Investors are demanding a consistent approach to ESG across the investment spectrum. Developed as an engagement overlay to Sustainalytics’ flagship ESG Risk Ratings, Material Risk Engagement promotes and protects long-term value by engaging with high-risk companies on financially-material ESG issues.

The focus is on companies with the highest unmanaged ESG risk, as identified by the ESG Risk Ratings. We protect and develop the value of our clients’ portfolio companies through collaborative and constructive engagement that help companies better identify, understand and manage these ESG risks.

Latest Insights

Lines in the Sand: How Canada’s Oil Sands Companies Can Pave Their Way to Net Zero

SDGs and ESG: Why the United Nations Sustainable Development Goals Should Top Every Boardroom Agenda

Global Greenwashing Regulations: How the World Is Cracking Down on Misleading Sustainability Claims

Key Features and Benefits

Engagement with over 350 high-risk companies on the most financially material ESG issues – as identified by Sustainalytics’ ESG Risk Ratings.

Consistent engagement on a global scale in alignment with our comprehensive ratings universe covering > 4,500 companies.

With ~ 30 engagement managers Sustainalytics has a diverse and experienced team dedicated to issuer engagement in collaboration with institutional asset owners and asset managers.

Refined over more than 25 years, we follow a robust and proven approach to ESG engagement with face-to-face interactions, well-defined objectives and a strategy for each case.

Covering more than 2.5 trillion dollars in assets under advisement (AuA), Sustainalytics is the largest engagement services provider, enabling us to leverage our pooled resources to increase our impact.

Unparalleled transparency with the option to attend engagement dialogues and access all ESG information, including company responses.

Use Cases

ESG Risk Management

Material Risk Engagement focuses on high-risk holdings, aiming to help companies better identify, understand and manage ESG risks. With Material Risk Engagement, investors gain better insight to ESG risk and adopt a proactive ESG risk management tool.

ESG Integration

The assessment of responses and progress as well as other data points can improve investors’ insight into companies’ readiness and ability to mitigate ESG risks and opportunities.

ESG/SDG Reporting

Positive engagement cases are consistently tracked, which enable investors to report positive impact from the engagement to clients and beneficiaries. Engagements are also mapped against the Sustainable Development Goals (SDGs).

Proxy Voting

Engagements address material ESG Issues that may end up on companies’ AGM agendas, making case information a useful input for voting decisions.

Compliance with Stewardship Codes and International Guidelines

Engagement is a key element of guidelines for responsible investors, such as the Principles for Responsible Investing (PRI) and the OECD: Responsible business conduct for institutional investors, as well as relevant regulations, such as the UK Stewardship Code.

Engagement Overlay for Passive Strategies

By consistently engaging with the highest risk companies on various indexes, passive investors can meet their stewardship obligations while differentiating their fund and reducing the overall risk of their passive portfolio.

How It Works

1

Process Commences

As soon as a company is assigned an ESG Risk Rating score above 30, the Material Risk Engagement process commences.

2

First Meeting With Company

The first meeting with the company is preferably face-to-face to build a common understanding of the company’s material ESG issues, creating the trust that is key for our collaborative engagement approach.

3

Engagement Strategy

Based on the first meeting, the engagement team defines a change objective and an engagement strategy. The company also receives the first set of suggested actions to address management gaps in the Material ESG Issues.

4

Regular Follow-ups

Sustainalytics regularly follows up with the company and tracks progress on action points and positive developments. Change objective and suggested actions are updated regularly to ensure continuous improvement.

5

Engagement Case Closure

An engagement case is closed when the company’s ESG Risk Rating improves to below a score of 28.

Delivery Options

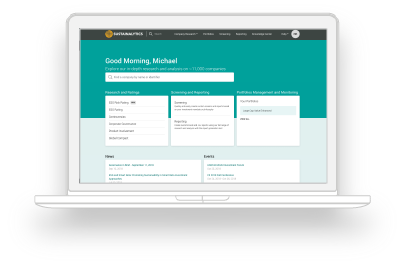

Global Access

Sustainalytics’ user-friendly investor interface provides full insight into a company’s engagement profile, overall ratings and dialogue. It also includes engagement manager commentary on the case, next steps and upcoming meetings.

Data Services

Basic data points can be delivered as a standard portfolio report in Excel or as a data feed.

Why Sustainalytics?

A Single Market Standard

Consistent approach to ESG assessments across the investment spectrum.

Award-Winning Research and Data

Firm recognized as Best ESG Research and Data Provider by Environmental Finance and Investment Week.

End-to-End ESG Solutions

ESG products and services that serve the entire investment value chain.

30 Years of ESG Expertise

800+ ESG research analysts across our global offices.

A Leading SPO Provider

As recognized by Environmental Finance and the Climate Bonds Initiative.

Related Insights and Resources

SDGs and ESG: Why the United Nations Sustainable Development Goals Should Top Every Boardroom Agenda

The world is failing to achieve the UN Sustainable Development goals, with just 15% of targets on track. In this article, we explore the role of SDGs in developing sustainability objectives and how boards of directors can make progress on their targets.

Global Greenwashing Regulations: How the World Is Cracking Down on Misleading Sustainability Claims

Amid fears of greenwashing claims and evolving reporting standards, sustainable investment assets have dropped as much as 51 percent. In this rapidly changing environment, ESG stewardship is one of the most effective ways to integrate genuine sustainability principles into investment management.

ESG Stewardship: A Powerful Tool to Mitigate Greenwashing Risks

Amid fears of greenwashing claims and evolving reporting standards, sustainable investment assets have dropped as much as 51 percent. In this rapidly changing environment, ESG stewardship is one of the most effective ways to integrate genuine sustainability principles into investment management.

Related Solutions

ESG Risk Ratings

Take a coherent and consistent approach to assessing financially material ESG risks.

Global Standards Engagement

Engage with companies that breach international norms and standards as identified by our Global Standards Screening research.

Thematic Engagement

Engage on the most challenging ESG issues, from climate change to human capital.