Key Insights:

|

|

|

Climate change mitigation appears to have become taboo, as illustrated by the growing list of organizations leaving net zero alliances.1,2,3 However, a recent report stated that the outcomes related to climate change create a systemic risk: an undiversifiable risk “that can impact entire markets or economic systems through complex interconnections, potentially triggering chain reactions across multiple sectors and undermining overall market growth.”4

An increasingly heard narrative argues that it is not the job of investors to actively push the economy to contribute to carbon neutrality by 2050; investors are not elected officials and should therefore not have the power to influence societies’ evolution. Additionally, if the economy is not on track to reach this goal, collaborative actions would not only breach antitrust laws but also fiduciary duty.5 As a result, many believe that driving climate action should be left to governments.

In this article, I explore other narratives, and look at some concrete actions asset owners may take to address climate-related systemic risks.

Green Swan: Why is Climate Change More Serious Than Other Systemic Risks?

In a 2020 report, the Bank for International Settlements (BIS) argued that investors should pay closer attention to climate change. Its authors contend that climate-related systemic risks share the characteristics of “black swan” events in that they are rare, their impacts are wide-ranging or extreme, and they cannot be anticipated.6

However, given the threat it poses, climate change is defined as a “green swan.” This is because:

- The likelihood that physical and/or transition risks will materialize in the future is high.

- The complex effects associated with both physical and transition risks have unpredictable environmental, geopolitical, and economic outcomes.7

Recent analyses have tried to take these factors into account. Norges Bank Investment Management (NBIM), the largest sovereign wealth fund in the world with over USD 1.7 trillion of asset under management,8 has reassessed physical climate value-at-risk (VaR) of its US equities investments. Accounting for damages and macroeconomic impacts to a business model, NBIM has revised its VaR from 2% to 19%, under a 3 degrees Celsius scenario.9 Another study, by the EDHEC Risk Climate Impact Institute, showed that 40% of global equities are at risk at the current pace of decarbonization.10

Why Reducing Climate-Related Systemic Risks Can Benefit Investors and Climate

Addressing systemic risks, such as climate change, can affect the overall performance of the financial markets. Studies estimate that between 75% and 94% of a typical fund's return variation stems from general market movements.11 Hiromichi Mizuno, former CIO of the Japanese Government Pension Investment Fund (GPIF), suggested that due to its size, the GPIF’s returns “are overwhelmingly a function of the market and of the systemic risks which affect the real-world economy.”12

Secondly, climate-related risks are likely to be mispriced. This is because many of these risks have only just started to materialize and will potentially only get worse. According to BIS, traditional backward-looking risk models lack the data to accurately price those risks, and climate risks often fall outside of the scenarios that these models account for.13

Lastly, climate change, and related crises such as biodiversity loss, are characterized by deep uncertainty when it comes to the science, economic consequences, and policy responses. So, any effort to mitigate climate change, and in turn lessen this uncertainty, could be beneficial to investors in the long term.

How Asset Owners May Address Climate-Related Systemic Risks

Large investors with diversified portfolios and long-term investment horizons have a particular role to play, which is consistent with their long-term fiduciary duty. Tom Gosling, Senior Visiting Fellow at the London School of Economics, speaking of asset owners, states that “the correct stance for climate concerned investors is to have a position of supporting the most rapid politically feasible decarbonization” since they play a role across the economy and can stress the overall benefits.14

On the positive side, asset owners’ climate change-related risks are well identified. According to Morningstar’s latest Voice of the Asset Owner survey, respondents cited climate transition readiness (56%), energy management (48%), and physical climate risks (42%) among the most material environmental factors.15

To integrate climate-related risks and opportunities, investors can finance climate adaptation. According to JP Morgan, the potential return on investment in adaptation ranges from USD 2 to USD 43 for every dollar spent.16 Investors could also finance climate change mitigation by investing in climate solutions and issuers that are on a robust decarbonization pathway.17 However, these strategies focus on firm-specific risks and opportunities, and do not address the long-term and structural causes of systemic risks.

To mitigate systemic risks, asset owners may also focus on market-wide changes. Below are four strategies asset owners could pursue:18,19

- Conduct collective policy engagement with regulators and policymakers, by sharing expertise and resources.

- Have clear and public expectations and rules regarding their stewardship policies.

- Integrate approaches to systemic risks in the asset manager selection process, setting clear expectations in investment mandates, and tracking how they interact with portfolio companies and policymakers.

- Support academia by funding programs or conducting joint research to better understand and assess climate-related financial risks.

How Asset Owners Currently Address Climate-Related Systemic Risks

A combination of risk and climate data, such as those provided by Sustainalytics’ ESG Risk Ratings and Low-Carbon Transition Ratings (LCTR), can be used to assess companies’ climate commitments and initiatives.

Using these indicators (see Table 1) as a proxy, I assessed how the top 20 listed insurers by market capitalization address climate-related systemic risks. These 20 companies represent 47% of the total market capitalization of listed companies researched by Sustainalytics in the following four subindustries of our current ESG Risk Ratings research universe: property and casualty insurance, diversified insurance services, life and health insurance, and reinsurance.

Table 1. Description of Selected Sustainalytics ESG Risk Ratings and LCTR Management Indicators

Indicator | Definition |

Responsible Investment Policy | This indicator assesses a company's commitment to responsible investment practices by integrating environmental, social and governance (ESG) criteria into the investment decision-making process. |

Responsible Investment Program | This indicator assesses a company's initiatives to integrate ESG factors into investment decisions, including executive or board oversight, and reporting on strategy implementation. |

UNEP FI Signatory | This indicator identifies whether a company is a member of the internationally recognized United Nations Environment Programme Finance Initiative (UNEP FI), indicating its commitment to mobilize finance for sustainable development. |

Positive Climate Policy Engagement | This indicator assesses a company's initiatives to support positive climate policy and lobbying. |

Source: Morningstar Sustainalytics.

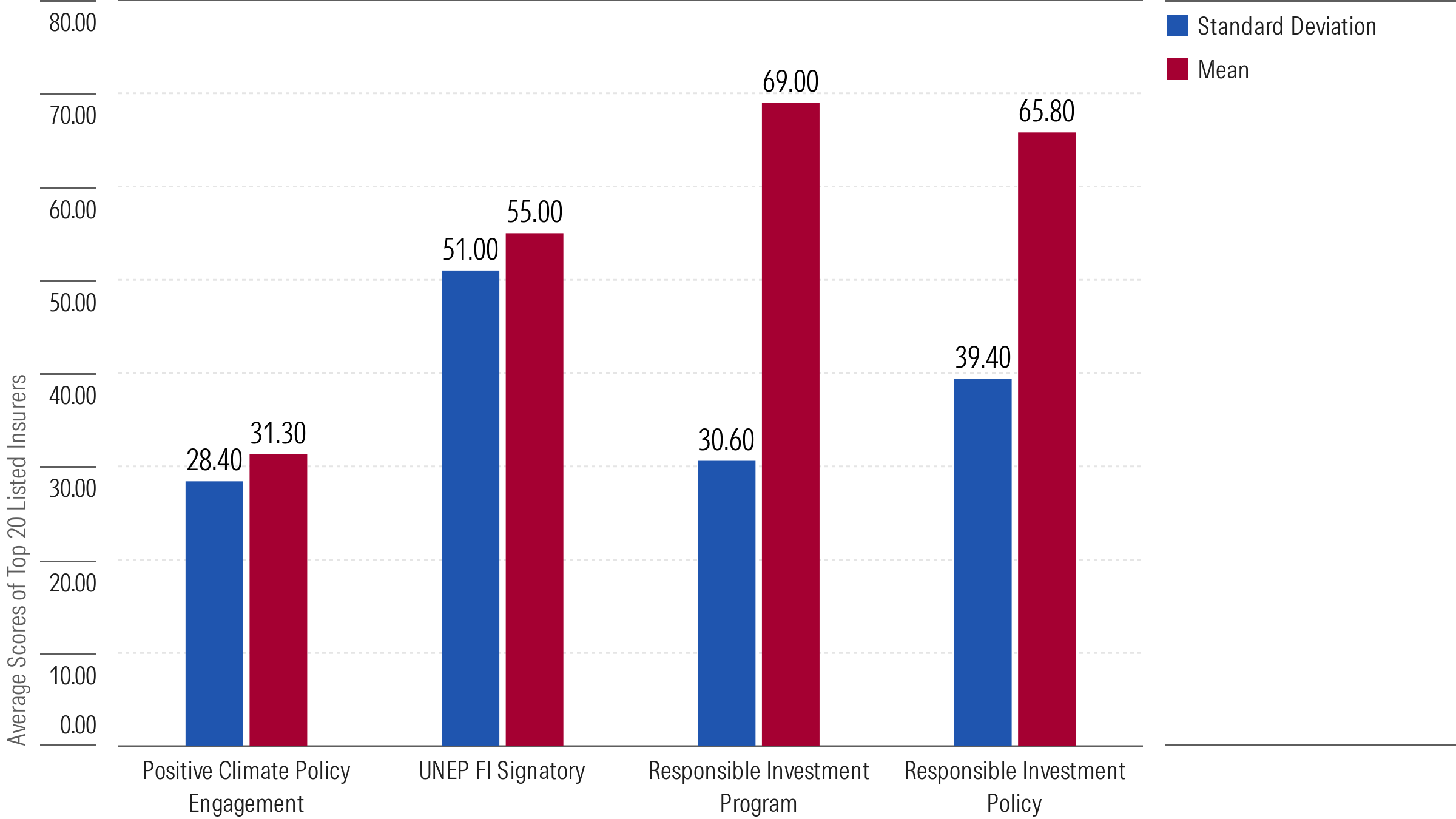

Figure 1 highlights the average scores of this sample on four key climate commitment indicators. The results suggest:

- Engagement with asset managers is strong. The average scores for the responsible investment policy (65.8/100) and responsible asset management (69/100) indicators are strong according to Sustainalytics’ classification. Among other underlying criteria, these indicators assess “requirements for investment managers to integrate ESG issues into investment strategies” and “commitment to engage with companies on ESG issues.”20

- There is weak overall performance when it comes to policy engagement and cross-industry collaboration. While scores related to internal policies are relatively good (i.e., responsible investment policy and responsible investment program-related policies), there is substantial room for improvement when it comes to outreach beyond the financial industry, as shown by the average scores for the UNEP FI signatory (55.0/100) and positive climate policy engagement (31.3/100) indicators, respectively.

- There is heterogeneity across asset owners. The high standard deviation, which is actually close to the mean for the positive climate policy engagement and UNEP FI signatory indicators, shows a wide dispersion, which points to the weaknesses of a large share of insurers.

Figure 1. Mean and Standard Deviation on Advocacy Policies Risk Management Indicators

Source: Morningstar Sustainalytics. Data as of September 3, 2025. For informational purposes only.

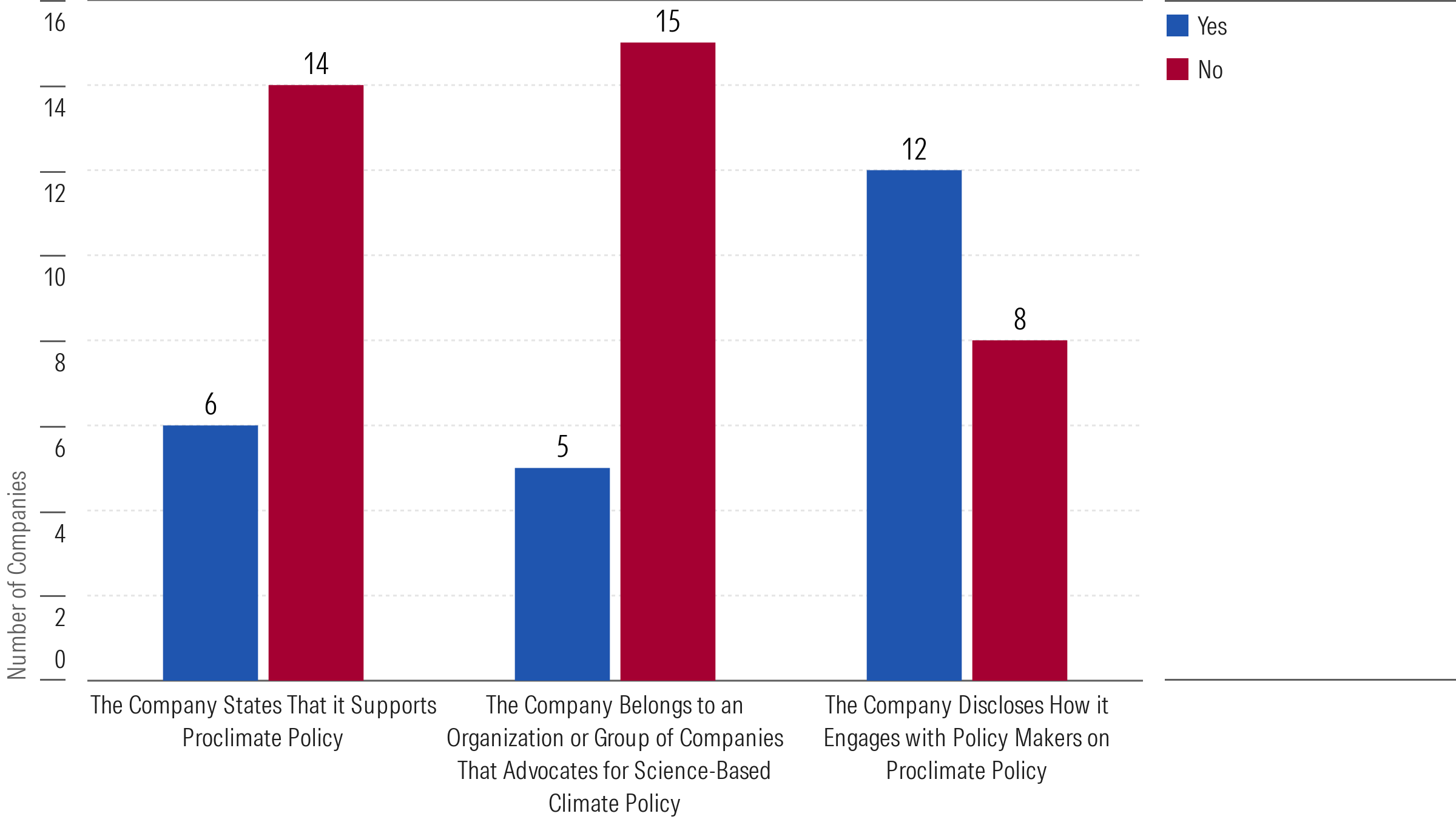

Table 2 highlights the criteria for the positive climate policy engagement indicator, a risk management indicator that uses more granular data.

Table 2. Underlying Criteria of the Positive Climate Policy Engagement Indicator

Indicator | Underlying Criteria |

Positive Climate Policy Engagement | The company states that it supports proclimate policy. |

The company has compared its internal policies with the organizations in which it holds membership. | |

The company discloses how it engages with policy makers on pro-climate policy. | |

The company belongs to an organization or group of companies that advocates for science-based climate policy. |

Source: Morningstar Sustainalytics.

Looking again at the sample of 20 insurers, a striking difference stands out, this time between transparency and proactive and positive action. Twelve companies in the sample disclose how they engage with policy makers on proclimate policy. However, only five insurers belong to organizations or groups of companies whose purpose is to lobby governments to enact science-based policies meant to limit greenhouse gas emissions to keep global warming to 1.5 C. Likewise, only six insurers state that they support proclimate policies.

Figure 2. Positive Climate Policy Engagement of the Top 20 Listed Insurers by Market Capitalization

Source: Morningstar Sustainalytics data as of September 3, 2025. For informational purposes only.

What Does the Way Forward for Asset Owners Look Like?

The lack of resources and expertise among asset owners and net zero alliances has been cited as an obstacle to effective action. However, this is changing. In countries such as the Netherlands, Australia, and Canada, “greater consolidation has enabled asset owners to develop robust internal capabilities, particularly around systemic sustainability issues.”21

The InfluenceMap think tank states that asset owners should also monitor the lobbying policies of investee issuers: “European businesses have become significantly more supportive of green policies in the public positions they’ve taken – but their industry lobby groups have proved much less so.”22 Unfortunately, due to a lack of specific lobbying data, doing so can be tricky.23

To overcome this resource and information challenge, asset owners, and investors more generally, can leverage Sustainalytics’ data to analyze companies’ climate lobbying policies.

Sustainalytics’ Net Zero Transition Stewardship Program not only currently engages 100 companies, but also covers three out of the four actions mentioned previously:

- Setting out clear and public expectations.

- Learning from other organizations that may have relevant expertise.

- Helping asset managers best implement effective stewardship policies and, thus, respond to enhanced expectations asset owners may have.

It is under these conditions that asset owners may be able to mitigate climate-related systemic risks, which are being viewed as a threat to long-term value creation.

References

- Net-Zero Insurance Alliance. 2024. The Net-Zero Insurance Alliance was discontinued as of 25 April 2024. April 25, 2024. https://www.unepfi.org/insurance/insurance/projects/net-zero-insurance-alliance/.

- Segal, M. 2025 “Net Zero Banking Alliance Drops Requirement to Align Financing with 1.5°C”. ESG Today. April 16, 2025. https://www.esgtoday.com/net-zero-banking-alliance-drops-requirement-to-align-financing-with-1-5c/.

- Net Zero Asset Managers Initiative. 2025. Update from the Net Zero Asset Managers initiative. January 13, 2025. https://www.netzeroassetmanagers.org/update-from-the-net-zero-asset-managers-initiative/.

- Shaw, E., Martindale, W., Gupta, S., & Alexander, J., 2025. “Systemic risks: A framework for portfolio resilience”. UKSIF, Scottish Widows and Canbury Insights. https://uksif.org/a-stronger-focus-on-systemic-risks-needed-for-resilient-portfolio-returns/.

- Gosling, T. 2023. “Net Zero Asset Management And The Fiduciary Duty Dilemma”. Forbes. January 10, 2023. https://www.forbes.com/sites/lbsbusinessstrategyreview/2023/01/10/net-zero-asset-management-and-the-fiduciary-duty-dilemma/.

- Taleb, N. N. 2007. The Black Swan: The Impact of the Highly Improbable (Random House).

- Bolton, P., Després, M, Perreira da Silva, L. et al., 2020. “The green swan: Central banking and financial stability in the age of climate change”. Bank for International Settlements. https://www.bis.org/publ/othp31.htm.

- Statista. 2025. “Assets Under Management (AUM) of Norway's Norges Bank Investment Management (NBIM) sovereign fund worldwide from 2008 to June 2024”. Accessed on September 22, 2025. https://www.statista.com/statistics/1497876/nbim-assets-under-management-worldwide-sovereign-fund/?srsltid=AfmBOop55xwR1xBUgTdNGVN06yHziwIV2fLG1hfJdwdpD1YpVIbd0mrp.

- Norges Bank Investment Management. 2024. “Climate and Nature Disclosures 2024.” https://www.nbim.no/contentassets/6fdfd333e6bf460f8e538b9b55a95bb7/gpfg-climate-and-nature-disclosures-2024.pdf. December 31, 2024.

- Marchant, C. 2024. « 40% of global equity at risk from current pace of decarbonization, study says.” Pensions & Investments. August 30, 2024. https://www.pionline.com/esg/40-global-equity-risk-current-pace-decarbonization-study-says.

- Lukomnik, J. & Hawley J. P. 2021. Moving Beyond Modern Portfolio Theory: Investing That Matters (Routledge Taylor & Francis Group).

- Appell, D. 2023. “GPIF hopes to use size as way to enhance beta”. Pensions & Investments. November 17, 2017. https://www.pionline.com/article/20171127/PRINT/171129920/gpif-hopes-to-use-size-as-way-to-enhance-beta.

- Bolton, P., Després, M, Perreira da Silva, L. et al., 2020. “The green swan: Central banking and financial stability in the age of climate change”. Bank for International Settlements. https://www.bis.org/publ/othp31.htm.

- Gosling, T. and Mitchell, J. 2025. “Prof. Tom Gosling, London School of Economics, on Whether Investors Reset, Recalibrate, or Retreat from Net Zero“. January 29, 2025. A Sustainable Future Podcast. https://www.man.com/insights/ri-podcast-prof-tom-gosling.

- Edwards, R. 2025. “Voice of the Asset Owner Survey 2025 Quantitative Analysis”. Morningstar. September 18, 2025. https://indexes.morningstar.com/insights/analysis/blt698e1113cca0c28f/voice-of-the-asset-owner-survey-2025-quantitative-analysis.

- Kapnick, S. 2025. “Climate Intuition: Unlocking resilience through strategic climate adaptation”. J.P. Morgan. May 1, 2025. https://www.jpmorgan.com/insights/sustainability/climate/unlocking-resilience-through-climate-adaptation.

- Institutional Investors Group on Climate Change. 2024. Updated Net Zero Investment Framework, the most widely used net zero guidance by investors, published as 'NZIF 2.0'. June 24, 2024. https://www.iigcc.org/media-centre/updated-nzif-2.0.

- Shaw, E., Martindale, W., Gupta, S., & Alexander, J., 2025. “Systemic risks: A framework for portfolio resilience”. UKSIF, Scottish Widows and Canbury Insights. https://uksif.org/a-stronger-focus-on-systemic-risks-needed-for-resilient-portfolio-returns/.

- Sierra Club. 2025. The Long Term Will Be Decided Now: Why Climate Risk Demands System-Level Action from Investors. https://www.sierraclub.org/press-releases/2025/06/new-sierra-club-paper-calls-investors-confront-climate-change-systemic.

- Morningstar Sustainalytics. ESG Risk Ratings. https://www.sustainalytics.com/esg-data.

- Shaw, E., Martindale, W., Gupta, S., & Alexander, J., 2025. “Systemic risks: A framework for portfolio resilience”. UKSIF, Scottish Widows and Canbury Insights. https://uksif.org/a-stronger-focus-on-systemic-risks-needed-for-resilient-portfolio-returns/.

- Mundy, S. 2025. “European companies’ muddled message on climate”. Financial Times. May 19, 2025. https://www.ft.com/content/6b49b8a0-12a8-4a80-ad63-51890e42ae03.

- The Good Lobby. 2025. The Good Lobby Tracker 2025. https://thegoodlobby.eu/press-release-the-good-lobby-tracker-2025/.