Key Insights:

|

|

|

In the first half of 2025, global assets in Climate Transition open-end funds and exchange-traded funds (ETFs) — those that focus on companies better prepared for the low-carbon transition — grew by 16% to USD 318 billion.

The rise of Climate Transition strategies reflects a growing intent among investors to both decarbonize their portfolios and contribute to real-world emission reductions by supporting companies actively navigating the shift to a low-carbon economy. Increasingly, traditional core holdings are being replaced with strategies designed to remain resilient in a world in transition. This is consistent with investors’ net zero commitments.

In this article, we explore the regional trends, flows, and growth drivers in Climate Transition funds for the first half of 2025, and assess these funds through the lens of transition metrics.

Europe and the US Shift Focus Toward Climate Transition Funds

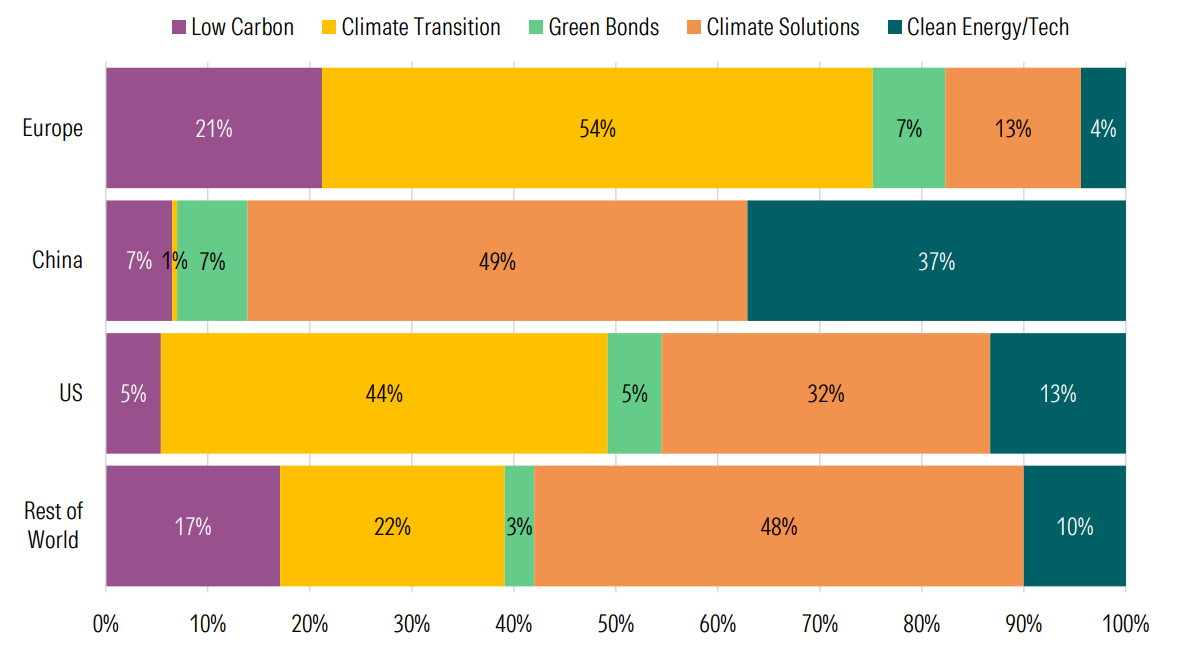

Europe houses 86% of global climate fund assets, leading all other regions across every climate strategy type, from Low Carbon and Climate Transition to Green Bonds, Climate Solutions and Clean Energy/Tech.

Of all these strategies, however, European investors tend to favor Climate Transition funds, which represent over half (54%) of all climate fund assets in the region, followed by Low Carbon funds (21%) (see Figure 1).

Figure 1. Regional Breakdown of Climate Funds by Climate Category

Source: Morningstar Direct and Morningstar Sustainalytics. Data as of June 2025. For informational purposes only.

Amid 8% growth in European-domiciled climate funds in the first half of 2025, Climate Transition funds expanded by 16% to almost USD 300 billion. This was driven by market price appreciation and new entrants, with close to 120 funds being added to the category over this period, bringing combined assets of almost USD 23 billion.

In the US, investors’ focus has also shifted towards Climate Transition funds, with declining appetite for Clean Energy/Tech and Climate Solutions funds. As a result, Climate Transition now represents the largest (44%) climate fund category at USD 14.4 billion.

In the rest of the world, excluding China, Climate Transition funds make up only 22% of assets in this universe, totaling almost USD 5.5 billion as of June 2025. In China, Climate Transition funds made up only 1% of climate fund assets.

Global Climate Transition Funds Continue to Attract Inflows

In Europe, Climate Transition funds were the only category of climate fund assets to attract inflows (USD 1.6 billion) in the first half of 2025, following net subscriptions of USD 6.2 billion in 2024.

Four of the five best-selling climate funds in Europe were Climate Transition strategies (see Figure 2), led by UBS Equities World ex CH Climate Awareness NSL (AUM USD 3.6 billion), UBS Global Equity Climate Transition Fund (AUM USD 5.5 billion), and Mercer Passive Sustainable Global Equity CCF (AUM USD 7.2 billion).

Figure 2. YTD 2025 Flow Leaders and Laggards – European Climate Funds

| Name | Net Flows YTD (USD mn) | AUM (USD bn) | Climate Category |

| UBS Equities World excl. CH Climate Aware NSL | 872 | 3.6 | Climate Transition |

| UBS Global Equity Climate Transition Fund | 870 | 5.5 | Climate Transition |

| Mercer Passive Sustainable Global Equity CCF | 759 | 7.2 | Climate Transition |

| NTCM World Low Carbon Plus Equity Index Fund | 740 | 6.4 | Low Carbon |

| Handelsbanken Europa Index Criteria | 737 | 2.2 | Climate Transition |

| iShares Env. & Low Carbon Tilt Real Estate Index Fund (UK) | -3,048 | 6.3 | Low Carbon |

| Xtrackers MSCI USA ESG ETF | -1,344 | 8.2 | Low Carbon |

| Xtrackers MSCI World ESG ETF | -1,132 | 7.2 | Low Carbon |

| Pictet Global Environmental Opportunities | -1,037 | 6.5 | Climate Solutions |

| Handelsbanken Norden Index Criteria | -1,023 | 4.4 | Climate Transition |

Source: Morningstar Direct and Morningstar Sustainalytics. Data as of June 2025. For informational purposes only.

Similarly, in the US, Climate Transition funds were the only category to have recorded positive net flows in the first half of 2025, garnering USD 580 million. Since 2021, these strategies have attracted a combined USD 4.4 billion.

Three Climate Transition funds ranked among the five best-selling US climate funds in the first half of 2025 (see Figure 3): Xtrackers USA Climate Action Equity ETF (AUM USD 3 billion), Xtrackers Emerging Markets Climate Selection ETF (AUM USD 0.5 billion), and Invesco North America Climate ETF (AUM USD 2.6 billion).

Figure 3. 2025 Flow Leaders and Laggards US Climate Funds

| Name | Net Flow YTD (USD mn) | AUM (USD bn) | Climate Category |

| VanEck Uranium and Nuclear ETF | 603 | 1.7 | Climate Solutions |

| Xtrackers USA Climate Action Equity ETF | 472 | 3.0 | Climate Transition |

| Xtrackers Emerging Markets Climate Selection ETF | 288 | 0.5 | Climate Transition |

| First Trust NASDAQ® Clean Edge® Smart Grid Infrastructure Index Fund | 252 | 2.6 | Climate Solutions |

| Invesco North America Climate ETF | 207 | 2.6 | Climate Transition |

| Invesco Global Climate 500 ETF | -527 | 1.3 | Climate Transition |

| Impax Global Environmental Markets Fund | -435 | 2.1 | Climate Solutions |

| Invesco Solar ETF | -207 | 0.6 | Clean Energy/Tech |

| iShares Global Clean Energy ETF | -198 | 1.4 | Clean Energy/Tech |

| Global X Lithium & Battery Tech ETF | -192 | 0.8 | Climate Solutions |

Source: Morningstar Direct and Morningstar Sustainalytics. Data as of June 2025. For informational purposes only.

In the rest of the world, Climate Transition funds attracted net new money of USD 300 million in the first six months of 2025. Two of the best-selling funds were Transition-related, including the Japan-domiciled NEXT FUNDS Global Climate 500 Japan Selection Index ETF.

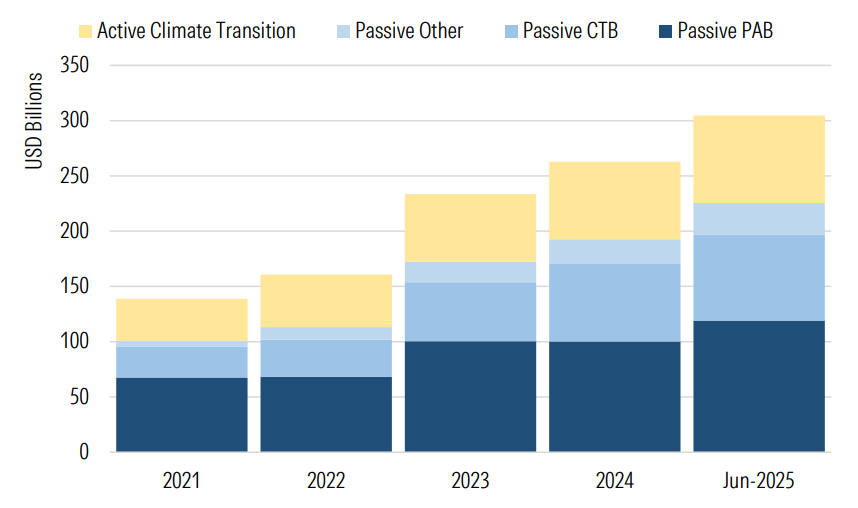

Passive Funds Dominate Climate Transition Fund Assets, But Investors Favor Active Strategies

Passive funds, including those that track Paris-Aligned Benchmarks (PABs) and Climate Transition Benchmarks (CTBs), dominate the global Climate Transition funds category. In Europe specifically, these strategies have been driven by the Regulation on the EU Climate Transition Benchmarks.1

Together, globally, passive Climate Transition funds reached USD 225 billion in assets as of June 2025, equating to 74% of global investment in Climate Transition funds (see Figure 4). However, PAB-tracking funds have experienced outflows over the last 18 months, including USD 1.7 billion in the first half of 2025. In our estimation structural factors, including tracking errors, fossil fuel exclusions, turnover, and competition from other transition strategies, have contributed to reduced investor appetite for these products.

On the other hand, actively managed strategies, which account for only 26% of Climate Transition fund assets, continued to register inflows, totaling almost USD 2 billion in the first half of 2025, following subscriptions of USD 3.2 billion in 2024.

Figure 4. Assets in Climate Transition Funds Sub-Categories

Source: Morningstar Direct and Morningstar Sustainalytics. Data as of June 2025. For informational purposes only.

Note: Passive CTB: Funds that track an EU climate-transition benchmark. Passive PAB: Funds that track an EU Paris-aligned benchmark. Other Passive Climate Transition: Funds that track a climate index that is neither a PAB nor a CTB. Active Climate Transition: Actively managed funds that invest in companies that contribute to the global decarbonization (by being aligned/aligning with the Paris Agreement or providing solutions).

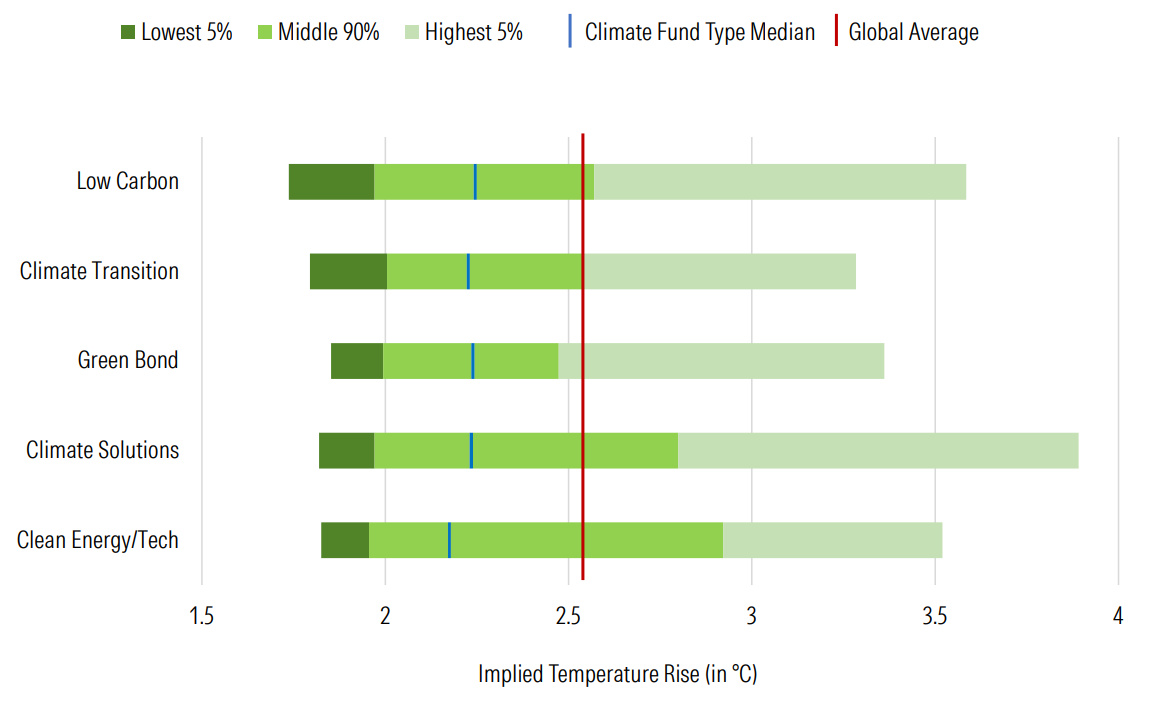

Assessing Climate Transition Funds Through the Lens of Transition Metrics

No climate fund is aligned to a net zero pathway consistent with a 1.5-degree Celsius global warming scenario, but the vast majority (84%) are better aligned than the average peer in the global fund universe (see Figure 5). Climate Transition strategies exhibit a median Implied Temperature Rise (ITR) score of just over 2.2 degrees, second only to Clean Energy/Tech strategies (2.2 degrees). This is partly because of their typical underweight positions in heavy-emitter sectors such as coal, oil and gas, steel, and cement.

Figure 5. Distribution of Implied Temperature Rise Scores Across Climate Fund Types

Source: Morningstar Direct and Morningstar Sustainalytics. Data as of June 2025. For informational purposes only.

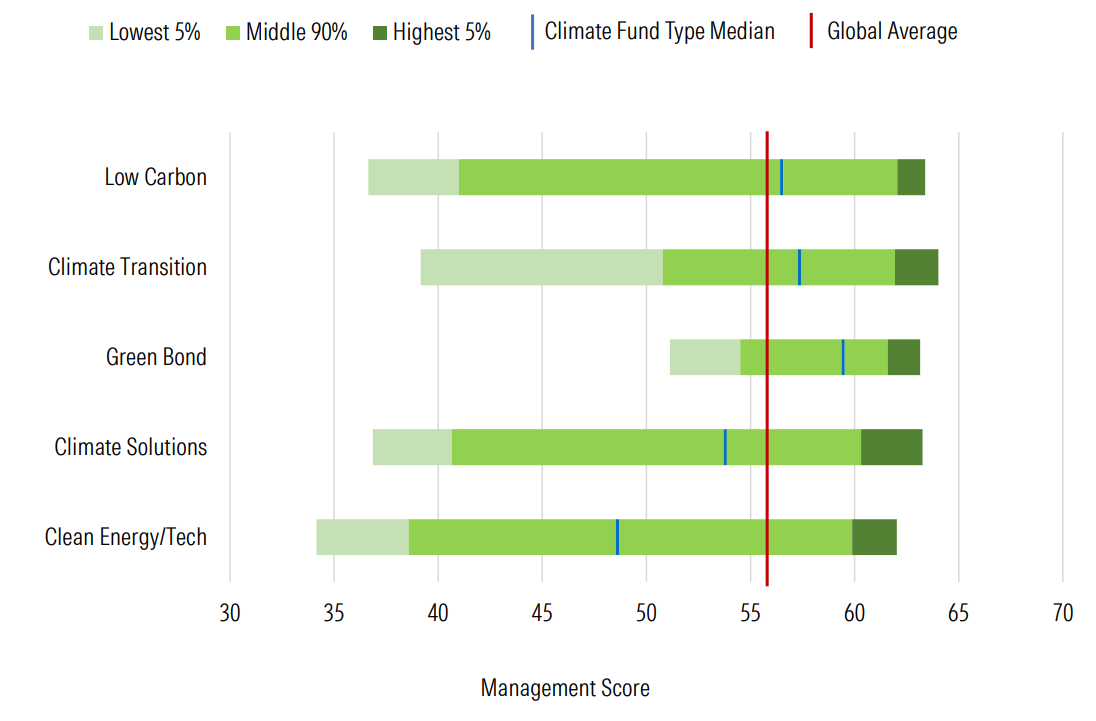

Climate Transition funds also have one of the highest median emissions management scores (57) compared to the other assets in this universe (see Figure 6). At 59, only Green Bond funds score higher. A fund’s management score indicates how prepared its company holdings are to manage their emissions.

Figure 6. Distribution of Management Scores Across Climate Fund Types

Source: Morningstar Direct and Morningstar Sustainalytics. Data as of June 2025. For informational purposes only.

In terms of the quality of emissions management, four of the top ten performing funds concentrate mostly on Climate Transition strategies, while these strategies also have the lowest median Value at Risk (VaR) score of all climate fund assets (2.4%). The VaR metric signals the potential loss in value that an issuer may experience due to the risk posed by the transition to a low-carbon economy between now and 2050.

To learn more about Climate Transition strategies, and how other climate asset funds performed in early 2025, read the full report, Investing in Times of Climate Change.

References

- European Securities and Market Authority. 2025. “Climate benchmarks and ESG disclosure.” https://www.esma.europa.eu/esmas-activities/sustainable-finance/climate-benchmarks-and-esg-disclosure.