At a time when climate change has caught global attention and efforts are being made to meet the UN sustainable development goals, however concrete – the most widely used man-made material on earth – is a significant source of carbon dioxide (CO2) emissions and often overlooked. Cement, a key ingredient in concrete, accounts for about 7% of global CO2 emissions and is the second-largest industrial emitter of CO2 after the iron and steel industry [i]. The cement production process is responsible for 95% of concrete’s carbon footprint. Under the International Energy Agency’s sustainable development scenario, cement producers will need to reduce their carbon intensity at an annual rate of 0.3% per tonne of cement produced up to 2030 [ii]. With carbon emission regulations tightening globally to meet the 2-degree scenario (2DS) targets, cement companies that fail to adopt low-carbon processes and improved energy efficiency could face risks in the form of potential fines from non-compliance and lost opportunity costs by failing to innovate processes.

What drives the high carbon output?

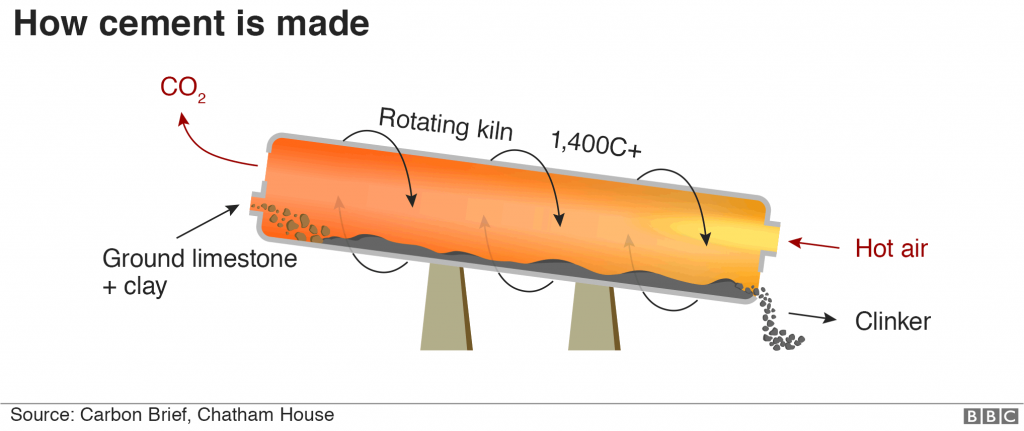

The clinker formation in the cement manufacturing process accounts for 60-70% of the total carbon emissions. The remaining 30-40% of emissions come from the combustion of fuels that power the process [iv]. Additionally, factors such as cement plant capacity, the moisture content and burnability of raw materials, and the availability of alternative fuels also influence energy efficiency and the carbon footprint of cement production.

The clinker formation stage in the cement manufacturing process cannot be substituted as there is no practical alternative currently available to replace limestone [iii].

Carbon reduction opportunities:

Although there is no one single solution available to achieve carbon neutrality in this sector, research suggests that a combination of several initiatives can be implemented to reduce CO2 emissions across the industry value chain.

- Energy efficiency: Manufacturing clinker in wet kilns uses about 85% more energy compared to carrying out calcination in a state-of-the-art dry process kiln [ii]. By replacing all wet-kilns with the modern technologically advanced dry-kilns, a 10% improvement can be made by 2050 in the best-case scenario globally.

- Alternative fuels: Refers to waste materials such as sewage sludge, waste oil and biomass. Traditionally, the firing of clinker is done with coal, natural gas, or fuel oil. By replacing fossil fuels with these alternative fuels, a cumulative CO2 reduction of 12% can be reached globally by 2050 in the 2DS [i].

- Reducing the clinker factor: The average clinker to cement ratio is called the clinker factor and the 2014 global average clinker ratio of 0.65 needs to be reduced to 0.6 by 2050 to meet the Paris goals [ii]. This can be lowered by substituting some of the clinker with alternative materials such as fly ash, limestone or slag.

- Novel cement and innovative carbon capture technologies: Developments are underway to manufacture next-generation cements that have significant carbon reductions. Also known as green cement, they are produced by implementing a carbon-negative manufacturing process and using renewable electricity. Advanced carbon capture and storage methods also have the potential to decarbonize the cement industry. These emerging technologies can provide approximately 48% of cumulative CO2 emission savings by 2050 in a 2DS [i].

How are the major players responding?

Some of the leading cement producers across the globe are working to develop breakthrough technologies that can produce superior quality cement with greater energy efficiency and reduced emissions.

- LafargeHolcim in partnership with an American start-up, Solidia Technologies, has developed a novel form of concrete that reduces the overall carbon footprint by up to 70%. The process involves using a different composition of raw materials to produce cement at lower temperatures and adding CO2 instead of water to form concrete [vii].

- Heidelberg Cement has discovered an alternative clinker technology called TernoCem. The technology works on an altered chemical composition and lower burning temperatures. The company reports that CO2 output is 30% lower in comparison with conventional clinker and energy consumption can be reduced by around 15% [viii].

- CRH Plc’s subsidiary Tarmac is a participant in LEILAC, the Low Emissions Intensity Lime and Cement project. The project is focused on developing a calciner that can directly separate and capture about 95% of the CO2 released from limestone when being transformed into clinker. This is part of the EU Horizon 2020 project [ix].

- CEMEX’s R&D team in Egypt has launched a novel cement product which can reduce carbon emissions by 15% to 20%. The product uses clinker with around 20% natural pozzolanic material after it has been treated mechanically and chemically. Additionally, the company is involved in several European research projects aimed at carbon capture, storage and utilization. These include Solpart, which intends to pilot a high-temperature solar process suitable for the calcination of cement raw materials and DESTINY, that aims to employ microwave energy in clay calcination for use in low clinker cements [x].

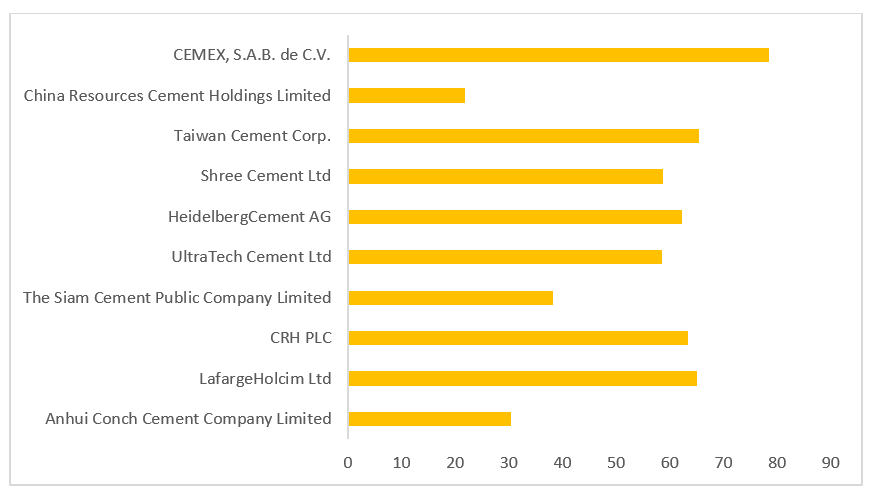

Analyzing Sustainalytics’ Carbon – Own Operations management data of the top 10 cement manufacturing companies globally based on market capitalization, we find that companies tend to exhibit strong management (average management score of 54), indicating they are making progress towards lowering carbon emissions in the cement industry. This, in turn, translates to companies generally having low to medium ESG Risk Rating scores for the issue.

Carbon - Own Operations-Management Score

Source: Sustainalytics Data, January 2020

The companies that have a strong management score have developed robust GHG emission reduction programmes with formal commitments and regular monitoring of emissions. Those companies also disclose detailed metrics on their scope 1 and scope 2 emissions, with relevant information on scope 3 emissions. Additionally, the majority of companies with strong management scores recognise the transition risks facing the cement industry and have integrated it into their overall risk assessment procedures.

Carbon - Own Operations-Risk Score

Source: Sustainalytics Data, January 2020

Challenges to a low-carbon transition:

Despite growing interest in low-carbon cement technologies, several difficulties remain in fully embracing this transition. There is a lack of support from national governments to convince cement manufacturers to increase their investments in new technologies. The cement sector is also highly conservative when it comes to commercial implementation of these technologies, due to quality and safety concerns among customers over the reliability of novel products and the lengthy bureaucracy associated with obtaining permits for the use of alternative fuels in different jurisdictions. Additionally, building standard codes vary regionally in terms of the type of blended cements that are allowed for construction, posing difficulties for builders using new products. Cost-effectiveness for cement manufacturers to invest and scale up advanced technologies remains a barrier as customers are reluctant to pay a premium for these products. Furthermore, the absence of legally mandated requirements from regulators across the globe is slowing down the transition process [iii].

What lies ahead

Although the industry is often overlooked by the general public, evidence suggests that there is a growing interest among investors and other stakeholders to address this business-critical issue. A coalition of investors belonging to the Institutional Investors Group on Climate Change and the Climate Action 100+, representing more than USD 33 trillion in assets under management, have expressed interest in European cement companies becoming carbon neutral by 2050 [v]. Furthermore, the recent EU taxonomy report released by the EU technical expert group on sustainable finance has announced thresholds that cement manufacturing companies must follow to reduce carbon emission output [vi]. While cement has greatly shaped the modern built environment around us, its high CO2 impact is a concern that needs to be addressed to ensure the transition towards a sustainable economy. Consequently, cement manufacturers will need to continuously develop innovative carbon reduction technologies and revise their short-term targets to help this transition.

Sources:

[i] IEA (2018), Technology Roadmap – Low-Carbon Transition in the Cement Industry. https://webstore.iea.org/technology-roadmap-low-carbon-transition-in-the-cement-industry

[ii] IIGCC, Investor Expectations of Companies in the Construction Materials Sector

[iii] https://www.scientificamerican.com/article/cement-producers-are-developing-a-plan-to-reduce-co2-emissions/

[iv] https://www.bbc.com/news/science-environment-46455844

[v] https://www.bloomberg.com/news/articles/2019-07-21/cement-companies-are-starting-to-get-a-33-trillion-headache

[vi] EU Taxonomy Report: Technical Annex, https://ec.europa.eu/info/sites/info/files/business_economy_euro/banking_and_finance/documents/200309-sustainable-finance-teg-final-report-taxonomy-annexes_en.pdf

[vii] https://www.lafargeholcim.us/lafargeholcim-and-solidia-technologies-announce-first-us-commercial-expansion

[viii] Heidelberg Cement 2018 Sustainability Report https://www.heidelbergcement.com/en/sustainability-report

[ix] CRH PLC 2018 Sustainability report https://www.crh.com/media/1022/crh-sustainability-report-2018.pdf

[x] CEMEX 2019 Integrated Report https://www.cemex.com/documents/20143/49694544/IntegratedReport2019.pdf/4e1b2519-b75f-e61a-7cce-2a2f2f6f09dc

Recent Content

Six Best Practices Followed by Industries Leading the Low Carbon Transition

In this article, we take a closer look at the leading industries under the Morningstar Sustainalytics Low Carbon Transition Rating (LCTR) and examine the best practices that have allowed them to emerge as leaders in managing their climate risk.