Key Insights:

|

|

|

|

|

|

Following the European Commission’s release of plans to overhaul the Sustainable Finance Disclosure Regulation (SFDR), we examine what the new landscape of EU sustainability-related funds (Article 7, 8, and 9) could look like and some possible outcomes for each product category, not accounting for any changes that asset managers may make to their product offerings and any changes to current EU regulations. But first, we outline the proposed SFDR changes and key implications for investors and asset managers.

Overhauling SFDR

The European Commission has unveiled its long-awaited proposal to overhaul the SFDR,1 the EU’s transparency framework for financial products integrating environmental or social aims. The move marks a significant shift in EU sustainable finance rules since SFDR’s inception in 2021. The changes aim to simplify the framework, improve usability, and reduce compliance burdens, while addressing persistent concerns around greenwashing and comparability. The proposals are also intended to improve coherence across the EU’s sustainable finance rules, such as MiFID II (Markets in Financial Instruments Directive), PRIIPS (Packaged Retail and Insurance-based Investment Products), and CSRD (Corporate Sustainability Reporting Directive).

From Disclosure to Categorization

The proposal replaces the current Article 8 and Article 9 regime with three product categories:

- Transition (Article 7) Products – 70% of the portfolio must consist of investments that contribute to measurable transition goals (e.g., science-based targets, engagement strategies).

- ESG Basics (Article 8) Products – 70% of investments must integrate sustainability factors.

- Sustainable (Article 9) Products – At least 70% of investments must align with sustainability objectives.

This shift eliminates the definition of sustainable investment, which, according to the commission, generated a considerable number of challenges and concerns. Instead, category-specific criteria will guide product classification.

Simplified Disclosures

The commission proposes significant changes to disclosure templates and entity-level Principal Adverse Impact (PAI) statements:

- Entity-level PAIs are removed entirely.

- Product-level PAIs are maintained, but only for Transition and Sustainability categories and are focused on material impacts rather than exhaustive lists.

- Pre-contractual templates will be capped at two pages, with a clear section titled “How sustainable is this product?”. For Transition and Sustainable funds with an impact objective, there will be an additional one-page allowance to cover the intended impact and relevant metrics.

Fund reporting on Taxonomy alignment is no longer mandatory but remains an important optional pathway with relevant safe harbors to qualify for the Transition and Sustainable label, alongside EU climate benchmarks and green bonds.

Exclusions and Guardrails

The proposal introduces mandatory exclusions for controversial weapons, tobacco, and violations of UN Global Compact/Organisation for Economic Co-operation and Development principles across all categories. Transition products also have restrictions around new fossil fuel exploration, while Sustainable products are subject to the full exclusion of fossil fuels as stipulated in the requirements for Paris-Aligned Benchmarks (PAB) in the benchmark regulation. The topic of fossil fuel exclusions is likely to spark further debate.

What This Means for Asset Managers

- Reclassification required: Existing Article 8 and 9 funds will need to requalify under the new regime — there is no grandfathering.

- Data strategy shift: ESG data needs will move from volume to quality and credibility, with emphasis on exclusions, EU Taxonomy alignment, transition plans, and engagement metrics.

- Investor communication: Shorter, clearer disclosures aim to improve retail usability and comparability, but managers must prepare for scrutiny on category criteria.

Another Reclassification Wave

Since the inception of SFDR in March 2021, many funds (active and passive) have changed SFDR status, moving between Article 6 (funds not categorized as sustainability-related), Article 8, and Article 9. The largest wave of reclassifications occurred at the end of 2022, when more than 300 Article 9 funds downgraded to Article 8. The implementation of the European Securities and Markets Authority fund naming guidelines earlier this year prompted further changes. Once SFDR 2.0 rules are in place, financial products will have to reclassify to the new product categories.

With the exact rules around exclusions and qualifying criteria to be defined in delegated acts at a later stage, there is still some uncertainty around how current Article 8 and Article 9 funds would likely reclassify. Notably, it is not clear whether a Paris-aligned product (active or passive) would classify as a Transition or Sustainable fund. At present, certain PAB funds fall under Article 8 (some having been downgraded from Article 9 in 2022), while others are classified as Article 9. Another area of uncertainty is how the proposed criteria for the ESG Basics category will be interpreted and whether additional criteria will be introduced (beyond the mandatory exclusions).

Nonetheless, using assumptions and Morningstar data points, we estimated what the new landscape of EU sustainability-related funds may look like and a range of outcomes for Article 6, 7, 8, and 9 funds. For that purpose, we have created two sets of assumptions — one looser and one stricter — without considering any changes that asset managers may make to their product offerings or any upcoming changes to EU regulations.

Range of Potential Outcomes for Article 6, 7, 8, and 9 Funds

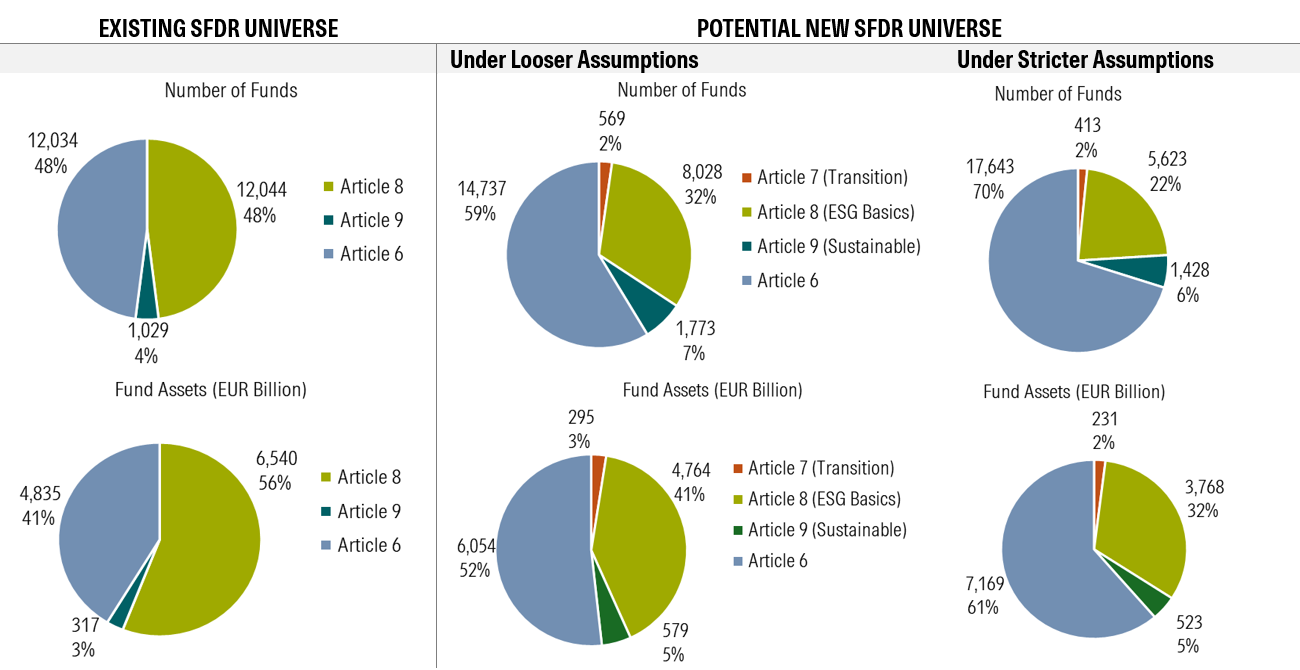

Our first observation (Figure 1) is that regardless of the assumptions and measures (number of funds or AUM), the Transition (Article 7) category will likely represent a niche segment of the EU fund market, with a share estimated between 1.6% and 3%. In that category, we included all active and passive funds that have a climate transition or Paris-aligned strategy, as well as funds with transition-related terms within their name. (For additional information, read Investing in Times of Climate Change).2

Figure 1. Forecast of How SFDR 2.0 Could Reshape the EU Fund Universe

Source: Morningstar Sustainalytics. Data as of November 2025, excluding money market funds, feeder funds, and funds of funds.

The Sustainable (new Article 9) category could double in size but remain small, potentially reaching between 4.5% and 7% of the EU fund universe, depending on the measure (by AUM or number of funds), up from just 2.7% (by AUM) and 4% (by number of funds), today.

This new Article 9 category will encompass a broader and more diversified range of strategies than it does today, mainly because the requirement for 100% of sustainable investments will no longer exist. As we highlighted in our SFDR Q3 review,3 two-thirds of funds with sustainable in their names are currently classified as Article 8. We expect many of these to migrate to Article 9, provided they comply with its fossil-fuel exclusion rule.

As intended by the commission, the ESG Basics (new Article 8) category will shrink. But the extent of this reduction will depend on the strictness of the final criteria and how they are interpreted by the market. The proposed minimum exclusions for the new Article 8 category do not represent a high hurdle, nor does the outperformance of the investment universe based on sustainability factors (another proposed criteria).

However, additional and more constraining criteria could significantly reduce that category.

Under our stricter assumptions, the number of funds in the new Article 8 category could fall by more than half, dropping to 22%, from 48% today. Under our looser assumptions, the category could still represent 32% of EU funds. In AUM terms, its market share could decline to between 32% and 41%, down from 56% today.

Finally, by all measures, funds not categorized as sustainability-related (Article 6) are set to represent the largest segment of the EU fund market, reaching between 52% and 70% of the universe, up from 48% (by number of funds) and 41% (by AUM) today.

Table 1 presents our list of quantitative assumptions for the two scenarios outlined above. These do not strictly mirror the commission’s proposed criteria, as we have incorporated qualitative assumptions informed by our understanding of the current EU fund universe. Also, as noted earlier, the purpose of this analysis is to illustrate two extreme types of potential outcomes, ignoring any potential changes that asset managers may make to their product lineups and any changes to current EU regulations.

Table 1. Quantitative Assumptions Underlying Our Two Scenarios

| Article 7 | New Article 9 | |

|---|---|---|

| Looser Assumptions |

|

|

| Stricter Assumptions |

|

|

* Or Net Zero, Progress, Transformation, Improvers

| New Article 8 | New Article 6 | |

|---|---|---|

| Looser Assumptions |

|

|

| Stricter Assumptions |

|

|

Source: Morningstar Sustainalytics

Next Steps

The proposal now enters the EU legislative process, with final rules expected no earlier than 2026–2027. Delegated acts will define category names, thresholds, and templates — critical details for implementation. Implementation timelines are yet to be confirmed, including how existing rules may be enforced during the transition period between publication (in the Official Journal of the EU) and when the new rules come into effect.

Sustainalytics actively engages with policymakers and ensures that our EU regulatory solutions continue to help clients navigate SFDR 2.0. Our focus is to enable robust product classification, credible sustainability metrics, and streamlined reporting workflows.

For further analysis, read SFDR Article 8 and Article 9 Funds: Q3 2025 in Review, and Investing in Times of Climate Change.

References

- European Commission. 2025. Commission simplifies transparency rules for sustainable financial products. November 20, 2025. https://finance.ec.europa.eu/publications/commission-simplifies-transparency-rules-sustainable-financial-products_en.

- Bioy, H., Wang, B. 2025. Investing in Times of Climate Change. November 2025. https://www.morningstar.com/business/insights/research/investing-in-times-of-climate-change.

- Bioy, H., Wang, B., Lennkvist, A., and Mitchell, L. 2025. SFDR Article 8 and Article 9 Funds: Q3 2025 in Review. October 29, 2025. https://www.morningstar.com/en-uk/business/insights/research/sfdr-article8-article9.