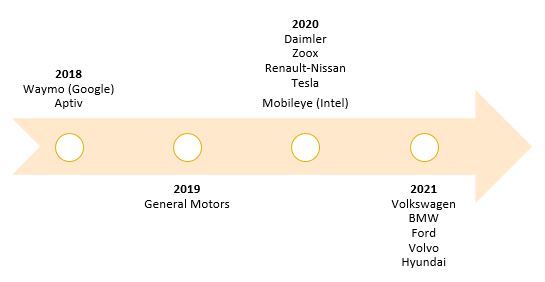

As technology and automobile companies race to bring autonomous vehicles (AVs) to the road, we consider the ESG risks and opportunities facing this disruptive technology. Estimates of when AVs will be fully automated vary (Figure 1); however, the consensus is that AVs are inevitable and different stages of automation will be slowly introduced.

Estimates suggest that 98% of new cars sold in Europe and the US by 2021 will be connected cars[i], vehicles that can communicate with other vehicles, networks and infrastructures via the internet. Since an AV is, by definition, a connected car, it inherits all ESG issues related to a connected car. With companies moving closer to commercialization, and regulators and consumers trying to catch up to this rapidly advancing technology, public trust is identified as the biggest barrier to adoption. We discuss concerns surrounding safety and privacy that could impact public trust.

Figure 1: AV companies’ estimate of when they will achieve Level 4 automation[ii]

Vehicle automation is categorized from Level 0 (No automation) to Level 5 (full automation). Level 4 (High Automation) is when a self-driving vehicle can perform all aspects of driving under certain circumstances, without any intervention from a human driver [iii]

Self-managing safety risks

In March 2018, Uber’s self-driving car was involved in a fatal crash. Investigations revealed Uber disabled Volvo’s automatic emergency braking system to prevent erratic driving and the safety driver was distracted at the time of the accident. Unsurprisingly, following this accident the public’s trust in AVs declined[iv].

Companies have taken different approaches to ensure safety in AVs. For instance, GM imposes a speed limit of 25 miles per hour on its AVs. In 2018, six companies filed voluntary safety self-assessment reports[v] with the US National Highway Traffic Safety Administration (NHTSA). Despite some useful information, such as component testing procedures and analyses of crash scenarios, the reports provide limited information that can be used to accurately assess safety performance.

The ethical principles underlying decisions made by AVs are also unclear. Companies typically use model cities with street signs and fake pedestrians for preliminary testing. Do these testing grounds include simulations of senior citizens, children, minorities and disabled people? User diversity is key for safety given well documented cases of bias in image recognition technology[vi]. Governments are catching up with this nascent technology and are starting to impose regulations on AVs[vii]. However, creating regulation for new technologies is complex and slow; leaving companies to regulate themselves.

Privacy and security in connected cars

AVs are the ultimate connected car. With the capacity to communicate with users on the road (other cars and pedestrians for instance) through multiple communication channels and components, they are highly exposed to privacy and security risks. In 2014, Chrysler recalled 1.4 million vehicles after security researchers demonstrated[viii] the ability to wirelessly hack the vehicle and takeover control. Companies state they follow industry standards, such as the NHTSA’s cybersecurity guidance. However, given the evolving nature of the technology and related standards, as well as threats to networks, ensuring alignment with a standard might be just a starting point. Going beyond expectation to establish public trust will be important to bringing this technology to market.

The involvement of technology companies, such as Google, that rely on an advertising-based business model further raises concerns about how data will be handled. Regulations are adapting slowly compared to the rapid technological advancements in AVs, leaving the door open for automakers to profit from the sale of impersonalized data (i.e., data not linked to the identity of the driver) gathered from their manufactured vehicles. Weak regulation in this regard could also increase the risk of unethical practices. In China, the government is reportedly already harvesting private passenger data from connected vehicles for alleged surveillance purposes[ix].

Complex partnerships and supply chains

Given the multiple moving parts in a self-driving system, industry constituents (automakers, auto-parts manufacturers, semiconductor and electronic component manufacturers, software developers, ride sharing and car rental companies) are forming partnerships with each other. Such partnerships permit these companies to reduce R&D costs and to share technological know-how. Among the most notable partnerships between the auto industry and the technology sector are those between BMW-Delphi-Aptiv-Continental-FCA-Magna, the tandems Fiat Chrysler-Waymo, Toyota-Uber and Ford-Qualcomm as well as the relationship between Alliance Renault-Nissan with Microsoft[x]. Although, partnerships are integral to the commercialization of AVs, they raise questions about where responsibility lies in the case of a defect and/or accident. These partnerships also add another layer of complexity to the auto supply chain, further increasing the need for collaborative supply chain management and adequate governance structures.

Muddled ESG Opportunities

Self-driving vehicles could potentially reduce road accidents by up to 90%[xi], decreasing fatalities and hospitalizations, and disrupting the insurance industry. The realization of potential benefits depends on the adoption rates of this technology and the presence of relevant infrastructure such as the large-scale deployment of 5G coverage. Given their promised comfort, the wide-spread adoption of AVs may lead to congestion and emissions problems, especially within city-centers; however, the combination of automated driving with other trends, such as car-sharing, could combat these issues.

Companies at the forefront of AV innovation have a responsibility to understand these risks and opportunities and to be transparent about management efforts. In the past, companies were quick to collect and sell data but slow to appoint Chief Privacy and Security Officers. AV companies may be in danger of repeating this pattern as they push to commercialize self-driving vehicles but appear slow to manage AV-related ESG issues. In the case of AVs, the repercussions of unmanaged risks on human life are significantly higher. Failure to manage these risks could derail commercialization and adoption and negatively impact financial returns.

Recent Content

Six Best Practices Followed by Industries Leading the Low Carbon Transition

In this article, we take a closer look at the leading industries under the Morningstar Sustainalytics Low Carbon Transition Rating (LCTR) and examine the best practices that have allowed them to emerge as leaders in managing their climate risk.

Navigating the EU Regulation on Deforestation-Free Products: 5 Key EUDR Questions Answered About Company Readiness and Investor Risk

The EUDR comes into effect in December 2024, marking an important step in tackling deforestation. In this article, we answer five key questions who the EUDR applies to, how companies are meeting the requirements, and the risks non-compliance poses to both companies and investors

-5-key-questions-answered-about-company-readiness-and-investor-risk.tmb-thumbnl_rc.jpg?Culture=en&sfvrsn=ee2857a6_2)