COVID-19 pandemic has disrupted lives and livelihoods on an unprecedented scale. Despite massive government spending, the pandemic resulted in the global economy shrinking by 3.5% in 2020.[i] However, the financial burden of this pandemic has not been borne evenly.

Women’s jobs are more vulnerable to the financial fallouts of COVID-19 — 1.8 times more vulnerable, according to research by McKinsey. Women accounted for 54% of job losses in the U.S., despite making up 38% of the labor force. [ii] Job loss rates for women of color are even higher. With over half of U.S. school districts still closed in December 2020, it’s no surprise that one in four working women in North America is considering downsizing their career or leaving the workforce because of the pandemic.[iii]

With more women leaving the workforce, whether by choice or by circumstance, COVID-19 is threatening important progress made on gender diversity in recent years. How does the gendered impact of COVID-19 affect companies’ ESG Risk profile? Which companies are best positioned to manage these risks and ultimately preserve and improve gender equity in their organizations?

Gender equity and company value are at risk

Research continues to demonstrate that a diverse management team is positively correlated with company value. In its updated 2019 analysis of 3,000 companies in 56 countries, Credit Suisse found evidence of a quality premium for both diversity of boards and management teams.[iv] Promoting diversity and inclusion can benefit businesses in many ways—by attracting and retaining key talent, through better decision-making, improved innovation, and stronger reputation and goodwill among customers and suppliers—all of which contribute to higher profitability.

Given COVID-19’s impact on labor participation rates, companies will face more competition to achieve the diversity quality premiums outlined above. Intangibles, such as human capital, make up the highest proportion of company value ever recorded. That means companies cannot afford to lose talent, whether to a competitor or the pandemic.

As COVID-19 continues to play out, businesses with a strong track record on gender diversity may be better able to withstand human-capital related risks like ensuring a strong talent pipeline and managing turnover while tapping into important diversity premiums.

Where do companies stand? Unpacking the data

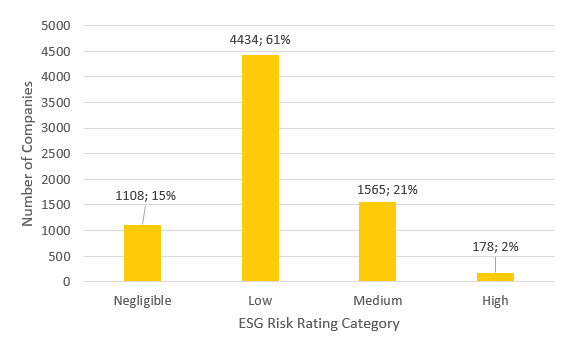

As shown in Exhibit 1, nearly 25% of companies assessed by Sustainalytics face medium to high unmanaged risk related to Human Capital. Human Capital is one of 20 Material ESG Issues (MEIs) that form the ESG Risk Ratings, and one topic addressed within this MEI is diversity, equity, and inclusion.

Exhibit 1: Human Capital Risk Scores

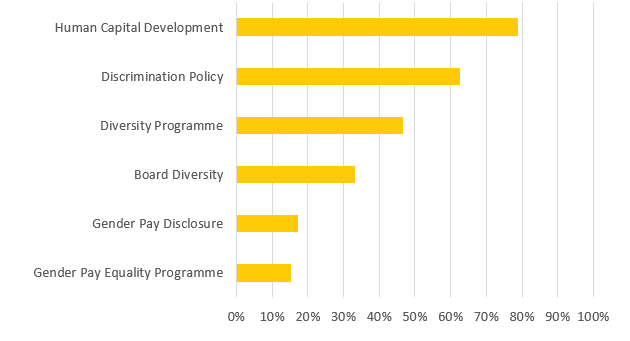

Despite meaningful progress in recent years, there is still significant divergence in company performance on various diversity indicators. Exhibit 2 shows differences in the proportion of researched companies that demonstrate strong management of select human capital indicators.[v] Nearly 80%of companies have a robust Human Capital Development Program and more than 60% of companies have a strong Anti-Discrimination Policy. That said, less than 20%of companies have strong initiatives to ensure gender pay equality, such as gender pay auditing and gender pay differential reporting. Research shows that disclosing gender pay data helps to shrink wage gaps, with no negative impact on profitability.[vi]

Moreover, there seems to be a disconnect between intentions and outcomes when it comes to board diversity. Although 43%of companies have a diversity policy for board membership, only 27%of companies have more than one-third female representation on their boards. Worryingly, 13% of companies have no female board members, and 16% have no female senior executives.

In addition to upside benefits, strong management can help companies minimize downside risk related to controversies, which can result in significant legal costs. The downside risk of gender or diversity controversies should not be overlooked, given that Sustainalytics observed a 458% increase in discrimination and harassment incidents between 2013 and 2017.[vii]

Exhibit 2: Proportion of researched companies with Strong Management on select indicators

COVID-19 has raised broader questions about diversity, equity, and inclusion, including progress on socio-economic and ethnic diversity. Investors and companies have expressed commitments to racial justice and gender parity. More transparency on diversity metrics is needed to achieve these commitments, as is progress on the indicators featured in Exhibit 2.

As COVID-19 continues to disrupt businesses worldwide, we expect investors to utilize ESG data to identify which companies are best positioned to withstand pipeline risks and tap into diversity premiums. At the same time, deeper conversations are needed in the market about how to best address diversity issues more broadly.

Learn more about how companies in your portfolio stand on Human Capital risks and explore all Material ESG issues in Sustainalytics ESG Risk Ratings.

Sources:

[i] IMF (January 2021) “World Economic Outlook Update” accessed (15.02.2021) at: https://www.imf.org/en/Publications/WEO/Issues/2021/01/26/2021-world-economic-outlook-update

[ii] Women’s job loss rates were 1.8 times higher in U.S. and India. McKinsey & Company (15.07.2020) “COVID-19 and gender equality: Countering the regressive effects” accessed (15.02.2021) at: https://www.mckinsey.com/featured-insights/future-of-work/covid-19-and-gender-equality-countering-the-regressive-effects#

[iii] Lean In and McKinsey & Company (2020) “Women in the Workplace 2020” accessed (14.02.2021) at: https://womenintheworkplace.com/

[iv] Credit Suisse (10.10.2019) “Gender diversity is good for business” accessed (15.02.2021) at: https://www.credit-suisse.com/about-us-news/en/articles/news-and-expertise/cs-gender-3000-report-2019-201910.html

[v] Strong Management refers to a raw score greater than 50 for ESG indicators and 70 for Corporate Governance indicators (Board Diversity)

[vi] Bennedsen, M, Simintzi, E, Tsoutsoura, M, and Wolfenzon, D (05.11.2018) “Do firms respond to gender pay transparency” accessed (15.02.2021) at: https://wpcarey.asu.edu/sites/default/files/daniel_wolfenzon_seminar_november_9_2018.pdf

[vii] Sustainalytics (08.03.2018) “ESG Spotlight: The Rise of Gender Equity: Momentum Building in Key Markets” accessed (14.02.2021) at: https://www.sustainalytics.com/esg-research/issue-spotlights/the-rise-of-gender-equity/

Recent Content

Six Best Practices Followed by Industries Leading the Low Carbon Transition

In this article, we take a closer look at the leading industries under the Morningstar Sustainalytics Low Carbon Transition Rating (LCTR) and examine the best practices that have allowed them to emerge as leaders in managing their climate risk.

Navigating the EU Regulation on Deforestation-Free Products: 5 Key EUDR Questions Answered About Company Readiness and Investor Risk

The EUDR comes into effect in December 2024, marking an important step in tackling deforestation. In this article, we answer five key questions who the EUDR applies to, how companies are meeting the requirements, and the risks non-compliance poses to both companies and investors

-5-key-questions-answered-about-company-readiness-and-investor-risk.tmb-thumbnl_rc.jpg?Culture=en&sfvrsn=ee2857a6_2)