Companies can leverage their ESG performance to improve their bottom line and their company’s overall ESG performance through Sustainability Linked Loans (SLLs). SLLs give borrowers the opportunity to apply the loan toward general business purposes as the terms are tied solely to the borrowers ESG-related performance and not the use of proceeds or the projects financed. This flexibility has made the SLL a popular alternative to traditional capital raising and debt.

Learn more about our SLL service.

Find out how the path of green finance has evolved, as well as our view on where the sustainable finance bond market is headed.

Latest Insights

ESG in Conversation: The AI Revolution Comes to ESG

Reducing Emissions Through Sustainable Finance: A Guide for Companies in Carbon Intensive Industries

ESG in Conversation: Asset Owners Share Their Views on the Changing Investment Landscape

Key Benefits

Sustainalytics works with banks and companies to build the Sustainability Linked Loan Program. Our solutions are aligned to the Sustainability Linked Loan Principles and we work in-close collaboration with the borrower and the client to identify and track the ideal metrics that the Sustainability Linked Loan will be tied to.

Expand lending portfolios and meet firm-wide sustainability financing commitments

Incentivize corporate clients to improve their sustainability performance

Leverage credible third party ratings and opinions to accelerate lending process

Support positioning as sustainable finance leader

Assist to meet public commitments made for sustainable finance

Deeper relationship and engagement with customers

Access to discounted loan rates

Improve overall sustainability performance

Demonstrate sustainability commitment to stakeholder

Flexibility to use the funds for general corporate purposes

Deepen relationship and interactions with banks

Drive internal alignment across the business

Sustainalytics KPI-SPT Assessment Service

At Sustainalytics we also offer a KPI-SPT Assessment. The assessment is an evaluation of the relevance and materiality of an issuer’s Key Performance Indicators (KPIs) and the ambitiousness of the associated Sustainable Performance Targets (SPTs) that can be considered as part of the potential sustainability-linked loan.

Non-public Assessment

The final report is a non-public assessment and can be used by the issuer teams only for internal purposes

Sustainalytics Methodology

Final report will be a detailed KPI-SPT assessment in line with Sustainalytics’ SLB methodology

Option to Extend

Issuer can extend the engagements to a full Second Party Opinion within 12 months

No SPO commitment required.

The internal report can be used to inform Framework development process.

Contract value

The assessment offered can be extended to a full SPO

Expedited Assessment

The KPI-SPT has a quick turnaround time

SPO LinkedIn instruments FAQ

What Linked Instruments SPO’s

Our Methodology

How to set up KPI’s and SPTs

Why Sustainalytics?

A Single Market Standard

Consistent approach to ESG assessments across the investment spectrum.

Award-Winning Research and Data

Firm recognized as Best ESG Research and Data Provider by Environmental Finance and Investment Week.

End-to-End ESG Solutions

ESG products and services that serve the entire investment value chain.

30 Years of ESG Expertise

800+ ESG research analysts across our global offices.

A Leading SPO Provider

As recognized by Environmental Finance and the Climate Bonds Initiative.

Related Insights and Resources

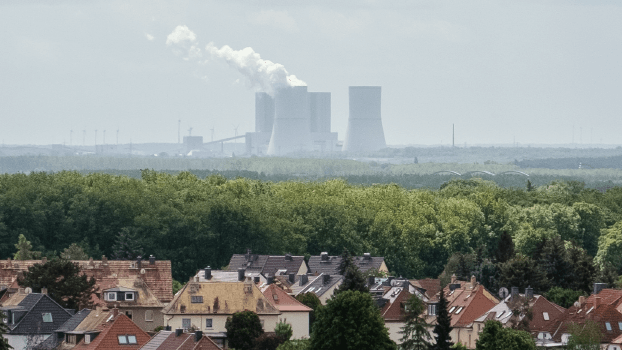

Reducing Emissions Through Sustainable Finance: A Guide for Companies in Carbon Intensive Industries

This corporate guide discusses the difficulties in measuring, reporting, and reducing GHG emissions in hard-to-abate sectors and provides key takeaways so that companies can take advantage of the opportunities sustainable finance offers.

Related Products

ESG Risk Ratings

Identify your corporate sustainability risk with ESG research and data on more than 12,000 companies.

Sustainable Banking Insights

Advance your financial institutions' approach to sustainable finance to better meet your investors and customers expectations.

Sustainability Linked Bonds

Participate in sustainable financing and build credibility for your SLB with a second-party opinion.