Sustainable investing continues to shape global capital markets. Despite a slowdown in recent years, sustainability-focused funds continue to grow as investors incorporate environmental, social and governance (ESG) factors into their analysis. To support investors, comprehensive sustainability-related reporting requirements and standards have been rolled out worldwide. These measures aim to foster transparency, accountability, and sustainability in financial and corporate sectors.

These rules are not without their challenges and detractors, with some proposals likely to be contested or reversed, while others will be fine-tuned to meet changing market demands or reflect regional contexts. Despite these potential headwinds, issuers and investors must prepare to gather and disclose the relevant information to regulators and interested stakeholders or face fines, penalties and reputational damage.

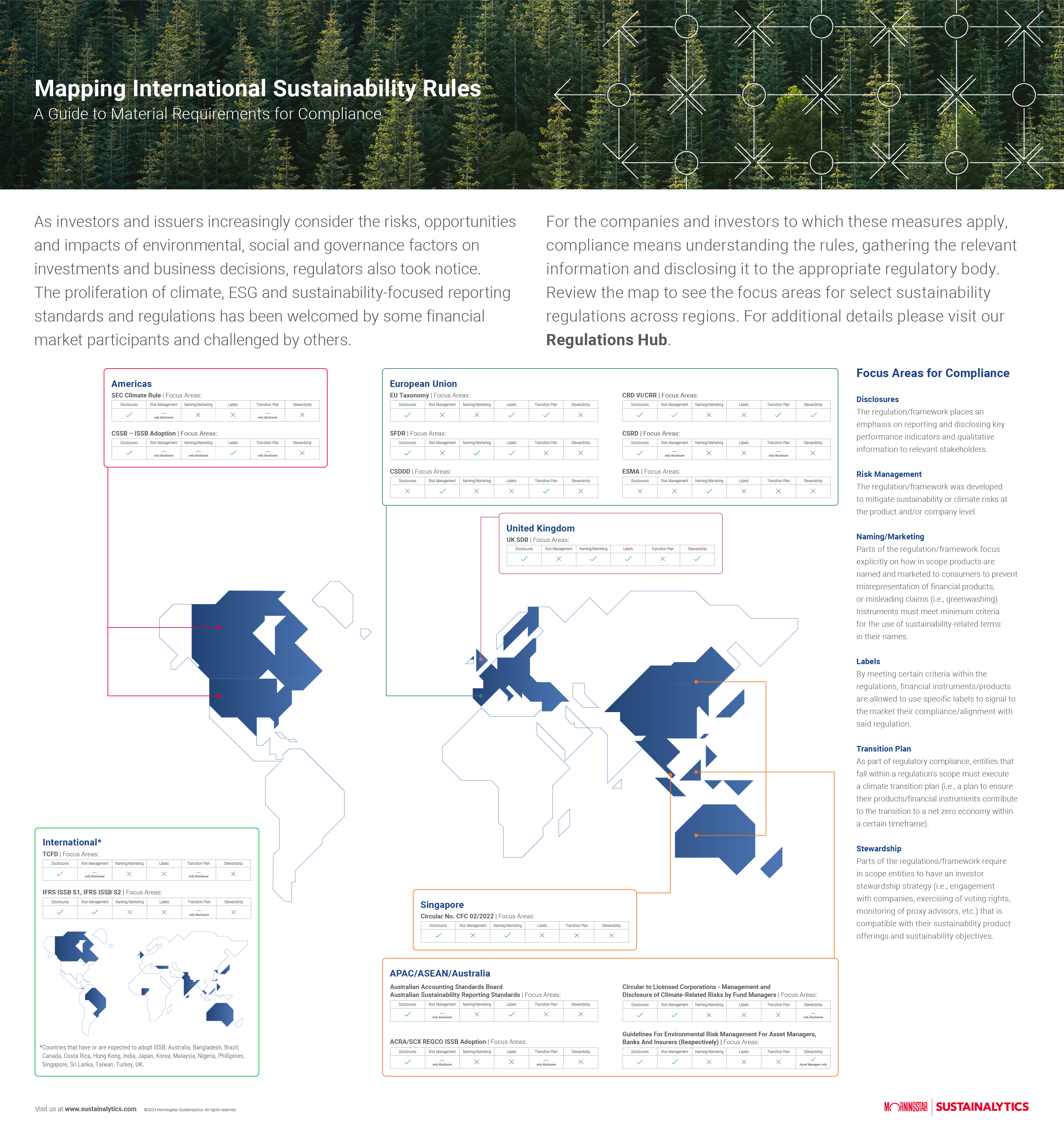

For an overview of the state of ESG and sustainability-related reporting requirements, click here or on the map below. The regulations map highlights select rules and standards from around the world. For more information on how Sustainalytics can help you comply with global reporting requirements and standards, visit the ESG Regulatory Hub on our website.