Heather Lang

Executive Director

Sustainable Finance Solutions

In October 2020, our Sustainable Finance Solutions team hit a major milestone. We delivered our 500th second-party opinion (SPO) of a sustainable bond framework, solidifying Sustainalytics’ position as the leading global external reviewer of green/social/sustainability bonds. Celebration of this key milestone marks an opportunity to reflect on how our offering has evolved in conjunction with this fast-growing market since we delivered our first opinions back in December 2014.

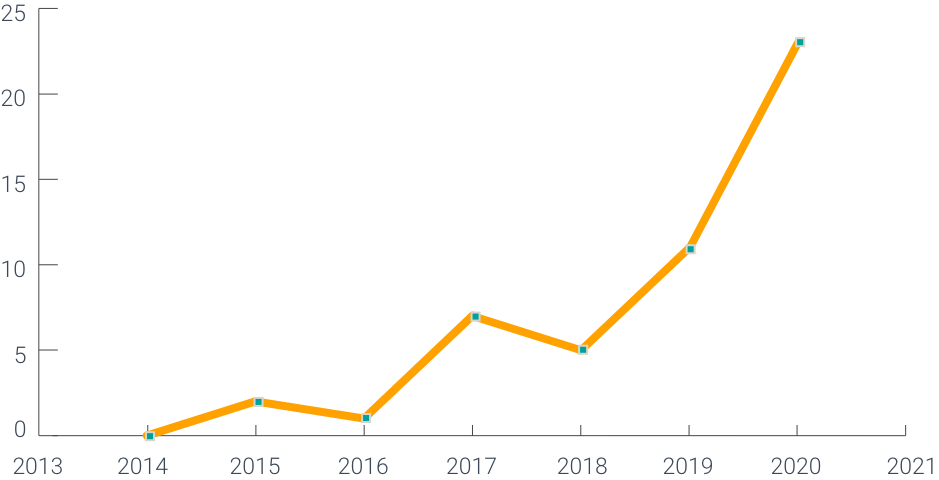

The Numbers: Hockey Stick Growth

When Lloyds Bank approached us to opine on their Helping Britain Prosper Framework in late 2014, the sustainable debt market was somewhat nascent. Development banks, spearheaded by the World Bank, were amongst the first issuers and second-party opinions were not yet market practice. The International Capital Market Association’s (ICMA) Green Bond Principles, guiding issuers on the key pillars to be addressed in their green bond frameworks, had yet to be released (with the first edition published in June 2015).

Sustainalytics has continually been ahead of the curve, with SPO offerings either proceeding the release of ICMA principles or following soon after. Our first SPO published in 2014 was for a sustainability bond framework, followed by our first Green Bond SPO and Social Bond SPO in early 2015.i

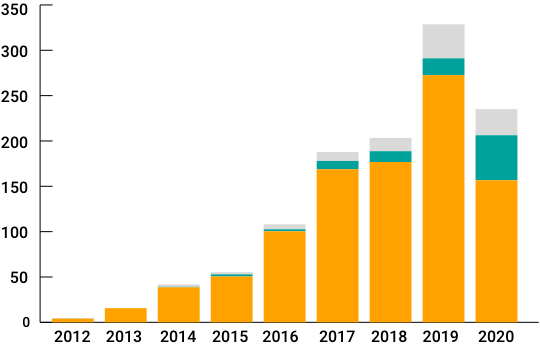

Fast forward to 2017, when the market had doubled in size for two consecutive years and Sustainalytics celebrated its 100th SPO. By October 2020, cumulative volumes of sustainable debt issuance had surpassed USD 2 trillion, with green bonds accounting for USD 1 trillion, according to Bloomberg NEF.ii Despite a dip in green bond issuance in Q2 triggered by the COVID-19 pandemic, over USD 200 billion was issued by early October, marking a 12% increase over the same period in 2019. With approximately two-thirds of issuers soliciting SPOs, independent reviews (while not yet mandatory) have become market practice, providing investors with assurance that use of proceeds are credible and impactful.iii

Total Global Issuance* (US$)

* Total global issuance data as of August, 28, 2020 (source: BloombergNEF)

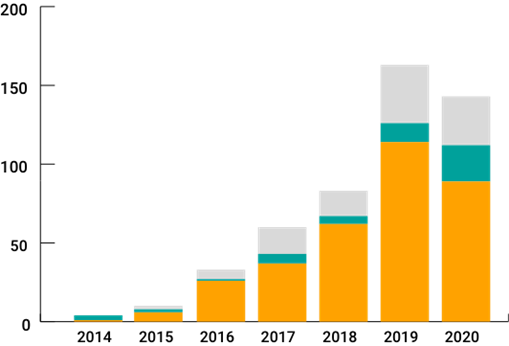

Number of SPOs Delivered by Sustainalytics*

* SPOs delivered by Sustainalytics as of October 2020

On average between 2014 and 2019, Sustainalytics has experienced a 120% growth in the number of SPOs published every year. As the leading Approved Verifier of Climate Bonds, 22 of our SPOs were combined with CBI verification. We also delivered a large number of standalone pre- and post-issuance CBI verifications, in addition to our 500 SPOs.

120%

Growth per year between 2014 and 2019

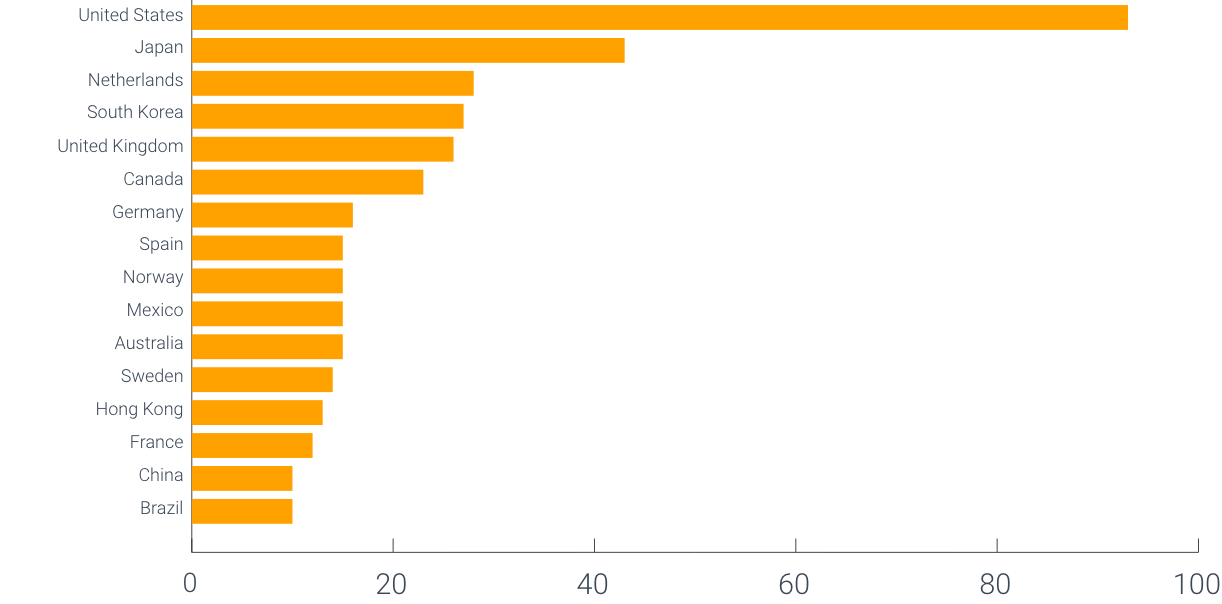

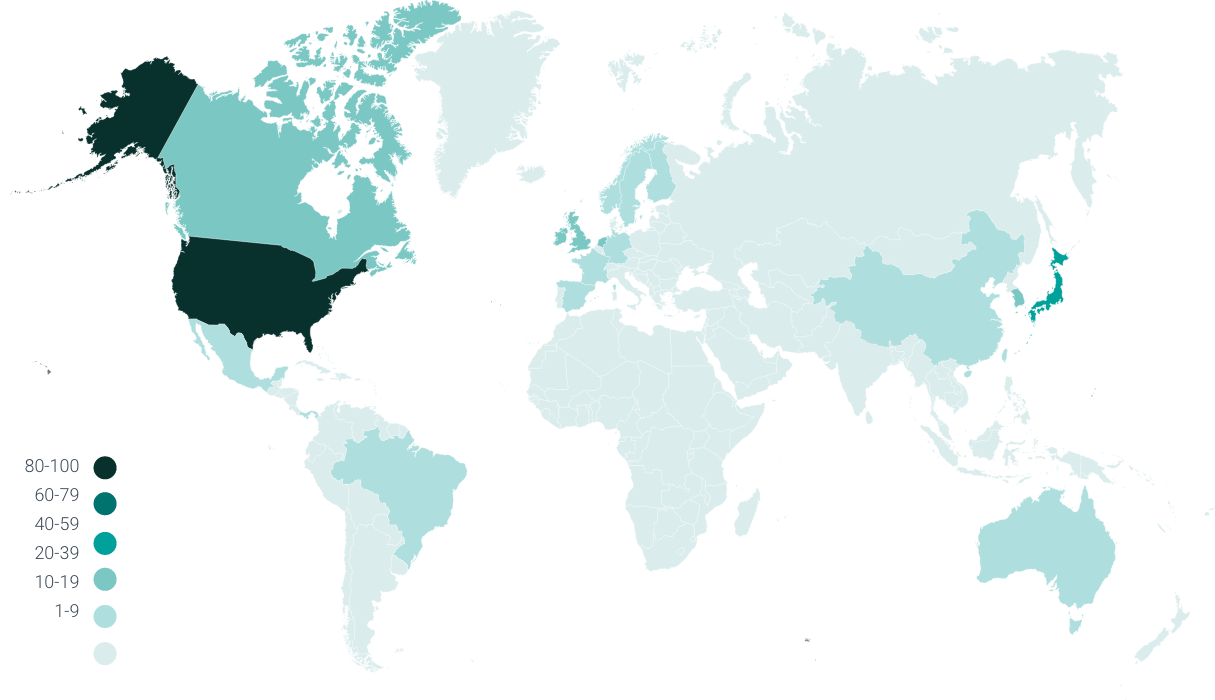

The Regional Story

Compared to the overall sustainable debt market where the highest number of issuers came from the US, China and Japan in 2019,iv Sustainalytics has experienced its strongest growth in some of its home markets lead by the US, Japan and the Netherlands and followed by the UK, Canada, Germany, Australia and France. The global momentum of sustainable debt finance has also allowed us to quickly expand into new regions, such as South Korea, the Nordics, Spain, Mexico, Hong Kong and Brazil.

SPOs by Country

The Big 3

.png?sfvrsn=54dfbd46_0)

The US

The absence of a favorable regulatory environment has prompted leadership by the private the sector, municipalities and state entities, positioning the US as a global leader in sustainable debt issuance. Sustainable bond issuance from US-based corporates has soared in recent years in terms of both number of issuers and volume. With Apple and Starbucks as corporate frontrunners back in 2016, two-thirds of regional issuances that Sustainalytics has supported took place in the past two years alone. Prominent issuers included PepsiCo, Bank of America, Pfizer, Goldman Sachs, JP Morgan and Freddie Mac. In August 2020, Alphabet took center stage for issuing the largest sustainability bond to date for a total of USD 5.75 billion. As an emerging trend unique to the US context, a number of large foundations and non-profits have issued sustainable (notably, social) bonds of late, including six so far in 2020.

Japan

Sustainalytics’ presence in this leading fixed income market, coupled by a high degree of government support, including a subsidy scheme by the Ministry of Environment to cover the costs of SPOs, have contributed to our successful collaboration with Japanese issuers and underwriters. Repeat issuance has come from leading regional financial institutions including, Development Bank of Japan, Mitsubishi UFJ Financial Group, Mizuho Financial Group and Sumitomo Mitsui Financial Group. With issuance peaking in the first year of the government subsidy scheme in 2018, there has been a heavy emphasis on financing renewables and green buildings across a diverse corporate issuer base.

Netherlands

The Dutch sustainable debt market has been underscored by heavy underwriter activity, with dedicated expertise in sustainable finance at leading banks like ING. In fact, the majority of sustainable bond issuance that we have supported in this market has come from financial institutions, including repeat issuance from BNG, FMO and Rabobank. In May 2019, the Dutch State Treasury set the tone from above by issuing a sovereign green bond in the amount of EUR 5.98 billion, with use of proceeds including renewables, energy efficiency, clean transportation and climate change adaptation.

Diversification of Issuers

In addition to servicing sovereigns, sub-sovereigns, municipalities and development banks, the bulk of our SPOs have been delivered to corporate issuers: 39% to financial institutions and 50% to other sectors. In the past few years, we have observed a considerable degree of sector diversification with new entrants including but not limited to tech, telecom, shipping, big pharma and luxury apparel. This diversification is expected to continue as heavier industries leverage access to transition financing.

As noted above, foundations and non-profits have experienced a recent uptick in social (and to a lesser extent, green) bond issuances. Social bonds issued by US-based foundations in 2020 have included Ford Foundation, Doris Duke Charitable Foundation, and MacArthur Foundation, whose work is a natural fit for these instruments. Proceeds have largely focused on targeting disadvantaged groups via Socioeconomic Advancement and Empowerment, Education and Health. The current socioeconomic context, coupled with record-low interest rates, have prompted large foundations to rapidly mobilize vast amounts of funding at a time when other sources of support for charity have decreased, yet demand is higher than ever. We can presumably expect this trend to expand beyond the US into other regional markets.

Breakdown of Corporate Issuers:

50%

Other sectors

39%

Financial institutions

Uptick in Social Bonds

Despite disproportionately higher volumes of green bond issuance relative to other themes in the broader market, two-thirds of Sustainalytics’ SPOs to date were explicitly focused on green bonds, compared to one-quarter for sustainability bonds and 10% for social bonds. This higher representation of social use of proceeds in our portfolio of SPOs relative to the broader market speaks to our position as a frontrunner in this area. As highlighted in the timeline above, Sustainalytics was opining on social use of proceeds well before the release of related ICMA principles via social and sustainability bond SPOs. That said, 45% of the social bond frameworks that we reviewed were issued in 2020 alone – due in large part to COVID-19.

Mirroring the market, the top green use of proceeds represented in our SPOs relate to renewable energy (in 60% of our SPOs; 11% as single category); green buildings (in 42% of our SPOs; 7% as single category); and clean transport (in 32% of our SPOs; 2.5% as single category). The most widely applied social use of proceeds have included affordable housing, small to medium enterprise (SME) finance/microfinance, and socioeconomic advancement. With an average of four use of proceed categories included per framework, single use of proceeds constitute about 28% of the frameworks we’ve reviewed, compared to 25% of frameworks targeting six or more use of proceed categories.

Social Bond SPO

Innovation and Flexibility in Use of Proceeds

In this dynamic market, we have observed a clear innovation trend with respect to assets financed, expanding well-beyond commonly applied categories to include circularity, water management, SME financing, gender and racial equality, to name a few. The unique socioeconomic context of 2020 saw the market pivot to quickly address timely social challenges via an uptick in social and sustainability bonds (some of which were labeled as Covid-response bonds). Preliminary analysis from CBI suggests that about USD 75 billion of debt carrying the “pandemic” label was issued in the first half of 2020 alone.vi Sustainalytics supported leading issuers including Pfizer, Ford Foundation, JP Morgan, and the EU Commission, targeting the impacts of COVID via two main areas – healthcare and socioeconomic impact mitigation – as defined in Sustainalytics’ use of proceeds taxonomy.

2020 also saw the market embrace the concept of transition financing, broadening the tent to include heavier industries that were historically omitted from green finance given that low-carbon solutions were not yet scalable for them. Prompted in large part by investor support and demand, transition financing is expected to play a key role in helping shift heavier industries’ business activities along a transitional pathway compatible with long-term climate goals. Due to a distinct set of challenges and barriers for each economic activity, the transition pathways will vary across different industries. Sustainalytics’ transition bond offering, launched this past summer, outlines transitional pathways for key industries (starting with steel, natural gas, and shipping). We anticipate considerable traction in this area from heavy industries with hard to abate business activities.

Innovation in Types of Instruments

The sustainable finance toolkit has expanded in recent years to include a range of financial instruments, from covered bonds to commercial paper to revolving credit facilities and, most recently, Sustainability Linked Bonds. Building on the success of sustainability linked loans – the fastest growing market segment in the past two years – issuers have embraced the opportunity to expand sustainability criteria into general purpose debt financing via sustainability linked bonds. The emphasis here is on forward-looking performance-based targets where the coupon rate is adjusted based on achievement of these pre-defined targets. Following ICMA’s release of the Sustainability Linked Bond Principles this past summer, these general-purpose loans providing greater flexibility to issuers are rapidly gaining traction. Sustainalytics delivered its first SPO for a Sustainability Linked Bond to Novartis in September 2020, supporting a USD 2.2 billon issuance with targets focused on access to strategic therapies in low- and middle-income countries.

Looking Forward…

The sustainable finance market has demonstrated its resilience and staying power through an unprecedented socioeconomic upheaval. Based on its proven ability to pivot during COVID, we can expect to see this dynamic market flexibly respond to future crises, whether social or environmental in nature. Issuers have demonstrated their ability and commitment to redirect capital on short-notice to pressing social and environmental challenges. Social bonds have exhibited the capacity to support businesses and communities most at risk during an economic downturn, while sustainability bonds address key interconnections between social and environmental issues.

The regulatory environment is also rapidly evolving, most notably by way of the EU Sustainable Finance Action Plan, whose regulatory measures for financial institutions and corporates will be far-reaching beyond European borders.

In light of these developments, it won’t be long before our Sustainable Finance Solutions team at Sustainalytics celebrates its 1,000 bond milestone.

Learn more about our Second-Party Opinion Services and contact us to get started.

Leading Approved Verifier of Climate Bonds

Frontrunner in Social Bond

Greater flexibility with Sustainability Linked Bonds

Read about some of our recent second-party opinions

To celebrate this major milestone, Sustainalytics has donated to One Tree Planted (onetreeplanted.org), a non-for-profit organization that focuses on global reforestation. Through this donation trees will be planted in various regions globally to help combat forest fires and deforestation.

i Climate Bonds Initiative, “Green Bond Principles and Climate Bonds Standard”:

https://www.climatebonds.net/market/best-practice-guidelines

ii Veronika Henze, “Record Month Shoots Green Bonds Past Trillion-Dollar Mark,” Bloomberg NEF, October 5, 2020:

https://about.bnef.com/blog/record-month-shoots-green-bonds-past-trillion-dollar-mark/

iii Climate Bonds Initiative, “Green Bonds Global State of the Market 2019,”:

https://www.climatebonds.net/files/reports/cbi_sotm_2019_vol1_04d.pdf

iv Ibid

v Morgan Davis, “Japan Finds Own Shades of Green,” GlobalCapital, March 28, 2019:

https://www.globalcapital.com/special-reports?issueid=b1dpgqgwxjhlr1&article=b1dpvy95d6082r

v Climate Bonds Initiative, “Green Bond Market Summary, H1 2020,” August 2020:

https://www.climatebonds.net/files/reports/h1_2020_highlights_final.pdf