Key Insights:

|

|

|

Despite decades of advocacy from NGOs, consumers, and shareholder groups, as well as corporate commitments to eliminate deforestation from supply chains, significant progress is still required to end and reverse the trend. The main driver of deforestation is the expansion of agricultural land linked to the production of commodities like palm oil and some of its derived products. Reversing this trend is a critical lever to reaching net zero goals and protecting supply chain stability in sectors exposed to forest-risk commodities.

The European Union Regulation on Deforestation-free Products (EUDR) underscores this urgency, marking a shift from voluntary action to regulatory obligation by restricting deforestation and degradation-linked products from entering the EU. Since the regulation was introduced in 2023, companies sourcing palm oil and other forest-risk commodities have faced heightened pressure to strengthen their supply chain transparency and due diligence systems to safeguard their access to the EU market. However, the European Commission recently proposed a second postponement to the regulation’s compliance deadline, which could make the law applicable on December 30, 2026, for large and medium companies, and June 30, 2027, for micro and small enterprises.1 Although the deferral creates uncertainty for palm oil producers, traders, and downstream buyers, and for investors attempting to navigate deforestation risks in their portfolios, in the medium term, the EUDR will likely remain a key consideration within the strategic decision-making of all players.

Supply chain traceability and transparent anti-deforestation programs are not only important for regulatory compliance but they can also lower reputational risks for companies, stabilize the distribution chain, and help build more resilient supply chains that can withstand market pressures. Thus, such programs remain a key risk mitigation tool for companies sourcing palm oil amid growing consumer scrutiny, stricter expectations from downstream buyers regarding sustainable sourcing, and broader market risks such as volatile commodity costs. Morningstar Sustainalytics’ ESG Risk Ratings research provides insights into palm oil buyers’ deforestation management programs and involvement in any related incidents.

Land Use and Biodiversity Issues in Palm Oil Supply Chains

Since 2005, global palm oil production has more than doubled, reaching over 78 million metric tons in 2024.2 The rapid expansion of palm plantations to meet consumer demand for everyday products has been associated with environmental and social issues, from community conflicts to large-scale deforestation. Notably, in 2023, around 30,000 hectares of forest in Indonesia were cleared for palm oil plantations.3 While Indonesia has about 92 million hectares of forest, this represents a 36% increase from the prior year, signaling a sharp acceleration in deforestation.4 By 2050, the production of palm oil is expected to increase by four to six times, putting forest resources at risk globally if sustainable production is not prioritized.5 For instance, the World Wildlife Fund (WWF) estimates that 230 million hectares of forest area could disappear by 2050 if no action is taken, undermining progress towards the UN COP26 goal of ending and reversing deforestation by 2030.6

Companies sourcing palm oil have been scrutinized for their role in contributing to global deforestation. Sustainalytics tracks company involvement in incidents related to land use and biodiversity issues in the supply chain. Moreover, these incidents are typically linked to deforestation, ecosystem destruction, and negative impacts on wildlife. Approximately 63% of all Land Use and Biodiversity – Supply Chain incidents captured in Sustainalytics’ Controversies research (as of September 2025) are related to palm oil. Three industries drive that involvement: Packaged Foods, which account for 45% of Land Use and Biodiversity – Supply Chain palm oil-related incidents; Agriculture, representing 24%; and Personal Products, accounting for 21%. Despite reputational issues, until recently, companies linked to deforestation have faced limited financial risks. However, in recent years, regulatory proposals, particularly from the EU — with comparatively slower progress in the United Kingdom and the United States — have sought to transform anti-deforestation efforts into regulatory obligations, raising the stakes for companies sourcing forest-risk commodities like palm oil. The EU’s EUDR is the most developed to date.

EUDR Obligations and Risks for Companies Sourcing Palm Oil

Despite the EUDR’s potential delay to the end of 2026, the core obligations of the regulatory mandate remain unchanged. Companies importing in-scope products to the EU market are required to submit a due diligence statement to confirm that the product has been traced to its origin and legally produced without deforestation or degradation.7 Considering its link to global deforestation, palm oil is one of the seven commodities under the scope of the EUDR, along with 12 of its derivatives, including crude palm oil, palm kernel oil, and some palm-based chemicals like glycerol.8

The EU regulation is complex and implies different levels of obligation depending on the supply chain actor. We have broken down the implications in Table 1 to highlight the potential risks that the EUDR brings to companies sourcing palm oil and its relevant products.

Table 1. Palm Oil Supply Chain Actor — Overview of EUDR Obligations and Risks

Supply Chain Actor | Activity | Obligation | Risks Related to Non-Compliant Sourcing |

Non-EU Supplier (palm oil plantation, mill, exporter) E.g., SD Guthrie Bhd | Grows, processes or exports palm oil or deriver product | Collect geolocation and legality data (plot-level) to give to EU buyers |

|

Non-EU Trader/Exporter E.g., Wilmar International Ltd. | Aggregates or distributes palm oil to EU | Required to collect and share full traceability and legality information regarding palm oil sources |

|

EU Importer/Operator E.g., Bunge Global SA | First to place palm oil or in-scope product on EU market | Required to submit a due diligence statement to prove produce is deforestation-free and legally produced using traceability and legality information |

|

EU Manufacturer E.g., Unilever Plc | Uses palm oil in production of finished products (e.g., food, personal care) | If importing in-scope products directly (e.g., buying palm oil from non-EU trader), due diligence obligations also apply |

|

EU Retailer E.g., Carrefour SA | Markets and sells final products to consumers | If importing in-scope products directly (e.g.,buying palm oil from non-EU trader), due diligence obligations also apply |

|

Source: Compiled using information from the European Commission.9 For informational purposes only.

The EUDR brings increased financial and reputational risks and heightened risk of operational disruptions for palm oil buyers. Companies with transparent, comprehensive anti-deforestation programs are best positioned to navigate the regulatory challenges, and secure sustainable palm oil supplies as demand continues to rise.

Leveraging ESG Risk Ratings to Assess Palm Oil Buyers’ Management of Deforestation-Related Risks

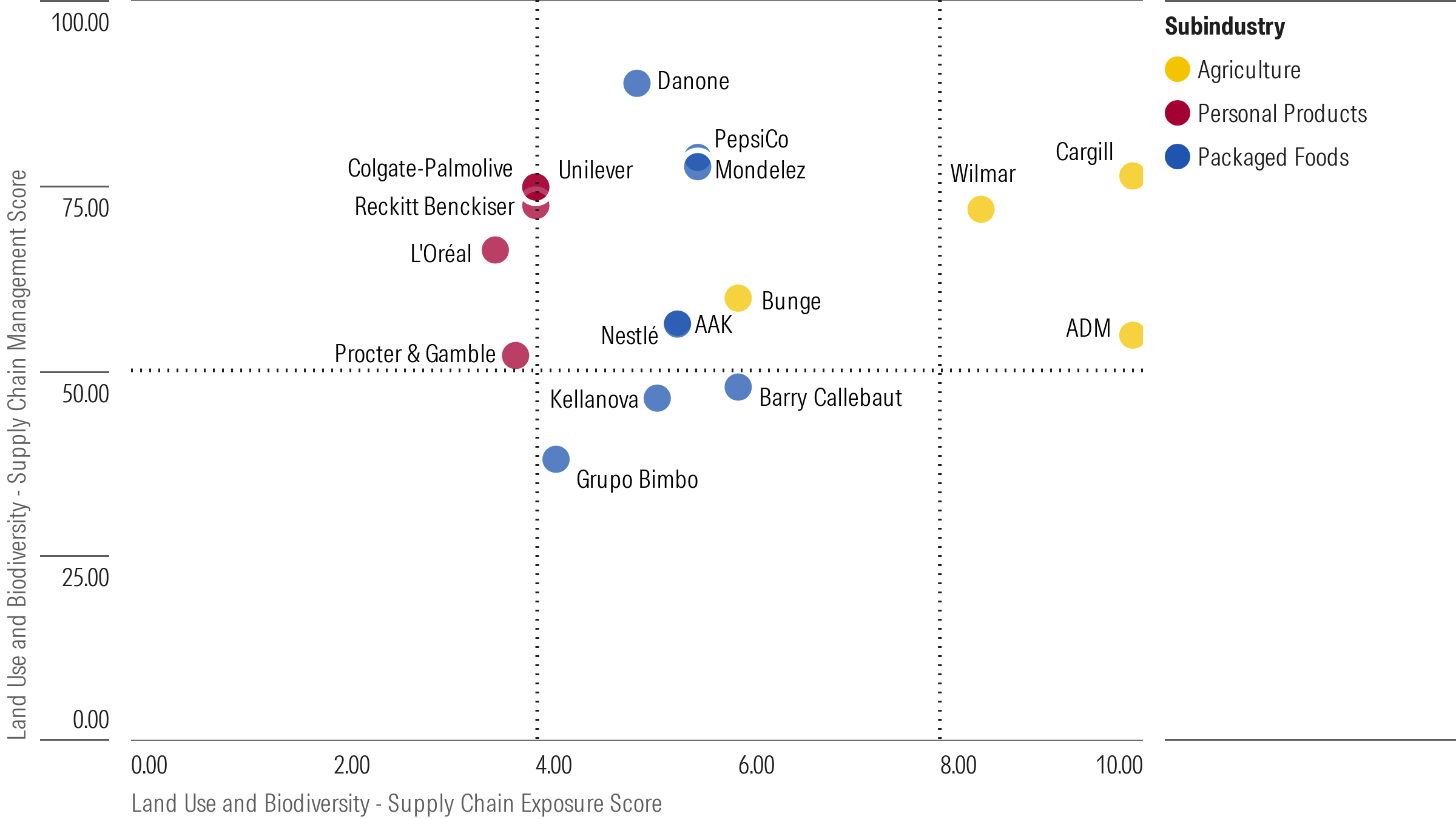

Sustainalytics’ ESG Risk Ratings provide data on how companies manage their relationship with suppliers regarding land use and biodiversity issues. Based on our research universe, we have compiled a sample of 17 key companies sourcing palm oil. This covers four of the largest palm oil traders in the agriculture industry, each sourcing over 1.5 million metric tons of palm oil and derivatives in 2024, and 13 palm oil buyers in the packaged food and personal products industries that together accounted for over 50% of the reported volumes of palm oil purchased.10 As shown in Figure 1, agricultural traders are more exposed to risks related to Land Use and Biodiversity – Supply Chain, a key management indicator used in the ESG Risk Ratings, given they source large quantities of forest-risk commodities and are closer upstream to the plantation-level where issues are more likely to occur. Personal products and packaged food products companies face medium exposure, given they rely on forest-risk commodities as an input to finished products. Figure 1 demonstrates that most companies have strong scores (i.e., >50 points) based on our assessment of their Land Use and Biodiversity – Supply Chain management. Three companies fall into the adequate range.

Figure 1. Land Use and Biodiversity – Supply Chain Exposure and Management Scores of Companies Sourcing Palm Oil

Source: Morningstar Sustainalytics. Data as of September 25, 2025. For informational purposes only.

Note: Sample includes public palm oil buyers from the packaged foods and personal products industries purchasing over 50,000 MT of palm oil in 2024 (according to the WWF Palm Oil Scorecard)11 and four agricultural traders sourcing over 1.5 MT of palm oil (according to the latest RSPO ACOP reports).12

Strong management scores indicate that companies are integrating commodity-driven deforestation and land-use concerns into their sourcing strategies, likely a response to decades of growing awareness. This is confirmed by looking more closely at the Deforestation Program Management indicator, which assesses companies’ initiatives to mitigate deforestation in their supply chain. Table 2 shows that most companies in the sample have a strong or very strong deforestation-management program, with just four companies having weak programs.

Table 2. Performance of Palm Oil Buyers’ Deforestation Program

Company Name | Deforestation Program Indicator Management Score |

Cargill | 100 |

Colgate-Palmolive | 100 |

Danone | 100 |

Mondelez International | 100 |

PepsiCo | 100 |

Unilever | 100 |

Wilmar | 100 |

AAK AB | 75 |

Archer-Daniels-Midland | 75 |

Bunge Global | 75 |

Nestlé | 75 |

Procter & Gamble | 75 |

Reckitt Benckiser | 75 |

Barry Callebaut | 25 |

Grupo Bimbo | 25 |

Kellanova | 25 |

L'Oréal | 25 |

Source: Morningstar Sustainalytics. Data as of September 25, 2025. For informational purposes only.

Nevertheless, companies continue to be scrutinized for any link between their supply chain and deforestation. In July 2025, Rainforest Action Network, an environmental organization, alleged that the palm oil supply chains of Wilmar, PepsiCo, Mondelez, and Nestlé could be linked to illegal land degradation in Indonesia’s protected Rawa Singkil Wildlife Reserve of the Leuser Ecosystem, a biodiversity hotspot and home to the densest population of critically endangered Sumatran orangutans.13 The management challenges are largely due to the complexity of agricultural supply chains. In the case of palm oil, supplies are frequently mixed, making it difficult to fully distinguish between deforested and non-deforested sources.

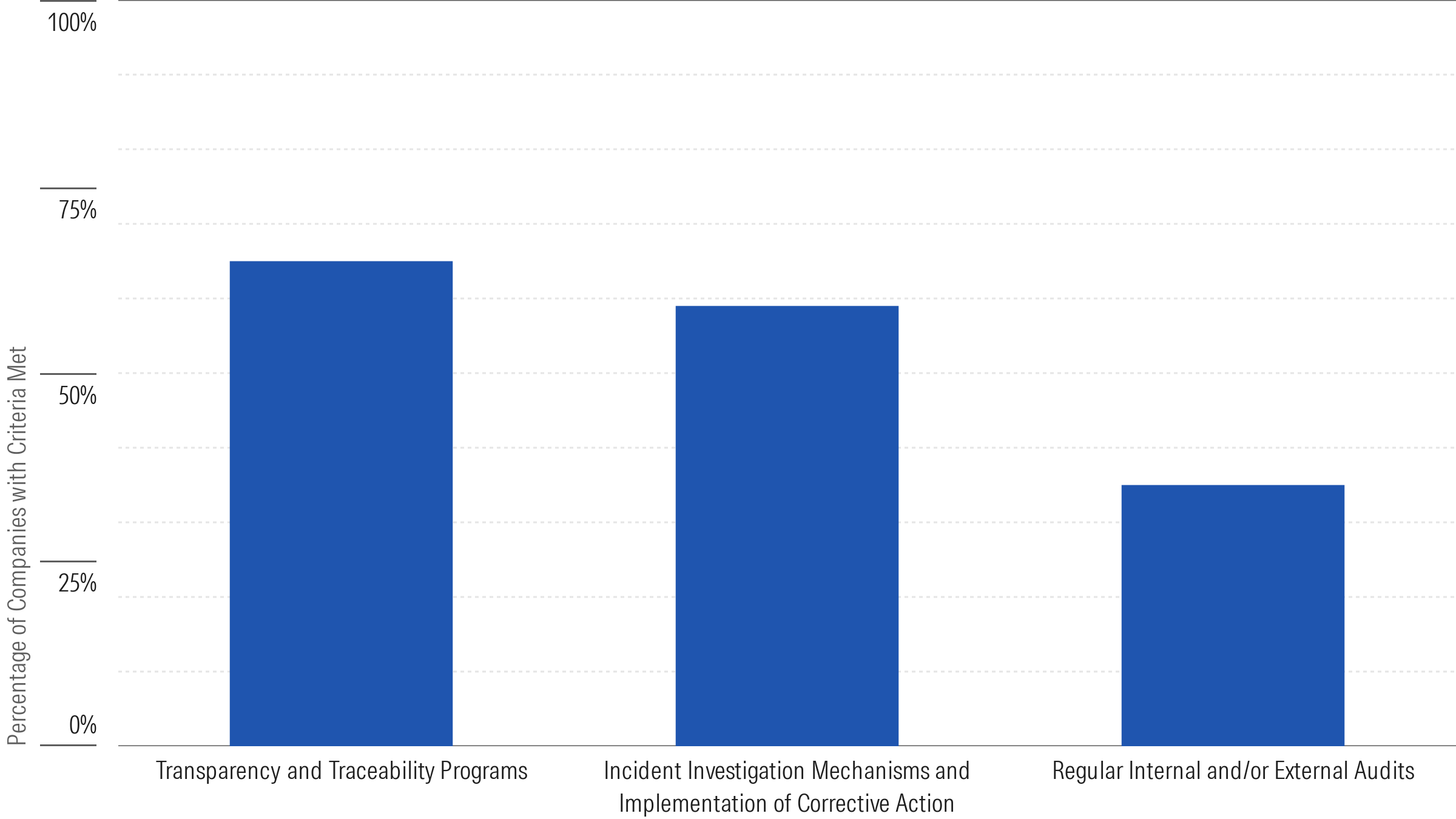

The EUDR aims to address some of these challenges by mandating traceability back to origin and restricting the use of certification methods such as “mass balance,” which allows for the mixing of sustainable and non-sustainable sources. At the same time, companies need to be prepared to respond to any cases of non-compliance in their supply chain to avoid operational disruptions and reputational risks. Therefore, strong traceability programs, robust incident investigation mechanisms, and regular supplier audits can help ensure companies are prepared to meet regulatory obligations and maintain a deforestation-free supply chain. Figure 2 breaks down how the sample is performing on these critical aspects of a comprehensive deforestation program, revealing important takeaways.

Figure 2. Company Performance on Select Deforestation-Program Criteria

Source: Morningstar Sustainalytics. Data as of September 25, 2025. For informational purposes only.

Companies are Investing in Traceability Programs; the Next Step is Plantation-Level Coverage

One key takeaway is that most companies in the sample (69%) have traceability programs covering both direct and indirect suppliers, publicly disclosing the location of their suppliers to at least the mill level. However, traceability to origin is becoming increasingly important to enable better procurement decisions and to foster collaboration across the value chain. Some companies are proactively working towards this. Colgate-Palmolive has reported it achieved 81% traceability to the plantation level for its palm oil and palm kernel oil volumes in 2024.14 Danone has also reported that it achieved 98% overall traceability to plantation, and publicly discloses the GPS coordinates of the plantations from which it sources.15 This strong progress is encouraging, especially considering the upcoming EUDR requirements. This is an area that needs continual effort and collaboration among supply chain actors, given the complexity of palm oil supply chains.

Grievance Mechanisms are Becoming More Common, but Continued Progress is Needed

Another key takeaway is that over half (59%) of the companies within our sample have disclosed evidence of incident investigation mechanisms such as grievance procedures, which can be used to identify and address deforestation (actual or alleged) within supply chains. Best practice involves maintaining publicly available grievance logs that track company engagement with suppliers implicated in such allegations. For example, Archer-Daniels-Midland regularly updates its grievance log, disclosing details of where the issue took place and the status of the case.16 This not only enhances transparency but also provides insights into how companies are actively remediating issues. However, almost 40% of companies within the sample are still lacking these mechanisms, representing a significant gap that may expose them to risks if they are not transparent on how they manage supply chain-related issues.

Evidence of Regular Audits is Sparse

On top of achieving more visibility into supply chains, companies should ensure that their sourced palm oil aligns with their deforestation-free commitments and any new regulatory requirements. NGOs have criticized companies for sourcing commodities from suppliers involved in deforestation, despite companies’ commitment to the No Deforestation, No Expansion on Peat and No Exploitation reporting framework. Verification tools like regular audits are critical to address this issue. However, approximately two thirds (65%) of companies in the sample do not conduct regular internal or external audits on direct and third-party suppliers, highlighting an important management gap that should be addressed to avoid reputational and operational risks stemming from non-compliant supply chains.

Delays to EUDR Offer Breathing Room, but Risk of Inaction Persists

While key players such as Colgate-Palmolive, Danone, and Unilever report strong deforestation programs and high levels of traceability, gaps remain across the relevant industries. Best practice includes traceability to the plantation-level, adopting grievance mechanisms, and conducting regular audits to ensure sourced amounts are deforestation-free. These gaps highlight that challenges persist as companies adapt to the stricter requirements of the upcoming EU regulation.

The proposed further delay of the EUDR provides companies with additional breathing room to strengthen their anti-deforestation programs. However, the risk of inaction remains high. Companies that take the delay as a sign to postpone investments in traceability and compliance systems could face higher costs, operational disruption, and financial risks once enforcement begins. Early movers — many of whom have already invested time and financial resources toward compliance — could gain a competitive advantage through strengthened supply chain transparency and improved stakeholder trust. Supply-chain transparency and anti-deforestation programs are not only a regulatory necessity, but also a signal of strong risk management, supply chain resilience, and long-term value creation.

References

- Euractiv. 2025. EU set to propose new delay to anti-deforestation rules. September 23, 2025. https://www.euractiv.com/news/eu-set-to-propose-new-delay-to-anti-deforestation-rules/.

- United States Department of Agriculture. 2025. Production - Palm Oil. https://www.fas.usda.gov/data/production/commodity/4243000.

- Nusantara Atlas. 2024. 2023 Marks a Surge in Palm Oil Expansion in Indonesia. January 24, 2024. https://nusantara-atlas.org/2023-marks-a-surge-in-palm-oil-expansion-in-indonesia/.

- Stockholm Environment Institute. 2024. Trase: Indonesian Palm Oil Exports and Deforestation. October 8, 2024. https://www.sei.org/features/indonesian-palm-oil-exports-and-deforestation/.

- World Wildlife Fund. 2025. Palm Oil Scorecard. https://palmoilscorecard.panda.org/#about.

- World Economic Forum. 2015. Over 80% of future deforestation confined to just 11 places, says WWF report. April 29, 2015. https://wwf.panda.org/es/?245573/Over-80-of-future-deforestation-confined-to-just-11-places-says-WWF-report.

- EUR-Lex. 2023. “Regulation (EU) 2023/1115 of the European Parliament and of the Council of 31 May 2023 on the making available on the Union market and the export from the Union of certain commodities and products associated with deforestation and forest degradation and repealing Regulation (EU) No 995/2010.” June 9, 2023. https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32023R1115&qid=1687867231461.

- EUR-Lex. 2023. “Regulation (EU) 2023/1115 of the European Parliament and of the Council of 31 May 2023 on the making available on the Union market and the export from the Union of certain commodities and products associated with deforestation and forest degradation and repealing Regulation (EU) No 995/2010.” https://eur-lex.europa.eu/eli/reg/2023/1115/oj/eng.

- European Commission. 2024. Guidance document for Regulation (EU) 2023/1115 on deforestation-free products. https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52024XC06789&qid=1731687748447.

- World Wildlife Fund. 2025. Palm Oil Scorecard. https://palmoilscorecard.panda.org/scores.

- Ibid.

- Roundtable on Sustainable Palm Oil. 2025. Annual Communication of Progress Reports. https://rspo.org/as-an-organisation/membership/acop/.

- Rainforest Action Network. Orangutan Emergency: Fresh Evidence Exposes Illegal Deforestation for Palm Oil. July 14, 2025. https://www.ran.org/forest-frontlines/orangutan-emergency-fresh-evidence-exposes-illegal-deforestation-for-palm-oil.

- Colgate-Palmolive. 2024. 2024 Palm Oil Implementation Plan. https://www.colgatepalmolive.com/content/dam/cp-sites/corporate/corporate/en_us/corp/locale-assets/pdf/colgate-palm-oil-implementation-plan-2024.pdf.

- Danone. 2024. Danone Palm Oil Suppliers and Mill & Plantation List H1 2024. March 2024. https://www.danone.com/content/dam/corp/global/danonecom/about-us-impact/policies-and-commitments/en/2024/palm-oil-suppliers-mill-and-plantation-list-h1-2024.pdf.

- Archer-Daniels-Midland Co. 2025. Grievance and Resolution Log. https://www.adm.com/globalassets/sustainability/sustainability-reports/grievance--resolution-logs/grievance-and-resolution-log-07-jul-2025.pdf.