Key Insights:

|

|

|

The previous two articles in this series focused on the quality of companies’ climate disclosures1 and on the metrics, beyond carbon emissions,2 that investors could use to evaluate a company’s alignment to a decarbonization pathway. In both instances, our analysis found that European companies outperformed their global peers — both in terms of the quality and completeness of their climate disclosures and their preparedness to manage climate transition risks.

In this third and final article of the series, we use the Morningstar Sustainalytics Low Carbon Transition Ratings (LCTR) to analyze companies against three relevant metrics for assessing a transition plan’s credibility.

Looking Beyond Targets When Assessing Corporate Climate Risks

For many institutional investors, knowing whether a company has a climate transition plan is no longer enough when it comes to managing transition risks and meeting their own climate commitments and regulatory obligations.

The transition to a low-carbon economy could pose serious regulatory, market, technology, and reputational risks to companies. For instance, governments may tighten their climate policies to meet their decarbonization goals, consumer demands could continue to shift towards more sustainable goods and technologies, or companies may come under greater scrutiny for their sustainability record.3 The risks may be even greater for those companies without a clear and robust plan to meet decarbonization targets.

To better manage the related risks to their portfolios, investors can thoroughly analyze companies to determine whether they have a transition plan in place, and, if so, assess the credibility of those plans.

Steps to Determining a Transition Plan’s Credibility

The current assessment and disclosure frameworks, such as those from the Taskforce for Climate-related Financial Disclosure (TCFD), the International Sustainability Standards Board (ISSB), and the Transition Plan Taskforce (TPT), provide useful guidance for investors, helping them evaluate how companies manage climate-related risks and opportunities, while providing transparency into their transition readiness. However, given the number of climate transition focused standards, frameworks, and assessment methods available, investors may want to develop proprietary approaches to assess climate transition plans. Table 1 outlines a practical method for evaluating the credibility of these plans, combining qualitative and quantitative metrics. Investors can follow the steps outlined below to align their approaches with leading regulatory standards (see The Investor’s Guide to Assessing Corporate Climate Transition Plans for more details).

Table 1. Steps to Determine a Climate Transition Plan’s Credibility

Step 1: Assess Governance and Strategy | Effective plans include strong governance frameworks with defined roles and accountability structures, as well as clear strategies for addressing the low-carbon transition. |

Step 2: Evaluate Metrics and Targets | A credible plan should include measurable targets covering all scopes of greenhouse gas (GHG) emissions.4, 5 |

Step 3: Check for External Verification and Oversight | Credible plans should include third-party verification and oversight mechanisms to ensure transparency and accountability (e.g., integrity assessments from third-party entities like the Climate Bonds Initiative or the ACT initiative).6, 7 |

Step 4: Assess the Company’s Short- and Medium-Term Investments | The company’s short- and medium-term investments should align with its transition goals, as well as contribute to decarbonization. |

Credible Climate Transition Plans: Three Key Indicators

For investors, managing climate-related risks and opportunities requires thoroughly evaluating how well companies are prepared to align with decarbonization goals, while staying resilient and competitive in the transitioning economy. However, analyzing and comparing complex corporate climate transition plans is time intensive and requires specialized expertise.

In our previous analysis, which included assessments of companies’ management scores within the Low Carbon Transition Rating, three indicators stood out for the insight they provide into a transition plan’s credibility: GHG performance incentives, supply chain GHG reduction programs, and internal carbon price disclosure. And, as in our previous articles, company performance on these three indicators varied across regions, with those based in Europe leading the way.

GHG Performance Incentives

Tying compensation to performance against climate goals — whether at the board, business unit, or CEO-level — is a tool by which companies can demonstrate the credibility of their commitment to net zero. As shown in Figure 1, compared to their global peers, companies in the EU do a better job of linking executive and board pay to climate and transition targets. However, less than half of EU companies disclose that their CEOs’ remuneration is linked to performance on emissions or climate-related targets.

Figure 1. Comparison of GHG Performance Incentive Disclosures Among EU and Non-EU Companies

Source: Morningstar Sustainalytics. For informational purposes only.

Note: Data as of August 6, 2025.

Transition risks exist across a company’s value chain. Although CEOs and boards of directors hold decision-making power, much of the work done further down the organizational chart is exposed to transition risks. Thus, the changes needed to mitigate those risks must happen there.

Supply Chain GHG Reduction Programs

Scope 3 emissions are indirect emissions associated with a company’s supply chain, sold product use, or investments. Considering that scope 3 emissions, on average, constitute around 60% of a company’s overall GHG footprint, having strategies to reduce these emissions is a crucial part of a credible transition plan.8 Effectively managing scope 3 exposure can have a significant positive impact on reducing real-world emissions and transition-related climate risks. Additionally, an increasing number of climate disclosure policies across jurisdictions are moving from voluntary disclosure to mandatory reporting of scope 3 emissions. For example, the Australian Accounting Standards Board’s climate-related financial disclosure requires scope 3 emissions reporting in the second year.9

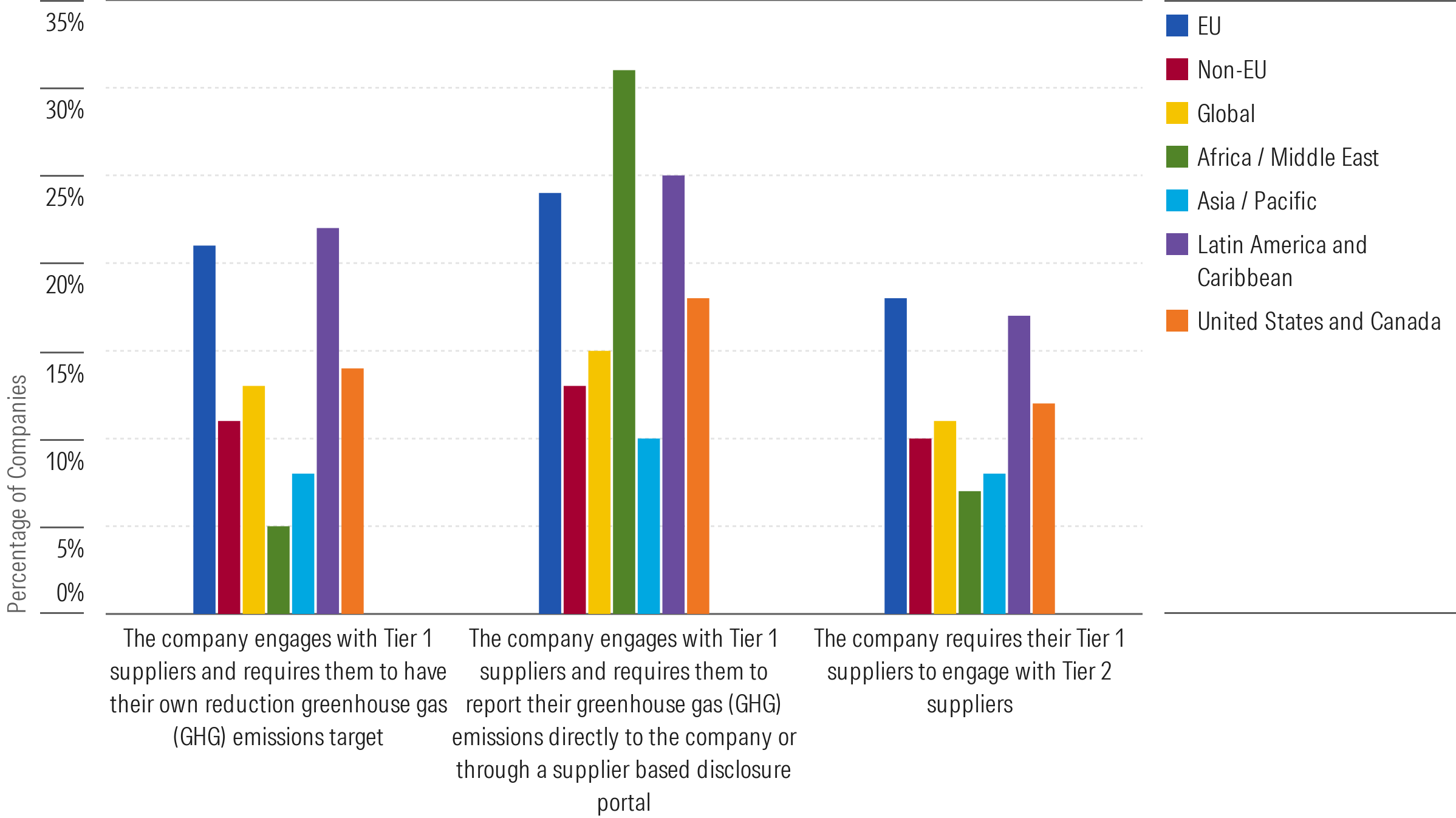

To meet more stringent reporting requirements for both upstream and downstream emissions,10 companies need to collect emissions information from their suppliers. However, analysis of companies in Sustainalytics’ LCTR universe shows that disclosures of corporate policies that require suppliers to report emissions data remains very low. Only 13% of companies globally require their tier 1 suppliers to set their own GHG reduction targets and make it a mandatory requirement for suppliers to directly report on their own emissions to the company (Figure 2). European companies are only marginally better, with 24% requiring suppliers to disclose emissions and 21% requiring suppliers to have a GHG reduction target (Figure 2).

Figure 2. Comparison of Supply Chain GHG Reduction Programs Across Regions

Source: Morningstar Sustainalytics. For informational purposes only.

Note: Data as of August 6, 2025

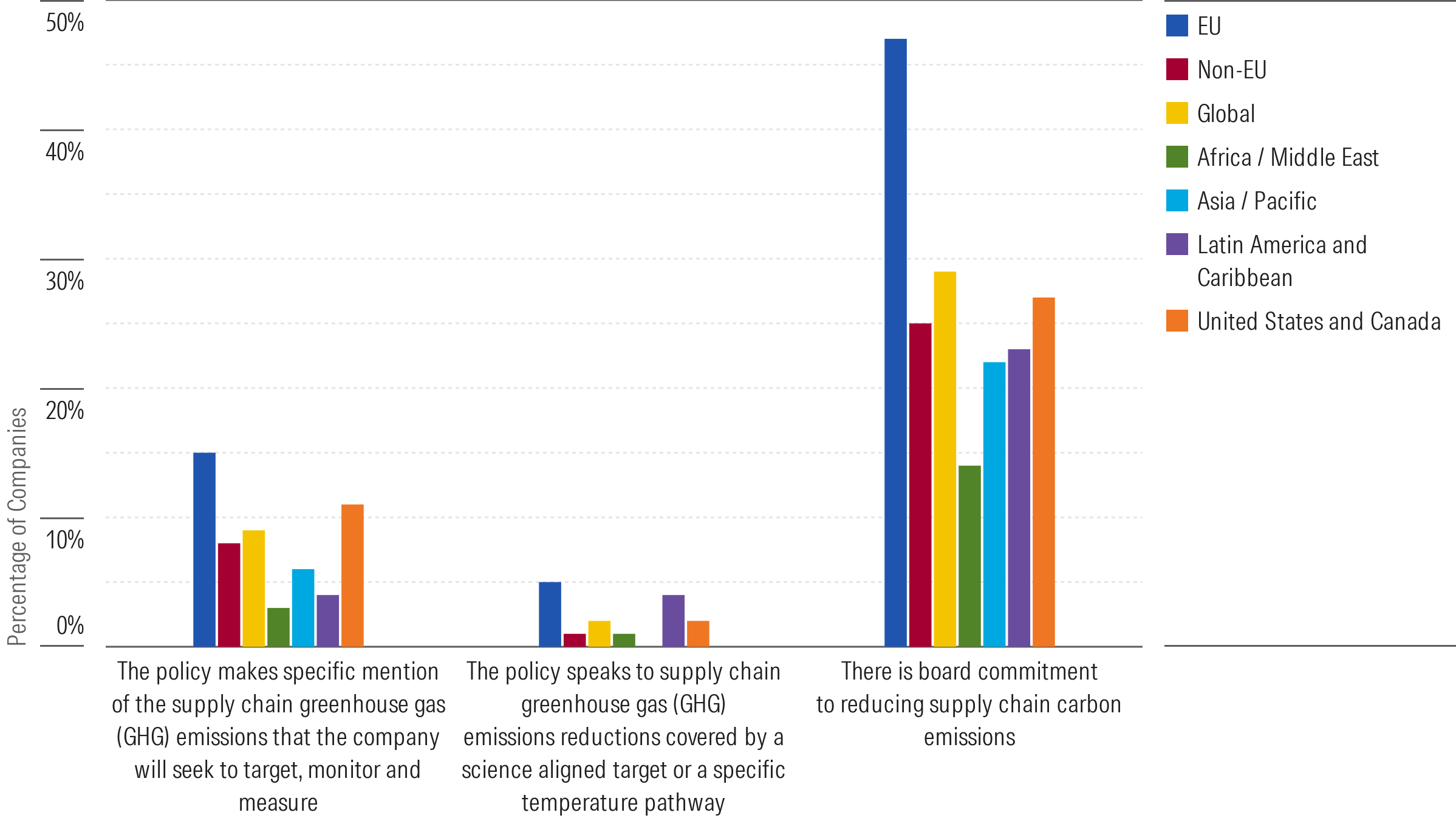

To comply with stricter scope 3 disclosure mandates, companies will need to take significant steps to improve supply chain management, to ensure they are obtaining the right data. Per the LCTR assessment of best practices in managing supply chain emissions, we would expect to see companies not only improve GHG disclosure requirements, but also increase collaboration with industry peers, investors, and other stakeholders to support supply chain decarbonization innovation. Notably, given the higher percentage of board-level commitments to reducing supply chain carbon emissions (Figure 3), we would expect this to be a key area of focus for many companies.

Figure 3. Comparison of Supply Chain Emissions Policy Across Regions

Source: Morningstar Sustainalytics. For informational purposes only.

Note: Data as of August 6, 2025

Internal Carbon Price Disclosure

Effectively addressing potential climate transition risks includes anticipating future regulations that may come in the form of a carbon tax. Using an internal carbon price allows a company to account for future cash outflows based on its emissions. Per the Center for Climate and Energy Solutions:

"Companies say that internal carbon pricing gives them an incentive to shift investments to low-carbon alternatives. It also helps them achieve their greenhouse gas targets, address shareholder concerns about disclosure, build resilient supply chains, gain a competitive edge, and showcase corporate leadership."11

Internal carbon pricing is typically used in one of two ways. Companies can determine a hypothetical cost for carbon use, or a shadow price. Calculating this price can help companies better manage climate risks and identify opportunities in operations, projects, and supply chains to lower emissions and avoid locking their investments in long-lived, high-carbon capital and infrastructure. For example, the World Bank Group applies a shadow carbon price to relevant investment projects using a price consistent with the recommendations of the High-Level Commission on Carbon Prices.12

Companies may also charge an internal carbon fee to their business units for their emissions. Funds generated from this fee are typically channeled back into cleaner technologies and greener activities that support low-carbon transition.

Taking a closer look at two carbon-intensive industries, automotives and utilities, we can see how companies perform with respect to disclosing internal carbon pricing across regions.

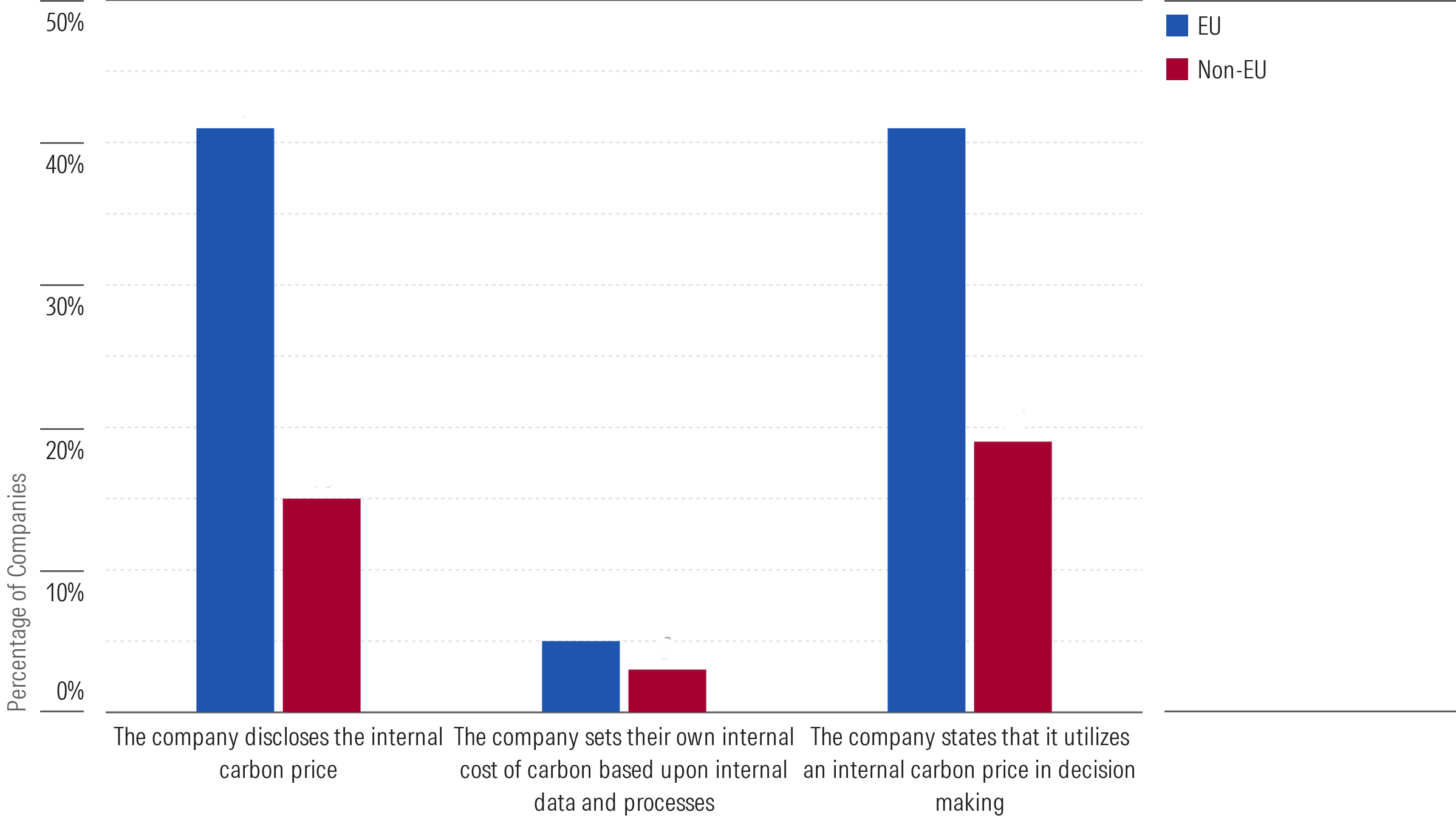

As shown in Figure 4, only 13% of the automotive companies in our LCTR research universe outside of the EU disclose their internal carbon price. However, within the EU, where sustainability and climate reporting has traditionally been more advanced, 50% of automotive companies researched share their internal carbon price. EU automotive companies are also performing well in that 68% of them disclose that they use an internal carbon price in decision-making.

Figure 4. Comparison of Internal Carbon Price Disclosures for EU and Non-EU Automotive Companies

Source: Morningstar Sustainalytics. For informational purposes only.

Note: Data as of August 6, 2025

This result may be attributed to the regulatory environment in the EU. For instance, in 2022, the European Commission introduced the Fit for 55 package which aimed to reduce GHG emissions in the EU by at least 55% by 2030 compared to 1990 levels and achieve climate neutrality in 2050.13

Under the package, rules for the automotive industry include the following targets:

- 55% CO2 emission reductions for new cars and 50% for new vans from 2030 to 2034 compared to 2021 levels.

- 100% CO2 emission reductions for both new cars and vans from 2035.

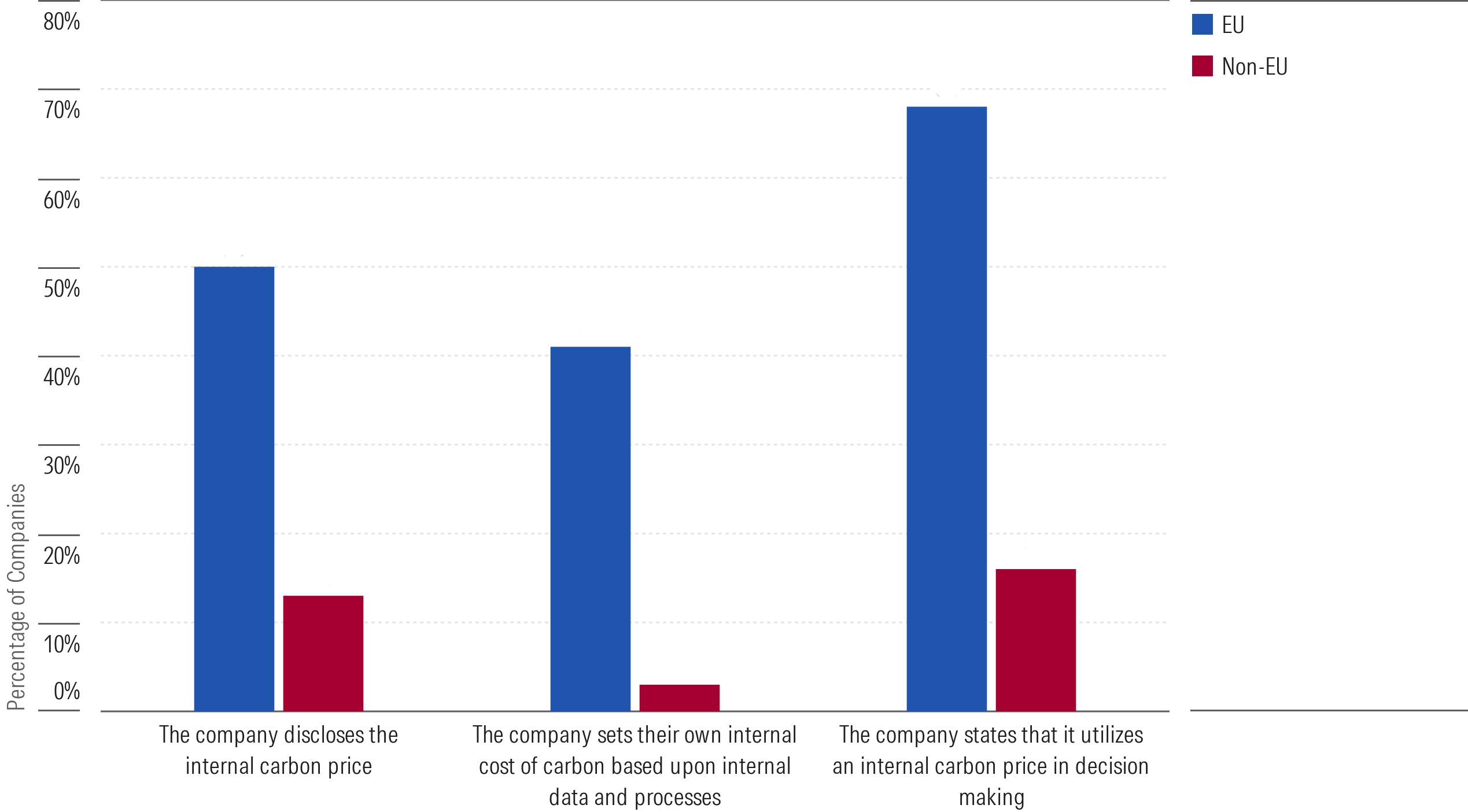

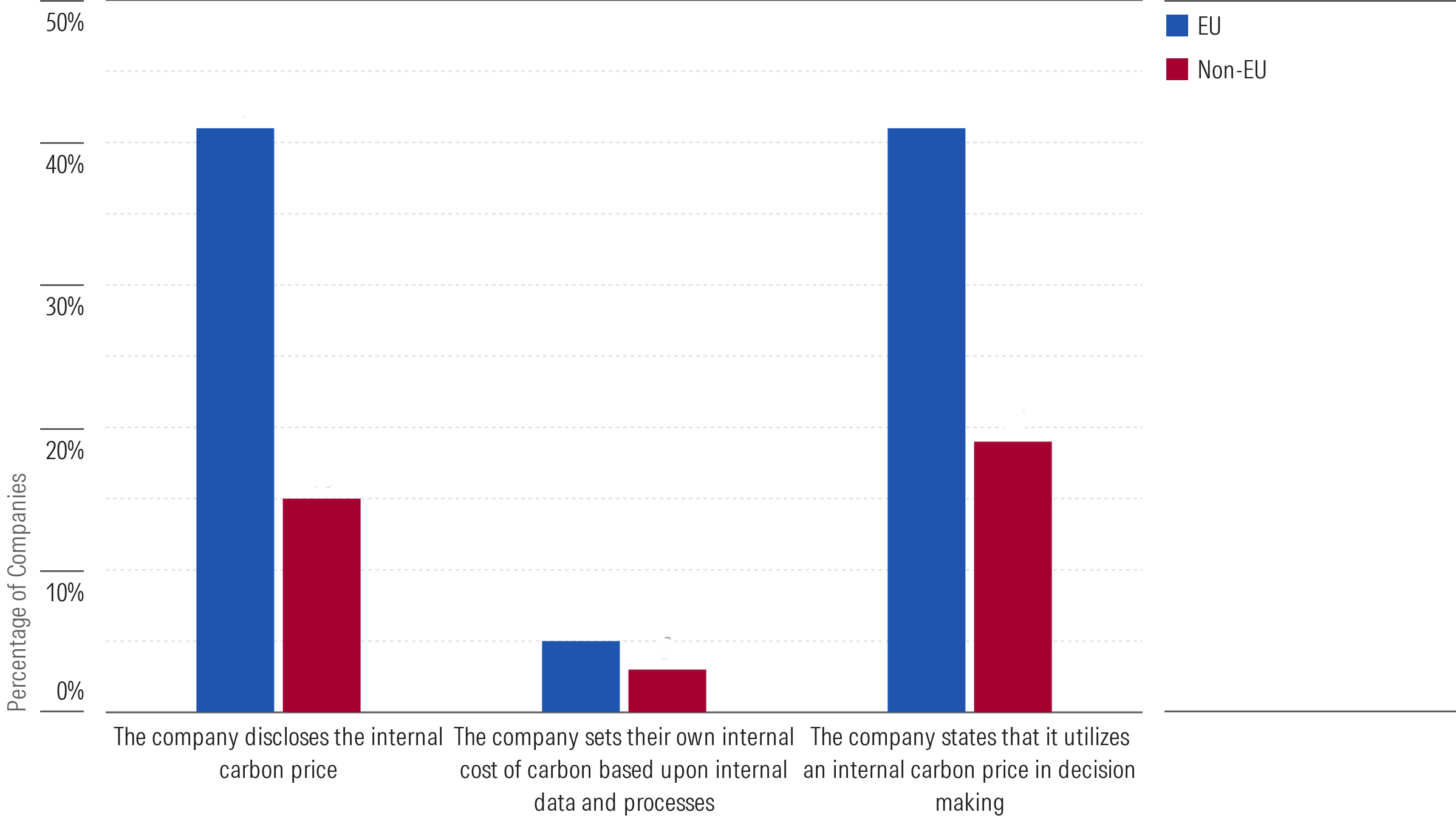

Looking at utilities companies, Figure 5 shows that only 15% of researched companies outside of the EU disclose their internal carbon price, and only 19% state that they use an internal carbon price in their decision-making. Again, EU-based companies outperform their global peers, but it is an area for improvement, especially within an industry with significant exposure to carbon pricing across scopes. Also, with the EU Emissions Trading System being the world’s largest carbon market, EU companies are close to a sophisticated carbon pricing scheme that should inform their internal carbon pricing.

Figure 5. Comparison of Internal Carbon Price Disclosures Among EU and Non-EU Utilities Companies

Source: Morningstar Sustainalytics. For informational purposes only.

Note: Data as of August 6, 2025.

Conclusion

For investors, meeting climate goals and mitigating transition risks means looking beyond issuer disclosures and commitments, to their actual plans. Having the management and governance structures in place — in particular, management incentives, supply chain emissions reduction and internal carbon pricing — is a good indication to investors that a company understands its climate-related risks and has a credible transition plan to help guide the business into a low-carbon economy.

References

- White A. and Feldman, J. 2025. "EU Corporate Climate Disclosures: An Evaluation of Completeness and Quality." March 26, 2025. https://www.sustainalytics.com/esg-research/resource/investors-esg-blog/eu-corporate-climate-disclosures--an-evaluation-of-completeness-and-quality.

- White, A. 2025. "It’s Not Just Emissions: Other Metrics Evaluating EU Companies and Their Decarbonization Pathway." May 13, 2025. https://www.sustainalytics.com/esg-research/resource/investors-esg-blog/beyond-emissions-other-metrics-evaluating-eu-companies-decarbonization-pathway.

- Sustainalytics. 2024. “Low Carbon Transition Ratings Methodology.” https://connect.sustainalytics.com/inv-low-carbon-transition-methodology-abstract-download.

- OECD. 2022. “Elements of Credible Corporate Climate Transition Plans.” In OECD Guidance on Transition Finance (Paris: OECD, 2022), https://doi.org/10.1787/f092a7f7-en.

- Lloyds Bank. 2023. “Sustainability | Just Transition.” https://www.lloydsbank.com/business/resource-centre/insight/just-transition.html.

- OECD. 2022. “Elements of Credible Corporate Climate Transition Plans.”

- Lloyds Bank. 2023. “Sustainability | Just Transition.”

- Morningstar Sustainalytics GHG Emissions Data, March 2023.

- Australian Treasury. 2024. “Mandatory climate-related financial disclosures – Policy position statement.” https://treasury.gov.au/sites/default/files/2024-01/c2024-466491-policy-state.pdf.

- Scope 3 upstream emissions are indirect GHG emissions related to purchased or acquired goods and services, and which occur up to the point of receipt by the reporting company. Downstream emissions, on the other hand, are indirect GHG emissions that result from the use or disposal of a company’s goods or services.

- Center for Climate and Energy Solutions. “Internal Carbon Pricing.” N.d. https://www.c2es.org/content/internal-carbon-pricing/.

- World Bank Group. 2024. “The Shadow Price of Carbon in Economic Analysis.” Guidance Note. https://documents1.worldbank.org/curated/en/099553203142424068/pdf/IDU1c94753bb1819e14c781831215580060675b1.pdf.

- Council of the EU. 2023. “’Fit for 55’: Council adopts regulations on CO2 emissions for new cars and vans.” March 28, 2023. Press Release. https://www.consilium.europa.eu/en/press/press-releases/2023/03/28/fit-for-55-council-adopts-regulation-on-co2-emissions-for-new-cars-and-vans/pdf.