Key Insights

|

|

|

With biodiversity loss increasingly recognized as a systemic risk to the global economy,1 more financial institutions are beginning to address the nature-related risks and opportunities associated with their financing activities. However, based on our engagement with key global financial institutions as part of our Biodiversity and Natural Capital Thematic Stewardship Program, we have identified three common challenges they are currently facing, as well as potential opportunities for overcoming them.

Nature-Related Risk Assessments Remain at the Hotspot Level

According to the Responsible Investor Nature Survey 2025, which gathered responses from 100 global asset owners and asset managers, when asked whether their organization has sufficient data to effectively measure nature-related risks, impacts, and dependencies, 63% responded “no,” 25% said they “don’t know,” and only 13% answered “yes.”2

Most institutions currently rely on tools such as ENCORE, the World Wide Fund for Nature’s (WWF) Biodiversity Risk Filter, and World Resources Institute’s (WRI) Aqueduct for water risk assessments. For example, ING Groep’s Nature Report, includes a hotspot analysis identifying sectors with high impacts and dependencies.3 Sumitomo Mitsui Financial Group’s Taskforce on Nature-related Financial Disclosures (TNFD) report also features a heatmap of priority sectors.4 Among the global financiers we engage with, more than half of them have conducted initial hotspot evaluations, but none have yet provided deeper, more granular assessments at the portfolio level.

Since nature-related risks are highly localized, often occurring at the subnational level and not where institutions are headquartered, risk assessments may be more meaningful when they incorporate value chain insights and asset-specific location data. For example, in the agricultural sector, diverse challenges arise across subsectors such as livestock, fruit cultivation, and cereal production, each presenting distinct nature-related risks and opportunities. Moreover, scaling up these commodity-specific assessments across a financial institution’s entire lending book and portfolio remains a significant challenge.

Nature Financing Lacks a Clear Taxonomy and Investable Projects

In addition to managing nature-related risks, financial institutions face challenges in capitalizing on nature-related opportunities. The financial industry is still in the early stages of developing a common taxonomy to identify activities that contribute to nature-positive outcomes. The absence of a globally recognized taxonomy is a major barrier to implementation. While the EU Taxonomy offers some guidance, it is limited to sectors like conservation and forestry, and does not comprehensively cover all relevant activities. Although there has been growing interest from investors in nature financing, there remains a shortage of bankable projects in the market and effective financial vehicles to channel capital for the greatest positive impacts.5

Based on my engagement dialogues with global financiers, insufficient policy and regulation make it difficult to create a global enabling environment. The National Biodiversity Strategies and Action Plans (NBSAPs) outlines a country’s plan to protect nature and mobilize actions and funding for biodiversity recovery. However, more than 85% of countries still haven’t updated their NBSAPs in line with the goals from the Global Biodiversity Framework as of the end of 2024.6 As the national-level ambitions and regulations are not advancing, there are limited demands from the private sector for nature-related finance, despite investor appetite.

Trouble in Setting Effective and Measurable Nature Targets

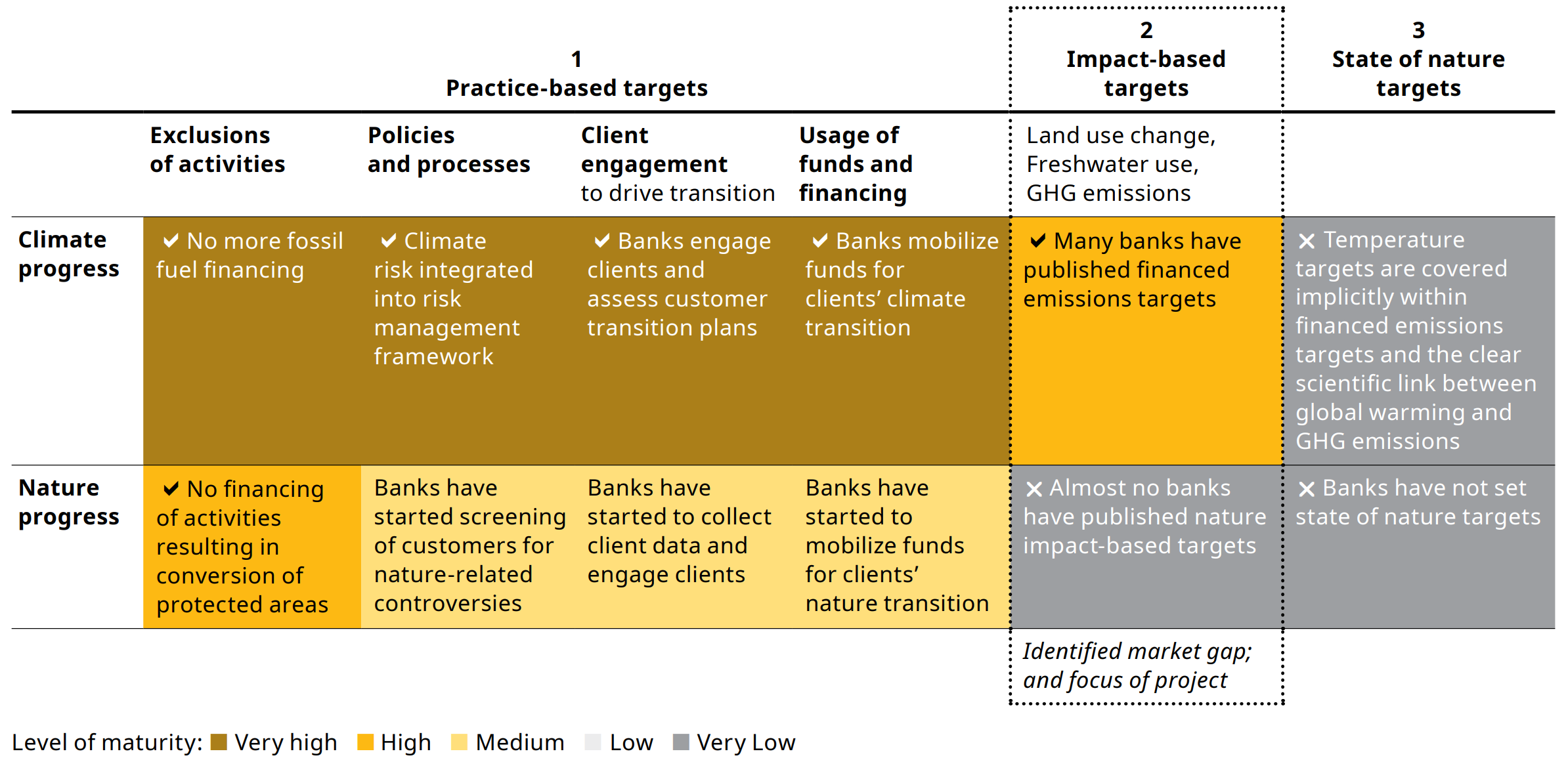

Due to current data limitations, financial institutions are not yet able to evaluate the nature-related performance of their financing activities. As a result, most nature-related targets remain qualitative. A recent research paper by Oliver Wyman categorizes nature targets into three types: practice-based targets, impact-based targets and state-of-nature targets.7 While many institutions have adopted practice-based targets, nearly none have progressed to setting impact-based or state-of-nature targets. This outcome is also reflected by the financial institutions in our Biodiversity and Natural Capital Thematic Stewardship Program. Many have not made significant progress toward setting targets for material impacts and dependencies. Going forward, our engagements will encourage financial institutions to adopt impact-based targets with quantifiable and measurable outcomes to reduce environmental harm and enhance ecosystem health effectively.

Figure 1. Banks’ Adoption of Climate and Nature Targets

Source: Oliver Wyman analysis. For informational purposes only.

Looking Ahead

To address these challenges, collaboration is essential across financial institutions, academia, NGOs, and governments. Establishing a common baseline and shared expectations may help level the playing field and drive consistency across the market. Several initiatives are already supporting this effort. For instance, the Finance for Biodiversity Foundation has grown significantly since its launch in 2020, continuously updating its guidance and best practices to accelerate the integration of nature considerations into financial decision-making. Additionally, the TNFD anticipates that enabling data, analytics tools, technologies, and methodologies will continue to evolve.8

In the meantime, it is important for financial institutions to build internal expertise and resources to meet future reporting and regulatory requirements, such as the Corporate Sustainability Reporting Directive (CSRD) and International Financial Reporting Standards (IFRS). Our engagement efforts with financial institutions suggest constructive actions and provide market intelligence to keep them informed about available guidance, support the adoption of good practices, and help them meaningfully mitigate nature-related risks across their financing activities. For more information, please reach out to [email protected].

References

- World Economic Forum. 2025. "The Global Risks Report 2025: 20th Edition." January, 2025. https://reports.weforum.org/docs/WEF_Global_Risks_Report_2025.pdf.

- Fitzgeorge, L., & Gambetta, G. 2025. “RI Nature and Investors Survey 2025: Results.” Responsible Investor. June 12, 2025. https://www.responsible-investor.com/ri-nature-and-investors-survey-2025-results/.

- ING Group NV. 2024. ING’s nature approach. https://tnfd.global/wp-content/uploads/2024/06/Nature-Publication-ING-Groep-NV.pdf.

- SMBC Group. 2023. TNFD Report 2023. https://www.smfg.co.jp/english/sustainability/materiality/environment/naturalcapital/pdf/tnfd_report_e_2023.pdf.

- United Nations Environment Programme Finance Initiative (UNEP FI). 2024. “Trend Report Nature and Finance: Looking ahead to 2025.” https://www.unepfi.org/themes/ecosystems/trend-report-nature-finance-looking-ahead-to-2025/.

- Dunne, D., & Greenfield, P. 2024. “COP16: More than 85% of countries miss UN deadline to submit nature pledges.” Carbon Brief. October 15, 2024. https://www.carbonbrief.org/cop16-countries-miss-un-deadline-to-submit-nature-pledges/.

- Neumann, C.; Tsim, J. & Bailey, R. 2025. “How Banks Can Contribute to Global Nature Goals.” Oliver Wyman. https://www.oliverwyman.com/content/dam/oliver-wyman/v2/publications/2025/jun/how-banks-can-contribute-to-global-nature-goals-06082025.pdf.

- Taskforce on Nature-related Financial Disclosures (TNFD). 2025. “Discussion Paper on Identification, Assessment and Disclosure of Dependencies and Impacts on Nature in Financial Portfolios.” https://tnfd.global/wp-content/uploads/2025/08/Discussion-paper-on-identification-assessment-and-disclosure-of-dependencies-and-impacts-in-financial-portfolios_.pdf?v=1754395815.