Key Insights:

|

|

|

|

Fund names are important signals of a fund’s investment strategy and portfolio composition. They are also a powerful marketing strategy. With that in mind, and to protect investors against greenwashing risks, the European Securities and Markets Authority (ESMA) released guidelines on funds’ names using ESG or sustainability-related terms in May 2024.1 Consistent with the scope of the Sustainable Finance Disclosure Regulation, or SFDR, the guidelines are directed at fund managers marketing funds in the EU. These managers had until May 21, 2025 to either align with the new requirements or change the funds’ names to comply.

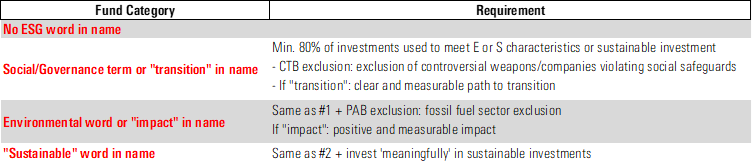

Table 1. Summary of ESMA’s Categories of Terms and Related Requirements

Source: Morningstar Sustainalytics.

Notes: Summary is based on ESMA’s final report on the guidelines on funds' names. PAB stands for Paris-aligned benchmarks. CTB stands for climate-transition benchmarks.

Exclusions related to the Paris-aligned benchmark (PAB), and which environmental, ESG, sustainable, and impact funds are required to apply, are particularly significant as they rule out investments in companies that derive a certain proportion of their revenues from fossil fuels.

In our latest report, we look at how the universe of open-end and exchange-traded funds in scope of the ESMA fund naming guidelines has changed since their introduction in May 2024. We analyzed rebranding activity and assessed the impact of the requirements — primarily exclusions — on fund portfolios using Morningstar Sustainalytics’ company ESG research.

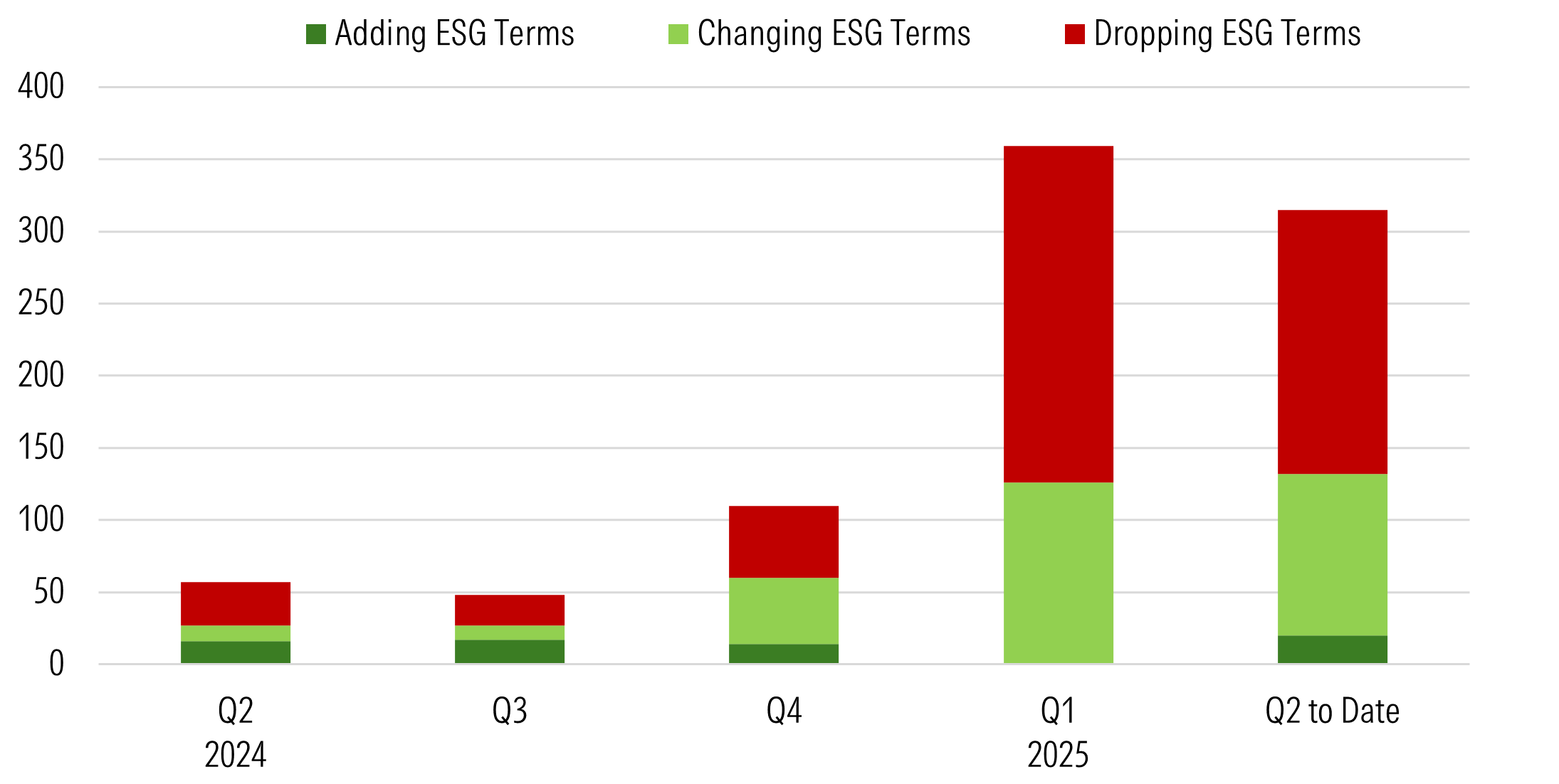

We estimate that at least 880 funds using ESG-related terms in their names (or 19% of the 4,570 in-scope funds in May 2024) have rebranded in the past 12 months. This includes 508 funds that have dropped ESG-related terms, 304 that have replaced one ESG term with another, and 68 that have added an ESG term.

Figure 1. In-Scope Rebrand Funds

Source: Morningstar Direct.

Notes: Data as of May 16, 2025. Based on 880 funds that have added, dropped, or changed ESG- and sustainability-related terms in their legal names since May 14, 2024. Including money market funds, funds of funds, and feeder funds.

Article 8 funds make up the majority of rebranded products (89%), followed by Article 9 funds (8%) and Article 6 funds (3%). Meanwhile, passive funds are disproportionately represented, accounting for one-third of rebranded products, more than triple their presence in the SFDR fund universe.

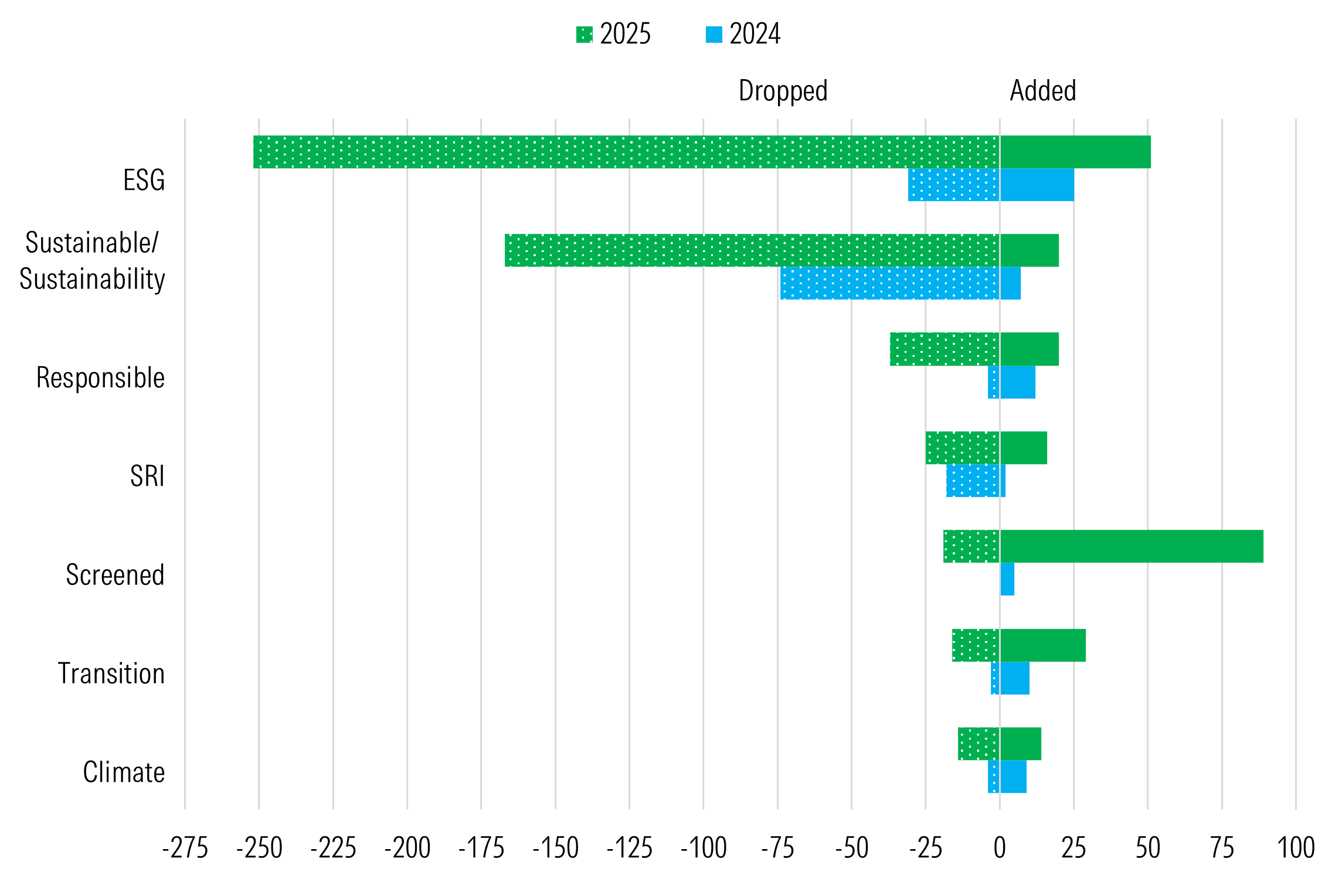

The exhibit below shows that “ESG” was by far the most dropped or replaced term by rebranded funds, followed by “sustainable.” At the same time, “ESG” was also the second most frequently added term to fund names during this period; the first was “screened” and the third was “transition.”

Figure 2. ESG-Related Terms With the Most Frequent Changes in the Past 12 Months

Source: Morningstar Direct.

Notes: Data as of May 16, 2025. Based on 880 renamed funds between May 2024 and May 2025. Data includes money market funds, funds of funds, and feeder funds.

Contentious ESG-Related Terms Replaced With Non-ESG Alternatives

Among the 508 funds that removed ESG-related terms from their names, about 200 funds (40%), primarily passive ones, have retained or introduced alternative, often vaguer, terms such as “screened,” “select,” “committed,” or “advanced.” This suggests that managers remain keen to signal ESG characteristics — primarily via exclusions — through fund names.

These substitutions indicate a shift in language, as managers adjust their wording to comply with regulatory requirements, while continuing to respond to investor preferences. Strategies based solely on exclusions continue to appeal to certain investors. We identified more than 200 products that replaced contentious words, such as “sustainable” and “ESG,” with non-ESG alternatives.

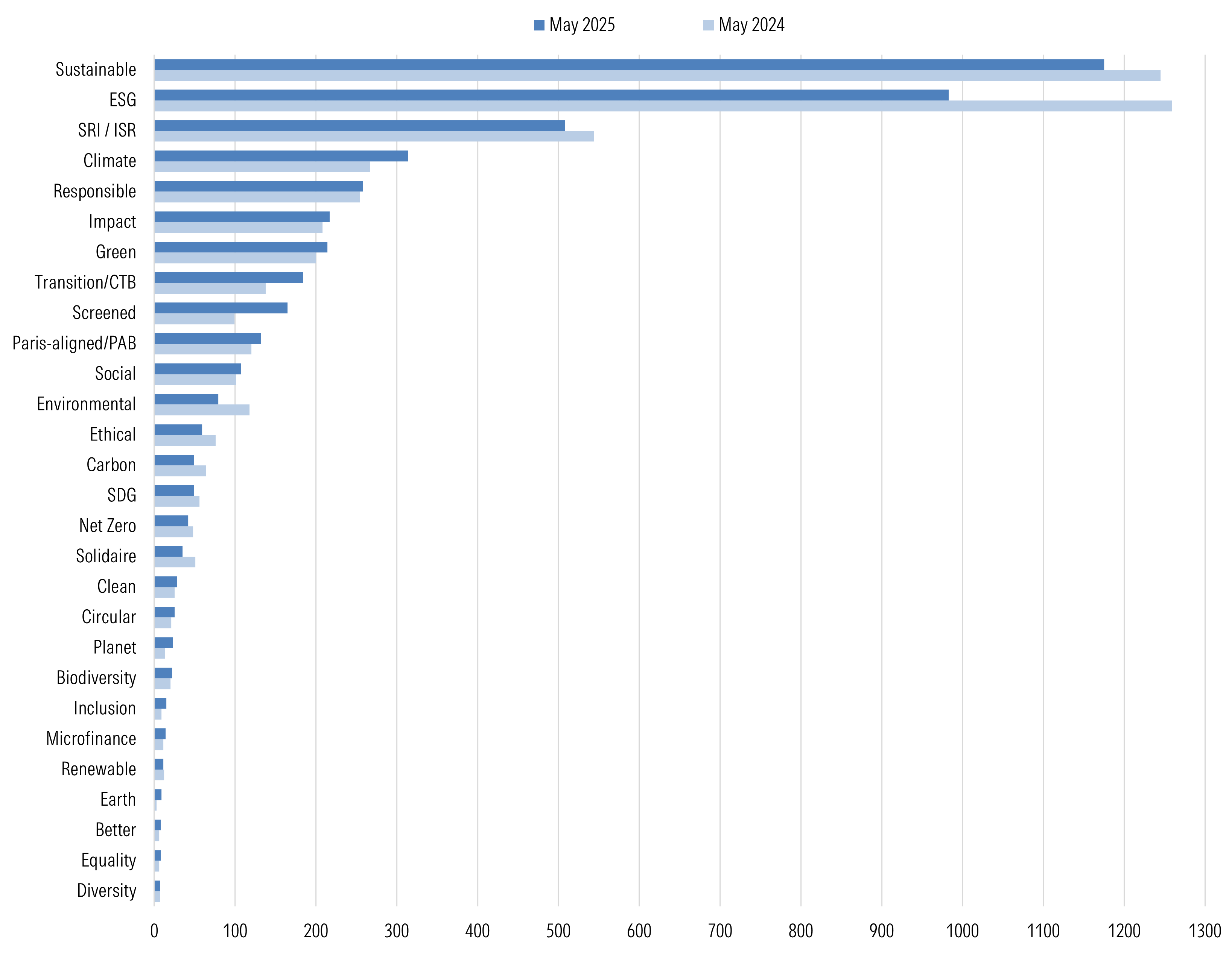

As a result of the fund rebranding activity, combined with fund launches, mergers and liquidations, we estimate that the universe of funds using ESG and sustainability-related terms in their names has decreased by only 8% (to around 4,220 funds) over the past year, reflecting the continuous market interest despite the regulatory scrutiny. And the chart below shows that “sustainable” and “ESG” remain the most commonly used terms in fund names.

Figure 3. Most Commonly Used Sustainability-Related Terms and Number of Occurrences for In-Scope Funds

Source: Morningstar Sustainalytics. Morningstar Direct.

Notes: Data as of May 16, 2025. Money market, funds of funds, and feeder funds are included. Numbers include ESG or sustainability-related terms in English and non-English languages. Funds can be counted multiple times. This list is not comprehensive. Additional terms were included in our search and our analysis but do not appear here.

Asset Managers Have Taken Various Approaches to Comply with the Guidelines

Asset managers have adopted various approaches to comply with the ESMA guidelines. Over the past year, they assessed which funds within scope could retain their ESG-related terms based on the underlying strategies and portfolios. Some made minor adjustments, such as divesting from companies that breach exclusion rules. Others refined the funds' investment objectives and policies. For funds requiring more extensive changes, managers opted to rebrand, either by replacing the ESG-related term or removing it altogether. However, even some rebrand funds underwent adjustments to the strategy and/or portfolio. All of this means that, whether they were rebranded or not, funds within the scope of the guidelines may require investors to reassess the funds they hold to ensure they still align with their preferences.

An Early Assessment of Portfolio Impact

As part of our analysis, we also compared new portfolios with last year’s to assess the impact of the guidelines' exclusion rules on in-scope funds. As expected, we found that the number of funds holding contentious stocks, especially those involved in fossil fuels, has declined. While some of the stocks are likely to be further divested, others may remain due to differing interpretations of the rules (when it comes to the scope of activities to exclude, for example) and discrepancies in data sources.

Investors should consider all these factors when evaluating a fund’s compliance with the ESMA guidelines. They should also be aware that the more stringent the criteria, the narrower the investable universe.

Download and read the full report: ESMA's Guidelines on ESG Fund Names.

References

- European Securities and Markets Authority. Final Report: Guidelines on funds’ names using ESG or sustainability-related terms. May 14, 2024. https://www.esma.europa.eu/sites/default/files/2024-05/ESMA34-472-440_Final_Report_Guidelines_on_funds_names.pdf.