The European Commission has recently introduced the Environmental Delegated Act to expand the environmental classifications in the European Union’s taxonomy for sustainable finance activities (EU taxonomy). Known as Taxo4, the framework aims to go beyond climate objectives and cover other crucial environmental aspects, such as biodiversity, water, pollution, and the circular economy. Below we look at what the new criteria cover and why it matters to investors.

What Is the EU Taxonomy?

The EU taxonomy is a classification system developed to identify and define environmentally sustainable economic activities. It aims to provide clarity and transparency on which activities can be considered environmentally sustainable, and to promote sustainable investments and economic growth.

To that end, the founding regulation establishing the EU Taxonomy requires issuers and various products and entities within the financial industry to disclose how they align with this classification system. Financial products covered include pension and insurance-based products, investment funds, and investment mandates. Financial market participants such as banks, asset managers, insurers, and reinsurers, are also subject to this requirement.

The EU taxonomy regulation defines six primary environmental objectives: climate change mitigation; climate change adaptation; sustainable use and protection of water and marine resources; transition to a circular economy; pollution prevention and control; and protection and restoration of biodiversity and ecosystems. The specific screening criteria needed to assess substantial contributions to the first two objectives – climate change mitigation and adaptation – have already been established. The new Environmental Delegated Act looks to focus on the other four objectives.

What Is Covered by Taxo4: A Wider View of Sustainability

The Environmental Delegated Act defines the criteria for economic activities substantially contributing to one or more of the non-climate environmental objectives of the EU taxonomy. It includes 35 activities in eight economic sectors. The Taxo4 proposal expands the coverage of activities that can be considered environmentally sustainable to include, among others, disaster risk management, water supply and sewerage, transport, information and communication technology (ICT) and professional activities, manufacturing, services, and buildings (Table 1).

Table 1. Sectors and Activities Covered by EU Taxo4

Source: European Commission. Sustainable Finance Package 2023.

Why Taxo4 Matters to Investors: Unlocking New Opportunities

Investors are optimistic overall about the expansion of the EU taxonomy and see it as a positive development. This is because issues such as biodiversity loss1 and water stress2 have gained significant prominence, where having new tools to identify related risks and opportunities is invaluable.

Secondly, regulatory requirements already demand that financial market participants disclose their level of taxonomy alignment as a measure of their sustainability contributions. The proposed criteria will allow them to showcase even greater alignment figures.

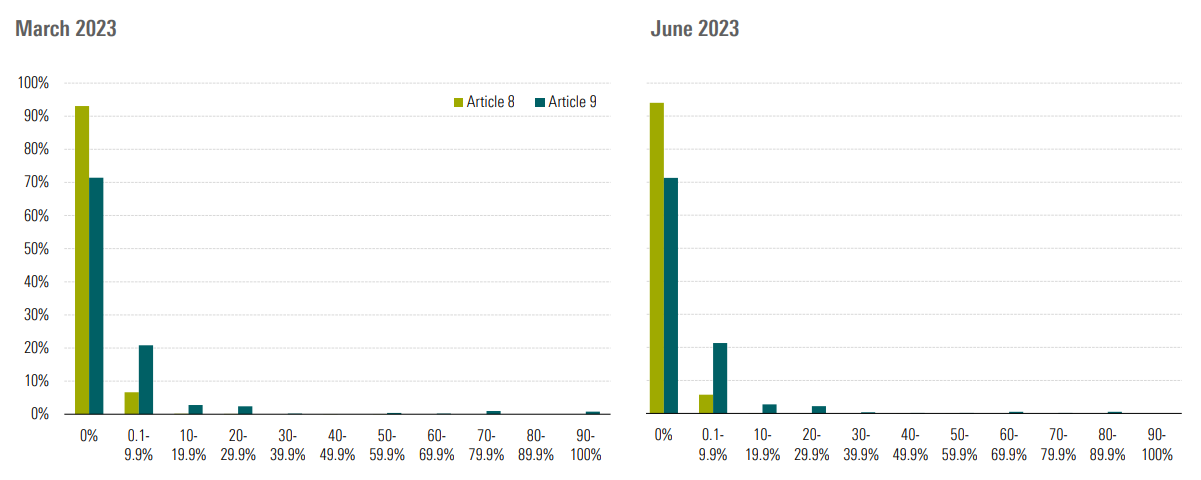

So far, misalignment between issuers’ and investors’ reporting timelines, coupled with a stringent approach regarding the use of estimates, has hindered the taxonomy’s usability. According to Morningstar, as of June 2023, 94% of Article 8 and 71% Article 93 funds reported having no taxonomy-aligned sustainable investments, and only 21% of Article 9 funds reported between 0 and 10% aligned investments — leaving investors frustrated (see Figure 1). However, with the incorporation of the new activities, issuers and investors will have the opportunity to factor them into their alignment reporting.

Figure 1. Proportion of Article 8 and Article 9 Funds With Various Commitments to Taxonomy-Aligned Sustainable Investments4

Source: Morningstar Direct. Data as of June 2023. March 2023 data is based on 4,641 Article 8 funds and 504 Article 9 funds that report the field. June 2023 data is based on 5,564 Article 8 funds and 586 Article 9 funds that report the field. For informational purposes only.

Areas That Need Attention

While Taxo4 represents a positive step forward, it does face certain complexities and potential concerns. One notable concern is the lack of clarity regarding the timeline for covering other impactful activities. Key sectors such as agrifood and mining are not yet covered, and a decision on the adoption of a delegated act for a second set of activities is pending. With the looming European Parliament elections scheduled for May 2024, it is likely that the content of the taxonomy will remain frozen in the short term.

Furthermore, while some sectors remain outside of the taxonomy’s purview, certain activities with questionable sustainability outcomes, like aviation, have been included. This inclusion has already prompted opposition from some investors that may resort to applying specific carve-outs and excluding certain assets, sectors or investments to align with their sustainability preferences or meet their clients’ expectations.

Additionally, the usability of the taxonomy faces constraints as outlined in a recently released frequently asked questions document that states taxonomy-aligned investments via equities or corporate debt will not necessarily qualify as sustainable investments under the Sustainable Finance Disclosure Regulation (SFDR).

Moreover, to avoid double reporting, financial market participants will need to determine how to allocate activities to specific taxonomy objectives. While this accounting approach may seem practical, it runs the risk of losing sight of the bigger picture and disregarding the interconnections between sectors and their impacts across objectives. For example, certain activities, such as renewable energy, can make substantial contributions to multiple objectives like climate and pollution. Unfortunately, end investors may not be adequately informed of these multifaceted contributions.

Striving for an Effective EU Taxonomy

The introduction of Taxo4 marks a significant step forward for investors seeking sustainable investments. However, there is still work to be done to refine the EU taxonomy and make it more accessible for investors. This includes addressing criticisms, incorporating missing sectors, and improving the usability of the taxonomy for a global investment context.

As we await further developments, it will be up to the next European Commission to take the reins and shape the future of the EU taxonomy. By doing so, they can ensure the taxonomy becomes a valuable tool for investors, helping to drive sustainable change and making a positive impact on our environment.

References

- Andersen, S. 2022. "Biodiversity loss and climate change call for a nature-positive economy – Stewardship may lead the way." Morningstar Sustainalytics. May 4, 2022. https://www.sustainalytics.com/esg-research/resource/investors-esg-blog/biodiversity-loss-and-climate-change.

- Zerter, L. and Karoui, A. 2022. "The Emergence of Water Risk: From Marginal to Systemic." Morningstar Sustainalytics. April 19, 2022. https://www.sustainalytics.com/esg-research/resource/investors-esg-blog/emergence-of-water-risk.

- Under the Sustainable Finance Disclosure Regulation, Article 8 funds (light green) are classified as those that promote environmental and/or social characteristics and Article 9 funds (dark green) have a sustainable investment objective. See SFDR Article 8 and Article 9 Funds: Q1 2023 in Review for more details.

- Bioy, H., Wang, B., Carabia, A., and Biddappa, A R. 2023. “SFDR Article 8 and Article 9 Funds: Q2 2023 in Review.” July 27, 2023. Morningstar Manager Research. https://assets.contentstack.io/v3/assets/blt4eb669caa7dc65b2/blt9685e938248f0c02/64c27d4941fe507d980dc439/SFDR_Article_8_and_Article_9_Funds_Q2_2023_FINAL_2.pdf.