Key Insights:

|

|

|

The ongoing war in Ukraine, rising geopolitical tensions, and concerns over missing out on financial returns have led sustainability-oriented investors to rethink the role of defense sector companies in their portfolios.

In March 2025, the European Commission introduced the ReArm Europe Plan / Readiness 2030 initiative, allocating up to EUR 800 billion in funding.1 To encourage greater capital flows into the defense industry, policymakers have also recently clarified that financing and investing in defense-related activities is compatible with EU ESG regulations, including the Sustainable Finance Disclosure Regulation (SFDR).2

Under the SFDR, EU funds are classified as Article 6, 8, or 9, reflecting different levels of ESG considerations and commitment. Article 8 funds promote environmental and/or social characteristics and are often called light green funds. Article 9 funds have a sustainable investment objective and are often called dark green funds. Funds within the scope of the SFDR that are neither Article 8 nor Article 9 are classified as Article 6 funds.

In this article, we examine the evolution of Article 8 and Article 9 funds’ exposure to the defense sector since the start of the war in Ukraine in 2022 and, more notably, since Europe’s decision to step up its military efforts earlier this year.

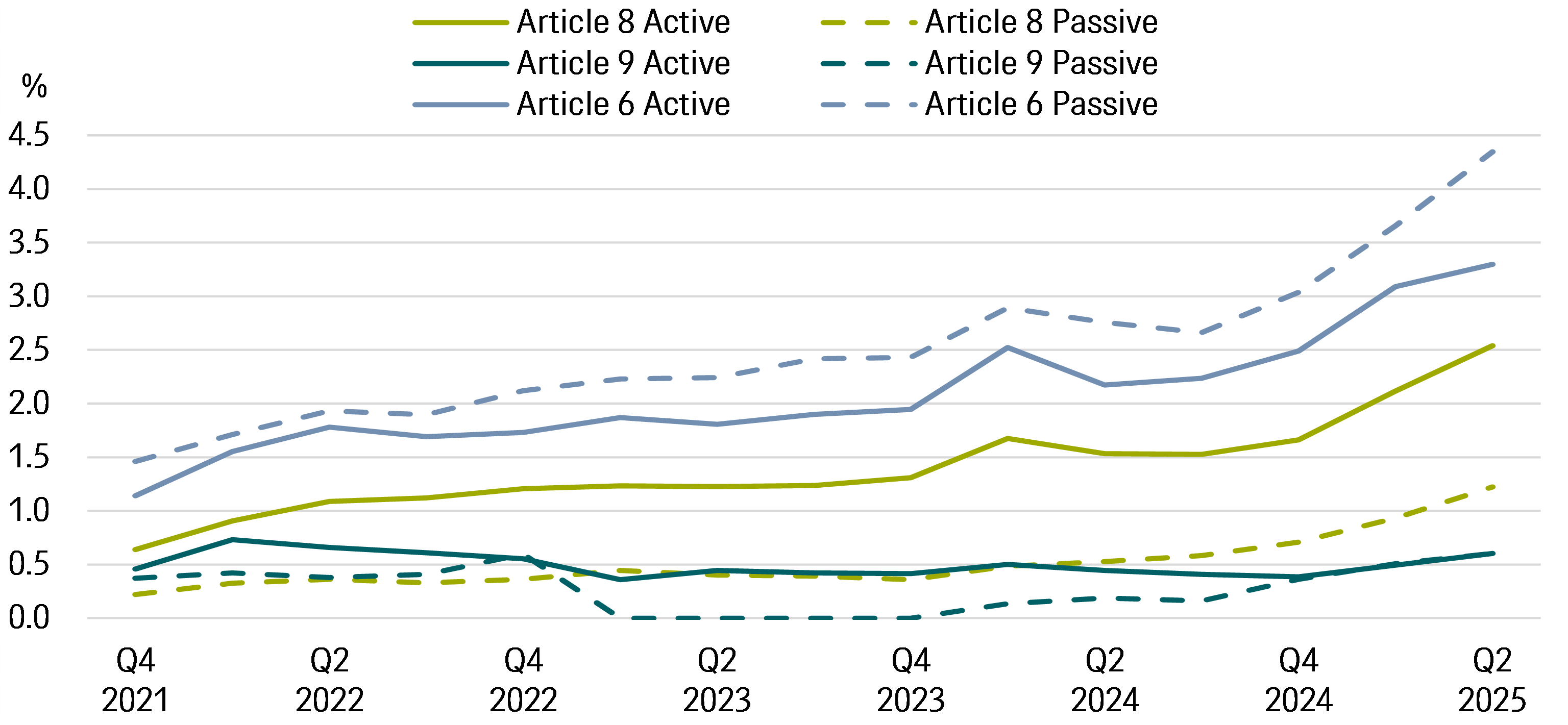

Exposure to Aerospace and Defense Has More Than Quadrupled Among Article 8 European Equity Funds, But Remains Below That of Article 6 Funds

Since Russia’s full-scale invasion of Ukraine in 2022, exposure to aerospace and defense stocks within European equity Article 8 funds has increased significantly — rising to an average of 2.5% for active funds and 1.2% for passive funds, up from 0.6% and 0.2% respectively, at the start of 2022. Despite their growth, these exposures remain below those of Article 6 European equity funds, which average 3.3% for active and 4.3% for passive funds. The average underweight of 3.1% in passive Article 8 funds, relative to their Article 6 counterparts, is particularly striking due largely to the strict ESG exclusion policies embedded in many of the underlying indexes. For context, the Morningstar Europe Index had 4.7% exposure to the aerospace and defense sector as of June 2025, up from 1.5% at the beginning of 2022.

Meanwhile, Article 9 European equity funds — both active and passive — have maintained near zero exposure to aerospace and defense companies, with little change over time.

Exhibit 1. Exposure of European Equity Article 8, 9 and 6 Funds to Aerospace and Defense

Source: Morningstar Direct. Data as of June 2025. For informational purposes only.

Note: Article 6, 8, and 9 funds in pan-European and single European country Morningstar Categories.

The rise in exposure to aerospace and defense companies among Article 6 and Article 8 funds can be attributed to two main factors: increased buying by fund managers and appreciation in defense stocks. While the former is harder to quantify, the latter is evident in the strong performance of defense-related indexes. The Morningstar Developed Markets Europe Aerospace & Defense Index gained 249% between January 2022 and June 2025, beating its US counterpart, which gained 78% over the same period. Meanwhile, the broad European developed equity market benchmark returned 26%.

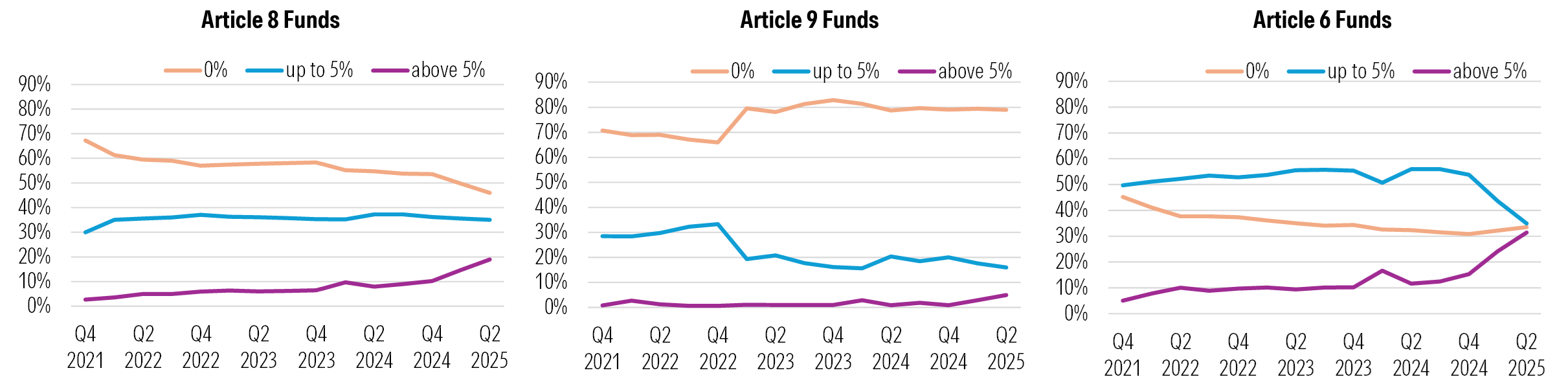

Over Half (54%) of Article 8 European Equity Funds Invest in Defense, Compared With 21% of Article 9 Funds

Below, we show how the proportion of Article 8, 9 and 6 European equity funds with exposure to the aerospace and defense sector has evolved over time.

Exhibit 2. Evolution of the Number of European Equity-Focused Funds with Different Exposures to Aerospace and Defense

Source: Morningstar Direct. Data as of June 2025. For informational purposes only.

Note: Article 8, 9, and 6 funds in pan-European and single European country Morningstar Categories.

The proportion of Article 8 European equity funds with zero exposure to the aerospace and defense sector has dropped markedly since 2022 — from 67% to 46% — while the share of funds with at least 5% exposure has risen to 19%, up from just 3% in 2022. This shift, however, is less pronounced than that observed in Article 6 European equity funds, where the proportion of funds with zero aerospace and defense exposure has declined from 45% to 34%, while 31% now have exposure of at least 5% — six times the level seen in 2022.

Meanwhile, the proportion of Article 9 European equity funds with zero aerospace and defense exposure has remained relatively stable, around 80%, over the past three and a half years (ignoring the uptick observed at the beginning of 2023, which was due to a wave of reclassification of funds from Article 9 to Article 8.3 Still, as of the end of June, 16% of Article 9 funds had up to 5% exposure to the aerospace and defense sector, while 5% of funds had exposure of 5% or more.

While 92% of Article 8 Funds Have Controversial Weapons Exclusion Policies, Only 31% Apply Exclusions Related to Military Contracting

Meanwhile, the proportion of Article 8 funds that explicitly state in their prospectuses that they exclude controversial weapons has increased from 76% in 2022 to 92% as of the end of June, matching the level reached by Article 9 funds.

Exhibit 3. Proportion of Article 8 and Article 9 Funds with Controversial Weapons and Military Weapons Exclusion Policies, Compared with Article 6 Funds

Source: Morningstar Direct and Morningstar Sustainalytics Research. Data as of June 2025. For informational purposes only.

While the 92% figure may appear high — especially compared to just 29% for Article 6 funds — it masks notable differences in how these exclusion policies are applied. In the absence of a universal definition of “controversial weapon,” the list of excluded companies varies across funds. For example, some funds exclude all involvement in nuclear weapons, while others make exceptions for companies domiciled in countries that are signatories to the Treaty on the Non-Proliferation of Nuclear Weapons. Additionally, some funds only exclude companies that manufacture controversial weapons, while others also exclude companies that provide components, logistics, or support services. These nuances result in wide variations in the scope of controversial weapons exclusions.

By contrast, 31% of Article 8 funds and 48% of Article 9 funds have military contracting-related exclusion policies. This means that most managers of Article 8 and Article 9 funds are not opposed to investing in conventional weapons in principle, even though the proportion of funds applying such exclusions has increased since 2022, from 19% and 34%, respectively. While this trend is unlikely to change for Article 9 funds — given their generally stricter ESG mandates and limited inclination to shift their stance on weapons, despite the absence of regulatory constraints — a plateau or a reversal may occur among Article 8 funds.

Under pressure from clients and politicians, asset managers are revising their weapons exclusion policies to allow investments in certain types of weapons. For example, Allianz Global Investors has removed exclusions for its Article 8 mutual funds in two specific areas: military equipment and services and nuclear weapons permitted under the Non-Proliferation Treaty.4 Similarly, UBS Asset Management withdrew its policy prohibiting its sustainable funds from investing in companies that generated more than 10% of their revenues from producing conventional military weapons.5 Meanwhile, Danske Bank Asset Management removed approximately 30 defense-related companies from its exclusion lists.6

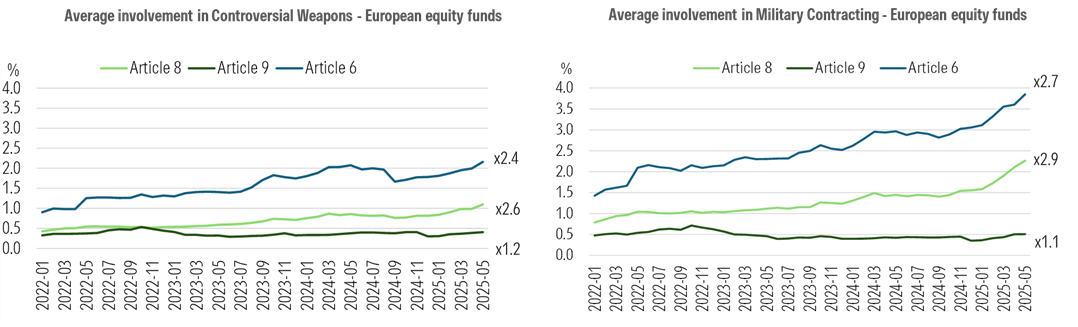

Looking at the actual involvement of Article 8, 9 and 6 European equity funds in controversial weapons and military contracting7 using Morningstar Sustainalytics’ definitions and data, we can see in Exhibit 4 that, on average, Article 8 funds have more than doubled their involvement in controversial weapons and military contracting since 2022, to 1.1% and 2.3%, respectively, as of May 2025. However, involvement levels are still about 40%-50% lower than those of Article 6 funds. Meanwhile, for Article 9 funds, involvement in controversial weapons and military contracting remains much lower and has stayed nearly unchanged over time.

Exhibit 4. Average Involvement in Controversial Weapons and Military Weapons of European Equity-Focused Funds

Source: Morningstar Direct and Morningstar Sustainalytics Research. Data as of May 2025. For informational purposes only.

Note: Article 8, 9, and 6 funds in pan-European and single European country Morningstar Categories.

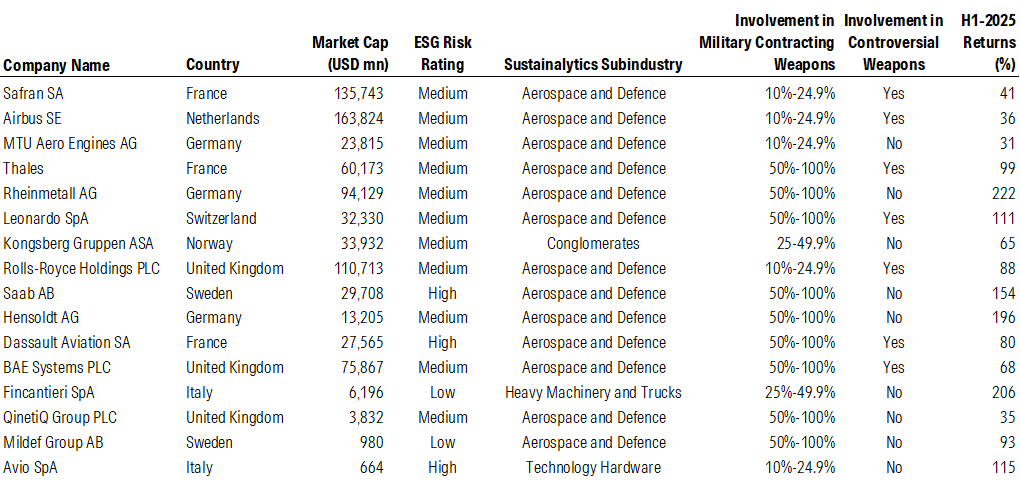

Top European Defense Companies Have Medium ESG Risks

Below is a list of the defense companies most commonly held by European equity funds marketed in the EU. These companies have varying levels of revenue generated from defense-related activities. Companies such as Thales, Rheinmetall, and Leonardo generate most of their revenue from military contracting products (between 50% and 100%), while others, such as Safran, Airbus, and Roll-Royce, derive less than 25% of their revenue from military contracting activities.

Exhibit 5. EU European Equity Funds - Commonly Held Defense Stocks

Source: Morningstar Direct and Morningstar Sustainalytics Research. Data as of June 2025. For informational purposes only.

Note: Controversial weapons comprise six types of weapons, including nuclear weapons.

Some of these companies are also involved in what Sustainalytics classifies as controversial weapons. In the case of Safran, Airbus, Thales, and others, this is due to their involvement in the production of nuclear missiles. As previously mentioned, the vast majority of Article 8 and Article 9 funds exclude companies associated with controversial weapons, but many make exceptions for firms involved in nuclear weapons if they are domiciled in countries that are signatories to the Treaty on the Non-Proliferation of Nuclear Weapons.

Most companies on this list carry a medium ESG Risk Rating, while a few, such as Sweden’s Saab and France’s Dassault Aviation, are rated high. Two companies, Fincantieri (Italy) and Mildef (Sweden), stand out with low ESG Risk Ratings.

Sustainability-Oriented Investors Remain Divided on Defense-Related Investments

To conclude, investor sentiment toward defense has shifted over the past three and a half years, including among sustainability-oriented investors. Average exposure to defense stocks within Article 8 funds has significantly increased, and more of these funds are now invested in weapons. However, the same trend is not observed among Article 9 funds and Article 8 funds remain, on average, underweight in the sector. These findings reflect the fact that Article 8 and Article 9 funds span a broad spectrum of ESG strategies — from very light green (where ESG considerations are present but not binding; these funds tend to have no ESG reference in their name) to dark green (where investments are 100% sustainable).

This spectrum of ESG strategies, in turn, reflects the range of investor preferences on defense-related investments, a divide that is likely to persist. Some investors believe that financing European defense is a social responsibility, viewing investment in weapons as protecting democracy and freedom, especially in light of the ongoing war in Ukraine. These investors are also concerned about potentially missing out on financial returns.

Other investors, however, continue to view defense companies as incompatible with sustainable investment objectives, including good governance and the principle "do no significant harm.” More specifically, some argue that funding weapons, conflict, and surveillance poses ethical issues. These concerns are further compounded by limited transparency around the end users of weapons, as well as the sector’s heightened exposure to bribery and corruption risks. Morningstar Sustainalytics’ ESG Risk Ratings for companies highlight these specific unmanaged risks as material to enterprise value for companies in the defense industry.

For additional information on the Defense Readiness Omnibus, watch our webinar replay Navigating EU ESG Rules and Defense Financing Priorities and for further analysis, read SFDR Article 8 and Article 9 Funds: Q2-2025 in Review.

References

- European Commission. 2025. Commission Unveils the White Paper for European Defence and the ReArm Europe Plan/Readiness 2030. March 19, 2025. https://ec.europa.eu/commission/presscorner/detail/en/ip_25_793.

- European Commission. 2025. Defence Readiness Omnibus. https://defence-industry-space.ec.europa.eu/eu-defence-industry/defence-readiness-omnibus_en.

- Reclassifications reached their zenith in the last quarter of 2022, with close to 420 funds altering their SFDR status. Out of these, 307 were downgraded to Article 8 from Article 9, representing a total size of EUR 175 billion at the time. That large reclassification wave was triggered by the European Securities and Markets Authority's clarification of the EU Commission’s June 2021 Q&A. It specified that funds making Article 9 disclosures may only invest in sustainable investments based on the definition provided by Article 2, No. 17 of the Disclosure Regulation, with the exception of cash and assets used for hedging purposes.

- Allianz Global Investors. 2025. "AllianzGI evolves defence-related exclusion criteria for Article 8 mutual funds under EU SFDR." March 27, 2025. https://regulatory.allianzgi.com/-/media/allianzgi/eu/regulatory/2025-march/client-letter-exclusions-policy-changes.pdf.

- Rovnick, N, & Withers, I. 2025. "UBS ditches weapons exclusion from sustainable investment criteria." April 1, 2025. Yahoo! Finance. https://uk.finance.yahoo.com/news/ubs-ditches-weapons-exclusion-sustainable-160733744.html.

- Danske Bank. 2025. "Danske Bank expands its investment universe for defence shares." April 1, 2025. https://danskebank.com/news-and-insights/news-archive/news/2025/01042025.

- "Involvement in controversial weapons" includes the production, trade, or sale of controversial weapons — directly or via ownership. This covers manufacturers of weapons systems, suppliers of essential or nonessential components, and providers of services or parts used in such weapons, even if they are not custom-built or critical to their function. Morningstar Sustainalytics defines controversial weapons as, "weapons with indiscriminate, long-term impacts on civilians." This includes the following six types of weapons: anti-personnel mines, biological and chemical weapons, cluster weapons, nuclear weapons, depleted uranium, and white phosphorus. Companies involved in military contracting activities are those earning revenue from weapons, components, or custom products/services for armed forces or defense original equipment manufacturers.