With this blog, we continue our mini-series on the novel coronavirus and some of the related impacts that we see developing in specific industries and for specific ESG issues.

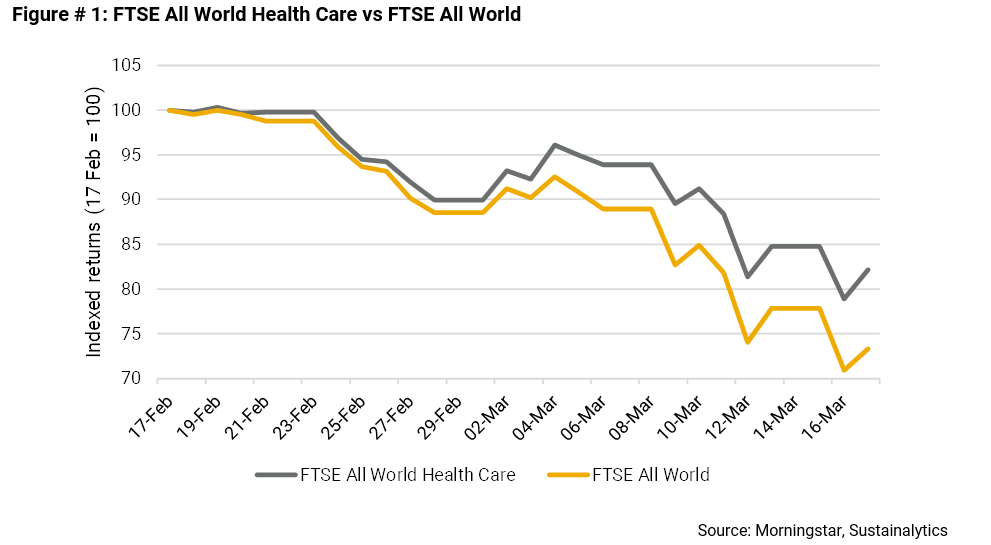

Clearly no industry has escaped the vast market sell-off that began in February and picked up in earnest in early March. However, some industries have held up better than others, and investors in healthcare equities have so far been spared the worst of the rout.

As shown in the chart below, the FTSE All World Health Care index, which tracks the performance of global healthcare, pharmaceuticals and biotechnology firms, is down 18% from February 17, compared to a loss of 27% for the broader FTSE All World index.

Some of this insulation, no doubt, reflects investors’ expectations that the industry will benefit from the development of potential vaccines and treatments for COVID-19. The standout is Gilead Sciences, whose stock is up 15% from February 17.

ESG scores may help healthcare investors with security selection

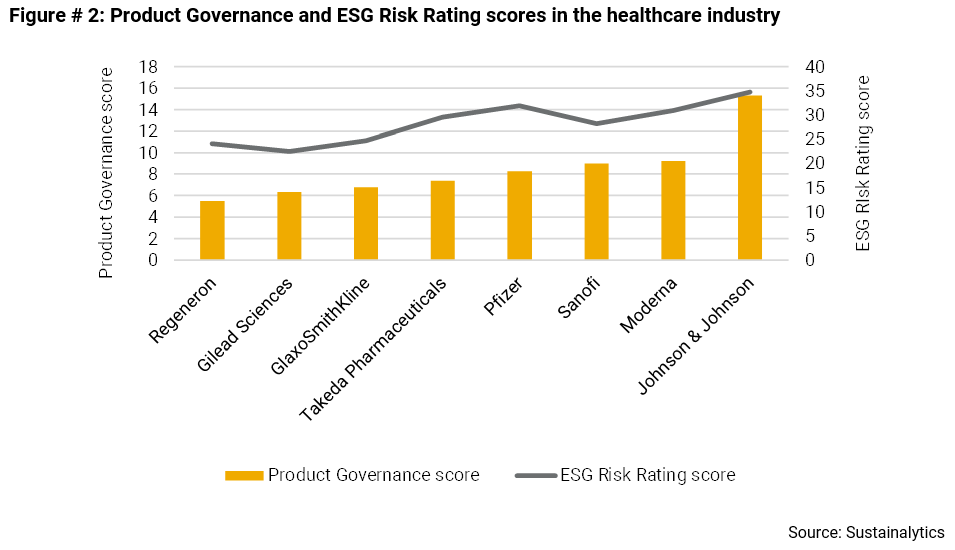

We believe that ESG scores can be of use to investors as they reconsider their exposure to the healthcare industry, as a response to COVID-19 and the collapse in the global equity markets. The first angle that we see relates to Sustainalytics’ Product Governance Material ESG Issue (MEI), which encapsulates companies’ quality assurance programmes, from manufacturing to product labeling.

Our thesis is that firms with attractive Product Governance scores may be better able to navigate the complex regulatory and stakeholder pressures that are bound to intensify as companies race to develop vaccines and treatments for the novel coronavirus.

Several biotech and pharma companies are working towards a vaccine or treatment for the virus. Moderna has started Phase 1 clinical trials for its RNA-based vaccine while Pfizer, GlaxoSmithKline, Inovio, Johnson & Johnson and Sanofi are all in preclinical testing of their own vaccines.

Gilead Sciences, Regeneron, Sanofi and Takeda Pharmaceuticals are all testing potential treatments, although Gilead seems to be the furthest along as it enters Phase 3 testing for Remdesivir, which it originally developed to treat Ebola.

Yet, as shown below, these firms are highly differentiated by their Product Governance scores and by their overall exposure to unmanaged ESG risk. Regeneron is tops when it comes to Product Governance, followed by Gilead Sciences and GlaxoSmithKline. The same three also exhibit the lowest level of overall ESG risk.

These three companies may be at an advantage in the race to bring vaccines and treatments for COVID-19 safely to market.

In our 10 for 2020 report, we discussed the opportunity for connected healthcare technology, like remote diagnostics or telehealth, to improve patient outcomes by facilitating access to healthcare in remote areas.

The US Centers for Disease Control and Prevention (CDC) even recommended alternative healthcare delivery methods like remote care as a way to combat the spread of the virus by reducing patient traffic in overburdened healthcare facilities.[i]

Healthcare companies and supply chain disruption

A second angle that we see relates to supply chain disruption.

Last week we argued that disruptions in heavy hit regions like China and Italy would likely have executives examining the resilience of their supply chains. On the same note, the pandemic has exposed vulnerabilities in the supply chain for pharmaceuticals and medical supplies.

While supply chain is often top of mind when engaging with consumer-facing sectors, a lack of transparency in medical supply chains makes it difficult to fully quantify the risk of shortages.This includes the world’s reliance on China as a main producer of Active Pharmaceutical Ingredients (APIs) and essential medical supplies, like protective masks.

We are already seeing tangible downstream effects from COVID-19. In February, India stopped the export of several drugs, including antibiotics, in order to ensure sufficient domestic supply. India relies on China for nearly 70% the APIs it uses to produce generic medicines for the rest of the world. The US FDA has already identified one drug shortage due to COVID-19 and 20 drugs that rely exclusively on APIs from China.[ii] It’s important to note that while pharma companies are required to notify the FDA of potential shortages, there is no such requirement for medical device manufacturers.

We think the coronavirus pandemic could catalyze a new wave of management and investor interest in improving the transparency of medical supply chains.

To summarize, the healthcare industry has so far held up relatively well in the recent market sell-off, although there is no guarantee it will continue. We think Product Governance scores can help investors select companies that are relatively well-positioned to manage regulatory pressures in the race to develop vaccines and treatments for COVID-19. Moreover, we think the outbreak will begin to shine light on medical supply chains.

Sources:

[i] https://www.cdc.gov/coronavirus/2019-ncov/healthcare-facilities/guidance-hcf.html

[ii] https://www.fda.gov/news-events/press-announcements/coronavirus-covid-19-supply-chain-update