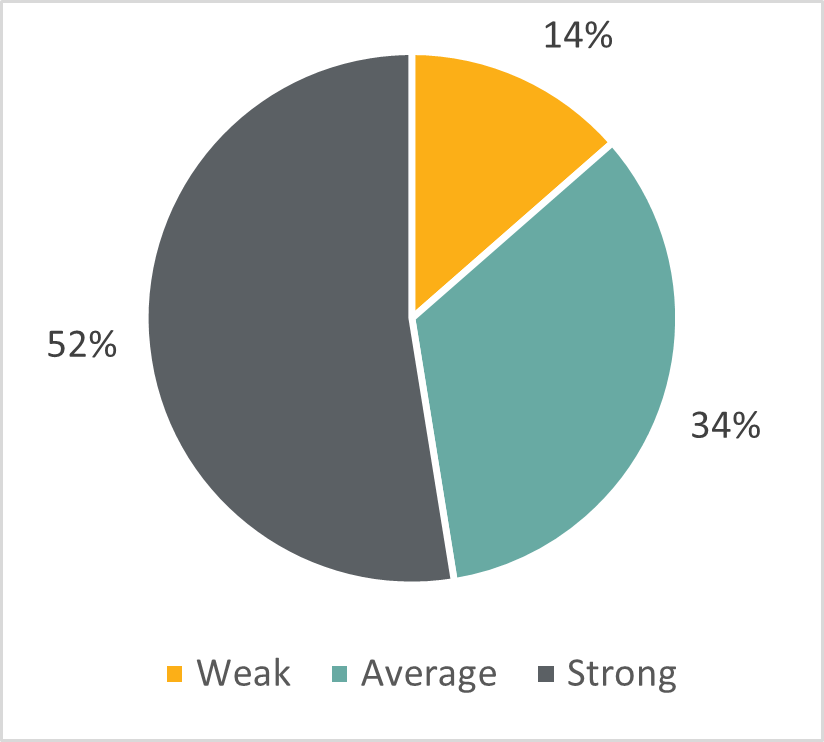

The challenges imposed by COVID-19 to companies are mainly social aspects of ESG, linked primarily to Human Capital and Occupational Health and Safety. The figures below show how well companies manage risks related to Human Capital and Occupational Health and Safety, as per our ESG Risk Ratings assessment.

1. Human Capital

With the decline in construction activity and the weakening of companies’ finances, many firms had to reduce their workforce. The issue is intensified by informality and subcontracting, which are prevalent in parts of the construction industry. Considering the high competition for skilled professionals, the dismissals and freezing of the recruitments process could lead to future labor shortfalls for those companies. Of the companies that disclosed their workforce variation between 2019 and 2020, 63% showed a decline in the number of employees. However, firms where our ESG Rating Risk Score reflects robust management of Human Capital issues have implemented several initiatives to suppress the COVID-19 downturn impact on the workforce. Examples include providing regular salaries for employees placed on furlough and advancing payments for contractors within the companies’ supply chain. In addition, many countries – such as Germany and England - have established national employment protection measures that helped construction companies to retain their workforce.

Figure 2: Management score category – Human Capital, Source: Sustainalytics

2. Occupational Health and Safety

Companies had to reinforce and adapt their occupational health and safety measures to incorporate COVID-19 risks. In this context, the International Labour Organization (ILO) has developed health and safety guidelines and checklists specific to the construction industry. The alignment of the companies’ code of conduct with ILO standards is an essential measure to our risk assessment of Labour Relations management. Relevant initiatives observed across the companies analyzed include establishing separate working zones, thermal screening and access to COVID-19 testing in the construction sites and providing psychological support for workers suffering from anxiety caused by the pandemic.

Figure 3: Management score category – Occupational Health and Safety, Source: Sustainalytics

Main controversies

According to the Sustainalytics’ Controversies screening, most COVID-19 incidents in the construction industry are linked to Occupational Health and Safety (OH&S) and Labor Relations. OH&S incidents were primarily related to a failure to implement safety measures against COVID-19 in the workplace. Our Global Standards Screening team has flagged allegations of national decrees violations to pursue business activities and corporate events that did not respect social distancing or lacked sanitation protocols at work sites. Labour relations incidents were mainly associated with strikes over massive dismissals and unpaid wages during Covid-19 lockdowns. Business Ethics issues were notably frequent as well; some companies received pandemic-related government relief while reportedly distributing investor dividends and company executive bonuses.

The Post-COVID World

As the COVID-19 vaccination advances and the economy shows signs of recovery in many countries, the construction industry is expected to gain momentum in the post-COVID scenario.[vi] From an ESG risk mitigation perspective, the implementation of solid human capital initiatives to recruit and retain the workforce is crucial for the companies to ensure a sustainable recovery path. On the demand restoration side, sustainable construction solutions to match the increasing call for green building standards can help companies gain market share.

Sources:

.png?Status=Master&sfvrsn=f46cedf4_1)