Key Insights:

|

|

With the EU’s Capital Requirements Directive (CRD VI) coming into effect, and amid the recently released Basel framework guidelines, IFRS S2 Climate-related Disclosures, and the European Banking Authority (EBA) guidelines, global systemically important banks (G-SIBs) are under mounting pressure from regulators and investors to demonstrate credible, data-driven management of climate‐related financial risks. A report by Morningstar Sustainalytics analyzed all 29 G-SIBs, revealing some divergence in preparedness. While certain European and UK banks lead with advanced governance, scenario analysis, and integration of climate risk into capital and liquidity planning, some North American and Chinese institutions lag, particularly in quantitative assessment and disclosure. This article highlights some of the report’s findings.

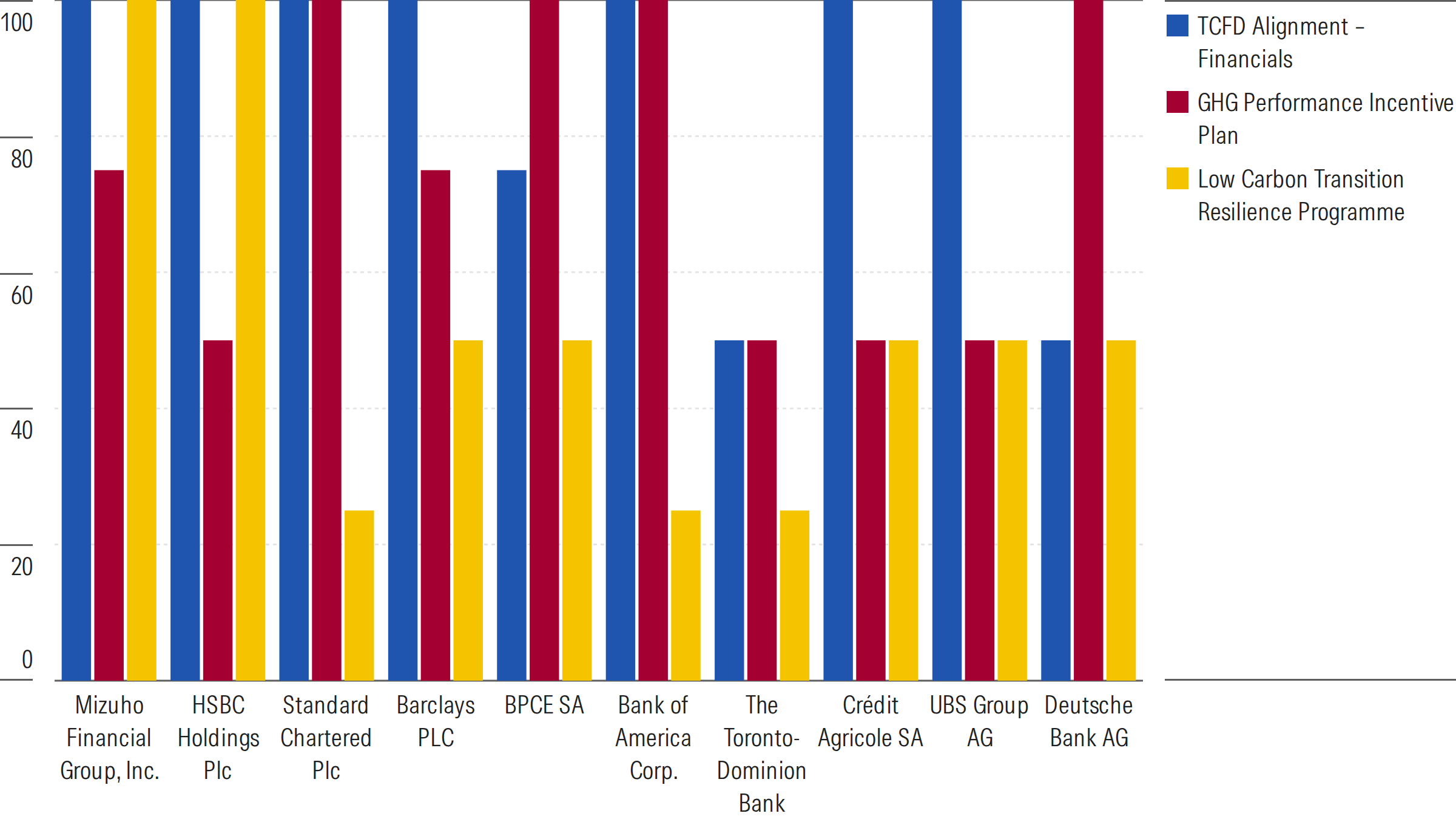

Figure 1. G-SIBs’ Alignment with Key Sustainability Metrics: Top Performers

Source: Morningstar Sustainalytics. Data as of September 11, 2025.

Note: Scores: 100 – Very Strong Performance; 75 – Strong Performance; 50 – Adequate Performance; 25 – Weak Performance.

Regulations for Climate Reporting in Banking Continue to Evolve

The CRD VI, which takes effect in 2026, and the EBA’s guidelines on managing environmental, social, and governance (ESG) risks mandate prudential planning for climate and environmental risks. The Corporate Sustainability Reporting Directive further accelerates disclosure quality and comparability. Meanwhile, the Basel Committee on Banking Supervision's (BCBS's) voluntary framework for climate risk disclosure and IFRS S2 is driving convergence across jurisdictions. In the UK, Canada and Switzerland, mandatory climate reporting is already in place. In Asia, regulation is rapidly evolving. Authorities in Singapore and China expect financial companies to implement International Sustainability Standards Board (ISSB) rules by 2026 and 2027, respectively. Regulators in Hong Kong and Japan have created a roadmap for the decarbonization of lending portfolios.

Linking Executive Pay to Climate Targets

All G-SIBs have established strong climate governance structures aligned with the Task Force on Climate-related Financial Disclosures (TCFD) framework, with boards overseeing climate risk and management tasked with assessing transition and physical risks. However, executive remuneration remains a key differentiator. As of September 11, 2025, 16 G-SIBs linked pay to climate targets, supporting accountability and aligning incentives with long-term strategy. Banks that lack these links — primarily in the US and China, including JPMorgan, Morgan Stanley, Goldman Sachs, State Street, Bank of Communications, and ICBC — fall behind regulatory expectations and peers.

How Well Are G‑SIBs Integrating Climate Risk Into Their Core Strategy?

Most G-SIBs demonstrate adequate or strong alignment between their climate strategies and relevant frameworks, reflecting the influence of TCFD, BCBS guidance, and EBA expectations. Just over half of G-SIBs qualify as best-in-class, with clear approaches to identifying and managing climate risks. Two banks — Mitsubishi UFJ Financial Group and ICBC — show weak alignment, indicating a lack of robustness in terms of climate risk strategy and management. EU regulators expect banks to assess material climate risks and integrate findings into strategy, capital planning, and risk appetite.

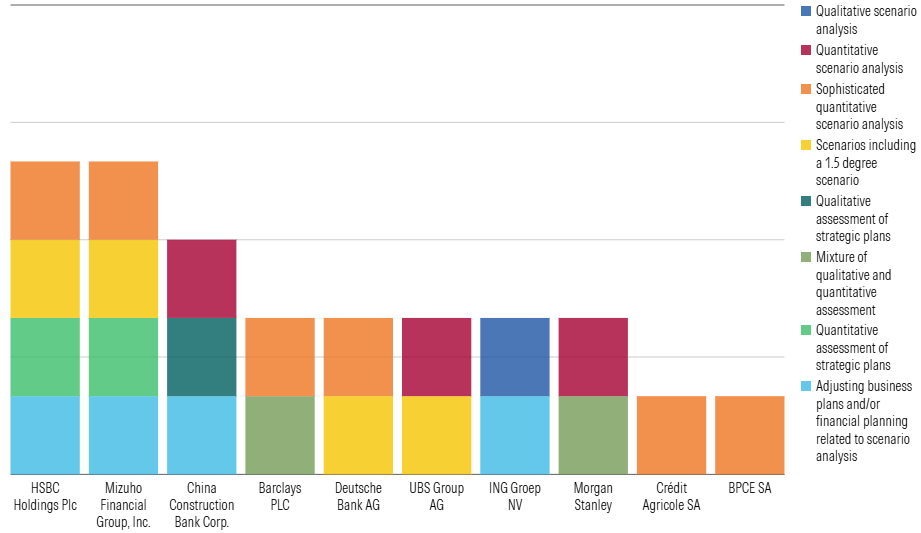

Are Banks Using Climate Scenario Analysis to Strengthen Resilience?

According to Morningstar Sustainalytics data, three out of the 29 G-SIBs have very strong or strong performance in terms of their Low Carbon Transition Resilience Programme. This metric focuses on financial institutions’ climate assessments and considers whether financial companies use them to understand the impact on their business and update their strategy, business plans, and financial planning in line with the TCFD’s recommendations on resiliency. Supervisory authorities increasingly require financial institutions to incorporate climate-related risks within their scenario analysis and stress-testing frameworks to enhance the assessment of vulnerabilities within their portfolios.

The top 10 financial institutions, shown in Figure 2, demonstrate at least adequate preparedness in terms of performing climate assessments and integrating them into their strategic plan and/or financial planning, and are relatively well positioned to align with CRD VI regulation and/or the BCBS’s framework.1 Meeting regulatory requirements indicates a lower probability for regulatory scrutiny and lower compliance costs. This is especially the case for G-SIBs in Europe due to the European Central Bank’s regular follow-ups with financial institutions on their preparedness. Meeting these requirements also helps to reduce financial risk regardless of jurisdiction.

Figure 2. Top 10 G-SIBs Based on Carbon Transition Resilience Programme Performance

Very Strong Performance | Strong Performance | Adequate Performance |

| HSBC Holdings Plc | China Construction Bank Corp. | Barclays PLC |

| Mizuho Financial Group, Inc. | BPCE SA | |

| Crédit Agricole | ||

| Deutsche Bank AG | ||

| ING Groep NV | ||

| Morgan Stanley | ||

| UBS Group AG |

Source: Morningstar Sustainalytics. Data as of September 11, 2025.

Climate Risk in Capital and Liquidity Planning

Based on the outputs of climate-related scenario analyses (e.g., the Network of Central Banks and Supervisors for Greening the Financial System’s climate scenarios), financial institutions should allocate economic capital to either credit, market, or operational risk.2 The EBA expects banks to integrate into their internal capital adequacy assessment process (ICAAP) a forward-looking view of their capital adequacy under adverse scenarios that includes environmental and climate risks among traditional ones such as credit, interest rate, or concentration risk. They must also specify changes to their business plan or other measures derived from climate stress testing. Although 14 out of 29 G-SIBs have started integrating climate into their capital adequacy assessments, there is limited quantitative disclosure of the impact of climate risks on capital.

Table 1. Climate Integration in Capital and Liquidity Adequacy Among the 29 G-SIBs

| Have Started Integrating Climate in ICAAP | Have Started Integrating Climate in ILAAP | No Evidence of ICAAP/ILAAP Integration |

| Barclays PLC | Barclays PLC | Mizuho Financial Group, Inc. |

| Deutsche Bank AG | Deutsche Bank AG | China Construction Bank Corp. |

| UBS Group AG | UBS Group AG | Morgan Stanley |

| BPCE SA | BPCE SA | Bank of Communications Co., Ltd. |

| Standard Chartered Plc | Standard Chartered Plc | JPMorgan Chase & Co. |

| Banco Santander SA | Banco Santander SA | Citigroup, Inc. |

| Société Générale SA | Société Générale SA | Bank of America Corp. |

| HSBC Holdings Plc | HSBC Holdings Plc | The Goldman Sachs Group, Inc. |

| ING Groep NV | Mitsubishi UFJ Financial Group, Inc. | |

| Agricultural Bank of China Ltd. | State Street Corp. | |

| BNP Paribas SA | Sumitomo Mitsui Financial Group, Inc. | |

| Royal Bank of Canada | The Toronto-Dominion Bank | |

| Bank of China Ltd. | Wells Fargo & Co. | |

| Crédit Agricole SA | Industrial & Commercial Bank of China Ltd. | |

| The Bank of New York Mellon Corp. |

Source: Corporate disclosure. Data as of November 2025.

Note: The italicized banks represent the strongest performers in terms of capital and liquidity measures.

Additionally, EU banks are expected to integrate climate risks, among other ESG risks, into their internal liquidity adequacy assessment process (ILAAP), which is used internally to identify, measure, and manage liquidity adequacy under adverse scenarios.3 Based on corporate disclosure, eight out of the 29 G-SIBs use outcomes of their climate scenario analysis to inform their internal liquidity adequacy planning. Best-in-class peers include Deutsche Bank and BPCE, which conduct ad hoc climate stress analysis to reflect the impact of climate risk drivers on liquidity flows.

How Strong Climate Management Can Support Long‑Term Value for Banks

In the medium term, large EU and UK banks may face greater regulatory scrutiny that could translate into additional operational complexity, further investment, and higher compliance costs. Nevertheless, sustainable performance is built over the long term. The identified leaders among the 29 G-SIBs, as shown in Figure 1, appear to be well positioned over the long term to reduce compliance costs, build trust with regulators and investors, and mitigate climate-related financial risks. This progress could ultimately benefit their bottom line and strengthen the resilience of their business model.

References

- Most of these 10 banks are aligned with key expectations of the BCBS’s framework regarding scenario analysis and disclose the climate-related scenarios they used and the sources of those scenarios, including the Intergovernmental Panel on Climate Change, the Network for Greening the Financial System, and the International Energy Agency. They also indicate whether the climate-related scenarios used for the analysis are associated with climate-related transition risks or climate-related physical risks while they typically cover both physical and transition risks and the time-horizons used. While the BCBS’s framework expects disclosure of the scope of operations covered by the scenario analysis, the ECB stresses that banks need to cover within their scenario analysis and stress testing all relevant portfolios and exposures.

- ECB. 2022. “Good practices for climate-related and environmental risk management.” November 2022. https://www.bankingsupervision.europa.eu/ecb/pub/pdf/ssm.thematicreviewcercompendiumgoodpractices112022~b474fb8ed0.en.pdf.

- European Banking Authority. 2025. “Guidelines on the management of environmental, social and governance (ESG) risks.” January 2025. https://www.eba.europa.eu/sites/default/files/2025-01/fb22982a-d69d-42cc-9d62-1023497ad58a/Final%20Guidelines%20on%20the%20management%20of%20ESG%20risks.pdf.